How can wealth management support my retirement planning goals?

Securing a comfortable future after years of hard work is a dream for many Indians. Whether you’re a dedicated salaried professional or a driven small business owner, the thought of a relaxed retirement, free from financial worries, is a powerful motivator. However, achieving this dream in today’s India requires more than just hope; it demands careful and strategic planning. Factors like increasing life expectancy, rising healthcare expenses, and persistent inflation mean that a robust retirement plan is no longer a luxury but a necessity. Retirement planning, at its core, is the process of setting specific financial goals for your post-work years and creating a detailed roadmap to reach them. While saving is crucial, navigating the complexities of investments, taxes, and risk requires expertise. This is where wealth management comes in – it’s a comprehensive financial advisory service designed to manage your financial life holistically. Professional wealth management support retirement planning efforts significantly, providing the necessary structure, discipline, and expert guidance essential for long-term financial security, a critical aspect of financial planning for retirement in India for everyone.

What Exactly is Wealth Management? (Beyond Basic Investing)

Many people confuse wealth management with simple investment advice or mutual fund distribution. While investment management is a key component, true wealth management offers a much broader and deeper level of service, taking a 360-degree view of your financial life. It’s a high-level professional service that combines financial planning, investment portfolio management, and several other aggregated financial services into one integrated approach. Instead of just suggesting where to invest, a wealth manager works closely with you to understand your complete financial picture – your income, expenses, assets (like property or business equity), liabilities (loans), short-term and long-term goals (especially retirement), risk tolerance, and family situation.

Wealth management typically encompasses several key areas:

- Comprehensive Financial Planning: This is the foundation. It involves assessing your current financial standing, understanding cash flows, creating budgets, and setting clear, achievable financial goals, including retirement.

- Strategic Investment Management: Based on your goals and risk profile, the manager creates and actively manages a diversified investment portfolio. This goes beyond just picking stocks or funds; it involves strategic asset allocation across different classes like equity, debt, real estate, and gold to optimize returns while managing risk. For further insights on maximizing your investments, refer to our Expert Commercial Real Estate Consultant guide.

- Risk Management & Insurance Planning: Identifying potential financial risks (like illness, disability, or premature death) and recommending appropriate insurance coverage (life, health, critical illness) to protect your wealth and financial plan.

- Tax Planning & Optimization: This is a critical aspect, especially in India. Wealth managers help structure your investments, income, and even expenses in the most tax-efficient manner possible, both during your earning years and post-retirement. At TaxRobo, our expertise in navigating the Indian tax system ensures this component is handled meticulously. Consider exploring our TaxRobo Income Tax Service for specialized assistance.

- Estate Planning (Often Included): For longer-term security, wealth management often includes advice on planning for the efficient transfer of your wealth to the next generation according to your wishes, involving wills, trusts, and succession planning.

The power of wealth management lies in its integrated and personalized nature. It ensures all aspects of your financial life work together harmoniously towards your specific objectives, particularly concerning wealth management and retirement goals in India. It’s not just about growing your money; it’s about protecting it, making it tax-efficient, and ensuring it serves your life goals, especially a secure retirement.

The Core Connection: How Wealth Management Support Retirement Planning

Retirement planning can feel overwhelming. How much money will you really need? Where should you invest? How do you protect your savings from inflation and market crashes? This is precisely where professional wealth management support retirement planning becomes invaluable. Wealth managers act as your financial quarterback, guiding you through the complexities and ensuring your strategy stays on track. They provide structure, expertise, and discipline, significantly increasing the likelihood of achieving a financially secure retirement. Understanding how wealth management can help retirement involves looking at the specific mechanisms they employ.

Here’s a breakdown of how wealth management directly supports your retirement goals:

Setting Clear and Quantifiable Retirement Goals:

One of the biggest challenges in retirement planning is figuring out the target corpus – the total amount you’ll need. A wealth manager helps you move beyond vague estimations. They conduct detailed analyses, considering factors like your desired retirement lifestyle (travel, hobbies, regular expenses), projected healthcare costs, anticipated inflation rates over decades, and expected lifespan. They translate your retirement dreams into concrete financial numbers, answering the crucial question: “How much is enough?” This clarity is the first step towards building an effective plan and directly addresses how wealth management can help retirement goal definition.

Developing a Personalized Retirement Roadmap:

Once the goal is clear, the next step is creating a strategy to reach it. Wealth managers design a personalized investment roadmap tailored to your specific situation, risk tolerance, and time horizon. This involves strategic asset allocation – deciding the optimal mix of investments across different categories like:

- Equity: For long-term growth potential.

- Debt: For stability and income generation (e.g., bonds, fixed deposits).

- Real Estate: For potential appreciation and rental income.

- Gold/Commodities: As a hedge against inflation.

They integrate your existing savings and investments, such as Employee Provident Fund (EPF), Public Provident Fund (PPF), National Pension System (NPS), mutual funds, and potentially business profits, into this overall strategy. They identify gaps and recommend suitable investment vehicles, considering various retirement strategies for salaried people India like maximising tax-saving investments.

Disciplined Investment & Portfolio Management:

Creating a plan is one thing; sticking to it is another. Wealth managers provide ongoing portfolio management. This isn’t a “set it and forget it” approach. They continuously monitor your investments, track performance against benchmarks, and make necessary adjustments based on changing market conditions, economic outlooks, and any shifts in your personal circumstances (like a change in income or goals). Regular rebalancing – bringing your asset allocation back to the target mix – is crucial for managing risk and capturing gains over the long term. This disciplined approach ensures your portfolio stays aligned with your retirement objectives.

Proactive Risk Mitigation:

Retirement planning faces several risks:

- Inflation Risk: The risk that rising prices will erode the purchasing power of your savings.

- Market Volatility Risk: The risk of sharp downturns impacting your investment value, especially close to retirement.

- Longevity Risk: The risk of outliving your savings.

- Health Risk: The risk of unexpected medical expenses derailing your finances.

Wealth managers build strategies to mitigate these risks. This includes investing in assets that historically outpace inflation, diversifying investments to reduce volatility impact, planning for adequate insurance coverage, and potentially suggesting annuity products for guaranteed income streams post-retirement.

Tax Optimization Strategies:

Taxes can significantly impact your retirement corpus if not managed effectively. Wealth managers are adept at tax planning throughout the retirement journey. During the accumulation phase, they help you choose tax-efficient investments (like ELSS, PPF, NPS) and structure your portfolio to minimize tax liability. Crucially, they also plan for the withdrawal phase (post-retirement), advising on the most tax-efficient ways to draw income from your various investments (e.g., structuring withdrawals from equity vs. debt funds, utilizing tax-free components). Efficient tax planning can add substantial value to your retirement savings. For complex scenarios, leveraging expert services like TaxRobo Online CA Consultation Service can be beneficial.

Behavioural Coaching:

Financial markets are often driven by emotions like fear and greed. During market downturns, the instinct might be to panic sell, locking in losses. During bull runs, the temptation might be to take excessive risks. A key role of a wealth manager is to act as a behavioural coach, helping you stay focused on your long-term goals and avoid making impulsive, emotionally driven financial decisions that could sabotage your retirement plan. They provide perspective and reinforce discipline, which is often as valuable as the investment advice itself.

Tailored Approaches: Retirement Planning for Salaried vs. Business Owners in India

While the core principles of retirement planning remain the same, the specific strategies and considerations can differ significantly for salaried individuals and small business owners in India. Wealth management providers tailor their advice to address these unique circumstances, ensuring the plan aligns with the individual’s income streams, existing benefits, and business realities. Understanding these nuances is crucial for effective wealth management for retirement planning India.

Focus on Retirement Planning Goals for Salaried Individuals:

Salaried professionals often have a more structured financial framework, which presents both opportunities and specific planning needs. Wealth managers focus on optimizing this structure for retirement:

- Maximizing Mandatory Contributions: The Employee Provident Fund (EPF) and Employee Pension Scheme (EPS) form the bedrock of retirement savings for many. A wealth manager ensures you understand these benefits and advises on voluntary contributions (VPF) if suitable for your goals.

- Leveraging Voluntary Tax-Saving Schemes: Beyond EPF, salaried individuals have access to powerful tools like the Public Provident Fund (PPF) and the National Pension System (NPS). Wealth managers help integrate these into the overall plan, considering contribution limits, tax benefits (under sections like 80C and 80CCD), lock-in periods, and withdrawal rules. These form key retirement strategies for salaried people India.

- Integrating Employer Stock Options (ESOPs): If you receive ESOPs, managing them requires careful planning regarding vesting schedules, exercise decisions, and tax implications (perquisite tax and capital gains tax). A wealth manager helps incorporate ESOP wealth into your retirement corpus strategically.

- Planning for Career Transitions: Salaried careers aren’t always linear. Wealth managers help plan for potential job changes, salary fluctuations, or career breaks, ensuring retirement savings continue consistently. They can model different income scenarios and adjust the plan accordingly.

- Insurance Integration: Ensuring adequate health and life insurance coverage beyond what the employer might provide is critical, as employer benefits cease upon retirement or job change.

Achieving specific retirement planning goals for salaried individuals often involves systematically building a diversified portfolio beyond mandatory savings, using instruments like mutual fund SIPs, direct equity (if risk appetite allows), and potentially debt instruments, all guided by the wealth manager.

Considerations for Small Business Owners:

Small business owners face a different set of challenges and opportunities when it comes to retirement planning:

- Integrating Business and Personal Finances: The lines are often blurred. Wealth managers help segregate finances where possible and develop strategies that account for business cash flow impacting personal investment capacity. Planning must consider reinvestment needs in the business versus allocation to personal retirement funds.

- Managing Irregular Income Streams: Unlike fixed salaries, business income can be volatile. Wealth managers help create flexible investment strategies, perhaps suggesting setting aside a larger emergency fund and using techniques like Systematic Transfer Plans (STPs) from debt to equity funds during periods of good cash flow to ensure consistent retirement investing.

- Business Succession Planning: How and when the owner exits the business is a major factor in retirement funding. Will the business be sold? Passed on to family? Wound down? Wealth management includes planning for this transition, estimating the potential funds realizable from the business, and integrating this into the overall retirement corpus calculation. Tax implications of the exit strategy are also crucial. Our experts at TaxRobo can assist with navigating the complexities of business structuring and succession through services like TaxRobo Online CA Consultation Service.

- Exploring Diverse Investment Options: Business owners might have opportunities beyond traditional routes, such as investing in commercial property through their business or personal capacity, or structuring investments via corporate entities. Wealth managers explore all viable, tax-efficient options.

- Self-Directed Retirement Accounts: While lacking EPF, business owners can aggressively utilize PPF, NPS (as self-employed individuals), and build substantial mutual fund or direct equity portfolios. The focus is on disciplined, self-directed saving and investment.

Effective wealth management for retirement planning India for entrepreneurs requires a deep understanding of both personal financial goals and the dynamics of their business.

Getting Started: Taking the First Step Towards a Secure Retirement

Reading about wealth management and retirement planning is informative, but taking action is what truly secures your future. The process might seem daunting initially, but breaking it down into manageable steps makes it achievable. Whether you’re just starting your career or are further along, initiating the process is key. Remember, the power of compounding works best over longer periods, so starting early is advantageous, but it’s genuinely never too late to begin improving your financial future through structured financial planning for retirement in India.

Here’s how you can take the first step:

- Assess Your Current Financial Situation Honestly: Gather all your financial information. This includes your income sources, monthly expenses, existing assets (bank balances, FDs, mutual funds, stocks, real estate, gold, EPF/PPF balances), and outstanding liabilities (home loan, personal loan, credit card debt). Understanding your net worth and cash flow is the starting point. Many free online tools or simple spreadsheets can help organize this data.

- Define Preliminary Retirement Goals: Think about what you envision for your retirement.

- At what age do you ideally want to retire?

- What kind of lifestyle do you aspire to (modest, comfortable, luxurious)? Consider travel, hobbies, healthcare needs.

- Do you have any major post-retirement financial responsibilities (e.g., children’s weddings, supporting parents)?

Write these down, even if they are rough estimates initially. A wealth manager can help refine these later.

- Acknowledge the Power of Starting Early (But Don’t Delay if You Haven’t): The earlier you start investing, the more time your money has to grow through compounding. Even small amounts invested regularly early on can become substantial over decades. However, if you’re starting later, don’t be discouraged. A focused plan, potentially involving higher savings rates, can still help you achieve significant progress. The key is to start now.

- Educate Yourself (Basic Concepts): Gain a basic understanding of different investment options (mutual funds, stocks, bonds, NPS, PPF), the concept of risk and return, and the importance of diversification. Reputable financial websites, government resources like the SEBI Investor Awareness website or the NPS Trust website, and introductory articles can be helpful.

- Research and Consider Professional Guidance: While DIY planning is possible, the complexities involved, especially regarding long-term projections, risk management, and tax optimization, often warrant professional help. Research qualified wealth managers or SEBI-Registered Investment Advisors (RIAs). Look for professionals with relevant experience, transparent fee structures, and a client-centric approach. Consider scheduling initial consultations with a few advisors to understand their process and see if there’s a good fit. Professional guidance significantly simplifies financial planning for retirement in India and increases your chances of success.

Taking these initial steps puts you firmly on the path towards taking control of your retirement planning.

Conclusion: Partner with Expertise for Your Retirement Goals

Planning for retirement in India presents unique challenges and opportunities. Navigating inflation, market fluctuations, evolving tax laws, and personal life changes requires a strategic and disciplined approach. As we’ve explored, professional wealth management support retirement planning by transforming a potentially overwhelming task into a structured, manageable process. It goes far beyond basic investment advice, offering a holistic strategy tailored to your individual circumstances and aspirations.

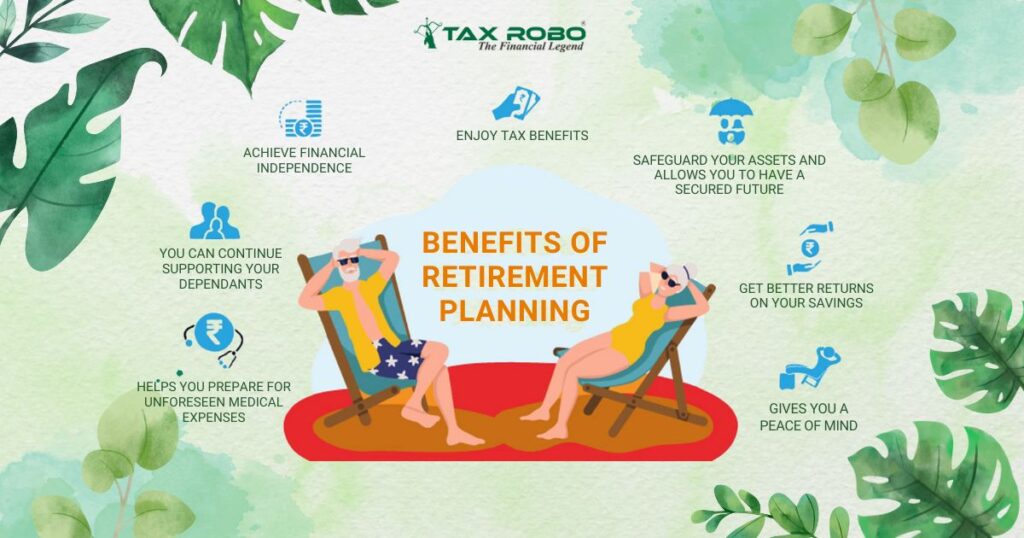

The key benefits of partnering with a wealth manager for your retirement journey include:

- Goal Clarity: Defining precisely how much you need and when.

- Personalized Roadmap: Creating a tailored investment strategy using appropriate tools.

- Disciplined Execution: Ensuring consistent investment, monitoring, and rebalancing.

- Optimized Investments: Balancing risk and return across various asset classes.

- Proactive Risk Management: Protecting your savings from inflation, volatility, and longevity risks.

- Enhanced Tax Efficiency: Minimizing tax impact both pre and post-retirement.

- Behavioural Guidance: Avoiding costly emotional financial decisions.

- Peace of Mind: Knowing your retirement plan is being professionally managed.

Whether you are a salaried individual optimizing structured savings or a business owner integrating personal and business finances, achieving your wealth management and retirement goals in India is significantly more attainable with expert guidance. Don’t leave your financial future to chance. Take control today by partnering with professionals who understand the intricacies of financial planning for retirement in India.

Ready to build a secure and comfortable retirement? Contact TaxRobo today for a personalized consultation on wealth management and retirement planning tailored to your unique needs. Let us help you navigate the path to financial freedom. Reach out via our TaxRobo Online CA Consultation Service page.

Frequently Asked Questions (FAQs)

- Q1: Is wealth management only for high-net-worth individuals in India?

Answer: While wealth management was traditionally associated with High-Net-Worth Individuals (HNWIs), this is changing. Many firms now offer tailored services accessible to professionals, salaried individuals with growing incomes, and small business owners who are serious about long-term financial goals like retirement. The complexity of your financial situation and goals, rather than just your current net worth, often determines the value you can derive from wealth management. It’s increasingly beneficial for those building wealth, not just those who already have it. - Q2: How is wealth management different from just buying mutual funds for retirement?

Answer: Buying mutual funds is simply an investment action, one component of a potential retirement strategy. Wealth management is a holistic process. It starts with understanding your complete financial picture and defining specific retirement goals. It then involves creating a comprehensive financial plan, strategic asset allocation (which includes selecting appropriate mutual funds, but also other assets), risk management (insurance), tax planning, and ongoing monitoring and advisory. Wealth management provides the overarching strategy and discipline for wealth management for retirement planning India, whereas buying funds in isolation lacks this integrated approach. - Q3: When is the right time to start using wealth management for retirement planning?

Answer: Ideally, the earlier you start, the better. This allows you to fully leverage the power of compounding over a longer time horizon. Even small, consistent investments started early can grow significantly. However, it’s never too late to benefit from professional advice. Whether you are in your 20s/30s (building phase), 40s/50s (acceleration phase), or even nearing retirement (preservation and withdrawal phase), a wealth manager can help structure your financial planning for retirement in India effectively based on your current stage and goals. - Q4: What are typical fees for wealth management services in India?

Answer: Wealth management fees in India can vary significantly based on the provider, the range of services offered, and the fee model. Common models include:- Assets Under Management (AUM) Fee: A percentage of the total assets managed (e.g., 0.5% to 1.5% annually).

- Fixed Fee: A flat annual or engagement-based fee, regardless of asset size.

- Commission-Based: Earning commissions from the financial products recommended (less common among fee-only advisors).

- Hybrid Models: A combination of the above.

It’s crucial to ask for complete transparency regarding all fees and charges before engaging a wealth manager. SEBI-Registered Investment Advisors often work on a fee-only basis, which aligns their interests more closely with the client’s.

- Q5: Can wealth management guarantee specific retirement returns?

Answer: No. No ethical or compliant wealth manager can or should guarantee investment returns. All investments carry market risk, and future performance cannot be predicted with certainty. What professional wealth management support retirement planning does is create a diversified, risk-managed, and goal-oriented strategy based on sound financial principles and rigorous analysis. This significantly increases the probability of meeting your retirement goals compared to ad-hoc or emotionally driven investing, but it does not eliminate risk or guarantee specific outcomes. The focus is on process, discipline, and managing probabilities effectively.