What are the most popular funding options available for startups?

Launching a startup in India is an exhilarating journey, filled with innovation, challenges, and immense potential. However, turning a brilliant idea into a thriving business often requires a critical ingredient: capital. Securing adequate funding is frequently the lifeline that enables startups to survive the initial hurdles, fuel growth, hire talent, and scale their operations effectively. Understanding the diverse landscape of funding options for startups is, therefore, paramount for any aspiring entrepreneur. This post will explore the various avenues available, focusing on the most popular and accessible funding options for startups in India. Whether you’re already navigating the path of a small business owner or are a salaried individual nurturing a startup dream, knowing these choices is the essential first step towards bringing your vision to life.

Understanding the Need: Why Startups Seek Funding

Before diving into the specific funding sources, it’s crucial to understand why startups typically need external capital. The reasons are manifold and evolve as the business grows. In the early stages, funding might be essential for product development, building a minimum viable product (MVP), conducting market research, and establishing a basic operational framework. As the startup gains traction, capital becomes necessary for team building – hiring skilled employees across various functions like technology, marketing, sales, and operations. Marketing and sales efforts require significant investment to acquire customers and build brand awareness. Furthermore, funding supports day-to-day operations, covering expenses like rent, utilities, inventory, and software subscriptions. Finally, for startups aiming for significant market share, capital is indispensable for scaling – expanding into new markets, enhancing product features, and potentially making strategic acquisitions.

The type and amount of funding needed often correlate with the startup’s stage. An Idea/Seed Stage startup might primarily seek funds to validate the concept and build an initial product, often requiring smaller amounts. In contrast, a Growth Stage startup, having proven its product-market fit, will seek larger sums to accelerate growth, capture market share, and achieve profitability. Recognizing these evolving needs helps entrepreneurs target the most appropriate funding sources at the right time.

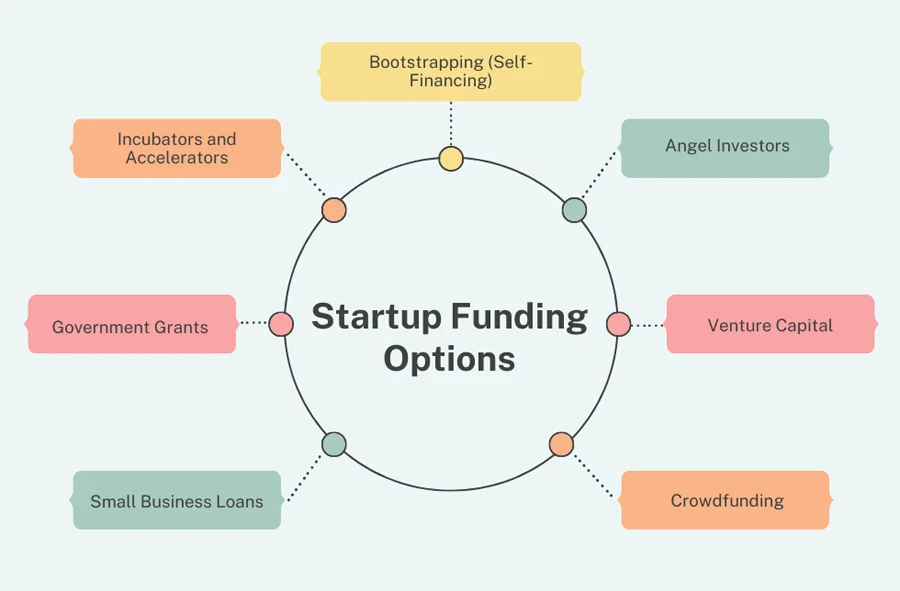

Key Funding Options for Startups in India

With a clear understanding of why funding is needed, let’s delve into the specific, popular funding sources for Indian startups. The landscape offers a variety of choices, each with its own set of advantages, disadvantages, and suitability depending on the startup’s unique circumstances. Exploring these funding options for startups will empower you to make informed decisions for your venture.

1. Bootstrapping (Self-Funding)

Bootstrapping is the quintessential starting point for many entrepreneurs. It essentially means building your company from the ground up using personal savings, revenue generated from initial sales, or other minimal external resources, without seeking formal investment. It’s about being resourceful, lean, and relying on your own capabilities and financial reserves to get the business off the ground and running. This approach forces a disciplined approach to spending and operations from day one.

Pros:

- Full Control: You retain complete ownership and decision-making authority over your company.

- Lean Operations: Encourages efficiency, cost-consciousness, and finding creative solutions.

- Proves Viability: Successfully bootstrapping demonstrates product-market fit and a sustainable business model to future investors.

- No Debt/Dilution: Avoids early debt burdens or giving away equity.

Cons:

- Limited Growth: Growth potential can be severely restricted by the availability of personal funds or slow revenue generation.

- Personal Financial Risk: You bear the entire financial burden, potentially risking personal assets.

- Slow Scaling: Expanding quickly can be challenging without external capital infusion.

Suitability: Bootstrapping is often ideal for the very early stages, testing business ideas, service-based businesses with low initial overheads, or when founders prefer maintaining absolute control. Many successful startups begin bootstrapped before exploring other available funding options for startups in India. For those looking to understand more about bootstrapping and doing it effectively, you might find What is bootstrapping a startup and how can I do it effectively? useful.

2. Friends and Family (and Fools – FFF)

Often the next step after exhausting personal savings, the Friends, Family, and Fools (FFF) round involves seeking capital from your personal network – close relatives, friends, or acquaintances who believe in you and your idea. This source relies heavily on personal trust and relationships rather than purely on business metrics, making it one of the more accessible early funding opportunities for startups in India. Investors in this category might be less sophisticated than professional investors but are often motivated by a desire to support the founder.

Pros:

- Easier Access: Can be quicker and less formal to secure than institutional funding.

- Flexible Terms: Often comes with more lenient repayment schedules or valuation expectations (though this isn’t guaranteed).

- Trust-Based: Built on existing relationships, which can mean more patient capital.

Cons:

- Strained Relationships: Mixing business with personal relationships can lead to tension or conflict if the venture struggles or expectations aren’t met.

- Informal Agreements: Lack of formal documentation can lead to misunderstandings regarding equity, repayment, or roles later on.

- Limited Funding: The amount raiseable is usually constrained by the network’s capacity.

Actionable Tip: Crucially, always formalize FFF investments. Treat them as seriously as any other investment. Use a clear loan agreement specifying repayment terms or a shareholders’ agreement detailing equity stakes, rights, and obligations. This protects both the founder and the investor and prevents future disputes.

3. Angel Investors

Angel investors are high-net-worth individuals (HNIs) who invest their personal capital directly into early-stage startups, typically in exchange for convertible debt or ownership equity. Unlike FFF investors, angels are usually experienced entrepreneurs or professionals who often bring more than just money to the table; they provide valuable mentorship, industry connections, and strategic guidance – often referred to as “smart money.” They bridge the gap between bootstrapping/FFF and larger institutional venture capital. Finding the right angel can be one of the top funding choices for startups in India for early validation and growth.

What they look for: Angels evaluate several factors, including:

- The Founding Team: Experience, passion, expertise, and coachability.

- Market Opportunity: Size and growth potential of the target market.

- Scalability: The potential for the business model to grow rapidly.

- Product/Service: Innovation, competitive advantage, and traction (if any).

- Potential Return on Investment (ROI): A clear path to a significant exit (e.g., acquisition, IPO).

Finding Angels in India: Entrepreneurs can connect with angels through:

- Angel Networks: Organized groups like the Indian Angel Network (IAN), Mumbai Angels, Chennai Angels, etc. These networks screen startups and present opportunities to their members.

- Online Platforms: Platforms like LetsVenture or AngelList connect startups with potential investors.

- Personal Networks & Events: Industry conferences, startup events, and introductions through mutual contacts.

Keyword Placement: Angel investment remains a cornerstone among the various funding options for startups.

4. Venture Capital (VC) Funding

Venture Capital (VC) firms are professional investment entities that manage pooled money (funds) raised from limited partners (LPs), such as pension funds, endowments, corporations, and wealthy individuals. They invest this capital in startups and small businesses that exhibit high growth potential, typically in exchange for equity and often a board seat. VCs usually invest larger amounts than angel investors and focus on startups that can scale rapidly and achieve substantial market presence, potentially leading to multi-billion dollar valuations. VC funding is one of the most sought-after popular funding sources for Indian startups aiming for hyper-growth.

Stages: VC funding typically occurs in distinct rounds, often named alphabetically:

- Seed Round: Often overlaps with Angel funding, focusing on product development and market research.

- Series A: For startups with proven traction (users, revenue) to optimize the product and scale user acquisition. Investment sizes typically range from ₹15 Cr to ₹100 Cr+.

- Series B: To scale the business significantly, expand market reach, and build the team. Investments are usually larger than Series A.

- Series C and Beyond: For further scaling, developing new products, international expansion, or preparing for an IPO/acquisition. Investments can be substantial.

Pros:

- Significant Capital: Access to large amounts of funding for aggressive growth.

- Strategic Guidance: VCs bring expertise, industry knowledge, and strategic direction.

- Network Access: Connections to potential customers, partners, talent, and follow-on investors.

- Validation & Credibility: Securing VC funding enhances the startup’s reputation.

Cons:

- Loss of Control: Founders give up significant ownership and often board control.

- High Expectations: Intense pressure to achieve rapid growth and meet milestones.

- Rigorous Due Diligence: A lengthy and demanding process of investigation before investment.

- Focus on Exit: VCs invest with the expectation of a profitable exit within a defined timeframe (typically 5-10 years).

Suitability: Best suited for startups with a proven business model, large addressable market, strong competitive advantage, and ambition for rapid, large-scale growth. It’s a demanding but potentially transformative path among the funding options for startups.

5. Bank Loans & Debt Financing

While equity financing (Angels, VCs) often dominates startup funding discussions, traditional debt financing through bank loans remains a viable option, particularly for businesses with predictable revenue streams or tangible assets. This involves borrowing money from banks or Non-Banking Financial Companies (NBFCs) that must be repaid with interest over a specified period. It’s considered one of the fundamental and best funding methods for Indian startups that wish to avoid equity dilution.

Types:

- Term Loans: A lump sum provided for a specific purpose (e.g., buying equipment) with a fixed repayment schedule.

- Working Capital Loans: To finance day-to-day operational needs (e.g., inventory, payroll).

- Overdraft Facilities: Allows businesses to withdraw more money than available in their account, up to an agreed limit.

Government Schemes: The Indian government actively promotes entrepreneurship through specialized loan schemes:

- MUDRA Yojana (Pradhan Mantri MUDRA Yojana): Provides loans up to ₹10 lakh to non-corporate, non-farm small/micro-enterprises. Loans are categorized as Shishu (up to ₹50,000), Kishor (₹50,001 to ₹5 lakh), and Tarun (₹5 lakh to ₹10 lakh). You can find more details on the MUDRA Yojana Portal.

- Stand-Up India Scheme: Facilitates bank loans between ₹10 lakh and ₹1 Crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and at least one woman borrower per bank branch for setting up a greenfield enterprise. Explore details via the Stand-Up India Scheme Portal.

Pros:

- Retain Ownership: Founders do not dilute their equity stake in the company (at least initially; some debt may have convertible features).

- Predictable Costs: Interest payments are usually fixed or follow a clear structure.

Cons:

- Repayment Obligation: Regular payments are required regardless of business performance, which can strain cash flow.

- Collateral Requirements: Banks often require personal guarantees or business assets as security.

- Strict Eligibility: Often requires a proven track record, profitability, or significant assets, making it difficult for very early-stage or idea-stage startups.

Keyword Placement: Bank loans and government-backed schemes are important available funding options for startups in India. For detailed guidance, visit our Bank Loan for Startup Business.

6. Government Grants & Schemes (Beyond Loans)

Beyond loan facilitation, the Indian government offers various grants and support schemes specifically designed to foster innovation and entrepreneurship. These grants are often non-repayable funds provided to startups meeting specific criteria, typically focused on innovation, social impact, or specific strategic sectors. These represent valuable funding opportunities for startups in India, especially those in R&D-intensive fields.

Explanation: Government bodies at central and state levels allocate funds to support startups through grants, subsidies, reimbursements, and incubation support, often without taking equity.

Key Initiative: Startup India

- The flagship initiative, Startup India, aims to build a strong ecosystem for nurturing innovation and startups. It offers various benefits, including funding support (like the Fund of Funds for Startups managed by SIDBI), tax exemptions, easier compliance, IPR facilitation, and networking opportunities. Exploring the official Startup India Scheme is essential for any Indian startup.

Examples:

- Schemes under the Ministry of Electronics and Information Technology (MeitY) support tech and electronics startups (e.g., TIDE scheme).

- Biotechnology Industry Research Assistance Council (BIRAC) offers numerous grants and schemes (like BIG, BIPP) for biotech startups.

- State governments often have their own startup policies and grant programs.

Pros:

- Non-Dilutive Capital: Funding received without giving up ownership.

- Government Validation: Receiving a government grant adds credibility.

- Focus on Innovation: Often supports high-risk R&D projects that might struggle to find private funding initially.

Cons:

- Highly Competitive: Application processes can be rigorous with many applicants.

- Specific Eligibility: Strict criteria related to sector, stage, innovation level, or social impact.

- Bureaucratic Processes: Applications can be time-consuming and involve significant paperwork.

7. Incubators and Accelerators

Incubators and accelerators are programs designed to support early-stage startups through mentorship, resources, networking, and sometimes seed funding. While often grouped together, they serve slightly different purposes.

Explanation:

- Incubators: Typically focus on very early-stage ideas, often pre-revenue. They offer longer-term support (months to years), providing workspace, basic mentorship, and help in developing the business model. Funding might be minimal or non-existent initially.

- Accelerators: Target startups that have already launched or have an MVP. They offer intense, fixed-term (usually 3-6 months), cohort-based programs focused on rapid growth (“acceleration”). They provide mentorship, networking, culminating in a “demo day” to pitch to investors. Accelerators usually provide seed funding in exchange for equity (typically 5-10%).

Key Differences:

| Feature | Incubator | Accelerator |

|---|---|---|

| Stage | Idea / Very Early | Early / MVP / Pre-Scale |

| Duration | Longer-term (Months/Years) | Fixed-term (3-6 Months) |

| Focus | Business Model Development | Rapid Growth / Scaling |

| Structure | Less Structured, Ongoing Support | Structured Curriculum, Cohort-based |

| Funding | Often Minimal/None, Maybe Grants | Seed Funding for Equity (Common) |

| Outcome | Viable Business Plan / MVP | Investment Readiness / Demo Day |

Benefits: Access to structured support, intensive mentorship from experienced professionals, valuable networking opportunities with peers and investors, shared resources, and potential for follow-on funding.

Finding Programs: Look for programs run by academic institutions (like IITs, IIMs), corporations (corporate accelerators), venture capital firms, or independent organizations across India. Many are listed on the Startup India portal.

8. Crowdfunding

Crowdfunding allows startups to raise capital by soliciting small contributions from a large number of individuals, typically through online platforms. It leverages the power of the crowd to fund ventures, validate ideas, and build a community around a product or service. It’s an increasingly popular channel among the available funding options for startups in India.

Explanation: Startups create a campaign page on a crowdfunding platform detailing their project, funding goal, and what backers will receive in return.

Types in India:

- Reward-Based: Backers receive a non-financial reward, like early access to the product, merchandise, or a discount (e.g., platforms similar to Kickstarter/Indiegogo). This is common for creative projects and consumer products.

- Equity-Based: Investors receive equity (shares) in the company in return for their investment. In India, this is regulated by SEBI (Securities and Exchange Board of India) and operates through specific registered platforms.

- Donation-Based: Contributors donate without expecting anything tangible in return, often used for social causes or non-profits.

- Debt-Based (Peer-to-Peer Lending): Individuals lend money to the business with the expectation of repayment plus interest.

Pros:

- Market Validation: A successful campaign demonstrates customer interest and validates the product idea.

- Community Building: Creates early adopters and brand advocates.

- Access to Capital: Provides funding, especially when traditional routes are difficult.

- Marketing Buzz: Campaigns can generate significant publicity.

Cons:

- Marketing Effort: Requires significant time and resources to plan and execute a successful campaign.

- Platform Fees: Crowdfunding platforms charge a percentage of the funds raised.

- Risk of Failure: Unsuccessful campaigns can damage reputation and yield no funds (often “all-or-nothing” models).

- Regulatory Hurdles: Equity crowdfunding has specific legal requirements in India.

- Pressure to Deliver: Must fulfill promises made to backers (rewards, product delivery).

Choosing the Right Funding Option for Your Startup

With such a diverse array of funding options for startups, selecting the right one can seem daunting. The optimal choice depends heavily on several factors unique to your business:

- Stage of the Startup: An idea-stage venture will likely target bootstrapping, FFF, or specific grants/incubators, while a growth-stage startup might pursue Angel or VC funding.

- Amount of Capital Needed: The required funding amount will narrow down the possibilities (e.g., bootstrapping for small needs vs. VCs for large capital injections).

- Willingness to Give Up Equity/Control: Bootstrapping and debt financing allow founders to retain full ownership, whereas Angel and VC funding involve significant equity dilution and loss of some control.

- Industry Type: Some funding sources favor specific sectors (e.g., VCs often prefer tech, BIRAC grants for biotech).

- Long-Term Vision: Are you aiming for moderate, sustainable growth or rapid, large-scale market domination? This influences whether you seek patient capital or growth-focused VC funding.

- Business Model: Revenue-generating businesses might qualify for debt financing sooner than pre-revenue R&D-focused startups.

Importance of Preparation: Regardless of the chosen path, approaching potential funders requires meticulous preparation. A solid business plan outlining your vision, market analysis, strategy, and team is essential. Realistic financial projections demonstrating potential returns are critical. Furthermore, understanding and ensuring legal and compliance requirements are met before seeking external funding is crucial. This includes proper business registration, clear cap tables (shareholding structure), and sound financial record-keeping. Getting these foundational elements right significantly increases your chances of securing funding.

Conclusion

Navigating the world of startup finance is a critical challenge for every entrepreneur in India. From leveraging personal resources through Bootstrapping and networks via Friends and Family, to attracting sophisticated capital from Angel Investors and Venture Capitalists, or utilizing Bank Loans, Government Grants & Schemes, Incubators/Accelerators, and Crowdfunding, the funding options for startups are varied and evolving. There’s no single “best” path; the ideal funding strategy is deeply intertwined with your startup’s specific stage, needs, industry, and long-term ambitions.

Finding the right capital at the right time is a pivotal step in transforming a startup idea into a successful enterprise. However, the journey involves more than just finding investors; it requires building a solid foundation. Navigating the financial and legal landscape, from company registration to ongoing compliance and strategic financial planning, can be complex. Don’t hesitate to consult with experts who can guide you. TaxRobo can assist you with essential groundwork like company registration, ensuring compliance, and setting up robust financial planning processes to make your startup ‘funding ready’. Understanding and choosing wisely from the available funding options for startups is key to fueling your entrepreneurial journey in India.

Frequently Asked Questions (FAQs)

FAQ 1: What is the easiest funding to get when starting with just an idea in India?

Answer: Bootstrapping (using your own funds) or raising money from Friends & Family are generally the most accessible initial funding sources. These rely more on personal conviction and relationships than proven business traction. Some government grants or incubator programs specifically target the ideation stage and might offer initial support, but competition can be high.

FAQ 2: Do I need to register my company before seeking funding?

Answer: While you might bootstrap or receive FFF funds informally before official registration, most formal funding options for startups require your business to be a registered legal entity. Angel investors, VCs, banks (for loans), and government grant providers almost always require registration (commonly as a Private Limited Company or LLP in India). Registration provides a legal structure, limits personal liability, and lends credibility to your venture. TaxRobo offers hassle-free Company Registration Services to get you started. Additionally, for more insights into company registration in India, refer to our detailed guide on Company Registration in India.

FAQ 3: How much equity do founders typically give away in early funding rounds?

Answer: Equity dilution varies significantly based on the startup’s valuation, the amount of funding raised, the stage of the company, and negotiation leverage. In typical Angel/Seed rounds, founders might dilute anywhere from 10% to 25% of their equity. Venture Capital rounds (Series A onwards) usually involve larger investments and potentially larger equity stakes (often 20% or more per round). It’s crucial to understand valuation mechanics and the long-term impact of dilution.

FAQ 4: Are there specific funding opportunities for startups in India focused on social impact or specific sectors?

Answer: Absolutely. India has a growing ecosystem of impact investors (VCs and foundations) specifically looking for startups creating positive social or environmental change alongside financial returns. Additionally, many VCs specialize in sectors like FinTech, HealthTech, EdTech, AgriTech, CleanTech, SaaS, etc. Government grants and schemes (like those from BIRAC for biotech or MeitY for electronics) are also often sector-specific. Researching funds and programs aligned with your sector or impact mission is highly recommended.

FAQ 5: What’s the difference between debt and equity financing?

Answer: The core difference lies in ownership and repayment obligations:

| Feature | Debt Financing | Equity Financing |

|---|---|---|

| What it is | Borrowing money | Selling ownership stake |

| Source | Banks, NBFCs, P2P Lending | Angel Investors, VCs, Equity Crowdfunding |

| Repayment | Required (Principal + Interest) | Not required (Investors profit via exit) |

| Ownership | Retained by founder | Diluted (Shared with investors) |

| Control | Founder retains control | Investors may gain influence/board seat |

| Collateral | Often required | Not typically required |

| Risk for Co. | Cash flow strain from repayments | Loss of ownership & control |

In essence, debt is a loan you must repay, while equity is an investment in exchange for a piece of your company. Both are important funding options for startups depending on the circumstances.