What strategies help reduce startup costs during the early stages?

Introduction: Launching Your Dream Without Breaking the Bank

Starting a business in India is an exciting journey, filled with ambition and the promise of innovation. However, this excitement often comes hand-in-hand with significant financial hurdles. The initial capital required to get a business off the ground can be daunting, and managing these early-stage expenses is absolutely critical for a startup’s survival and eventual growth. Inadequate funding or poor financial management are among the top reasons new businesses fail. Therefore, understanding and implementing effective strategies to reduce startup costs is not just beneficial, it’s essential. This post aims to outline practical, actionable approaches specifically tailored for the Indian context, helping aspiring entrepreneurs and small business owners launch their ventures smartly. Mastering the art of reducing startup costs for small businesses India requires careful planning, resourcefulness, and a clear understanding of compliance requirements – areas where expert guidance, like that offered by TaxRobo, can prove invaluable from day one.

Foundational Planning: Smart Initial Strategies to Reduce Startup Costs

The most effective way to control expenses begins long before you spend your first rupee. Careful, strategic planning forms the bedrock of sound financial management for any new venture. This proactive approach involves critically evaluating your business model, choosing the right legal framework, and meticulously budgeting every anticipated cost. By investing time in this foundational phase, you identify potential cost pitfalls and opportunities for savings early on, setting a sustainable course for your business. Implementing robust startup cost management strategies India from the outset can significantly improve your chances of navigating the challenging initial stages successfully. It’s about being deliberate and informed in your choices, rather than making rushed decisions under pressure.

Adopt a Lean Startup Approach

One of the most powerful methodologies for managing initial expenditure is the Lean Startup approach. This philosophy emphasizes agility and learning through a continuous cycle: Build-Measure-Learn. Instead of investing heavily in developing a fully-featured product or service based on assumptions, the focus is on creating a Minimum Viable Product (MVP). An MVP is the simplest version of your product that delivers core value to early customers and allows you to gather crucial feedback. This approach drastically reduces initial development costs, resource allocation, and time-to-market. By launching an MVP, you test your core business hypothesis in the real world quickly and affordably. The feedback gathered then informs future development iterations, ensuring you only build features that customers genuinely need and are willing to pay for. This iterative process is one of the most effective ways to minimize startup costs in India, preventing wasted investment in unvalidated ideas and allowing for flexible pivots based on market response.

Choose the Right Legal Structure Wisely

Selecting the appropriate legal structure for your business in India is a critical decision with significant cost implications. Common structures include Sole Proprietorship, Partnership Firm, Limited Liability Partnership (LLP), One Person Company (OPC), and Private Limited Company (PLC). Each structure has different setup costs, compliance burdens, and liability protections. For instance, a Sole Proprietorship is the simplest and cheapest to start, often requiring minimal registration, but offers no liability protection. A Private Limited Company provides limited liability and better access to funding but involves higher registration fees, mandatory audits, and more complex annual filings with the Ministry of Corporate Affairs (MCA). An LLP offers a middle ground with limited liability and simpler compliance than a PLC. Carefully consider your immediate needs, funding plans, and tolerance for compliance complexity. Often, starting with a simpler structure like an LLP or even a Proprietorship (if liability isn’t a major concern initially) and upgrading later as the business grows can be a smart move. This phased approach represents one of the key strategies for lowering startup expenses in India during the crucial early phase. Consulting with experts can help you make the right choice; for professional guidance tailored to your specific situation, consider exploring TaxRobo Company Registration Service.

Create a Detailed and Realistic Budget

A meticulously crafted budget is your financial roadmap. It’s not just about listing potential expenses; it’s about anticipating *all* possible costs, both one-time setup expenditures (like registration, equipment purchase, initial inventory) and recurring operational costs (like rent, salaries, utilities, software subscriptions, marketing). Be brutally honest and realistic – underestimate costs, and you risk running out of cash; overestimate, and you might deter potential investors or unnecessarily restrict growth. Use simple tools like spreadsheets or basic accounting software to categorize and track every expense right from day one. Regularly comparing actual spending against your budgeted amounts helps you identify variances quickly and take corrective action. This disciplined approach provides clarity on your financial position, highlights areas where costs might be creeping up, and reveals opportunities for savings you might otherwise miss. Rigorous budgeting and tracking are fundamental to effective cost control for any new business. For more detailed guidance, you can refer to Set Up An Accounting System for My Small Business.

Minimizing Setup and Infrastructure Expenses

Once the foundational planning is complete, the next major area for cost consideration involves the tangible expenses related to setting up your physical and operational infrastructure. These costs, often incurred upfront, can consume a significant portion of your initial capital if not managed carefully. Implementing clever cost-saving strategies for startups India in this phase focuses on finding efficient and affordable ways to acquire the necessary space, equipment, technology, and licenses without compromising essential functionality. Smart choices here can free up valuable funds for core business activities like product development or customer acquisition.

Rethink Your Physical Workspace

The traditional image of a startup often includes a dedicated office space, but this can be one of the largest fixed overheads. In today’s flexible work environment, startups have several cost-effective alternatives, especially in the early stages. Working from a home office is often the cheapest option initially, eliminating rent, commute costs, and utility expenses associated with a commercial space. As the team grows or a more professional setting is needed, co-working spaces offer a compelling alternative. They provide flexible membership plans (pay only for the space you need), essential amenities (internet, printing, meeting rooms), and valuable networking opportunities, all at a fraction of the cost of a traditional lease. Virtual offices are another option, providing a professional business address, mail handling services, and sometimes access to meeting rooms on demand, without the expense of physical office space. Carefully evaluating your actual workspace needs against these alternatives is one of the key tips for reducing startup costs in India, allowing you to allocate resources more effectively elsewhere.

Be Smart About Equipment and Technology

Equipping your startup doesn’t necessarily mean buying everything brand new. Significant savings can be achieved by being resourceful with your equipment and technology procurement. Consider purchasing used or refurbished computers, office furniture, and other necessary equipment; reputable vendors often offer warranties, providing reliability at a lower price point. Leasing equipment instead of buying outright can also be beneficial, especially for items that depreciate quickly or require significant upfront investment. This converts a large capital expenditure into a smaller, manageable operating expense. On the technology front, leverage the vast ecosystem of free and open-source software (FOSS) for tasks ranging from operating systems (Linux) and office suites (LibreOffice) to design tools (GIMP, Inkscape) and development platforms. Furthermore, embrace cloud-based services (Software as a Service – SaaS) for functions like CRM, accounting, project management, and data storage. These typically operate on a pay-as-you-go subscription model, offering scalability and eliminating the need for expensive on-premise servers and maintenance. To further understand the cost implications of setting up your infrastructure, check Cost of Incorporation of a Company in India.

Navigate Registration and Licensing Costs Effectively

While some costs are unavoidable necessities, navigating the landscape of registrations and licenses efficiently can prevent unnecessary expenses and penalties. Key registrations in India typically include Company Registration (depending on your chosen structure), Goods and Services Tax (GST) registration (if your turnover exceeds the threshold or you engage in inter-state trade), Permanent Account Number (PAN), Tax Deduction and Collection Account Number (TAN), and potentially specific industry licenses (e.g., FSSAI for food businesses, trade licenses from local municipalities). Understanding GST is crucial; it’s a destination-based tax with components like Central GST (CGST), State GST (SGST), and Integrated GST (IGST). Timely GST Registration is not just a compliance requirement but also enables you to claim Input Tax Credit (ITC) on your business purchases, effectively reducing your net tax liability – a direct cost saving. Ensure you understand all mandatory requirements for your specific business type and location. Utilizing reliable service providers like TaxRobo for these registrations ensures accuracy and timeliness, helping you avoid penalties and delays that ultimately add to your costs. Referencing official portals like the GST Portal is also advisable for authoritative information. Managing compliance diligently is one of the core strategies to reduce startup costs India by avoiding fines and leveraging benefits like ITC. For further insights into GST registration, visit Launching Your Startup Right – Mastering GST Registration in India.

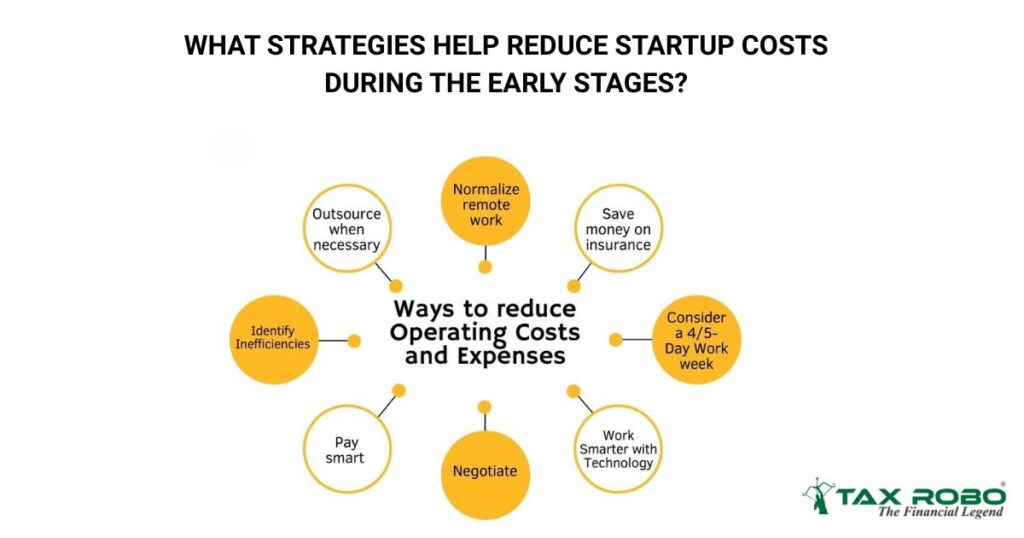

Controlling Ongoing Operational Costs

Beyond the initial setup phase, managing the day-to-day running expenses is crucial for maintaining financial health. Ongoing operational costs, such as salaries, marketing spend, and supplier payments, can quickly escalate if not carefully monitored and controlled. Implementing best practices to reduce startup expenses India involves adopting lean operational strategies, making smart choices about staffing, marketing frugally, and negotiating effectively with vendors. Continuous vigilance in these areas ensures that your startup operates efficiently and sustainably, preserving capital for growth and unexpected challenges.

Optimize Your Human Resources Strategy

Payroll is often one of the largest recurring expenses for any business. While building a dedicated team is essential for growth, startups can significantly reduce initial costs by optimizing their human resources strategy. Instead of immediately hiring full-time employees for every role, consider leveraging freelancers or independent contractors for specific projects or specialized tasks (like graphic design, content writing, or software development). This provides access to expertise on demand without the long-term commitment and overheads associated with full-time staff (like provident fund contributions, insurance, office space). Hiring interns can be another cost-effective way to get support for various tasks while providing valuable experience to students. Part-time employees can also fill roles that don’t require a full-time presence initially. Critically, outsourcing non-core functions is a highly effective strategy. Tasks like accounting, payroll processing, legal compliance, and even IT support can often be handled more efficiently and cost-effectively by specialized agencies like TaxRobo. Outsourcing these functions through services like TaxRobo Accounts Service not only reduces salary burden but also frees up founder time to focus on core business activities.

Implement Frugal Marketing Tactics

Marketing is essential for customer acquisition, but it doesn’t have to break the bank. Early-stage startups can achieve significant reach and impact through low-cost, high-return digital marketing techniques, making it a key area for reducing startup costs for small businesses India. Focus on content marketing – creating valuable blog posts, articles, guides, or videos that address your target audience’s needs and position your startup as a thought leader. Optimize this content for search engines (basic SEO) to attract organic traffic over time. Build a presence on relevant social media platforms, engaging directly with potential customers and sharing your content. Email marketing remains one of the most cost-effective ways to nurture leads and retain customers; build an email list and provide regular, valuable updates. Leverage the power of networking at industry events (online or offline) and encourage customer referral programs. These digital and relationship-based tactics often yield better results for startups than expensive traditional advertising channels like print, radio, or television, especially when budgets are tight.

Negotiate with Suppliers and Vendors

Every expense line item related to suppliers and vendors presents an opportunity for negotiation and optimization. Don’t simply accept the first quote you receive. Take the time to research multiple vendors for raw materials, software licenses, services, or any other business necessity. Build professional relationships with your key suppliers; often, long-term partners are more willing to offer favorable terms. Don’t hesitate to negotiate prices, especially if you can commit to a certain volume or a longer-term contract (provided it aligns with your lean strategy). Explore possibilities for bulk discounts, but only if you are certain you will use the quantity purchased, avoiding unnecessary inventory costs. Equally important is negotiating payment terms. Extending your payment cycles slightly (e.g., net 45 or net 60 instead of net 30) can significantly improve your cash flow, though this should be balanced with maintaining good supplier relationships. Regularly review your supplier contracts and benchmark their pricing against competitors to ensure you are consistently getting fair value. Proactive vendor management is a continuous process that contributes significantly to cost control.

Leveraging Financial Prudence and Government Support

Beyond operational tactics, sound financial management and tapping into available support systems are vital for cost reduction. This involves cultivating a mindset of financial discipline within the startup, managing cash flow diligently, and actively seeking out government schemes and benefits designed to aid new businesses in India. Combining internal prudence with external support can significantly strengthen a startup’s financial position during its vulnerable early stages.

Embrace Bootstrapping

Bootstrapping refers to the process of starting and growing a business using only personal finances (savings) or the revenue generated by the business itself, without relying on external funding like venture capital or bank loans. While it can limit the initial scale or speed of growth, bootstrapping enforces extreme financial discipline and forces founders to focus intently on generating revenue from day one. It allows founders to retain full ownership and control of their company, avoiding equity dilution or the pressure that often comes with external investors. Many successful companies started this way, proving its viability. Embracing bootstrapping, at least in the initial phase, is inherently a powerful strategy to reduce startup costs because it fundamentally limits spending to available resources and necessitates finding the most cost-effective solutions for every business need. It fosters resourcefulness and a lean operational culture from the very beginning. For more strategies on bootstrapping, you can explore Bootstrapping a Startup.

Explore Government Schemes and Tax Benefits

The Indian government offers various schemes and incentives aimed at fostering the startup ecosystem, which can indirectly or directly help manage costs. The Startup India Portal is a central hub providing information on recognition benefits, networking opportunities, incubation support, and potential access to funding schemes like the Fund of Funds for Startups (FFS). Recognized startups may also be eligible for certain tax exemptions (e.g., income tax holiday for a period, subject to conditions). Registering your business as a Micro, Small, or Medium Enterprise (MSME) through the MSME Udyam Registration Portal can unlock benefits like easier access to credit, preference in government tenders, and support for participation in trade fairs. While navigating these schemes and understanding eligibility criteria can be complex, exploring them is crucial. These initiatives represent valuable strategies to reduce startup costs India by potentially lowering tax burdens, easing compliance, or providing access to subsidized resources. Consulting with financial experts like those at TaxRobo can help identify and leverage relevant benefits applicable to your specific business.

Master Basic Financial Management

Effective cost reduction isn’t just about cutting expenses; it’s also about managing your finances intelligently to avoid unnecessary costs like penalties and interest charges. Mastering basic financial management is non-negotiable. This includes diligently tracking cash flow – understanding exactly when money comes in and when it goes out is critical for survival. Implement robust processes for timely invoicing and persistent but professional follow-ups on outstanding payments to minimize delays in revenue collection. Crucially, understand and adhere to basic tax compliance requirements. This means ensuring timely filing of GST returns (using services like TaxRobo GST Service can help) and accurate calculation and deposit of Tax Deducted at Source (TDS) where applicable. Failure to comply with tax regulations can lead to significant penalties and interest, adding substantial, avoidable costs to your operations. Maintaining clean books and seeking professional help for accounting and compliance (TaxRobo Accounts Service) prevents these costly mistakes and provides a clear view of your financial health.

Conclusion: Building a Resilient Startup Through Smart Spending

Launching a startup in India is a marathon, not a sprint. The initial phase is often the most challenging, particularly from a financial perspective. Successfully navigating this period requires more than just a great idea; it demands disciplined execution and a commitment to prudent spending. By implementing the strategies to reduce startup costs outlined in this post – covering foundational planning, minimizing setup and infrastructure expenses, controlling ongoing operational costs, and leveraging financial prudence and government support – you significantly enhance your venture’s chances of survival and long-term success. Remember, adopting lean principles and managing finances wisely doesn’t mean compromising on quality or ambition; it means being resourceful, strategic, and focused on building a sustainable business foundation in the competitive Indian market.

Starting lean is smart, but cutting corners on essential legal and financial compliance can lead to costly mistakes down the road. Let TaxRobo be your partner in ensuring your startup journey begins on the right foot. We handle your company registration, GST filings, accounting, and other compliance needs efficiently and accurately, saving you valuable time and preventing expensive errors. Focus on building your dream business; let us handle the complexities. Contact TaxRobo today (TaxRobo Contact Us) for expert assistance tailored to your startup’s needs.

Frequently Asked Questions (FAQs) on Reducing Startup Costs

Q1. What are the biggest hidden costs for new startups in India?

While founders budget for obvious costs like rent and salaries, several hidden costs can derail finances. Compliance penalties are a major one – missing deadlines for GST returns, income tax filings, or annual ROC (Registrar of Companies) filings can result in hefty fines and interest. Employee attrition is another; the cost of hiring, training, and lost productivity associated with replacing employees, especially key personnel, can be substantial. Unforeseen operational delays, such as delays in supplier deliveries or regulatory approvals, can disrupt cash flow. Finally, scope creep in product development or projects, where requirements expand beyond the initial plan without corresponding budget adjustments, can significantly inflate costs.

Q2. Is it better to use freelancers or hire employees initially to save costs?

There’s no single right answer; it depends on the role and stage of the startup. Freelancers offer significant cost savings initially: you pay only for the work done, avoid payroll taxes, benefits contributions (PF, ESI), and don’t need to provide office space or equipment. This offers great flexibility, ideal for specific, project-based tasks or specialized skills needed intermittently. However, freelancers may lack long-term commitment and deep integration into the company culture. Full-time employees offer greater dedication, easier collaboration, and help build institutional knowledge, but come with higher fixed costs and long-term commitments. Many startups find a hybrid approach works best initially: hiring a core team for essential functions and using freelancers for supplementary tasks.

Q3. How significant are government schemes like Startup India in actually reducing costs?

Government schemes like Startup India can offer valuable support, although direct, immediate cost reduction might vary. The primary benefits often lie in simplified compliance procedures (e.g., self-certification for certain labor laws), access to networking opportunities (connecting with investors, mentors, and other startups), and potential tax benefits (like the income tax holiday for eligible startups, though criteria must be met). While schemes might not hand out cash directly to cover operational costs universally, they can reduce the compliance burden (saving time and potential penalty costs), open doors to funding routes (like the Fund of Funds or SIDBI initiatives), and provide access to incubation centers or subsidized resources. Their significance lies more in creating a supportive ecosystem and offering specific reliefs rather than broad operational cost subsidies.

Q4. Can choosing the wrong business structure increase my startup costs?

Absolutely. The choice of legal structure directly impacts both setup costs and ongoing compliance expenses. For example, starting as a Private Limited Company involves higher registration fees compared to a Sole Proprietorship or Partnership. More significantly, a Private Limited Company (and to a lesser extent, an LLP) has mandatory annual compliance requirements, including filing annual returns with the MCA, conducting statutory audits (for PLCs above certain thresholds), and maintaining detailed statutory records. Failing to meet these compliance deadlines results in penalties. A Sole Proprietorship has minimal compliance, mainly related to income tax and GST (if applicable). Therefore, choosing a complex structure like a PLC when a simpler one like an LLP or Proprietorship would suffice initially can unnecessarily increase administrative burden and costs. Starting simple and upgrading later as the business grows and requires features like limited liability or easier equity funding is often one of the prudent strategies to reduce startup costs.

Q5. How can TaxRobo help me implement cost-saving strategies?

TaxRobo plays a crucial role in helping startups manage costs effectively, primarily by ensuring efficient and accurate compliance and outsourcing key financial functions. Firstly, by handling registrations (Company, GST, PAN/TAN), filings (GST returns, Income Tax Returns, ROC filings), and accounting meticulously, we help you avoid costly penalties and interest charges that arise from errors or delays. This directly saves money. Secondly, outsourcing these essential but non-core tasks to TaxRobo (using services like TaxRobo Accounts Service or TaxRobo GST Service) is often more cost-effective than hiring dedicated in-house finance or compliance staff, especially in the early stages. This reduces payroll expenses, training costs, and overheads. Furthermore, outsourcing frees up the founders’ valuable time – an often-underestimated cost – allowing them to focus on core business growth activities. We also provide expert advice tailored to your specific business structure and industry, helping you navigate complex regulations and potentially identify relevant tax benefits or deductions, further contributing to cost management.