TDS Rate Chart for FY 2024-25 (AY 2025-26) – Your Guide for India

Staying compliant with tax regulations is fundamental for every Indian taxpayer, whether you’re steering a small business or earning a monthly salary. One crucial aspect of this compliance is understanding and correctly applying Tax Deducted at Source (TDS). TDS is essentially a method used by the Indian government to collect income tax directly from the source of income generation. Instead of waiting for you to pay your taxes at the end of the year, the government mandates the payer (like your employer or a business paying a contractor) to deduct a certain percentage of tax before making the full payment to the recipient. This post serves as your comprehensive guide, providing the updated TDS rate chart FY 2024-25, which is essential for making accurate tax deductions during the financial year running from April 1, 2024, to March 31, 2025. It’s important to note that these rates are applicable for the income earned in this financial year, which will be assessed in the Assessment Year 2025-26 (TDS rate chart AY 2025-26). Understanding these rates is vital – for small businesses, it ensures correct deductions from payments made, and for salaried individuals, it helps in understanding the tax deducted from their income.

What is TDS and Why is it Important?

Navigating the world of taxes can seem daunting, but understanding core concepts like TDS is the first step towards financial clarity and compliance. Let’s break down what TDS is and why knowing the current rates is crucial for everyone.

Understanding Tax Deducted at Source (TDS)

Tax Deducted at Source (TDS) is a system introduced by the Income Tax Department of India where the person or company responsible for making specified payments (like salary, commission, rent, interest, professional fees, etc.) is required to deduct tax at the source before making the full payment to the recipient. This deducted amount is then deposited with the government. The entity deducting the tax is known as the ‘deductor’, and the entity receiving the net payment after tax deduction is known as the ‘deductee’. TDS is typically deducted either when the payment is actually made or when the payment is credited to the payee’s account in the books of the deductor, whichever occurs earlier. The primary purpose of TDS is to ensure a steady flow of revenue for the government throughout the year and to track income streams more effectively. It essentially shifts the responsibility of tax collection partially onto the payer, making the process more efficient and reducing the scope for tax evasion.

Importance of Knowing the Correct TDS Rates for FY 2024-25

Knowing and applying the correct TDS rates is not just about following rules; it has significant implications for both businesses and individuals. For businesses acting as deductors, using the accurate rates specified in the TDS rates FY 2024-25 India ensures compliance with the Income Tax Act. Failure to deduct TDS or deducting TDS at an incorrect (lower) rate can attract hefty penalties, including interest on the amount not deducted or short-deducted, and even disallowance of the corresponding expense while calculating business profits. Accurate TDS deduction also reflects sound financial management within the business. For individuals (deductees), understanding the applicable TDS rates helps in verifying the tax deducted by the payer (like an employer or a bank) and managing personal cash flows effectively. It allows individuals to estimate their net income more accurately and claim the correct amount of tax credit when filing their income tax returns. Ultimately, awareness of the correct TDS rates facilitates smoother tax processing for everyone involved and fosters a compliant tax environment.

Key Distinction: Financial Year (FY) vs. Assessment Year (AY)

Understanding the difference between a Financial Year (FY) and an Assessment Year (AY) is fundamental in the context of Indian income tax, especially when dealing with TDS rates. These terms define the period for earning income and the period for evaluating that income for tax purposes, respectively.

Financial Year (FY) 2024-25

The Financial Year (FY) is the 12-month period during which you earn income. In India, the Financial Year always starts on April 1st and ends on March 31st of the following calendar year. Therefore, FY 2024-25 refers to the period from April 1, 2024, to March 31, 2025. All income earned, expenditures incurred, and investments made during this specific timeframe fall under FY 2024-25. When we discuss the TDS rate chart for financial year 2024-25, we are referring to the rates applicable for tax deductions on payments made or credited during this period (April 1, 2024, to March 31, 2025). Businesses making payments subject to TDS must apply the rates relevant to this FY.

Assessment Year (AY) 2025-26

The Assessment Year (AY) is the 12-month period immediately following the Financial Year. It is the year in which the income earned during the preceding Financial Year is assessed, and taxes are paid. The Assessment Year also runs from April 1st to March 31st. For the income earned in FY 2024-25 (April 1, 2024 – March 31, 2025), the corresponding Assessment Year is AY 2025-26 (April 1, 2025 – March 31, 2026). When you file your Income Tax Return (ITR) for the income earned between April 2024 and March 2025, you will do so during AY 2025-26, typically by the due date (e.g., July 31, 2025, for most individuals). The TDS rate chart for assessment year 2025-26 technically refers to the rates applied during the previous financial year (FY 2024-25) whose income is being assessed in AY 2025-26. It’s crucial to remember that the TDS deduction itself happens in the FY based on the rates applicable for that FY.

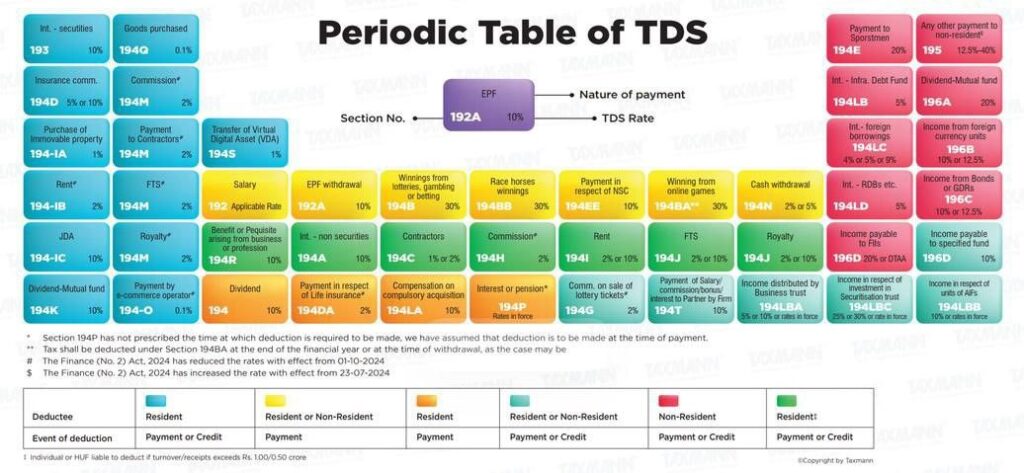

Comprehensive TDS Rate Chart FY 2024-25 (Applicable for AY 2025-26)

Here is a summary of the common TDS rates applicable for the Financial Year 2024-25 (relevant for Assessment Year 2025-26). Please note that TDS is generally deducted only if the total payment during the financial year exceeds a specified threshold limit for that particular section. These thresholds are as important as the rates themselves. For exhaustive details and specific conditions under each section, it is always advisable to refer to the Income Tax Act, 1961, and relevant circulars or consult a tax professional. The rates mentioned below are primarily for resident taxpayers.

(Table: TDS Rates for FY 2024-25 / AY 2025-26)

| Section | Nature of Payment | Threshold Limit (Per Financial Year) | TDS Rate (PAN Holders – Individuals/HUF) | TDS Rate (PAN Holders – Others e.g., Companies) | TDS Rate (If PAN Not Provided – Sec 206AA) |

|---|---|---|---|---|---|

| 192 | Salary | Taxable Income Limit | Applicable Income Tax Slab Rates | Applicable Income Tax Slab Rates | Applicable Slab Rate (at higher rate calc.) |

| 194A | Interest (Bank Deposits – Time Deposits) | Rs. 40,000 (Rs. 50,000 for Sr. Citizens) | 10% | 10% | 20% |

| 194A | Interest (Other than Securities/Bank Deposits) | Rs. 5,000 | 10% | 10% | 20% |

| 194C | Payment to Contractors/Sub-contractors (Single Sum) | Rs. 30,000 | 1% | 2% | 20% |

| 194C | Payment to Contractors/Sub-contractors (Aggregate) | Rs. 1,00,000 | 1% | 2% | 20% |

| 194H | Commission or Brokerage | Rs. 15,000 | 5% | 5% | 20% |

| 194I(a) | Rent – Plant & Machinery | Rs. 2,40,000 | 2% | 2% | 20% |

| 194I(b) | Rent – Land/Building/Furniture/Fittings | Rs. 2,40,000 | 10% | 10% | 20% |

| 194J(a) | Fees for Technical Services (FTS) (other than 194J(b)) | Rs. 30,000 | 2% | 2% | 20% |

| 194J(b) | Fees for Professional Services | Rs. 30,000 | 10% | 10% | 20% |

| 194J(c) | Royalty (Sale/Distribution/Exhibition of Films) | Rs. 30,000 | 2% | 2% | 20% |

| 194J(d) | Call Centre Operator Fees | Rs. 30,000 | 2% | 2% | 20% |

| 194Q | Purchase of Goods (Turnover > Rs. 10 Cr) | Rs. 50 Lakh | 0.1% | 0.1% | 5% |

| 194R | Benefit/Perquisite from Business/Profession | Rs. 20,000 | 10% | 10% | 20% |

| 194N | Cash Withdrawal (> Rs. 1 Cr) by ITR Filer | Rs. 1 Crore | 2% | 2% | 20% |

| 194N | Cash Withdrawal (> Rs. 20 Lakh) by Non-ITR Filer | Rs. 20 Lakh | 2% | 2% | 20% (5% > Rs. 1 Cr) |

| 194O | E-commerce Participants | Rs. 5 Lakh (Ind/HUF with PAN/Aadhaar) | 1% | 1% | 5% |

Common TDS Sections for Salaried Individuals

For most salaried individuals, the primary TDS section they encounter is Section 192 – Salary. Unlike other sections with flat rates, TDS on salary isn’t deducted at a fixed percentage from the gross salary. Instead, your employer estimates your total annual income (including salary, allowances, perquisites), allows for eligible deductions (like standard deduction, Section 80C investments, home loan interest under Section 24, etc.), and then calculates your estimated income tax liability based on the applicable income tax slab rates for the Financial Year 2024-25. This estimated annual tax is then divided by the number of months of employment remaining in the financial year, and that amount is deducted as TDS from your monthly salary. Your employer issues Form 16 at the end of the financial year, which details your salary components, deductions claimed, and the TDS deducted. This form is crucial for filing your income tax return.

Common TDS Sections Relevant for Small Businesses & Other Payments

Small business owners (SBOs) often act as deductors for various payments they make. Understanding these sections is crucial for compliance:

- Section 194A – Interest (Other than Interest on Securities): If a business pays interest (e.g., on loans taken from individuals/non-banks), TDS at 10% is required if the amount exceeds Rs. 5,000 in a financial year. For interest paid by banks or cooperative societies on time deposits, the threshold is higher (Rs. 40,000 or Rs. 50,000 for senior citizens).

- Section 194C – Payment to Contractors/Sub-contractors: This is highly relevant for SBOs engaging contractors for work (like advertising, broadcasting, carriage of goods, catering, etc.). If a single payment exceeds Rs. 30,000 or the aggregate payments in a financial year exceed Rs. 1,00,000, TDS applies. The rate is 1% if the payment is to an individual/HUF contractor and 2% if to other types of contractors (e.g., companies).

- Section 194H – Commission or Brokerage: Businesses paying commission or brokerage (excluding insurance commission covered under Sec 194D) must deduct TDS at 5% if the total payment exceeds Rs. 15,000 in the financial year.

- Section 194I – Rent: If your business pays rent for premises or equipment, TDS is applicable if the annual rent exceeds Rs. 2,40,000. The rate is 2% for rent paid on Plant & Machinery and 10% for rent on Land, Building, Furniture, or Fittings.

- Section 194J – Fees for Professional or Technical Services: Payments made for professional services (like legal, medical, engineering, architectural, accountancy, technical consultancy, interior decoration) or technical services are subject to TDS if the annual payment exceeds Rs. 30,000 per category of service. The rate is generally 10% for professional services and 2% for technical services (and specific cases like call centers or royalty for cinematograph films).

- Section 194Q – Purchase of Goods: Applicable to buyers whose total sales, gross receipts, or turnover exceed Rs. 10 crore in the preceding financial year. If such a buyer purchases goods worth more than Rs. 50 lakh from a single resident seller in a financial year, they must deduct TDS at 0.1% on the amount exceeding Rs. 50 lakh. For more insights on business taxation, refer to Taxation 101 for Small Business Owners.

- Section 194R – Benefits/Perquisites from Business/Profession: If a business provides any benefit or perquisite (in cash or kind) arising from business or profession to a resident, exceeding Rs. 20,000 in value during the financial year, TDS at 10% is required on the value of such benefit/perquisite.

- Other sections like 194N (TDS on cash withdrawals exceeding certain limits) and 194O (TDS by e-commerce operators on payments to e-commerce participants) might also be relevant depending on the nature of transactions.

TDS Rates for Non-Residents (Brief Overview)

It’s important to note that the TDS rates mentioned in the table above primarily apply to payments made to residents of India. When making payments to non-residents (NRIs or foreign companies), the TDS provisions can be more complex. The rates might be different, often higher, as specified in the Income Tax Act or as per the rates prescribed in the Double Taxation Avoidance Agreement (DTAA) between India and the non-resident’s country, whichever is more beneficial to the taxpayer. Determining the correct rate often requires careful examination of the nature of payment, the non-resident’s status, the availability of PAN, and the relevant DTAA provisions. The TDS rate chart India for non-residents requires specific attention. For accurate guidance on TDS applicability and rates for non-resident payments, it is highly recommended to seek professional advice. TaxRobo can assist you with specific queries related to non-resident taxation. For a deeper understanding, you can explore our article on Complete Guide to Income Tax for NRIs: Filing Requirements and Benefits.

Key Considerations for the TDS Rate Chart 2024-25

Simply knowing the TDS rates is only part of the equation. To ensure full compliance and avoid issues, businesses and individuals must also be aware of several related factors concerning the TDS rate chart 2024-25.

Impact of PAN

The Permanent Account Number (PAN) plays a critical role in the TDS mechanism. The Income Tax Act mandates that the deductee (the person receiving the payment) must furnish their PAN to the deductor (the person making the payment). If the deductee fails to provide their PAN, the deductor is obligated under Section 206AA of the Income Tax Act to deduct TDS at a higher rate. This higher rate is typically the rate specified in the relevant TDS section, the rate specified in the Finance Act for that year, or 20%, whichever is higher. As seen in the table above, for most common sections, failure to provide PAN results in a flat 20% TDS rate (or even higher in specific non-resident cases), significantly impacting the net payment received by the deductee. Therefore, ensuring PAN is correctly quoted and provided is essential for both parties. Learn more about the importance of PAN in our article on Section 139A: Importance and Application of Permanent Account Number (PAN).

Threshold Limits

Another crucial aspect often overlooked is the threshold limit specified for each TDS section. TDS is generally not required if the payment amount during the financial year remains below the prescribed threshold. For instance, TDS on rent (Section 194I) is only applicable if the total rent paid during the FY exceeds Rs. 2,40,000. Similarly, for professional fees (Section 194J), the threshold is Rs. 30,000. Deductors must track payments made under each relevant section to ascertain if the threshold limit has been crossed. Once the threshold is breached, TDS must be deducted on the entire amount (in most cases, including the threshold amount, though specific rules may vary per section – check the Act). Ignoring these limits can lead to non-deduction errors. It’s vital to check the specific threshold for each type of payment before deciding whether TDS is applicable.

Lower/Nil Deduction Certificate (Form 13)

What if a taxpayer’s estimated total income for the financial year is likely to be below the basic exemption limit, meaning they won’t have any tax liability? Or what if their actual tax liability justifies a lower rate of TDS than prescribed? In such scenarios, the taxpayer (deductee) can apply to the Assessing Officer (AO) using Form 13 to obtain a certificate authorizing the deductor to deduct TDS at a lower rate or deduct no TDS at all. If the AO is satisfied, they will issue such a certificate specifying the rate and validity period. The deductee then needs to furnish this certificate to the deductor, who can then deduct TDS accordingly. This mechanism prevents unnecessary tax deduction and subsequent refund claims, improving cash flow for the taxpayer. Individuals can also submit Form 15G/15H to banks (for interest income below taxable limits) to prevent TDS deduction, subject to conditions.

Due Dates for TDS Deposit & Return Filing

Deducting TDS is only the first step; depositing the deducted amount with the government and reporting the deduction are equally important compliance requirements. The TDS deducted by the deductor must be deposited with the government treasury generally by the 7th day of the month following the month in which TDS was deducted. For TDS deducted in March, the due date is usually April 30th. Failure to deposit TDS on time attracts interest penalties. Furthermore, deductors are required to file quarterly TDS returns electronically. These returns (Form 24Q for salaries, Form 26Q for payments other than salaries, Form 27Q for payments to non-residents) summarize the TDS deducted and deposited for each quarter. Timely filing of these returns is mandatory to avoid late filing fees and ensure that the deductees get credit for the tax deducted from their income. For assistance with timely TDS Filing, TaxRobo offers expert services.

Conclusion

Understanding and correctly applying the TDS rate chart FY 2024-25 is non-negotiable for maintaining tax compliance in India. Whether you are a small business owner responsible for deducting tax on various payments or a salaried individual wanting to understand your payslip better, knowing these rates and the associated rules is crucial. Accurate TDS deduction and timely deposit not only help avoid interest, penalties, and potential litigation with the Income Tax Department but also contribute to smoother financial operations for businesses and ensure individuals receive the appropriate tax credits seamlessly.

Navigating the nuances of TDS sections, thresholds, rates, deposit deadlines, and return filing can sometimes feel overwhelming. If you need expert assistance with TDS calculations, ensuring compliance, managing TDS Filing, or require support with Accounting Services or Income Tax Filing, TaxRobo is here to help. Contact TaxRobo today, and let our experts help your business and you stay compliant effortlessly.

Frequently Asked Questions (FAQs) about TDS Rate Chart FY 2024-25

1. Where can I find the official TDS rate chart for India?

Answer: The official TDS rates and detailed provisions are laid out in the Income Tax Act, 1961, and are updated through the annual Finance Acts and subsequent notifications or circulars issued by the Central Board of Direct Taxes (CBDT). For the most current and authoritative information, you should always refer to the official website of the Income Tax Department India.

2. Are there any major changes in the TDS rates for FY 2024-25 compared to last year?

Answer: As of the beginning of the Financial Year 2024-25 (starting April 1, 2024), no major structural changes have been announced to the general TDS rate structure compared to FY 2023-24 for most common sections applicable to residents. However, tax laws can be amended. It’s always best practice to refer to the latest official notifications and the TDS rate chart 2024-25 applicable for the specific section you are dealing with to ensure accuracy.

3. What happens if a business deducts TDS using an outdated rate chart?

Answer: Using an outdated rate chart and consequently deducting TDS at an incorrect (typically lower) rate is considered non-compliance. The Income Tax Department can raise a demand for the shortfall in TDS deduction, along with interest under Section 201(1A) for the delay in payment. In some cases, penalties may also be levied. Furthermore, the corresponding expense might be subject to disallowance under Section 40(a)(ia) when calculating the business’s taxable income.

4. Does the TDS rate chart AY 2025-26 apply to GST?

Answer: No, the TDS rate chart discussed here pertains specifically to Income Tax. Tax Deducted at Source (TDS) under the Income Tax Act is a mechanism for collecting direct tax. Goods and Services Tax (GST) is an indirect tax levied on the supply of goods and services, with its own set of rates, rules, and compliance procedures. While a specific provision for TDS under GST (Section 51) exists, it applies only to certain specified government entities and agencies making payments to suppliers above a certain threshold, and it is distinct from Income Tax TDS.

5. As a salaried employee, how does the TDS rate chart affect my monthly salary?

Answer: The standard TDS rate chart with flat percentages (like 10% for rent or 5% for commission) doesn’t directly apply to your salary deduction under Section 192. Instead, your employer estimates your total annual income, considers your declared investments and deductions (like HRA, 80C, 80D, standard deduction), calculates your potential tax liability based on the applicable income tax slab rates for FY 2024-25 (depending on whether you opt for the old or new tax regime), and then deducts tax proportionately each month. Understanding the broader TDS rates FY 2024-25 India ecosystem helps, but for salary, focus on understanding your tax slab and ensuring your employer accounts for your deductions correctly to arrive at the right monthly TDS amount reflected in your payslip and Form 16.