Foreign Remittance Over ₹7 Lakhs – How It Appears in AIS

In today’s interconnected world, sending money abroad has become increasingly common. Whether it’s for funding education overseas, investing in global markets, supporting family, managing business payments, or simply travelling, foreign remittance India is a frequent financial activity for many. As financial transactions become more digital and transparent, the Income Tax Department (ITD) has sophisticated tools to track them, with the Annual Information Statement (AIS) being a prime example. Understanding how your transactions, especially significant ones like foreign remittance over 7 lakhs, are captured is crucial for staying compliant. This post delves into the specifics of AIS foreign remittance appearance, explaining what information shows up, why it matters, and what steps you, as a salaried individual or small business owner, should take regarding foreign remittance reporting in AIS.

What is Foreign Remittance and the Liberalised Remittance Scheme (LRS)?

Before diving into the AIS details, it’s essential to grasp the basics of foreign remittances and the governing framework in India.

Defining Foreign Remittance

Simply put, foreign remittance India refers to the act of sending money from India to a beneficiary located outside the country. This transfer can be for various purposes permitted under the law, such as:

- Overseas education

- Travel for leisure or business

- Medical treatment abroad

- Maintenance of close relatives residing overseas

- Gifts or donations

- Overseas investments in shares, property, or debt instruments

- Setting up subsidiaries or joint ventures abroad (for businesses)

These transactions are regulated primarily by the Reserve Bank of India (RBI) to manage foreign exchange outflows.

The Liberalised Remittance Scheme (LRS) Explained

The RBI facilitates outward remittances by resident individuals through the Liberalised Remittance Scheme (LRS). This scheme allows resident individuals, including minors, to freely remit funds up to a certain limit for permissible current or capital account transactions, or a combination of both. As per current regulations, the overall LRS limit is USD 250,000 per person per financial year (April to March). It’s important to adhere to these foreign remittance rules India and ensure your remittances fall under permitted categories and within the prescribed limit. The LRS simplifies the process but also brings transactions under regulatory scrutiny.

For small business owners, understanding these financial frameworks can be crucial. Consider reading more on how to Set Up An Accounting System for My Small Business.

Why the ₹7 Lakh Threshold Matters

While the LRS provides a generous annual limit of USD 250,000, a specific threshold of ₹7 lakhs gains significance primarily due to tax regulations introduced under the Income Tax Act, 1961. This threshold is directly linked to the applicability of Tax Collected at Source (TCS). When outward remittances under LRS exceed this foreign remittance limit India of ₹7 lakhs in a financial year, the bank or authorized dealer facilitating the remittance is generally required to collect TCS from the remitter. This doesn’t mean remittances below ₹7 lakhs are completely invisible, but the ₹7 lakh mark acts as a critical trigger point for tax collection and, consequently, mandatory reporting that prominently features in your AIS.

What is the Annual Information Statement (AIS)?

The Annual Information Statement (AIS) is a comprehensive statement providing details of various financial transactions undertaken by a taxpayer during a financial year. It aims to promote transparency and enable taxpayers to file accurate income tax returns.

AIS: Your Financial Transaction Summary

Think of AIS as a consolidated report card of your significant financial activities that have been reported to the Income Tax Department by various entities. Its purpose is to:

- Display complete information to the taxpayer.

- Promote voluntary compliance and enable seamless pre-filling of returns.

- Deter non-compliance by making transaction data readily available.

Taxpayers can easily access their AIS through the official Income Tax portal. You just need to log in to your account on the Income Tax India Website, navigate to the ‘Services’ tab, and select ‘Annual Information Statement (AIS)’. Here you can view both a summary (Taxpayer Information Summary – TIS) and the detailed AIS.

Understanding how to accurately report your financial information is critical. You might find our Step-by-Step Guide to Filing Income Tax Returns for Salaried Individuals in India particularly useful.

How Information Reaches AIS

The data reflected in your AIS doesn’t appear magically; it’s collected from various sources obligated to report high-value financial transactions to the ITD. These reporting entities include:

- Banks and Financial Institutions

- Post Offices

- Registrars and Sub-Registrars (for property transactions)

- Companies issuing shares/debentures

- Mutual Fund Houses

- Foreign Exchange Dealers (Authorized Dealers)

These entities report specific transactions under the Statement of Financial Transactions (SFT) rules. When an Authorized Dealer (usually your bank) facilitates your foreign remittance under LRS, especially if it triggers TCS provisions, they are required to report this information, which then populates your AIS. This is how the system captures data related to foreign remittances.

Foreign Remittance Over 7 Lakhs: The AIS Foreign Remittance Appearance

Understanding exactly how your substantial foreign remittances are presented in the AIS is key to proactive tax management. The reporting is linked to the regulatory requirements placed on the financial institutions handling these transfers.

Reporting Mechanism by Banks/Authorised Dealers

Authorized Dealer (AD) banks play a crucial role in foreign remittance reporting in AIS. When you initiate an outward foreign remittance over 7 lakhs under the LRS during a financial year, the bank processing the transaction is generally obligated to collect TCS (Tax Collected at Source) based on the applicable rules. Concurrently, the bank must report these remittances and the associated TCS details to the Income Tax Department through the Statement of Financial Transactions (SFT). This reporting ensures that significant foreign exchange outflows are tracked and correlated with the taxpayer’s profile. The AIS foreign remittance appearance is a direct consequence of this mandatory reporting by the AD bank, triggered particularly when the aggregate remittance amount crosses the ₹7 lakh threshold within the financial year.

What Details Appear in Your AIS?

When you check your AIS, information related to foreign remittances will typically be listed under specific categories related to SFT or TCS. You are likely to find the following details concerning foreign remittance over 7 lakhs:

- Aggregate Value: The total amount of foreign remittance made under LRS during the financial year, as reported by the AD bank. This figure becomes particularly prominent once it exceeds the ₹7 lakh threshold.

- Reporting Entity: The name of the bank or Authorized Dealer who processed and reported the transaction.

- TCS Amount: If Tax Collected at Source was applicable (i.e., remittances exceeded ₹7 lakhs and weren’t exempt), the amount of tax collected by the bank will also be reflected.

- Transaction Date/Period: While individual transaction dates might not always be listed exhaustively, the report will pertain to the specific financial year.

The exact granularity of information might vary slightly depending on how the reporting entity submits the data, but the aggregate remittance value and any TCS collected are standard elements of the AIS foreign remittance appearance.

Understanding the Information Code in AIS

The Income Tax Department uses specific codes within the AIS framework to categorize different types of financial transactions reported under SFT. For foreign remittances under LRS and related TCS, you might encounter codes such as:

- SFT-014 (or similar): Often used for reporting outward foreign remittances under LRS by authorized dealers.

- TCS Codes (e.g., 206C(1G)): Specific sections under which TCS is collected, like Section 206C(1G) for LRS remittances, will have corresponding entries showing the tax collected.

Identifying these codes can help you pinpoint the foreign remittance transactions within your comprehensive AIS report and understand the context of the reported information more clearly. This aids in reconciling the figures with your personal records.

Foreign Remittance Tax Implications India: Focus on TCS

The most direct tax implication associated with large foreign remittances under LRS is Tax Collected at Source (TCS). Understanding these rules is vital for anyone sending significant amounts abroad.

What is Tax Collected at Source (TCS)?

TCS is a tax collected by the seller (in this case, the Authorized Dealer bank) from the buyer (the remitter) at the time of debiting the amount payable or receiving the payment, whichever is earlier. As per the foreign remittance under income tax act, specifically Section 206C(1G), AD banks are required to collect TCS on foreign remittances made under the LRS framework once certain thresholds are breached. This is not an additional tax burden in the final calculation, but rather an upfront collection that can be claimed as a credit against your final tax liability when filing your Income Tax Return (ITR). It ensures that the transaction is reported and tax is collected closer to the point of the transaction itself.

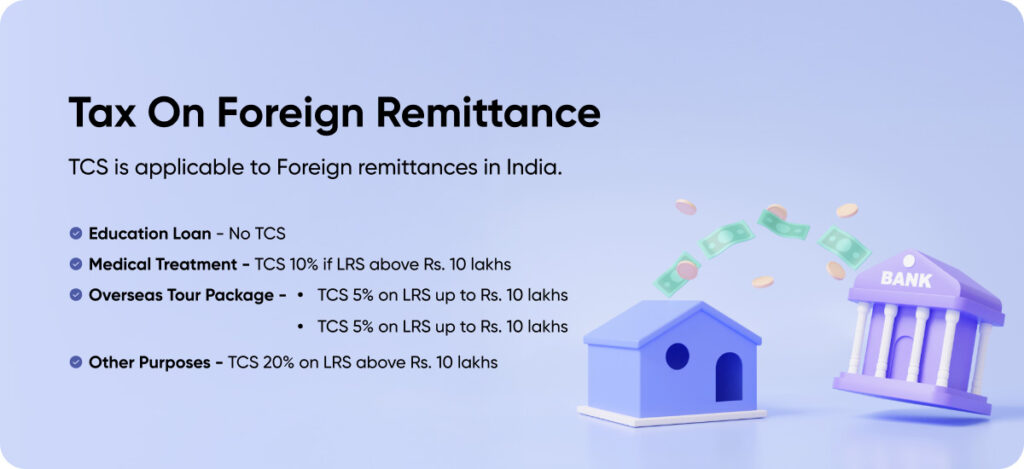

TCS Rules for Foreign Remittance Over 7 Lakhs

The applicability and rate of TCS on foreign remittance over 7 lakhs depend on the purpose of the remittance and the total amount remitted during the financial year. Here’s a general overview of the rules under Section 206C(1G) (Note: Rates are subject to change, always refer to the latest official notifications):

- Threshold: TCS is generally applicable only on the aggregate amount *exceeding* ₹7 lakhs remitted under LRS in a financial year. The first ₹7 lakhs are typically exempt from TCS for most categories.

- General Rate (e.g., for Investment, Travel, Gift): For remittances above ₹7 lakhs for purposes like overseas investment, travel (if not booking an overseas tour package where different rules might apply), gifting, or maintenance of relatives, a TCS rate (currently often cited at 20%, but was 5% previously for many categories – verify current rates) applies on the amount exceeding ₹7 lakhs.

- Education Financed by Loan: If the remittance is for overseas education and the amount is obtained via a loan from a specified financial institution (under Section 80E), a lower TCS rate of 0.5% applies on the amount exceeding ₹7 lakhs.

- Education/Medical (Self-Funded): For remittances towards education (not financed by loan) or medical treatment, a TCS rate of 5% generally applies on the amount exceeding ₹7 lakhs.

It is crucial to understand these foreign remittance tax implications India and provide the correct purpose code to your bank to ensure the appropriate TCS rate is applied. The ₹7 lakh threshold is cumulative for all LRS remittances made through any authorized dealer during that financial year. For the most current and specific rates, it’s advisable to consult the Income Tax India Website or seek professional advice.

How TCS Appears in AIS and Form 26AS

The TCS collected by your bank on your foreign remittances serves as an advance tax payment on your behalf. This collected amount will be reflected in two important documents accessible through the Income Tax portal:

- Annual Information Statement (AIS): As discussed, the AIS will show the aggregate remittance amount and the corresponding TCS deducted by the reporting bank under the relevant SFT/TCS codes.

- Form 26AS: This is your consolidated annual tax statement. It also includes details of Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) deposited against your PAN. The TCS paid on foreign remittances will appear here as well.

When filing your Income Tax Return (ITR), you must reconcile the information in your AIS and Form 26AS with your actual financial activities. You can then claim credit for the TCS amount already paid against your total income tax liability for the year. Ensure you accurately report the income related to these remittances (if any) and claim the corresponding tax credit.

If you’re looking to understand how taxes interact with other business processes, our article on TAXATION SERVICES IN INDIA could be illuminating.

Saw Foreign Remittance AIS Data? Here’s What to Do

Finding entries related to foreign remittances in your AIS requires careful attention and specific actions to ensure compliance and accuracy in your tax filings. Don’t ignore this information; use it proactively.

Step 1: Verify the Information

The first and most critical step upon noticing foreign remittance AIS entries is verification. Cross-check the details shown in your AIS, particularly the aggregate remittance amount and any TCS collected, against your personal financial records. Refer to:

- Your bank statements for the relevant financial year.

- Copies of Form A2 submitted to the bank for each remittance.

- Any communication or receipts received from the bank regarding the LRS transactions and TCS collection.

Ensure the amounts match and the reporting period is correct. Discrepancies can occur due to reporting errors, timing differences, or aggregation methods used by the bank. Meticulous verification forms the foundation for accurate tax reporting.

Step 2: Provide Feedback on the AIS Portal

The Income Tax portal provides a mechanism for taxpayers to respond to the information displayed in their AIS. If you find any discrepancies after verification, or even if the information is correct, you should provide feedback. The options typically include:

- Accept: If the information is correct.

- Deny: If the transaction does not pertain to you or is entirely incorrect.

- Modify: If the amount or other details are partially incorrect. You might need to provide the correct figures.

Submitting feedback is crucial. It helps communicate any inaccuracies to the Income Tax Department and creates a record of your response. If you deny or modify information, be prepared to provide supporting documents if requested later. This feedback process is vital for ensuring that the information used for pre-filling your ITR and potential scrutiny is accurate.

Step 3: Ensure Accurate ITR Filing

The ultimate goal of reviewing your AIS is to ensure accurate filing of your Income Tax Return (ITR). The information related to foreign remittances and associated TCS has direct implications:

- TCS Credit: Make sure you claim the correct amount of TCS shown in your AIS and Form 26AS as a credit against your tax liability in your ITR. Failure to claim it means losing out on the tax already collected.

- Income Reporting: While the remittance itself isn’t income, the purpose might be linked to income-generating activities (e.g., foreign investments leading to dividends or capital gains) or assets held abroad. Ensure you report any related foreign income or assets accurately in the relevant schedules of your ITR (like Schedule FA for Foreign Assets). Ignoring this can lead to penalties under the Black Money Act.

- Reconciliation: Use the verified AIS data to cross-check the information pre-filled in your ITR form. Correct any discrepancies before submitting your return. Understanding the full picture of foreign remittance tax implications India includes accurate reporting in your ITR.

Conclusion

Navigating the world of global finance means being aware of how transactions like foreign remittance over 7 lakhs are treated under Indian regulations. The Annual Information Statement (AIS) provides significant transparency into these transactions, reflecting data reported by your bank, particularly when TCS is involved. Monitoring the foreign remittance AIS section is no longer optional; it’s a crucial step for compliance.

Understanding the TCS rules associated with LRS remittances above the ₹7 lakh threshold and diligently verifying the data in your AIS are essential practices for both salaried individuals and small business owners. Compliance with foreign remittance rules India involves not just making permissible remittances but also ensuring they are correctly reported and accounted for in your tax filings.

Take Action: Proactively log in to the Income Tax portal and check your AIS today. Verify the foreign remittance details reported. If you find discrepancies or need help understanding the foreign remittance tax implications India, reconciling your AIS, or ensuring accurate ITR filing, expert guidance can be invaluable.

Need help navigating your AIS or filing your ITR accurately? Contact TaxRobo for expert assistance. Our team can help you understand complex tax rules, manage compliance, and ensure peace of mind. Visit TaxRobo Online CA Consultation Service or explore our TaxRobo Income Tax Service today!

Frequently Asked Questions (FAQs)

Q1: Does every single foreign remittance appear in AIS, or only those above a certain limit?

A: Not necessarily every single small remittance appears individually. Reporting by banks under SFT is often triggered by specific rules or thresholds. The foreign remittance limit India of ₹7 lakhs per financial year is a key threshold because it generally triggers TCS applicability under Section 206C(1G), making reporting mandatory for the bank. Banks report aggregate LRS remittances, and these are more likely to be prominently displayed in AIS once they exceed this ₹7 lakh threshold due to the linked TCS implications. Smaller remittances might still be aggregated or reported under broader categories depending on the bank’s reporting practices, but the focus is often on transactions exceeding significant thresholds.

Q2: What should I do if the foreign remittance over 7 lakhs amount shown in my AIS is incorrect?

A: If you find the aggregate foreign remittance over 7 lakhs amount or the associated TCS details in your AIS are incorrect, you should use the feedback facility within the AIS portal. Select the relevant transaction information and choose the ‘Deny’ option if it’s completely wrong or the ‘Modify’ option if the amount needs correction. Provide the accurate details as per your records. It’s also advisable to keep all supporting documents (bank statements, Form A2 copies, TCS certificates/proof) readily available in case the Income Tax Department requires justification for your feedback later.

Q3: Is the ₹7 lakh threshold for TCS calculated per transaction or for the entire financial year?

A: The ₹7 lakh threshold for the applicability of TCS under Section 206C(1G) for LRS remittances is calculated based on the aggregate amount remitted by an individual during the entire financial year (April 1st to March 31st). It’s not a per-transaction limit. For example, if you remit ₹4 lakhs in May and another ₹4 lakhs in October of the same financial year, TCS would typically apply only to the ₹1 lakh that exceeds the ₹7 lakh cumulative threshold (i.e., on ₹8 lakhs – ₹7 lakhs).

Q4: I received foreign remittance. Will that also show up in AIS in the same way?

A: This blog post focuses on outward foreign remittance India (money sent out of India) under LRS and its reporting, often linked to TCS. Inward remittances (money received into India from abroad) are treated differently. While significant inward remittances or high-value credits to your bank account might also be reported by your bank under different SFT codes (e.g., SFT-004 for cash deposits, or other codes related to large credits), they won’t appear under the same LRS/TCS categories discussed here (like SFT-014 or Section 206C(1G) TCS). You should still check your AIS for any reported large credits or deposits.

Q5: Are there any exemptions from TCS on foreign remittance over 7 lakhs?

A: Yes, there are specific situations where TCS might not apply or applies at a lower rate even if the foreign remittance over 7 lakhs threshold is crossed. Key exemptions/variations under current foreign remittance rules India (Section 206C(1G)) include:

- Education via Loan: Remittances for overseas education financed by a loan from a specified financial institution attract a lower TCS rate of 0.5% on the amount exceeding ₹7 lakhs.

- Medical Treatment/Education (Self-Funded): Remittances for specified medical treatment or education purposes (not financed by loan) generally attract a 5% TCS rate on the amount exceeding ₹7 lakhs.

- TDS Already Applicable: If tax is already deducted at source (TDS) on the payment under other provisions of the Income Tax Act, TCS under this section may not apply.

- Specific Exclusions: Remittances to certain IFSC units or other notified exceptions might exist.

It’s essential to check the latest provisions or consult a tax professional, as rules and rates can be updated by the government. Always provide the correct purpose code to your bank.