Section 80E: Claiming Deductions on Education Loan Interest

Introduction: Understanding Tax Savings on Higher Education Costs

The pursuit of higher education is a significant milestone, often opening doors to better career prospects and personal growth. However, the escalating costs associated with quality education in India can place a considerable financial strain on students and their families. Many turn to education loans to bridge the gap, making aspirations achievable. Thankfully, the Indian Income Tax Act, 1961, offers a valuable relief mechanism through Section 80E. This provision specifically allows taxpayers to reduce their taxable income by deducting the interest paid on education loans. Understanding the nuances of this section is crucial for both salaried individuals and small business owners who have availed such loans for themselves or their specified relatives. Effectively claiming deductions on Education Loan Interest can lead to substantial tax savings, making the investment in higher education slightly less burdensome. This guide aims to provide a clear understanding of Section 80E, helping eligible taxpayers in India leverage this benefit optimally.

What Exactly is Section 80E of the Income Tax Act?

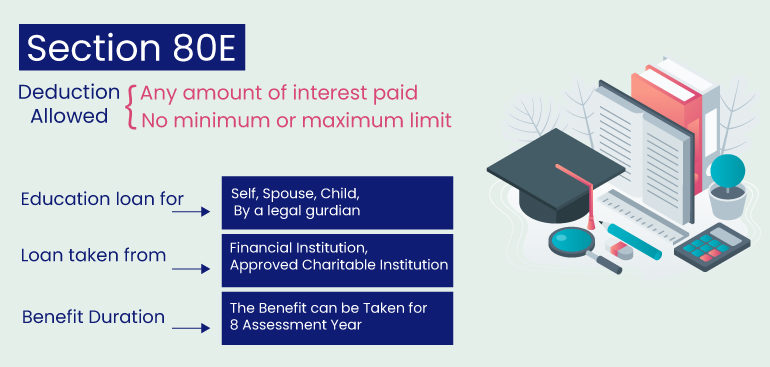

Section 80E is a specific provision within the Income Tax Act that focuses purely on providing tax relief related to education loans. It allows an individual taxpayer to claim a deduction from their gross total income for the amount paid as interest on a loan taken for higher education. It is absolutely critical to understand that this deduction applies only to the interest component of the Equated Monthly Instalment (EMI) or any other repayment structure; the principal portion of the loan repayment is not eligible for deduction under this section. This Section 80E education loan deduction India is designed to encourage individuals to invest in higher learning without being overly burdened by the interest accumulating on their educational debt. The government’s objective behind introducing and maintaining Section 80E is clear: to promote access to higher education across the country, thereby fostering skill development and contributing to national growth. Understanding this specific tax deductions on education loans in India can significantly impact your overall tax outgo during the loan repayment period. For more about general taxation services, you might explore TAXATION SERVICES IN INDIA.

Who is Eligible to Claim the Section 80E Deduction?

Eligibility is a key factor when considering any tax deduction, and Section 80E has specific criteria that must be met. Firstly, the deduction under this section can only be claimed by an Individual taxpayer. This means entities like Hindu Undivided Families (HUFs), Companies, Trusts, or Associations of Persons (AOPs) cannot avail this benefit, even if they finance education. Secondly, the loan itself must have been taken for the specific purpose of pursuing higher education. This higher education can be for the individual taxpayer themselves, their spouse, or their children. Furthermore, the deduction is also available if the loan is taken for a student for whom the individual taxpayer is the legal guardian. This covers a broad range of familial relationships, making the benefit widely applicable.

Another crucial condition relates to the source of the loan. To qualify for the deduction, the education loan must be obtained from an approved financial institution (which includes Banks and specified Non-Banking Financial Companies or NBFCs regulated by the RBI) or an approved charitable institution (those recognized under Section 10(23C) or Section 80G(2)(a) of the Income Tax Act). Loans taken from informal sources like friends, family members, or employers, while perhaps necessary in some situations, do not qualify for the interest deduction under Section 80E. It’s advisable to verify the lender’s approval status as per regulatory guidelines before assuming eligibility, ensuring you can fully realize the Section 80E benefits for students in India (paid by the eligible individual). This ensures that only structured, recognized lending contributes to the Section 80E deduction India for students.

Decoding Eligible Loans and Courses under Section 80E

Understanding precisely which courses and loan types qualify under Section 80E is essential for correctly claiming the deduction. The scope is quite broad, encompassing various fields and locations of study.

What Qualifies as ‘Higher Education’?

The term ‘higher education’ under Section 80E has a specific definition. It refers to any course of study pursued after passing the Senior Secondary Examination (Class 12) or its equivalent examination from a recognized school board or university. This is a broad definition that includes not just traditional academic streams like Arts, Science, Commerce, Engineering, or Medicine, but also vocational courses and specialized training programs. As long as the prerequisite is passing the Class 12 equivalent, the course generally qualifies. Furthermore, the location of the educational institution does not restrict eligibility; the course can be pursued either in India or abroad. This makes Section 80E beneficial for students opting for international education as well, provided the loan meets the other criteria. To ensure your business is adhering to all tax regulations in relation to education or any other loans, visit Taxation 101 for Small Business Owners.

Which Loans are Covered?

As mentioned earlier, the source of the loan is a critical determinant for Section 80E eligibility. The deduction is permissible only if the education loan is sanctioned and disbursed by:

- Banking Companies: Any bank to which the Banking Regulation Act, 1949 applies (including any bank or banking institution referred to in section 51 of that Act).

- Approved Financial Institutions: Institutions notified by the Central Government, typically specific NBFCs recognized for educational loans.

- Approved Charitable Institutions: Organizations referred to in clauses (23C) of section 10 or institutions referred to in sub-clause (a) of clause (2) of section 80G.

It’s crucial to reiterate that loans procured from relatives, friends, private unrecognized lenders, or employers are strictly not eligible for claiming interest deduction under Section 80E. Always ensure your loan agreement is with one of the specified categories of lenders. You can usually confirm this from the loan documentation provided by the lender or by checking their official registration and approval status.

The Deduction Limit: How Much Can You Actually Claim?

One of the most attractive features of the Section 80E deduction is related to the quantum of the claim. Unlike many other deductions under Chapter VI-A which have specific upper limits (like Section 80C), Section 80E works differently. The deduction allowed under this section is the entire amount of interest paid on the eligible education loan during the relevant financial year. This means if you paid ₹75,000 as interest in a financial year, you can claim the full ₹75,000 as a deduction, provided other conditions are met.

Crucially, there is no maximum monetary cap stipulated in the Act for the amount of interest that can be claimed under Section 80E per year. However, while there’s no amount limit, there is a significant time limit. The deduction for the interest paid is available for a maximum period of 8 consecutive Assessment Years. This period begins from the Assessment Year relevant to the Financial Year in which the individual first starts paying the interest on the loan. The deduction can be claimed for these 8 years, or until the interest component of the loan is fully paid off, whichever occurs earlier.

Let’s illustrate with an example: Suppose you start paying interest on your education loan in the Financial Year 2023-24 (which corresponds to Assessment Year 2024-25). You can claim the interest deduction starting from AY 2024-25 for a maximum of 8 consecutive years, i.e., up to AY 2031-32. If you manage to repay the entire loan interest within, say, 6 years (by FY 2028-29, relevant to AY 2029-30), then you can only claim the deduction up to AY 2029-30. You cannot claim it for the remaining 2 years of the 8-year window if no interest is outstanding. Properly understanding this timeline is key for accurately claiming education loan interest deduction.

A Step-by-Step Guide: How to Claim Section 80E Deductions in India

Knowing you are eligible and understanding the limits is one thing; actually claiming the deduction in your tax return is the practical next step. Here’s a straightforward guide on how to claim Section 80E deductions in India:

Step 1: Obtain the Loan Interest Certificate

The foundation of your Section 80E claim is proper documentation from your lender. You must obtain an official statement or certificate from the bank or financial institution that disbursed your education loan. This document is crucial as it needs to clearly segregate the principal amount and the interest amount paid by you towards the loan during the specific financial year (April 1st to March 31st) for which you are filing your taxes. Most recognized lenders provide this certificate annually, often downloadable from their online portal or available upon request at a branch. Ensure the certificate pertains to the correct financial year and clearly shows the total interest paid.

Step 2: Identify the Deduction Amount

Once you have the interest certificate, carefully examine it. Your task is to precisely identify the total amount of interest mentioned as paid during that particular financial year. Remember, under Section 80E, only the interest component is deductible. Do not mistakenly include any principal repayment figures in your deduction claim. The figure mentioned as ‘Interest Paid’ or equivalent terminology on the certificate is the amount you can claim under Section 80E, subject to the 8-year time limit rule.

Step 3: Report in Your Income Tax Return (ITR)

The actual process of claiming deductions on Education Loan Interest happens when you file your annual Income Tax Return (ITR). The deduction under Section 80E falls under Chapter VI-A of the Income Tax Act. When filling out your ITR form (whether it’s ITR-1 Sahaj for salaried individuals, ITR-2, ITR-3 for professionals/business income, or ITR-4 Sugam for presumptive income), you will find a specific section or schedule dedicated to deductions under Chapter VI-A. Within this section, locate the field designated for Section 80E. You need to accurately enter the total interest amount (as identified in Step 2) in this field. Double-check the amount entered before submitting your return to avoid errors. For more assistance, refer to our Beginners’ Guide to Filing Income Tax Returns Online.

Step 4: Keep Records Safely

Although the current ITR filing process (especially online) generally does not require you to upload or attach the loan interest certificate at the time of filing, it is mandatory to retain this document safely. The Income Tax Department may ask for proof to substantiate your claim during assessment, scrutiny, or processing of your return. Keep the interest certificate, loan sanction letter, and loan account statements for the entire period you are claiming the deduction, and preferably for a few years after the assessment is completed. Having these documents readily available will ensure a smooth process if any query arises. For official ITR forms and filing resources, you can always refer to the Income Tax Department website. Following this education loan interest deduction guide India diligently ensures you claim your rightful deduction.

Common Mistakes to Avoid When Claiming Section 80E

While Section 80E offers a valuable tax benefit, taxpayers sometimes make errors that can lead to incorrect claims or potential issues during assessment. Being aware of these common pitfalls can help you avoid them:

- Claiming Deduction for Principal: This is perhaps the most frequent error. Remember, Section 80E allows deduction only for the interest component, not the principal repayment amount. Always refer to the interest certificate from your lender.

- Exceeding the 8-Year Limit: The deduction is available only for a maximum of 8 consecutive Assessment Years, starting from the year you begin paying interest, or until the interest is fully paid, whichever is earlier. Claiming beyond this period is incorrect. Keep track of the start year.

- Forgetting to Claim: Some eligible taxpayers simply overlook this deduction, especially if they are unaware of the provision or misplace their interest certificate. Don’t miss out on potential tax savings.

- Claiming for Ineligible Loans: Deductions cannot be claimed for interest paid on loans taken from non-specified sources like friends, relatives, or employers. Ensure your loan is from an approved bank, financial institution, or charitable trust.

- Lack of Proper Documentation: Failing to obtain or retain the interest payment certificate from the lender is risky. Although not required for uploading during filing, it’s essential proof if asked for by tax authorities.

- Claiming in the Wrong Assessment Year: The interest paid during a Financial Year (e.g., April 2023 – March 2024) should be claimed in the corresponding Assessment Year (AY 2024-25). Ensure you claim the interest relevant to the correct period.

- Claiming for Ineligible Persons: The loan must be for the higher education of the individual taxpayer, their spouse, children, or a student for whom they are the legal guardian. Claiming interest on loans taken for siblings, parents (unless you are a legal guardian), or other relatives is not permitted.

Conclusion: Maximize Your Tax Savings with Section 80E

Section 80E of the Income Tax Act represents a significant opportunity for individuals financing higher education through loans to reduce their tax liability. By allowing a deduction for the entire interest paid during the year, for up to eight years, it provides substantial relief. Understanding the eligibility criteria – being an individual taxpayer, taking the loan for the specified relations’ higher education from an approved institution – and the timelines is crucial. Making sure you are accurately claiming deductions on Education Loan Interest requires careful attention to detail, particularly in obtaining the interest certificate and reporting the correct amount in your ITR.

Remember the key takeaways: the deduction is only for the interest component, there’s no upper limit on the annual interest amount claimable, but it’s restricted to a maximum period of 8 consecutive years. Don’t fall into common traps like claiming principal, exceeding the time limit, or using loans from ineligible sources. By diligently following the steps outlined and avoiding common mistakes, you can effectively leverage this provision. If navigating tax deductions seems complex, consider seeking professional guidance. “Let TaxRobo experts help you navigate your tax filing and maximize your savings through services like our Income Tax Filing Service or Online CA Consultation.”

Frequently Asked Questions (FAQs) about Section 80E

Here are answers to some common queries regarding the Section 80E deduction:

- Q1: Can I claim Section 80E deduction if the loan was taken for my sibling’s or parent’s education?

A: No. The deduction under Section 80E is strictly limited to loans taken for the higher education of the individual taxpayer, their spouse, their children, or a student for whom the individual is the legal guardian. Loans for siblings, parents (unless you’re the legal guardian), or other relatives are not covered. - Q2: Is there any limit on the principal loan amount for Section 80E eligibility?

A: No, the Income Tax Act does not specify any limit on the principal amount of the education loan itself for determining eligibility under Section 80E. The focus of the section is solely on the repayment of interest. The deduction you can claim is restricted to the interest portion paid during the financial year, not the principal loan amount. - Q3: What if my child (for whom I took the loan) starts repaying the loan? Can I still claim the deduction?

A: The deduction under Section 80E can only be claimed by the individual who took the loan and is making the repayments (specifically the interest component) from their own income which is chargeable to tax. If your child, for whose education the loan was taken, starts repaying the loan (both principal and interest) themselves from their own income, then you, the original borrower, cannot claim the deduction for the interest amount paid by your child. The deduction is linked to the payer of the interest who is also the borrower. - Q4: Can I claim this deduction if the course is completed part-time or through distance learning?

A: Yes, generally, the mode of study does not impact eligibility for the Section 80E deduction. As long as the course undertaken qualifies as ‘higher education’ (meaning any course pursued after passing the Senior Secondary Examination or equivalent) and the loan is taken from an approved financial or charitable institution, the deduction for interest payment should be available, regardless of whether the course is full-time, part-time, or pursued through distance learning. - Q5: Do I need to attach the interest payment certificate when I file my ITR online?

A: Currently, for online ITR filing, you are generally not required to attach the interest payment certificate along with your return submission. However, it is mandatory to possess this certificate at the time of filing and retain it securely. The details from the certificate (specifically the interest paid during the financial year) are needed to enter the correct deduction amount in your ITR. The Assessing Officer has the right to ask for this document later to verify your claim during assessment or scrutiny proceedings.