How to Start a Spices Export Business from India – Step-by-Step Guide

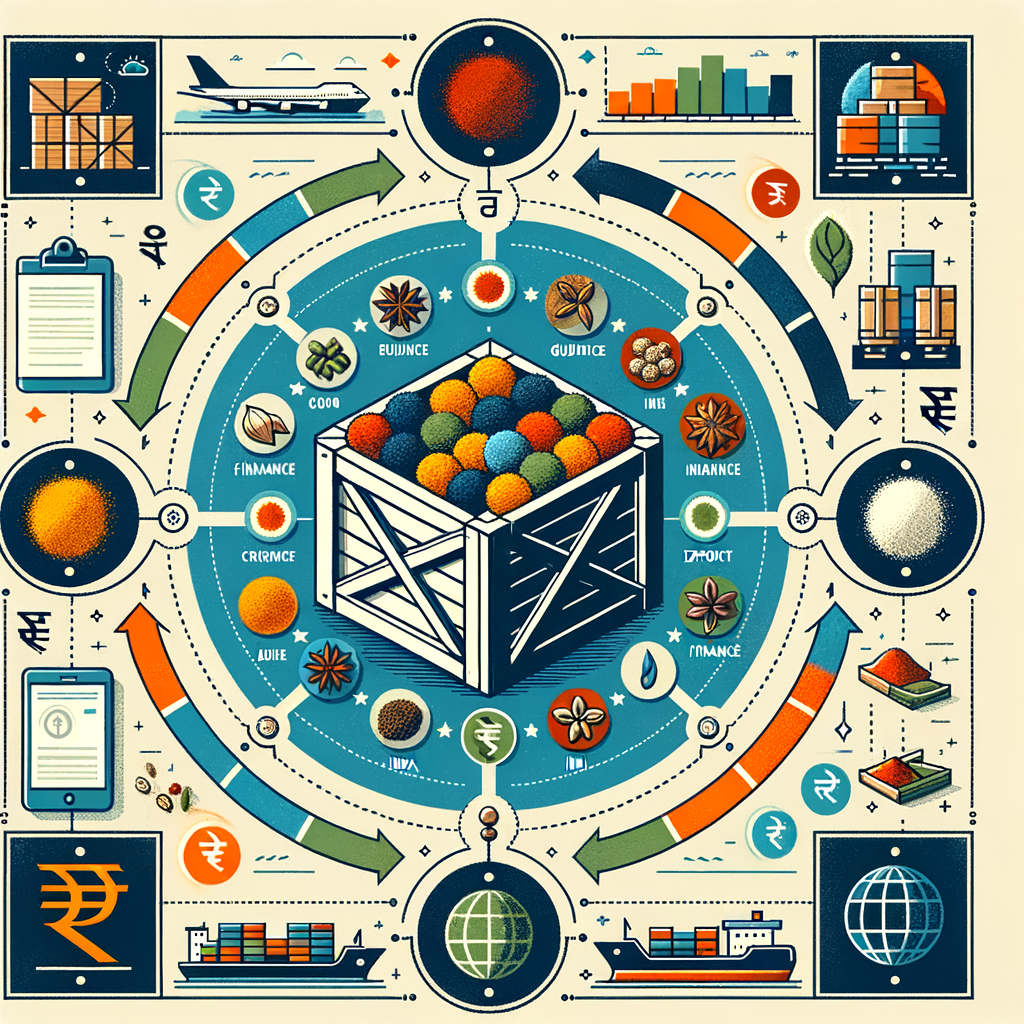

India, often called the “Spice Bowl of the World,” has a rich history of exporting aromatic and high-quality spices to every corner of the globe. The global demand for authentic Indian spices is not just ancient history; it’s a booming modern market with immense potential. If you’ve ever dreamt of tapping into this lucrative industry, this comprehensive guide on how to start a spices export business is your perfect starting point. While the journey from sourcing cardamom in Kerala to shipping it to a buyer in New York might seem complex, it’s a well-defined path. This spices export business guide India is designed to demystify the process, breaking it down into simple, actionable steps for aspiring entrepreneurs just like you.

Why Start a Spices Export Business in India?

Before diving into the procedural details, it’s crucial to understand why you should start a spices export business in India. This venture isn’t just about continuing a legacy; it’s a smart business decision backed by strong market forces and supportive government policies. The global appetite for Indian spices like chilli, turmeric, cumin, pepper, and cardamom remains consistently high, with major markets in the USA, UAE, UK, China, and Southeast Asia always looking for reliable suppliers. This consistent demand ensures a stable market for your products, reducing the risks often associated with new businesses.

Furthermore, the Indian government actively encourages exports through various schemes and institutional support. The Spices Board of India, for instance, provides invaluable resources, market data, and quality certification support to exporters. Additionally, policies under the Goods and Services Tax (GST) regime, such as zero-rated exports, allow businesses to claim refunds on taxes paid on raw materials, significantly improving cash flow. When you combine this strong international demand with government support and the potential for high-profit margins through value addition (like grinding, blending, and attractive packaging), the appeal of this business becomes crystal clear.

Your Step-by-Step Guide to Start a Spices Export Business

Embarking on this journey requires careful planning and a systematic approach. This section outlines the complete step-by-step spices export process, ensuring you cover all your bases from the initial idea to your first shipment. Following this roadmap will help you navigate the complexities of international trade and build a sustainable and profitable enterprise. We will cover everything from business planning and legal registration to sourcing and logistics, providing you with a clear understanding of how to export spices from India.

Step 1: Create a Robust Spices Export Business Plan

A well-thought-out business plan is the foundation of any successful venture. It serves as your roadmap, guiding your decisions and helping you secure funding if needed. Effective spices export business planning India involves a deep analysis of every aspect of the operation. Your plan should not be a static document but a dynamic guide that you can refer to and update as your business grows.

Your plan should meticulously detail the following key components:

- Market Analysis: Identify your target countries. Research their import regulations, quality standards, consumer preferences, and key competitors. Understand which spices are in high demand in those regions.

- Product Sourcing Strategy: Decide which spices you will export. Will you source them directly from farmers, from wholesalers, or manufacture your own blends? Outline your quality control measures right from the sourcing stage.

- Marketing and Sales Plan: How will you find international buyers? Detail your strategy, whether it’s through online B2B portals, participating in trade fairs, or hiring international agents.

- Financial Projections: This is a critical section. Estimate your startup costs (company registration, licenses, initial inventory), operational expenses, pricing strategy, and projected revenue for the first few years.

Step 2: Choose and Register Your Business Entity

The legal structure of your business is a crucial decision that impacts your liability, compliance requirements, and credibility with international buyers. For a spices export business setup India, you have several options, but Choosing the Right Legal Structure for Your Business is essential for long-term growth and legal protection. While a Sole Proprietorship is easy to start, it offers no liability protection, meaning your personal assets are at risk. A Partnership is similar but involves two or more people.

For an export-oriented business, it is highly recommended to opt for a structure that offers limited liability and a separate legal identity.

| Business Structure | Liability | Compliance | Credibility | Best For |

|---|---|---|---|---|

| Sole Proprietorship | Unlimited | Low | Low | Small-scale domestic testing |

| Partnership Firm | Unlimited | Low-Medium | Low | Joint ventures with low initial risk |

| LLP | Limited | Medium | Medium-High | Exporters wanting flexibility and protection |

| Pvt. Ltd. Company | Limited | High | High | Serious exporters aiming for scalability |

An LLP (Limited Liability Partnership) or a Private Limited Company is the most suitable choice. They project a professional image to international buyers, limit your personal liability in case of business debts, and make it easier to secure funding or investment in the future.

Need help with registration? Let TaxRobo handle the complexities. Check out our seamless TaxRobo Company Registration Service to get your business legally structured the right way.

Step 3: Secure All Necessary Licenses and Registrations

Compliance is non-negotiable in the export business. Fulfilling all exporting spices from India requirements is essential to operate legally and avoid customs hurdles. This step is detail-oriented and requires you to gather documentation for various government bodies. Each license serves a specific purpose, from identifying your business to ensuring your products meet international quality standards.

Here is a checklist of the mandatory registrations you will need:

- Company PAN Card & Current Bank Account: Once your business entity is registered, you must obtain a Permanent Account Number (PAN) in the company’s name. Following this, open a dedicated current account with a bank that is authorized to deal in foreign exchange.

- Importer-Exporter Code (IEC): This is the most crucial license for any import-export business. The IEC is a 10-digit unique code issued by the Directorate General of Foreign Trade (DGFT). No export or import can be done without it. You can apply for it online on the Directorate General of Foreign Trade portal.

- GST Registration: It is mandatory for exporters to register for Goods and Services Tax (GST) to claim tax benefits. Our Ultimate Guide to GST Registration for Small Businesses provides detailed information on the process. Exports are considered “zero-rated supplies,” which means no GST is levied on the final product. You have two options for this:

1. Export with payment of IGST and later claim a refund of the tax paid.

2. Export without payment of IGST by furnishing a Letter of Undertaking (LUT). This is the preferred method for most exporters as it doesn’t block working capital. You can manage your filings through the official GST Portal. - FSSAI Food License: As spices are a food product, obtaining a Food Safety and Standard Authority of India (FSSAI) license is mandatory. This license ensures that your products are processed and packaged in a hygienic environment and meet national food safety standards. You can apply for it on the FSSAI Portal.

- Spices Board of India Registration: To export spices, you must obtain a Certificate of Registration as an Exporter of Spices (CRES) from the Spices Board of India. This registration is mandatory and also provides you access to the board’s resources, including market research and buyer-seller meets. For detailed steps, see our guide on Spices Board Registration – Step-by-Step Guide for Exporting Spices from India. You can register on the Spices Board of India portal.

- Other Registrations: You will also need to complete Port Registration by registering your Authorized Dealer (AD) Code with the customs at the port from where you intend to ship your goods. Additionally, obtaining a Registration Cum Membership Certificate (RCMC) from the Spices Board (which is an Export Promotion Council) is a part of the CRES process and is beneficial for availing export incentives.

Step 4: Sourcing, Quality Control, and Packaging

The quality of your product is your brand’s biggest ambassador. In the international market, there is no room for compromise on quality, as standards are stringent and competition is fierce. Your success hinges on a robust supply chain that starts with sourcing the best raw materials and ends with world-class packaging.

- Sourcing: Identify and build relationships with reliable suppliers, whether they are farmers, farmer co-operatives, or large wholesalers. Always request samples and conduct your own initial quality checks. Visiting the farms or processing units can give you better insight into their practices. Sourcing from regions famous for specific spices (e.g., pepper from Kerala, turmeric from Telangana) can be a significant quality differentiator.

- Quality Control: International buyers often demand lab test reports. You must get your spices tested by NABL-accredited labs for parameters like moisture content, pesticide residue, microbial contamination, and purity. Meeting the specific quality standards of the importing country (e.g., FDA standards for the USA, EFSA standards for the EU) is crucial.

- Packaging & Labelling: Packaging must protect the spices from moisture, contamination, and loss of aroma. Use food-grade, moisture-proof materials like multi-layer pouches, tin cans, or glass jars. Your labelling must be accurate and compliant with the destination country’s regulations. Essential information on the label includes:

- Product name and brand name

- Net weight

- FSSAI logo and license number

- Country of origin

- List of ingredients (if it’s a blend)

- Manufacturing date and expiry date

- Nutritional information

Step 5: Finding International Buyers and Pricing Your Products

Once your business is set up and your product is ready, the next big challenge is finding customers. Marketing your products to an international audience requires a proactive and multi-pronged approach. Building trust and showcasing your product’s quality are key to securing orders and establishing long-term business relationships.

Here are some effective methods for finding international buyers:

- Online B2B Portals: Register your business on major international B2B platforms like Alibaba, Indiamart, and Global Sources. These websites are a primary resource for importers looking for suppliers.

- International Trade Fairs: Participate in food and beverage trade shows in your target countries. These events provide an excellent opportunity to showcase your products, meet potential buyers face-to-face, and understand market trends.

- Spices Board of India Network: The Spices Board regularly organizes buyer-seller meets and provides a directory of importers. Leverage their network to connect with verified buyers.

- Digital Marketing: Create a professional website and use social media platforms like LinkedIn to connect with food importers, distributors, and agents in your target markets.

For pricing, you need to understand standard export terms. FOB (Free on Board) means your price includes the cost of the goods and the cost of transporting them to the port of shipment. CIF (Cost, Insurance, and Freight) includes the cost of goods, insurance, and all freight charges to the destination port. Always prepare a detailed price quotation or a proforma invoice that clearly breaks down all the costs for the buyer.

Step 6: Managing Logistics and Documentation

The final leg of the export process involves shipping your goods and ensuring all paperwork is in order for smooth customs clearance. This stage can be complex, and errors can lead to costly delays. This is one of the most important spices exporting tips for beginners: do not try to handle logistics and customs on your own initially.

- Logistics: The best practice is to hire a reliable Customs House Agent (CHA) or a Freight Forwarder. These professionals are experts in managing the entire shipping process. They will book freight (air or sea), handle customs clearance at both the origin and destination ports, and manage all the required documentation. Their expertise is invaluable in avoiding common pitfalls.

- Key Export Documents: Your CHA will help you prepare and submit the necessary documents, but you should be familiar with them. The essential documents for a spice export shipment include:

- Commercial Invoice cum Packing List: A detailed bill that includes information about the product, quantity, price, and packaging.

- Bill of Lading (for sea freight) or Airway Bill (for air freight): A receipt issued by the carrier, which acts as a contract for the transportation of goods.

- Certificate of Origin: A document that certifies that the goods originate from India, which can be important for availing preferential tariffs in the importing country.

- Phytosanitary Certificate: Issued by the plant quarantine department, this certificate confirms that the spices are free from pests and diseases.

- Other documents: Depending on the buyer’s requirement, you may also need a quality analysis report or other specific certifications.

Conclusion: Launching Your Spices Export Business

The journey to start a spices export business is one of meticulous planning, strict compliance, and a relentless focus on quality. By following the steps outlined in this guide—from creating a solid business plan and completing all legal registrations to sourcing high-quality products and finding reliable buyers—you can build a successful and profitable venture. The global demand for authentic Indian spices presents a massive opportunity, and with the right knowledge and guidance, you can claim your share of this thriving market.

Navigating the legal and financial requirements can be challenging. Let TaxRobo be your partner. Contact us today for seamless Company Registration, GST filing, IEC, and other essential services to kickstart your start spices export business in India journey.

Frequently Asked Questions (FAQs)

1. How much investment is required to start a spices export business from India?

The investment can vary significantly based on the scale of your operation. A small-scale or home-based setup might start with an investment of ₹2 lakhs to ₹5 lakhs. A more medium-scale operation could require ₹5 lakhs to ₹10 lakhs or more. Key costs include: company registration and licenses (₹25,000 – ₹50,000), initial stock purchase, quality testing, professional packaging, developing a website, and initial marketing expenses.

2. Do I need a GST number to export spices from India?

Yes, absolutely. GST registration is mandatory for any individual or company involved in exporting goods from India, regardless of their turnover. It is essential for customs clearance procedures and, more importantly, for claiming refunds on the taxes you’ve paid on your inputs (raw materials, packaging, etc.), which is a significant financial benefit for exporters.

3. What is the role of the Spices Board of India?

The Spices Board of India plays a crucial dual role. Firstly, it is a regulatory body that makes it mandatory for every spice exporter to have a Certificate of Registration as an Exporter of Spices (CRES). Secondly, it is a promotional body that actively supports exporters by providing market intelligence, quality certification support (like the “Spice House Certificate”), and organizing events to connect Indian exporters with international buyers.

4. Can I start a spices export business from home?

Yes, you can certainly begin the initial operations from home. The planning, business registration, obtaining an IEC, online marketing, and communication with buyers can all be managed from a home office. However, for the physical operations—sourcing, processing, and packaging—you will need a dedicated, clean, and hygienic space that complies with FSSAI standards. You could either set up a small, compliant unit or outsource this part to a third-party packaging facility. A registered business address will still be required for all your licenses.