How do wealth managers tailor strategies for different life stages?

Introduction

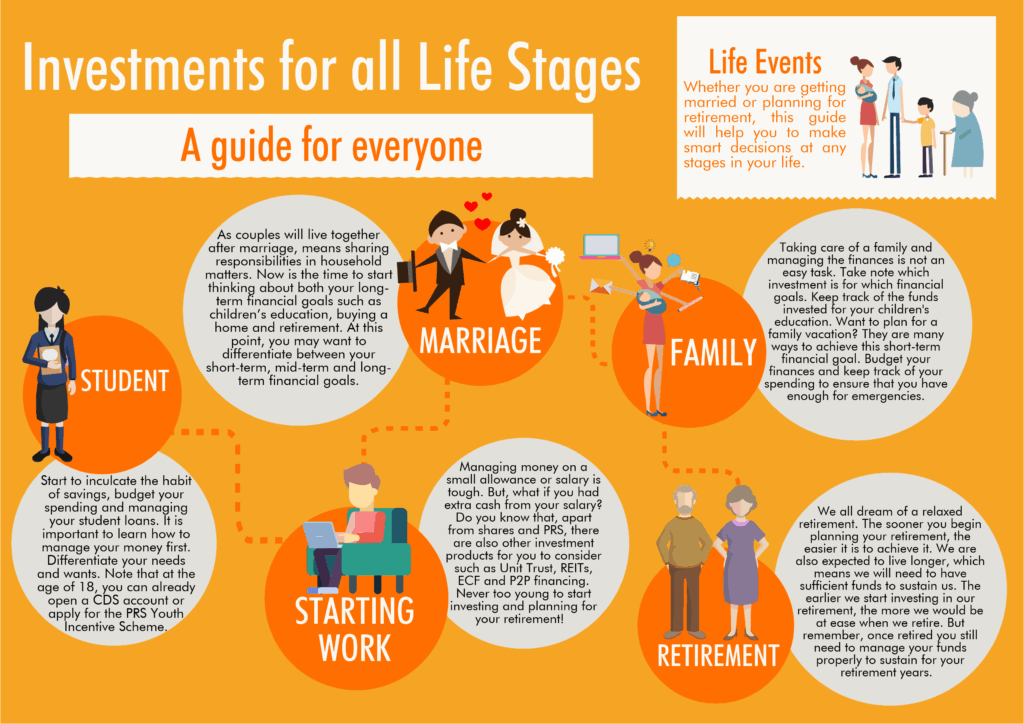

Remember when your biggest financial goal was saving up for that first bike, or maybe a fancy gadget? Fast forward a few years, and suddenly you’re thinking about down payments on a home, funding your child’s education, or even planning for a comfortable retirement decades away. Our financial goals, much like our lives, are constantly evolving. This natural progression highlights the importance of life stage financial planning for Indian clients, a concept crucial for long-term financial well-being. Simply put, a financial strategy that worked wonders in your 20s might be completely inadequate, or even counterproductive, in your 40s or 60s. This post explores exactly how wealth managers tailor strategies to align with your unique circumstances, needs, and aspirations at every significant milestone in your life journey, ensuring your financial plan grows and adapts alongside you.

Why Your Financial Strategy Needs to Evolve: Understanding Life Stage Wealth Management

Wealth management isn’t just about picking stocks or mutual funds; it’s a comprehensive approach to growing, protecting, and managing your assets to achieve your long-term financial objectives. Think of it as building a sturdy financial house designed to weather different seasons of life. However, a static blueprint won’t work because life isn’t static. Your income changes – hopefully increasing through your career, but perhaps becoming fixed in retirement. Your expenses fluctuate significantly, from managing student loans to funding education, buying property, raising a family, and eventually covering healthcare costs. Responsibilities shift, risk tolerance naturally decreases as you age and have more dependents, and the time horizon for your investments shrinks as you approach goals like retirement. This dynamic nature necessitates tailored wealth management solutions in India. A one-size-fits-all approach simply cannot effectively address the diverse and changing financial landscapes faced by individuals, whether they are salaried employees building their careers or small business owners navigating growth and succession. Simple investing focuses primarily on asset growth, whereas holistic wealth management integrates investments, insurance, tax planning, retirement planning, and estate planning into a cohesive strategy that adapts to your evolving life. Discover more about the role of a wealth manager and the services they offer.

The Personalized Approach: How Wealth Managers Tailor Strategies for You

The magic behind effective wealth management lies in its personalization. Reputable wealth managers tailor strategies through a structured and collaborative process, ensuring the plan genuinely reflects your individual situation and aspirations. This isn’t an off-the-shelf product; it’s a bespoke service built around you. The journey typically involves several key phases. It begins with Discovery & Goal Setting, an in-depth consultation where the manager seeks to understand your complete financial picture. This includes detailing your current income streams (crucially distinguishing between steady salary income and potentially variable business income for entrepreneurs), listing all assets (savings, investments, property) and liabilities (loans, mortgages), and articulating your life goals – both short-term ambitions like buying a car or taking a vacation, and long-term objectives such as retirement, children’s higher education, or leaving a legacy. Understanding your values around money and risk is also paramount during this initial phase.

Following discovery is Risk Profiling. This isn’t just about asking if you’re comfortable with market fluctuations; it involves a deeper assessment of your risk tolerance (your psychological willingness to take risks) and risk capacity (your financial ability to withstand potential losses without jeopardizing your essential goals). Factors like age, income stability, dependents, existing wealth, and time horizon heavily influence this profile, which naturally evolves over different life stages. Based on the gathered information and risk profile, the wealth manager proceeds to Strategy Development. Here, a comprehensive and bespoke financial plan is crafted. This plan outlines specific recommendations across various financial domains, including tailored life stages investment strategies India (determining the right asset allocation mix – equity, debt, gold, real estate), adequate insurance coverage (life, health, critical illness), efficient tax planning strategies suited to your income structure (salaried or business owner), and potentially foundational estate planning elements. The final step involves Implementation & Monitoring. The agreed-upon strategy is put into action, and crucially, regular reviews are scheduled. These reviews assess portfolio performance against benchmarks, discuss any changes in your personal circumstances or financial goals, and make necessary adjustments to keep the plan on track and relevant to your current life stage.

Managing Wealth According to Life Stages India: A Closer Look

Financial priorities shift dramatically as we navigate different phases of life. Understanding these shifts is key to effective planning. Here’s how wealth managers typically adjust strategies for common life stages relevant to the Indian context:

Early Career / Young Professionals (Approx. 20s – Early 30s)

This stage is all about laying a strong financial foundation. Income might be starting out, potentially burdened by education loans, but the longest investment horizon offers significant growth potential. The primary focus is on building disciplined financial habits, managing initial debt effectively, and starting the wealth creation journey early. Key strategies often employed by wealth management services for millennials in India during this phase include:

- Budgeting and Emergency Fund: Creating a realistic budget to track income and expenses is fundamental. Equally crucial is building an emergency fund (typically 3-6 months of living expenses) in liquid assets like savings accounts or liquid mutual funds to handle unexpected situations without derailing long-term plans.

- Disciplined Investing: Starting early with Systematic Investment Plans (SIPs) in equity-oriented mutual funds is highly recommended. Even small, regular investments can compound significantly over decades, leveraging the power of time. The focus is typically on growth-oriented assets due to the long time horizon.

- Tax-Saving Investments: Utilizing tax-saving instruments under Section 80C of the Income Tax Act is vital. Equity Linked Savings Schemes (ELSS) are popular as they offer potential equity growth along with tax benefits, fitting the long-term horizon of this stage. Other options like Public Provident Fund (PPF) can also be considered for diversification and guaranteed returns. You can find details on Section 80C deductions on the Income Tax India Website.

- Essential Insurance: Securing basic health insurance is non-negotiable to protect against unexpected medical expenses. A term life insurance policy, especially if one has dependents or loans, provides crucial financial security at a low cost during these early years.

Mid-Career / Family Building (Approx. Mid 30s – Late 40s)

This phase is often characterized by rising income but also significantly increasing expenses and responsibilities. Individuals are typically juggling multiple, often competing, financial goals: buying a home, funding children’s education, supporting aging parents, advancing their careers (or growing their business), and simultaneously saving for their own retirement. Managing wealth effectively during this complex stage requires careful balancing and strategic planning. Wealth managers focus on optimizing resource allocation to meet these diverse needs. Common life stages investment strategies India for this phase include:

- Scaling Investments: As income grows, it’s crucial to increase investment contributions proportionally. This often involves increasing SIP amounts (SIP top-ups) and making lump-sum investments when possible.

- Portfolio Diversification: While growth remains important, diversifying investments across different asset classes becomes more critical. This typically involves a balanced mix of equity (for growth), debt (for stability), real estate (often for primary residence and potential investment), and possibly gold (as a hedge).

- Goal-Based Planning: Specific financial plans are often created for major life goals. This includes calculating the required corpus for a house down payment, estimating future costs for children’s higher education (factoring in inflation), and earmarking specific investments for these objectives. Instruments like Sukanya Samriddhi Yojana (for daughters) or specific mutual fund schemes might be utilized.

- Advanced Tax Planning: Tax optimization goes beyond basic Section 80C deductions. Wealth managers explore strategies like maximizing home loan tax benefits (interest and principal repayment), leveraging contributions to the National Pension System (NPS) for additional tax savings, and structuring investments tax-efficiently. For business owners, tax planning involves optimizing business structure, expenses, and investments. Check out TaxRobo Tax Planning Service for expert help.

- Enhanced Insurance Coverage: As responsibilities grow, existing insurance coverage needs review and enhancement. This often means increasing the sum assured on term life insurance policies and potentially upgrading health insurance to a family floater plan with adequate coverage for potential medical emergencies. Critical illness riders might also be considered.

Pre-Retirement (Approx. 50s – Early 60s)

As retirement approaches, the financial focus shifts from aggressive wealth accumulation towards wealth consolidation and preservation. The primary goal is to ensure sufficient corpus has been built and to structure it in a way that minimizes risk while preparing for a post-retirement income stream. Managing wealth according to life stages India during this phase involves careful recalibration. Key strategies include:

- Maximizing Retirement Savings: This is the final push for retirement savings. Wealth managers advise on maximizing contributions to dedicated retirement accounts like the Employees’ Provident Fund (EPF) / Voluntary Provident Fund (VPF), Public Provident Fund (PPF), and the National Pension System (NPS). Understanding the withdrawal rules and annuity options of NPS becomes crucial. You can explore the NPS Trust or EPFO India portals for details.

- De-risking the Portfolio: Investment risk needs to be gradually reduced. This involves systematically shifting the asset allocation away from volatile equities towards more stable debt instruments like bonds, fixed deposits, and debt mutual funds. The goal is to protect the accumulated capital from significant market downturns close to retirement.

- Planning for Retirement Income: Strategies are devised to generate regular income post-retirement. This might involve identifying specific investments (like dividend-paying stocks or rental properties) or planning for systematic withdrawals from mutual funds or corpus liquidation strategies. Annuity plan options are also evaluated.

- Basic Estate Planning: While comprehensive estate planning might happen later, initiating the process is advisable. This includes ensuring nominations are updated across all financial accounts and investments, and drafting a basic Will to outline asset distribution wishes. This is particularly important for small business owners to ensure smooth business continuity or succession. Explore more about estate planning and wealth management.

Retirement (Approx. 60s onwards)

Retirement marks a significant shift – active income ceases, and reliance falls on the accumulated corpus and passive income streams. The primary financial objectives are capital preservation, generating a steady income to cover living expenses, managing healthcare costs effectively, and ensuring the smooth transfer of wealth to the next generation. Personalized wealth management for retirees in India focuses heavily on security and stability. Strategies include:

- Income Generation Structures: Investments are structured primarily for safety and regular cash flow. This involves utilizing instruments like Systematic Withdrawal Plans (SWPs) from mutual funds, fixed-income options such as the Senior Citizens Savings Scheme (SCSS), Post Office Monthly Income Scheme (POMIS), government bonds, and potentially immediate annuity plans offering guaranteed lifelong income.

- Healthcare Expense Management: Healthcare costs often rise significantly during retirement. Maintaining adequate health insurance coverage (preferably a specific senior citizen policy or porting a previous policy) is critical. Additionally, creating a separate medical corpus or contingency fund to handle expenses not covered by insurance is often advised.

- Tax-Efficient Retirement Income: Managing taxes on retirement income (pensions, withdrawals, investment returns) is important. Wealth managers help structure withdrawals and investments to minimize tax liability, taking advantage of applicable tax exemptions and deductions for senior citizens.

- Comprehensive Estate Planning: This stage requires detailed estate planning. Beyond updating nominations and Wills, this may involve setting up trusts (especially for complex family situations or business assets), exploring gifting strategies, and ensuring all legal documentation is in place for a seamless transfer of assets to beneficiaries according to the individual’s wishes. TaxRobo Online CA Consultation Service can assist with the financial aspects of estate planning.

More Than Just Numbers: How Wealth Managers Support Diverse Needs

It’s a common misconception that wealth management revolves solely around investment returns. While investment strategy is a core component, a good wealth manager offers holistic guidance that extends far beyond market charts and fund selection. They act as a financial quarterback, coordinating various aspects of your financial life, especially valuable for both salaried individuals juggling multiple goals and small business owners managing intertwined personal and business finances. Wealth managers for different life scenarios in India provide crucial advisory services on:

- Tax Planning & Optimization: For salaried individuals, this might involve structuring salary components, maximizing deductions, and choosing tax-efficient investments. For small business owners, it encompasses advice on business structure, optimizing expenses, managing GST compliance (TaxRobo GST Service), payroll, and ensuring efficient tax filing (TaxRobo Income Tax Service) for both personal and business income.

- Insurance Planning: Beyond basic recommendations, they help assess complex insurance needs – determining the appropriate life cover considering liabilities and future goals, choosing the right health insurance plan (individual, family floater, top-up), considering critical illness cover, and for business owners, evaluating keyman insurance or liability insurance. Learn more about the benefits of holistic wealth management.

- Estate & Succession Planning: This is particularly critical for business owners. Wealth managers work alongside legal experts to help structure business succession, plan for wealth transfer through Wills or trusts, minimize potential estate duties (if applicable in the future), and ensure family harmony and asset protection across generations. They help navigate the complexities of transferring ownership and control.

Essentially, a wealth manager acts as your trusted financial partner, guiding you through life’s major financial decisions and events – marriage, parenthood, career changes, business expansion, retirement, and legacy creation. They provide objectivity during emotional times and ensure your financial decisions remain aligned with your long-term goals.

Partnering for Your Financial Future: The Value of Tailored Wealth Management

Navigating the complexities of personal finance in India, with its evolving economic landscape and diverse investment options, can be challenging. As we’ve seen, your financial needs and priorities are not static; they change significantly across different life stages. This is precisely why a dynamic, personalized approach is essential. The key takeaway is that wealth managers tailor strategies specifically for your current life phase and future aspirations, moving beyond generic advice to create a plan that truly works for you. This adaptation is crucial for achieving long-term financial security and reaching your goals, whether it’s building initial wealth, funding major life events, or ensuring a comfortable retirement.

The value of partnering with a financial expert lies in receiving personalized, unbiased guidance. Tailored wealth management solutions in India provide clarity, discipline, and strategic direction, helping you make informed decisions and stay on course through market fluctuations and life changes. If you’re wondering how your current financial strategy aligns with your life stage and future goals, perhaps it’s time to consider professional advice.

Ready to build a financial plan that adapts with you? Contact TaxRobo today for a personalized wealth management consultation. Let our experts help you navigate your financial journey with confidence. Visit TaxRobo Online CA Consultation Service or call us to learn more.

Common Questions About Life Stage Wealth Management in India

Q1: What is the typical minimum investment required to start with a wealth manager in India?

A1: Minimum investment requirements vary significantly among wealth management firms in India. Some traditional firms catering to High Net-worth Individuals (HNIs) may have high minimums (often upwards of ₹1 Crore). However, many newer firms, registered investment advisors (RIAs), and platforms offer services for smaller portfolio sizes, sometimes starting from ₹5 Lakhs to ₹25 Lakhs, or even fee-only models without minimum investment amounts, making professional advice accessible to a broader audience including salaried professionals and small business owners.

Q2: How often should I review my financial plan with my wealth manager?

A2: It’s generally recommended to have a comprehensive review of your financial plan at least once a year. However, more frequent check-ins (quarterly or semi-annually) might be beneficial, especially during volatile market conditions or if significant life events occur (e.g., job change, marriage, birth of a child, inheritance, starting a business). Regular reviews ensure your plan remains aligned with your goals and current circumstances.

Q3: Can wealth managers tailor strategies specifically for small business owners versus salaried employees?

A3: Absolutely. A key aspect of personalized wealth management is understanding the client’s unique financial situation. Wealth managers tailor strategies by recognizing the differences: salaried individuals typically have predictable income streams, while business owners often face fluctuating income, specific business-related risks, and the need for succession planning. Strategies for business owners might integrate personal and business financial planning, focusing on cash flow management, reinvestment into the business vs. personal investments, tax optimization considering business structure, and exit strategies.

Q4: Is wealth management only suitable for very high-net-worth individuals (HNIs) in India?

A4: While traditionally associated with HNIs, wealth management services are increasingly accessible and beneficial for a wider range of individuals, including affluent and emerging affluent salaried professionals and small business owners. The core principles of goal setting, risk management, disciplined investing, and holistic planning are valuable regardless of the quantum of wealth. Many advisors now offer modular or fee-based services catering to those who are serious about long-term financial planning but may not yet meet traditional HNI criteria.

Q5: How does life stage financial planning for Indian clients account for specific goals like children’s marriage expenses or foreign education?

A5: Life stage financial planning for Indian clients explicitly incorporates culturally significant and individual goals. When planning for specific objectives like children’s marriage or funding foreign education, wealth managers:

- Estimate the future cost, factoring in inflation (especially education inflation, which can be high).

- Determine the time horizon until the funds are needed.

- Calculate the required investment amount (lump sum or regular SIPs).

- Recommend suitable investment vehicles based on the time horizon and risk profile (e.g., equity funds for long-term goals, hybrid or debt funds for shorter terms).

- Regularly track progress towards these specific goals and adjust the strategy as needed.