Section 269ST: Restrictions on Cash Transactions Above ₹2 Lakhs Explained

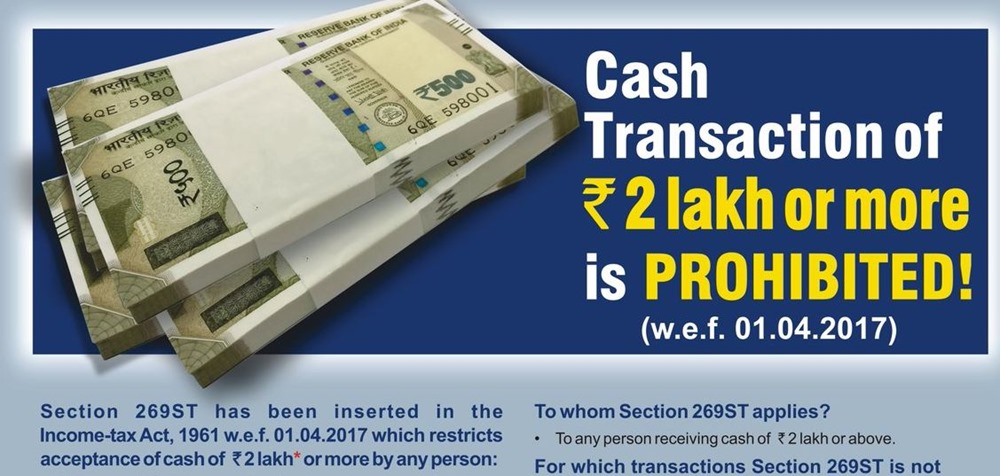

Cash transactions have long been a fundamental part of India’s economy, ingrained in daily life for both individuals and businesses. However, in recent years, the Indian government has actively encouraged a shift towards digital payments. This move aims to create a more transparent financial system and curb the flow of unaccounted money, often referred to as ‘black money’. A key legislative measure in this direction is Section 269ST of the Income Tax Act, 1961. This section introduces specific restrictions on cash transactions exceeding ₹2 lakhs, and understanding its nuances is absolutely crucial. Whether you’re running a small business or are a salaried individual managing personal finances, non-compliance can lead to significant penalties. This post will serve as your guide to understanding the maximum cash transaction limit India imposed by Section 269ST and how to navigate its rules effectively.

What Exactly is Section 269ST? Demystifying the Rule

Section 269ST was introduced via the Finance Act, 2017, to regulate large cash receipts and discourage unaccounted cash dealings. It fundamentally impacts how money changes hands in cash, setting a clear threshold to promote traceable, digital transactions. Understanding the core provision and its intent is the first step towards compliance.

The Core Provision:

At its heart, Section 269ST prohibits any person from receiving an amount of ₹2 lakh or more in cash under three specific circumstances:

- In aggregate from a person in a day: This means you cannot accept ₹2 lakh or more in cash from the same person within a single day, even if the payments are split into multiple smaller amounts or relate to different transactions.

- Example: If Mr. A pays you ₹1,20,000 in the morning and another ₹90,000 in the evening on the same day, you, as the receiver, have violated Section 269ST because the total cash received from Mr. A in that day is ₹2,10,000.

- In respect of a single transaction: You cannot accept ₹2 lakh or more in cash against a single bill or invoice, regardless of how many instalments or days the payment is spread across.

- Example: You sell goods worth ₹3,50,000 to Ms. B. If Ms. B pays you ₹1,80,000 in cash today and ₹1,70,000 in cash next week for this single sale, you have violated the rule upon receiving the second instalment because the total cash received relates to a single transaction exceeding ₹2 lakhs. The entire payment for such a transaction should ideally be through banking channels if the transaction value itself is ₹2 lakh or more.

- In respect of transactions relating to one event or occasion from a person: You cannot accept ₹2 lakh or more in cash from the same person for transactions related to a single event or occasion, even if payments are made on different days or split into parts.

- Example: If you are an event manager organising a wedding reception for Mr. C, and he pays you ₹1,00,000 cash for catering, ₹80,000 cash for decoration, and ₹50,000 cash for venue booking (total ₹2,30,000) related to that single wedding event, even on different dates, you have violated Section 269ST upon receiving the payment that crosses the aggregate ₹2 lakh threshold from Mr. C for that occasion.

It’s crucial to grasp these section 269ST cash transaction rules as they form the bedrock of the cash transaction limit India. Understanding section 269ST India involves recognizing these three distinct triggers for the restriction.

Purpose Behind Section 269ST:

The government introduced Section 269ST with clear objectives aimed at strengthening the financial ecosystem. The primary goals include:

- Curbing Black Money: Large cash transactions often facilitate the movement of unaccounted wealth. By restricting high-value cash receipts, the government aims to make such dealings more difficult and traceable.

- Promoting Digital Economy: Encouraging payments through banking channels like NEFT, RTGS, UPI, cheques, and demand drafts leads to better documentation and transparency. This aligns with the broader Digital India initiative.

- Increasing Tax Transparency: When transactions move through the banking system, they leave an audit trail, making it easier for tax authorities to track income and ensure proper tax payment, thus reducing tax evasion.

Who Needs to Comply? (Applicability):

A common point of confusion is who this section applies to. Section 269ST applies to the receiver of the cash. This means everyone is covered, regardless of their legal status or nature of income. This includes:

- Individuals

- Hindu Undivided Families (HUFs)

- Companies (Private or Public)

- Limited Liability Partnerships (LLPs)

- Partnership Firms

- Association of Persons (AOPs) or Body of Individuals (BOIs)

- Artificial Juridical Persons

Importantly, the rule applies whether the amount received is considered income under the Income Tax Act or not. Even if you receive a large cash gift or repayment of a loan in cash exceeding the limit, Section 269ST restrictions apply to you as the recipient.

Key Scenarios & Examples Under Section 269ST

To better understand the practical application of these restrictions on cash transactions, let’s delve deeper into the specific scenarios with more examples. Misinterpreting these can easily lead to unintentional non-compliance.

Scenario 1: Aggregate Receipts in a Day:

This rule focuses on the total cash received from one specific person within a 24-hour period. It doesn’t matter if the payments are for different goods, services, or reasons. If the sum total from that single payer crosses the ₹2 lakh threshold on that day, the rule is breached by the receiver.

Example Expanded: Imagine you own an electronics store. Mr. Sharma buys a laptop for ₹80,000 in the morning and pays in cash. Later the same day, he returns and buys a high-end television for ₹1,30,000, also paying in cash. Even though these are two separate transactions with separate invoices, you, the store owner, have received a total of ₹2,10,000 (₹80,000 + ₹1,30,000) in cash from Mr. Sharma on the same day. This constitutes a violation of Section 269ST. To comply, at least one of the payments, or the part exceeding the limit from the second transaction, should have been received through banking channels.

Scenario 2: Single Transaction Limit:

This scenario looks at the total value of a single transaction. If the transaction value itself is ₹2 lakh or more, you cannot accept cash payments totalling ₹2 lakh or more for it, even if the payments are split across multiple days or instalments. The defining factor is the linkage to that one specific transaction.

Example Expanded: You are a consultant providing services billed at ₹4,00,000. Your client proposes to pay you in three cash instalments: ₹1,50,000 on Day 1, ₹1,50,000 on Day 15, and ₹1,00,000 on Day 30. Although each individual payment is below ₹2 lakh, and the daily aggregate limit (from Scenario 1) isn’t breached on any single day, accepting the second cash instalment of ₹1,50,000 constitutes a violation. This is because the total cash received (₹1,50,000 + ₹1,50,000 = ₹3,00,000) pertains to a single transaction whose value exceeds ₹2 lakhs. The moment the cumulative cash received for that single transaction hits or exceeds ₹2 lakhs, the rule is broken.

Scenario 3: Transactions for a Single Event/Occasion:

This is perhaps the most nuanced scenario. It aggregates all cash payments received from one specific person that relate to a single identifiable event or occasion. This is common in sectors like hospitality, event management, catering, etc.

Example Expanded: Mrs. Verma hires your catering company for her daughter’s wedding festivities, which span multiple days (Mehndi, Sangeet, Wedding). She pays you ₹70,000 cash for the Mehndi catering, ₹90,000 cash for the Sangeet catering, and later ₹80,000 cash towards the main Wedding day catering. Although each payment is under ₹2 lakh and made on different days, they all relate to the single event of her daughter’s wedding. When you receive the third cash payment of ₹80,000, the total cash received from Mrs. Verma for this single occasion becomes ₹2,40,000 (₹70,000 + ₹90,000 + ₹80,000). This triggers a violation of Section 269ST. Proper cash handling rules section 269ST demand careful tracking of receipts per client per event. Increased section 269ST awareness for businesses in these sectors is vital.

Exceptions: When Do These Restrictions on Cash Transactions Not Apply?

While Section 269ST has broad applicability, the Income Tax Act provides certain specific exceptions where receiving cash of ₹2 lakh or more is permissible. Knowing these exceptions is as important as knowing the rule itself.

Government & Banking Transactions:

The restrictions under Section 269ST do not apply to receipts by the following entities:

- The Government

- Any banking company (as defined under the Banking Regulation Act, 1949)

- A post office savings bank

- A co-operative bank

This allows these institutions to continue their essential functions involving cash handling without being hindered by this specific restriction.

Specific Transactions Exempted:

Certain types of transactions are explicitly kept outside the purview of Section 269ST:

- Transactions covered under Section 269SS: Section 269SS deals with restrictions on acceptance of certain loans, deposits, and specified sums. If a transaction falls under the scope of Section 269SS (generally dealing with accepting loans/deposits in cash above ₹20,000), then Section 269ST will not apply to that specific transaction. The rules of Section 269SS would prevail. Essentially, these two sections cover different types of receipts, preventing overlap for loan/deposit related transactions.

- Receipts by Persons Notified by the Government: The Central Government has the power to notify specific persons, classes of persons, or classes of transactions that will be exempt from Section 269ST. For instance, cash receipts by business correspondents on behalf of banking companies, or receipts by white label ATM operators from retail outlets, have been notified as exceptions under certain conditions.

Cash Withdrawals:

It is crucial to remember that Section 269ST governs the receipt of cash. It does not restrict an individual or entity from withdrawing cash of ₹2 lakh or more from their own bank account, including a post office savings bank or cooperative bank account. However, other provisions related to Tax Deducted at Source (TDS) on large cash withdrawals (Section 194N) might apply, which is a separate consideration.

Recommendation:

The list of notified exceptions can evolve. It is always advisable to stay updated by checking the latest notifications and circulars issued by the Central Board of Direct Taxes (CBDT). You can refer to the official Income Tax India Website for authentic information.

Consequences of Non-Compliance: The Cost of Ignoring Section 269ST

The government has backed Section 269ST with stringent penalties to ensure compliance. Ignoring these restrictions on cash transactions can lead to severe financial repercussions. Understanding these consequences underscores the importance of adhering to the rules.

Penalty Under Section 271DA:

If a person receives cash in contravention of the provisions of Section 269ST, they become liable to pay a penalty under Section 271DA of the Income Tax Act. This section specifically penalises the receiver of the prohibited cash amount.

Penalty Amount:

The penalty levied under Section 271DA is equal to the amount of cash received in violation of Section 269ST. This means a 100% penalty on the entire sum received improperly.

Example: If you received ₹2,50,000 in cash from a single person in a single day, violating Section 269ST, the penalty levied on you (the receiver) under Section 271DA would be ₹2,50,000. This highlights the severe financial risk associated with non-compliance – you could effectively lose the entire amount received in cash as a penalty. The cash transactions above 2 lakhs consequences are therefore extremely significant.

Who Imposes the Penalty?

The authority to levy the penalty under Section 271DA lies with the Joint Commissioner of Income Tax. They are empowered to initiate penalty proceedings upon detecting a violation. Understanding the section 269ST penalties India framework is crucial for risk assessment.

Is there any Relief?

The Income Tax Act does provide a potential escape route under Section 273B. This section states that no penalty shall be imposed under provisions like Section 271DA if the person concerned proves that there was a “good and sufficient reason” for the failure or contravention. However, what constitutes a “good and sufficient reason” is subjective and depends on the facts and circumstances of the case, interpreted by the tax authorities and potentially the judiciary. Relying on this clause is risky, and proving the reason convincingly can be challenging. Therefore, proactive compliance is always the strongly recommended approach rather than hoping for relief after a violation.

Practical Compliance Guide: Staying on the Right Side of the Law

Adhering to Section 269ST requires diligence, especially for small businesses dealing with frequent transactions and individuals involved in occasional large-value dealings. Implementing practical measures can significantly reduce the risk of non-compliance. This section 269ST compliance guide offers tips for both businesses and individuals.

Tips for Small Business Owners:

Businesses, particularly those in retail, trading, services, or event management, need robust processes to manage cash receipts effectively.

- Promote Digital Payments: Actively encourage customers to pay via digital modes like UPI, NEFT, RTGS, IMPS, credit/debit cards, or account payee cheques/drafts. Display QR codes and POS machine availability prominently.

- Issue Clear Invoices: Ensure all invoices clearly mention the business PAN/GSTIN and ideally include a note encouraging digital payments for amounts nearing or exceeding the threshold. Specify payment modes received on the invoice itself.

- Maintain Meticulous Records: Keep detailed records of all transactions, especially cash receipts. This includes date, amount, payer’s details (if possible, especially for larger amounts below the threshold), and invoice reference. Proper accounting helps track aggregate receipts. Consider using accounting software for better management. TaxRobo Accounts Service can assist here. For more insights on setting up an accounting system, consider reading Set Up An Accounting System for My Small Business.

- Staff Training: Train your staff, especially cashiers and accounts personnel, about the specific

section 269ST cash transaction rules. Ensure they understand the limits related to daily aggregate, single transaction, and single event from one person.Section 269ST awareness for businessesstarts with informed employees. - Monitor Large Transactions: Be particularly vigilant when dealing with high-value sales, event bookings, or multiple transactions with the same party within short periods. Flag transactions nearing the ₹2 lakh mark for careful handling. Training on compliance and tax regulations is crucial. Learn more about Taxation Services in India.

Tips for Salaried Individuals:

Individuals might encounter Section 269ST primarily during significant personal financial activities. Awareness of cash handling rules section 269ST is equally important.

- Awareness for Large Transactions: Be mindful when selling personal assets like property, vehicles, or valuable jewellery. If the sale consideration is ₹2 lakh or more, insist on payment via banking channels (cheque, draft, online transfer) rather than accepting large amounts of cash.

- Gifts and Loan Repayments: If receiving substantial monetary gifts or repayment of loans given, ensure the amount received in cash from a single person doesn’t trigger the Section 269ST limits (per day, per transaction, per event). Request payments via banking channels for amounts exceeding the threshold.

- Prefer Banking Channels: As a general rule, for any receipt (other than from your employer as salary, which usually comes via bank transfer) that is ₹2 lakh or more, prefer receiving it through your bank account. This creates a clear record and avoids potential penalties.

- Keep Documentation: Maintain records for significant receipts, such as sale agreements, gift declarations, or loan repayment acknowledgements, specifying the mode of receipt. This documentation can be helpful if questions arise later. For more on handling personal finances and tax implications, check our Step-by-Step Guide to Filing Income Tax Returns for Salaried Individuals in India.

Conclusion

Section 269ST of the Income Tax Act represents a significant step by the government towards regulating high-value cash dealings in India. The core message is clear: there are stringent restrictions on cash transactions when an individual or entity receives ₹2 lakh or more in cash from a single person in a day, for a single transaction, or related to a single event/occasion from one person.

Ignoring these rules isn’t an option, as the consequences involve a hefty 100% penalty on the amount received improperly, as outlined under Section 271DA. For both small businesses and individuals, embracing digital payment methods for large transactions is not just convenient but a necessary compliance measure. Maintaining financial discipline, keeping accurate records, and understanding the nuances of Section 269ST are key to navigating India’s evolving financial landscape smoothly and avoiding penalties.

If you have specific questions about how Section 269ST applies to your business operations or personal financial situation, or need assistance with overall tax compliance, consider seeking expert advice. Professionals at TaxRobo can provide tailored guidance to ensure you remain compliant with all Indian tax regulations. Explore our TaxRobo Online CA Consultation Service for personalized support.

Frequently Asked Questions (FAQs) about Section 269ST

Here are answers to some common questions regarding the restrictions on cash transactions under Section 269ST:

Q1. Does the ₹2 lakh limit apply per person per day or per transaction?

Answer: The limit under Section 269ST is triggered if any of the following conditions are met regarding cash receipts of ₹2 lakh or more:

- The aggregate amount received from a single person in a single day reaches or exceeds ₹2 lakh.

- The amount received is against a single transaction (even if paid in instalments across days).

- The aggregate amount received from a single person relates to transactions for a single event or occasion.

It’s not just one condition; breaching any of these three triggers the restriction.

Q2. I received two cash payments of ₹1.5 lakhs each from the same buyer on the same day for two different invoices. Is this allowed?

Answer: No, this is not allowed and violates Section 269ST. The rule prohibits receiving cash of ₹2 lakh or more in aggregate from a person in a day. In this case, you received a total of ₹3 lakhs (₹1,50,000 + ₹1,50,000) in cash from the same buyer on the same day. Since this aggregate amount exceeds ₹2 lakhs, it contravenes the provision.

Q3. Does Section 269ST apply if I withdraw ₹3 lakhs cash from my own bank account?

Answer: No. Section 269ST applies specifically to the receipt of cash from another person. It does not restrict withdrawals of cash from your own bank account. However, be aware that Section 194N of the Income Tax Act may require the bank to deduct TDS if your total cash withdrawals exceed certain limits during the financial year.

Q4. Are agricultural transactions exempt from Section 269ST?

Answer: Section 269ST applies generally to all receipts of ₹2 lakh or more in cash, irrespective of the nature of the transaction or whether the income is taxable, unless specifically exempted. While agricultural income itself might be exempt from income tax under Section 10(1), the receipt of cash exceeding the limits of Section 269ST is generally not automatically exempt. Only receipts by entities like the Government, banks, post offices, or specific persons/classes notified by the Central Government are exempt. Therefore, unless a specific notification exempts cash receipts related to agricultural produce sales above the limit, Section 269ST rules would likely apply to the receiver. It is best to consult the latest notifications on the Income Tax India Website or seek expert advice.

Q5. What happens if I unknowingly accept cash above the limit?

Answer: Claiming ignorance of the law is typically not accepted as a valid defence against penalties. If you violate Section 269ST, you are liable for a penalty equal to the amount received under Section 271DA. However, Section 273B allows for the possibility of penalty waiver if you can demonstrate to the tax authorities that there was a “good and sufficient reason” for accepting the cash. Proving this can be difficult and depends heavily on the specific facts and the discretion of the Joint Commissioner. Facing potential section 269ST penalties India is a serious matter, so ensuring compliance proactively is always the safest approach. If a violation occurs, consulting a tax professional immediately is advisable. TaxRobo offers expert guidance through services like TaxRobo Income Tax Service.