Section 192: TDS on Salary – Employer’s Responsibilities

Payroll compliance is a cornerstone of running a successful business in India. Among the various statutory requirements, understanding and correctly implementing Tax Deducted at Source (TDS) is paramount. A significant component of this is TDS on Salary, governed specifically by Section 192 of the Income Tax Act, 1961. This provision mandates employers to deduct income tax from the salaries paid to their employees before the salary is credited. For employers across India, mastering Section 192 TDS compliance is not just a legal formality; it’s crucial for avoiding hefty penalties, interest, and potential legal complications, ensuring smooth business operations. Understanding TDS on Salary in India can seem daunting, especially for small business owners juggling multiple responsibilities. This post aims to simplify Section 192 TDS details and provide a clear, comprehensive guide on the specific employer responsibilities under Section 192, empowering you to manage your payroll tax obligations effectively.

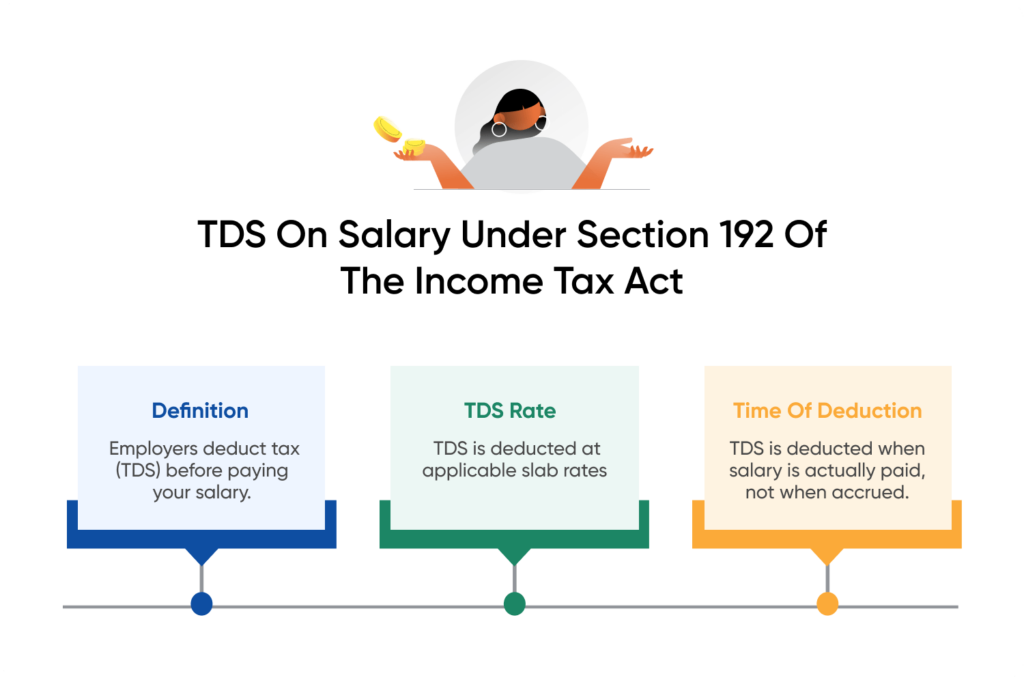

Understanding Section 192: The Basics of TDS on Salary

Before diving into the specifics of compliance, it’s essential to grasp the fundamental principles of Section 192 and how it applies to salary payments. This section forms the bedrock of TDS on Salary regulations.

What is Section 192 of the Income Tax Act?

In simple terms, Section 192 of the Income Tax Act, 1961, requires any person responsible for paying income chargeable under the head “Salaries” to deduct income tax on the amount payable. This deduction must occur at the time of payment. It essentially acts as a mechanism for the government to collect income tax directly from the source of income generation – the salary payment itself. The tax is deducted based on the estimated income of the employee for the financial year and the applicable income tax slab rates. This provision ensures regular tax collection throughout the year rather than relying solely on year-end tax payments by employees.

What Constitutes ‘Salary’ for TDS Purposes?

Understanding what components form the ‘salary’ base for TDS calculation is critical for accurate deductions. According to the Income Tax Act, ‘Salary’ under Section 17(1) is quite comprehensive and includes various monetary and non-monetary benefits provided by the employer. Key components generally include:

- Basic Pay: The fixed component of the salary structure.

- Dearness Allowance (DA): An allowance paid to mitigate the impact of inflation.

- Bonuses: Performance-based or festival bonuses paid during the year.

- Commissions: Sales-based or other forms of commission payable, whether fixed or percentage-based.

- Perquisites: Non-monetary benefits provided by the employer, whose value is taxable. Examples include rent-free or concessional accommodation (valuation rules apply), company car facility (partially taxable based on usage and car details), stock options (ESOPs), club memberships paid by the employer, etc.

- Profits in lieu of Salary: Payments received by an employee in addition to salary or wages, like termination compensation.

- Advance Salary: Salary paid in advance is taxed in the year of receipt.

- Leave Encashment: Amount received for encashing unutilized leave is generally taxable, especially if encashed during service.

- Pension: Pension received from a former employer is taxed under the head ‘Salaries’.

It’s important to note that reimbursements provided by the employer for actual expenses incurred wholly and exclusively for official duties (e.g., travel expenses for business trips, telephone bill reimbursement for official calls as per company policy) are generally not considered part of salary for TDS purposes, provided proper documentation is maintained. Grasping these Section 192 TDS details is fundamental for correct tax calculation.

Who is Responsible for Deducting TDS under Section 192?

The responsibility for deducting TDS under Section 192 falls squarely on the employer. This includes any entity making a payment classified as ‘Salary’. The definition of ’employer’ is broad and covers:

- Companies (Private Limited, Public Limited)

- Partnership Firms & LLPs

- Individuals & Hindu Undivided Families (HUFs) – if liable for tax audit.

- Trusts

- Societies

- Associations of Persons (AOP) / Bodies of Individuals (BOI)

- Government bodies

Essentially, any person or entity making salary payments that exceed the basic exemption limit must comply with these Employer’s TDS obligations India. The status of the employee (resident or non-resident) might affect the rate and procedure, but the primary responsibility remains with the payer.

When is TDS on Salary Required to be Deducted?

A crucial aspect of Section 192 is the timing of the deduction. TDS on salary must be deducted at the time of actual payment of salary to the employee. This is different from many other TDS provisions where tax might be deducted on accrual or payment, whichever is earlier. For salaries, the trigger is the payment event. Since salaries are typically paid monthly, employers are required to deduct TDS every month based on the employee’s estimated annual income and the average rate of tax applicable. This ensures a consistent flow of tax revenue to the government and prevents a large tax burden on the employee at the end of the financial year.

Calculating TDS on Salary: A Step-by-Step Guide for Employers

Accurate calculation is the first step towards fulfilling your TDS on Salary obligations. Employers need a systematic approach to estimate the employee’s tax liability for the year and determine the monthly deduction amount. Here’s a breakdown of the process:

Step 1: Estimate the Employee’s Total Annual Income

First, the employer must compute the employee’s gross salary for the entire financial year (April 1st to March 31st). This involves summing up all taxable components expected to be paid during the year: Basic Pay, DA, HRA, Transport Allowance (if taxable), other allowances, bonuses, commissions, taxable value of perquisites, etc. The employer should also consider any other income reported by the employee. Employees can declare other income (like rental income from house property or interest income) and losses (like loss from house property, limited to Rs. 2 Lakhs against salary income) to the employer using Form 12BB. Incorporating these declarations allows for a more accurate estimation of the total taxable income and consequently, the TDS amount.

Step 2: Consider Exemptions and Deductions Declared

After estimating the gross annual income, the next step is to account for eligible exemptions and deductions that reduce the taxable income. Employers must consider these based on the declarations and supporting proofs submitted by the employees, typically at the beginning of the financial year or as per company policy deadlines. Common items include:

- Exemptions: House Rent Allowance (HRA) under Section 10(13A) (subject to calculation limits), Leave Travel Allowance (LTA) under Section 10(5) (subject to conditions and limits).

- Standard Deduction: A flat deduction available to all salaried employees (currently Rs. 50,000).

- Professional Tax: Deduction for professional tax paid by the employee (subject to state laws).

- Deductions under Chapter VI-A: These are based on investments or expenses declared by the employee in Form 12BB, supported by proof. Key sections include:

- Section 80C: Investments like EPF, PPF, ELSS, life insurance premiums, tuition fees, home loan principal repayment, etc. (up to Rs. 1.5 Lakhs).

- Section 80CCD(1B): Additional deduction for NPS contribution (up to Rs. 50,000).

- Section 80D: Health insurance premiums for self, family, and parents (limits vary based on age).

- Section 80E: Interest paid on education loans.

- Section 80G: Donations to eligible funds/charities.

- Section 80TTA/80TTB: Deduction for interest on savings accounts (for regular individuals / senior citizens).

- Section 24(b): Deduction for interest paid on home loans (up to Rs. 2 Lakhs for self-occupied property).

It’s crucial for employers to collect necessary proofs for these deductions before allowing them for TDS calculation to ensure compliance.

Step 3: Determine the Applicable Income Tax Slab Rates

Once the net taxable income (Gross Income – Exemptions – Deductions) is computed, the employer needs to apply the income tax slab rates applicable for the relevant financial year. A critical point here is the choice between the Old Tax Regime (with various exemptions and deductions) and the New Tax Regime (Section 115BAC, with lower slab rates but fewer exemptions/deductions). Employees (without business income) can choose their preferred regime and intimate the employer. The employer must calculate TDS based on the regime chosen by the employee. If no intimation is received, the employer usually defaults to the New Tax Regime (it’s advisable to confirm current default guidelines). Remember to add the applicable Health and Education Cess (currently 4%) to the calculated income tax. These TDS Salary rules Bangalore or any other city follow the same national guidelines set by the Income Tax Act. For more in-depth guidance on India’s tax regulations, check out our TAXATION SERVICES IN INDIA post.

Step 4: Calculate the Average Rate of Income Tax

After calculating the total estimated annual income tax liability (including cess), the employer determines the average rate of income tax. This is typically done by dividing the total estimated tax payable by the employee’s estimated total taxable income for the financial year. For example, if the total tax is Rs. 60,000 on a taxable income of Rs. 8,00,000, the average rate is 7.5%. However, a more practical approach often used is to directly calculate the total annual tax liability. This total tax amount is then used to determine the monthly deduction.

Step 5: Determine the Monthly TDS Amount

The final step is to ascertain the amount of tax to be deducted each month. This is done by dividing the total estimated tax liability calculated in Step 3 (including cess) by the number of months the employee is expected to be employed with that employer during the financial year. For instance, if the total annual tax is Rs. 1,20,000 and the employee works for the full 12 months, the monthly TDS deduction would be Rs. 10,000. Any excess or shortfall arising due to changes in salary, investments, or income declarations during the year should be adjusted in the subsequent months’ TDS deductions.

(Optional) Example Calculation

Let’s consider a simplified example:

- Employee’s Gross Annual Salary: Rs. 9,00,000

- Standard Deduction: Rs. 50,000

- Declared 80C Deduction (Proofs Submitted): Rs. 1,50,000

- Employee opts for Old Tax Regime.

- Net Taxable Income = Rs. 9,00,000 – Rs. 50,000 – Rs. 1,50,000 = Rs. 7,00,000

Tax Calculation (Old Regime – Assuming rates for FY 2023-24):

- Up to Rs. 2,50,000: Nil

- Rs. 2,50,001 to Rs. 5,00,000 (Rs. 2,50,000 @ 5%): Rs. 12,500

- Rs. 5,00,001 to Rs. 7,00,000 (Rs. 2,00,000 @ 20%): Rs. 40,000

- Total Income Tax = Rs. 12,500 + Rs. 40,000 = Rs. 52,500

- Add Health & Education Cess @ 4% = 4% of Rs. 52,500 = Rs. 2,100

- Total Annual Tax Liability = Rs. 52,500 + Rs. 2,100 = Rs. 54,600

Monthly TDS:

- Monthly TDS = Rs. 54,600 / 12 = Rs. 4,550

The employer would deduct Rs. 4,550 each month from the employee’s salary. To avoid common pitfalls in tax filing, consider reading our guide on Common Mistakes in Income Tax Returns and How to Avoid Them.

Key Employer Responsibilities under Section 192 TDS Compliance

Compliance with TDS on Salary involves more than just calculation. Employers have several crucial responsibilities mandated by the Income Tax Act. Fulfilling these diligently is key to avoiding penalties and maintaining a clean record.

1. Accurate TDS Calculation and Deduction

The foremost responsibility is ensuring the correct calculation and deduction of TDS for every employee, every month. This requires meticulous computation based on the employee’s estimated income, applicable tax regime (Old vs. New as chosen by the employee), declared investments (with proof), and the prevailing income tax slab rates and rules for the financial year. Employers must also be vigilant about incorporating any changes during the year, such as salary increments, joining/leaving dates, revisions in investment declarations, or changes in tax laws, and adjusting the TDS deductions accordingly in the subsequent months. These core Employer responsibilities under Section 192 demand accuracy and up-to-date knowledge of tax regulations.

2. Obtaining TAN (Tax Deduction and Collection Account Number)

Every employer responsible for deducting TDS (whether on salary or other payments) must obtain a unique 10-digit alphanumeric number called the Tax Deduction and Collection Account Number (TAN). Applying for TAN is done using Form 49B, submitted online or through TIN Facilitation Centers. This number is mandatory and must be quoted in all TDS-related communications and documentation, including TDS deposit challans (Challan 281), TDS returns (Form 24Q), and TDS certificates (Form 16). Failure to obtain or quote TAN can attract penalties. This is a foundational step for fulfilling Employer’s TDS obligations India.

3. Timely Deposit of Deducted TDS to the Government

Once TDS is deducted from the employee’s salary, the employer has a strict deadline to deposit this amount with the government. The due date for depositing TDS is generally the 7th day of the subsequent month. For example, TDS deducted in June must be deposited by July 7th. However, there’s an exception for TDS deducted in the month of March; the due date for this is extended to April 30th. The deposit is made using Challan ITNS 281, specifying the correct TAN, assessment year, and payment type. Failure to deposit the deducted TDS on time attracts mandatory interest under Section 201(1A) of the Income Tax Act (currently 1.5% per month or part thereof from the date of deduction to the date of deposit).

4. Filing Quarterly TDS Returns (Form 24Q)

Employers are required to file quarterly statements detailing the TDS deducted and deposited for all employees. This statement, known as Form 24Q, provides a comprehensive record of salary payments and tax deductions for each employee during the quarter. Form 24Q has two annexures: Annexure I contains details of each employee, challan details of TDS deposited, etc., while Annexure II (submitted only in the last quarter, Q4) contains the detailed salary breakup, exemptions, deductions claimed by each employee. The due dates for filing Form 24Q are:

| Quarter Ending | Due Date |

|---|---|

| June 30th | July 31st |

| September 30th | October 31st |

| December 31st | January 31st |

| March 31st | May 31st |

Late filing of Form 24Q attracts a late filing fee under Section 234E (Rs. 200 per day, subject to the total TDS amount) and potential penalties. Whether your business operations are centered in a major hub like handling TDS on Salary for employers Mumbai or located elsewhere, these filing deadlines are mandatory nationwide.

5. Issuing TDS Certificates (Form 16) to Employees

After the financial year ends, employers must provide each employee with a TDS certificate in Form 16. This certificate summarizes the salary paid, TDS deducted, and deposited during the financial year. Form 16 has two parts:

- Part A: Contains details of TDS deducted and deposited quarterly, verified and downloaded from the TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal. It includes the employer’s and employee’s PAN, TAN, address, assessment year, and summary of tax deposited.

- Part B: An annexure prepared by the employer, detailing the gross salary components, exemptions allowed (like HRA, LTA), deductions claimed under Chapter VI-A, and the computation of tax.

The due date for issuing Form 16 to employees is typically June 15th following the end of the financial year. This certificate is crucial for employees as it serves as proof of tax deduction and helps them file their Income Tax Returns accurately. Fulfilling these TDS on Salary responsibilities ensures transparency and aids employee tax compliance.

6. Maintaining Proper Records and Documentation

Finally, employers must maintain meticulous records related to salary payments, TDS calculations, deductions, deposits, and employee declarations. This includes preserving copies of Form 12BB (employee declarations), investment proofs submitted by employees, TDS calculation worksheets, copies of Challan 281 (TDS deposit receipts), filed Form 24Q returns, and issued Form 16 certificates. These records are essential for internal audits, responding to queries from the tax department, and demonstrating compliance during assessments. Proper record-keeping is a fundamental aspect of sound financial governance and Section 192 TDS compliance.

Common Challenges and How TaxRobo Can Help

Navigating the complexities of TDS on Salary can be challenging for employers, especially small and medium-sized businesses. Some common hurdles include:

Navigating Complex Salary Structures

Modern salary packages often include variable components, performance-linked incentives, various perquisites (like stock options, car facilities, accommodation), and complex reimbursement policies. Correctly calculating the taxable value of these components and applying TDS appropriately requires expertise and careful attention to detail. Errors in valuation or classification can lead to incorrect TDS deductions.

Managing Employee Investment Declarations and Proofs

Collecting investment declarations (Form 12BB) from all employees at the beginning of the year, reminding them to submit proofs towards the year-end, verifying these proofs, and accurately factoring them into TDS calculations is a significant administrative task. Delays or inaccuracies in this process can affect the monthly TDS amounts and potentially lead to discrepancies later.

Staying Updated with Frequent Tax Law Changes

Income tax laws, slab rates, deduction rules, and compliance procedures are subject to change, often announced through the annual Union Budget or notifications from the Central Board of Direct Taxes (CBDT). Staying updated with these changes, especially those announced in New Delhi impacting nationwide regulations like Salary TDS in New Delhi and across India, is crucial but can be time-consuming for busy employers. Misinterpreting or overlooking updates can lead to non-compliance. For a detailed analysis of changes, see our article on The Impact of Recent Tax Law Changes on Businesses.

How TaxRobo Simplifies Your TDS Obligations

Managing TDS on Salary accurately and efficiently requires time, expertise, and robust processes. This is where TaxRobo can be your trusted partner. We offer comprehensive solutions designed to ease your compliance burden:

- Payroll Processing: Our services ensure accurate salary calculation, considering all components, exemptions, and deductions, integrated with precise TDS computation as per the latest laws.

- TDS Return Filing: We handle the preparation and timely filing of your quarterly Form 24Q returns, ensuring accuracy and adherence to deadlines, minimizing the risk of penalties.

- Compliance Management: TaxRobo stays updated on all tax law changes, ensuring your payroll and TDS processes remain compliant year-round.

- Tax Advisory: Our experts provide guidance on complex salary structuring, perquisite valuation, and other TDS-related queries.

By outsourcing your payroll and TDS management to TaxRobo, you can ensure accuracy, timeliness, and complete peace of mind regarding your TDS on Salary obligations, allowing you to focus on your core business activities. Visit our TaxRobo Accounts Service page or contact us for tailored solutions.

Conclusion

Compliance with Section 192 regarding TDS on Salary is a critical legal requirement for every employer in India. The core Employer responsibilities under Section 192 encompass accurate calculation and deduction based on employee income and declarations, obtaining a TAN, timely deposit of the deducted tax using Challan 281, meticulous filing of quarterly TDS returns (Form 24Q), and prompt issuance of Form 16 to employees. Adhering to these obligations is non-negotiable for avoiding significant interest, penalties, and potential prosecution. Effective management of TDS on Salary reflects good corporate governance and builds trust with employees. Given the complexities and frequent updates in tax laws, ensuring seamless Employer TDS Section 192 compliance can be challenging.

Are you struggling with TDS on Salary calculations, return filing, or overall payroll management? Don’t let compliance worries burden your business. Ensure seamless Section 192 TDS compliance – Let TaxRobo handle your TDS on Salary needs! Contact TaxRobo today for expert assistance and reliable payroll solutions. Visit our TaxRobo Online CA Consultation Service page to schedule a consultation.

FAQs (Frequently Asked Questions)

Q1: What is the threshold limit for deducting TDS on Salary under Section 192?

A: TDS under Section 192 is required to be deducted if the employee’s estimated salary income for the financial year, after considering eligible exemptions and deductions, exceeds the basic exemption limit applicable to them. This limit depends on the employee’s age and the tax regime chosen (Old or New). For instance, under the New Tax Regime for FY 2023-24, the basic exemption limit is Rs. 3,00,000. Under the Old Regime, it’s Rs. 2,50,000 for individuals below 60, Rs. 3,00,000 for senior citizens (60-80), and Rs. 5,00,000 for super senior citizens (80+). Always refer to the limits applicable for the specific financial year.

Q2: What are the consequences if an employer fails to deduct or deposit TDS on Salary?

A: Failure to deduct TDS or failure to deposit the deducted TDS with the government on time can lead to serious consequences for the employer. These include:

- Interest: Mandatory interest under Section 201(1A) is levied for late deposit (currently 1.5% per month or part month) and late deduction (currently 1% per month or part month).

- Penalty: Penalty under Section 271C, equivalent to the amount of tax not deducted or not paid, can be imposed.

- Disallowance of Expense: Salary expenditure might be disallowed under Section 40(a)(ia) for non-deduction/non-payment of TDS, increasing the employer’s taxable income.

- Prosecution: In severe cases of default, prosecution under Section 276B can be initiated.

- Assessee in Default: The employer can be treated as an ‘assessee in default’ for the amount of tax not deducted or deposited.

Q3: Can employees choose between the Old and New Tax Regimes for TDS calculation? How should employers handle this?

A: Yes, employees who do not have income from business or profession have the option to choose between the Old Tax Regime (with higher slab rates but various exemptions/deductions) and the New Tax Regime under Section 115BAC (with lower slab rates but fewer exemptions/deductions) each financial year. Employees should intimate their chosen regime to the employer, typically at the beginning of the financial year via a declaration. The employer is then obligated to calculate and deduct TDS on Salary based on the regime opted for by the employee for that financial year. If the employee does not make an intimation, the employer is generally required to deduct TDS based on the default regime, which is the New Tax Regime (Section 115BAC) effective from FY 2023-24 onwards (always verify the current rules).

Q4: How is TDS calculated if an employee joins or leaves mid-year?

A: If an employee joins or leaves employment during the financial year, the current employer needs to calculate TDS based on the salary *estimated to be paid by them* for the period of employment within that financial year. The employer should request the employee joining mid-year to furnish details of their previous employment and salary received/TDS deducted by the former employer using Form 12B. Based on the total estimated income for the year (including previous employment salary, if applicable) and deductions/exemptions applicable for the period, the total annual tax liability is computed. This tax liability (less any tax already deducted by the previous employer, if applicable) is then proportionately deducted over the remaining months of employment with the current employer. For an employee leaving mid-year, TDS is calculated based on the salary paid up to the leaving date.

Q5: Where can employers find the latest official information on TDS rates and rules?

A: The most reliable and official sources for the latest information on TDS rates, rules, procedures, and updates are:

- The official website of the Income Tax Department of India: https://incometaxindia.gov.in

- The TRACES (TDS Reconciliation Analysis and Correction Enabling System) portal: https://www.tdscpc.gov.in/

These websites provide access to the Income Tax Act, Rules, Circulars, Notifications, and guides related to TDS compliance. It is advisable to refer to these official sources or consult with tax professionals like TaxRobo for accurate and up-to-date information.