Section 80DDB: Deductions on Treatment of Specified Diseases

Introduction: Understanding Tax Relief for Medical Expenses in India

Dealing with critical illnesses is incredibly challenging, not just emotionally but also financially. The high cost of treating serious health conditions in India can place a significant strain on family finances, often depleting savings and causing immense stress. Fortunately, the Indian Income Tax Act, 1961, offers some relief. Section 80DDB is a vital provision designed to help taxpayers manage these substantial costs. Understanding the specifics of Section 80DDB deductions is crucial because it can lead to significant tax savings on specified diseases treatment, easing the financial burden during difficult times. This guide is designed for both salaried individuals and small business owners in India, providing essential information on claiming tax deductions for medical treatment India. We will delve into who is eligible, which diseases qualify, the applicable deduction limits, and the precise steps involved in claiming Section 80DDB deductions.

What Exactly are Section 80DDB Deductions?

Section 80DDB deductions India refer to a specific tax benefit available under the Income Tax Act, 1961. Situated under Chapter VI-A, which deals with deductions to be made in computing total income, this section allows taxpayers to deduct expenses incurred for the medical treatment of certain specified diseases or ailments. The deduction is allowed from the taxpayer’s Gross Total Income for the financial year, effectively reducing their taxable income and, consequently, their tax liability. The fundamental purpose behind Section 80DDB is to provide crucial financial relief and medical treatment tax benefits under 80DDB to individuals and families facing the substantial financial burden associated with treating critical illnesses listed under the rules. It acknowledges the extraordinary nature of these medical expenses and aims to offer some support through the tax system. This provision reflects a measure of social security, helping taxpayers cope with potentially crippling healthcare costs for specific serious conditions affecting themselves or their dependents.

Who is Eligible to Claim Section 80DDB Deductions?

Understanding eligibility is the first step towards claiming this valuable tax benefit. The Income Tax Act clearly defines who can claim the deduction and for whom the medical expenses must be incurred.

Eligible Assessees

The deduction under Section 80DDB can be claimed only by resident Individuals and Hindu Undivided Families (HUFs). Non-resident individuals or HUFs are not eligible for this specific deduction. This provision is particularly relevant for a wide range of taxpayers, including Section 80DDB deductions for salaried individuals who receive a fixed income and self-employed individuals or small business owners who manage their own finances. Whether you earn a salary, run a proprietorship, or are part of an HUF structure managing family assets and income, if you meet the residency criteria and have incurred eligible medical expenses, you can potentially claim this deduction to lower your tax outgo. This aligns well with topics covered in our Taxation 101 for Small Business Owners. The status of being a resident in India for the relevant financial year is a primary condition for the taxpayer seeking this relief.

Eligible Patients (Self or Dependent)

The deduction is available for medical expenses incurred on the treatment of specified diseases for either:

- The taxpayer themselves: If the individual taxpayer has incurred expenses for their own treatment of a specified disease.

- A dependent family member: If the taxpayer has incurred expenses for the treatment of a dependent. For an Individual taxpayer, dependents include their spouse, children, parents, brothers, and sisters. For an HUF, dependents include any member of the HUF.

Crucially, the term ‘dependent’ under Section 80DDB means a family member who is wholly or mainly dependent on the taxpayer for their support and maintenance. This implies that the dependent person does not have significant independent income or financial resources and relies primarily on the taxpayer claiming the deduction. The Income Tax Department may require proof or a declaration regarding the dependency status if clarification is needed during assessment. Therefore, accurately determining dependency based on financial reliance is essential before claiming the deduction for a family member.

Which Diseases Qualify for Section 80DDB Deductions?

Not all medical conditions or treatments qualify for this specific deduction. The benefit is targeted towards alleviating the cost burden associated with particularly serious ailments.

Understanding Section 80DDB Eligible Diseases India

The Section 80DDB deductions are exclusively available for medical expenses incurred on the treatment of diseases or ailments specified under Rule 11DD of the Income Tax Rules, 1962. This list includes severe conditions that typically involve prolonged and expensive treatment. It’s essential to confirm that the specific illness falls within this defined list to claim the specified diseases tax benefits. Some major categories and examples of Section 80DDB eligible diseases India include:

- Neurological Diseases: Where the disability level has been certified to be 40% or more. Examples include Dementia, Parkinson’s Disease, Motor Neuron Disease, Ataxia, Aphasia, Dystonia Musculorum Deformans, Hemiballismus, Chorea, Creutzfeldt-Jakob Disease.

- Malignant Cancers: Various forms of malignant cancers qualify.

- Full Blown Acquired Immuno-Deficiency Syndrome (AIDS): The advanced stage of HIV infection.

- Chronic Renal Failure: Meaning chronic kidney disease leading to end-stage renal failure requiring dialysis or transplant.

- Hematological Disorders: Such as Hemophilia and Thalassemia.

This list is not exhaustive and is subject to updates. Taxpayers should always refer to the latest version of Rule 11DD for the complete and current list of specified diseases. For the most accurate information, it is recommended to consult the official Income Tax Department website or seek professional advice. You can typically find this information here: Income Tax India Website.

The Importance of a Valid Medical Prescription/Certificate

A critical requirement for claiming the Section 80DDB deduction is obtaining a prescription or certificate confirming the disease and the patient’s treatment. This is typically provided in Form 10-I. This form must be obtained from a qualified medical specialist relevant to the specific disease. Rule 11DD specifies the type of specialist required:

- For Neurological Diseases: A Neurologist holding a Doctorate of Medicine (DM) degree in Neurology (or equivalent).

- For Malignant Cancers: An Oncologist holding a Doctorate of Medicine (DM) degree in Oncology (or equivalent).

- For AIDS: Any specialist holding a post-graduate degree in General or Internal Medicine (or equivalent).

- For Chronic Renal Failure: A Nephrologist holding a Doctorate of Medicine (DM) degree in Nephrology, or a Urologist holding a Master of Chirurgiae (MCh) degree in Urology (or equivalent).

- For Hematological Disorders: A specialist holding a Doctorate of Medicine (DM) degree in Hematology (or equivalent).

In some cases, particularly if treatment is received at a government hospital, a prescription from any specialist working full-time in that government hospital and holding a post-graduate degree in General or Internal Medicine is acceptable. Possessing this valid certificate from the correct medical authority is non-negotiable for claiming the deduction. You can usually find the format for Form 10-I on the Income Tax India Website.

Deduction Limits: How Much Can You Claim under Section 80DDB?

The amount of deduction available under Section 80DDB is subject to specific limits based on the age of the patient undergoing treatment. Understanding these limits is crucial for calculating your potential tax savings accurately.

Applicable Deduction Amounts

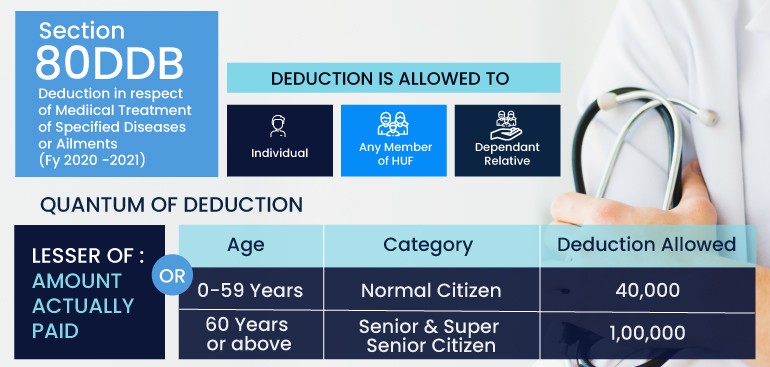

The Income Tax Act specifies two main tiers for the maximum deduction allowed under Section 80DDB, determined by the age of the person suffering from the specified ailment during the financial year for which the deduction is claimed:

| Patient’s Age Category | Maximum Deduction Limit (per financial year) |

|---|---|

| Below 60 years | ₹ 40,000 |

| 60 years or more (Senior Citizen) | ₹ 1,00,000 |

| 80 years or more (Very Sr. Citizen) | ₹ 1,00,000 |

Important Clarification: It is critical to note that the age criterion (below 60, 60 or more, 80 or more) applies to the patient receiving the medical treatment, not necessarily the taxpayer who is claiming the deduction. For instance, if a 45-year-old taxpayer is claiming the deduction for their dependent father who is 70 years old, the applicable limit for the deduction would be ₹1,00,000, based on the father’s age (senior citizen).

Actual Expenses vs. Deduction Limit

The amount you can actually claim as a deduction under Section 80DDB is the lower of the following two amounts:

- The actual amount paid by the taxpayer for the medical treatment (including nursing, diagnostic tests, medicines, etc.) of the specified disease for the eligible person (self or dependent) during the financial year.

- The maximum applicable limit based on the patient’s age (i.e., ₹40,000 or ₹1,00,000).

For example, if a taxpayer incurs ₹55,000 on the treatment of their 50-year-old dependent spouse suffering from a specified neurological disease, the deduction will be capped at ₹40,000 (the limit for patients below 60), even though the actual expense was higher. Conversely, if the actual eligible expense incurred was ₹30,000 for the same patient, the deduction allowed would be ₹30,000, as it is lower than the ₹40,000 limit.

Crucial Adjustment: Insurance Reimbursements

This is a vital point often missed. Before determining the eligible deduction amount, any sum received from an insurer (under a health insurance policy) or reimbursed by an employer specifically for the medical treatment of the patient must be subtracted from the total actual expenditure incurred. The Section 80DDB deduction can only be claimed on the net amount spent by the taxpayer out-of-pocket after accounting for such reimbursements. Reviewing how to save on taxes can be beneficial, and understanding deductions and exemptions can be key. Check out our article on How to Save on Income Tax: Top Deductions and Exemptions Explained.

Example:

Mr. Sharma spent ₹1,20,000 on the treatment of his 65-year-old father (a senior citizen) for malignant cancer. He received ₹50,000 from his health insurance policy towards these expenses.

- Actual Expenditure: ₹1,20,000

- Insurance Reimbursement: ₹50,000

- Net Expenditure by Mr. Sharma: ₹1,20,000 – ₹50,000 = ₹70,000

- Applicable Deduction Limit (Senior Citizen): ₹1,00,000

- Eligible Section 80DDB Deduction: ₹70,000 (Lower of Net Expenditure ₹70,000 and Limit ₹1,00,000)

If Mr. Sharma had not received any insurance reimbursement, his eligible deduction would have been capped at ₹1,00,000 (Lower of Net Expenditure ₹1,20,000 and Limit ₹1,00,000). Failing to make this adjustment can lead to incorrect claims and potential issues during tax assessment.

How to Claim 80DDB Deductions: A Step-by-Step Guide

Claiming the deduction under Section 80DDB requires careful documentation and accurate reporting in your Income Tax Return (ITR). Following the correct procedure ensures you avail the benefit smoothly. This section serves as a practical 80DDB deductions guide India.

Essential Documentation Required

While you don’t usually submit these documents with your ITR filing initially, you absolutely must possess them at the time of claiming the deduction and retain them safely for potential future verification by the Income Tax Department. The key documents are:

- Form 10-I (Certificate of Specified Disease): This is the cornerstone document. As mentioned earlier, it must be obtained from a qualified medical specialist as prescribed under Rule 11DD, relevant to the disease category (e.g., Neurologist, Oncologist, Nephrologist, Hematologist, Immunologist, or a specialist from a Government hospital in certain cases). This form certifies that the patient is suffering from a specified disease covered under Section 80DDB. The format can be obtained from the Income Tax India Website or tax professionals.

- Proof of Expenditure: Keep meticulous records of all expenses incurred related to the treatment. This includes original copies of hospital bills, doctor’s consultation fees, chemist bills for medicines, diagnostic test reports and receipts (like MRI scans, blood tests), and any other relevant payment receipts. These documents substantiate the actual amount spent, which is necessary for calculating the claim.

- Proof of Age (Patient): If claiming the higher deduction limit of ₹1,00,000 for a senior or very senior citizen patient, you need proof of their age. Documents like Aadhaar card, PAN card, Passport, Voter ID card, or Birth Certificate showing the date of birth are acceptable.

- Self-Declaration: It’s advisable to keep a self-declaration stating the expenses incurred by you for the specified patient. If claiming for a dependent, this declaration should also ideally mention the dependency status of the patient on you for support and maintenance during the relevant financial year.

Claiming the Deduction in Your Income Tax Return (ITR)

The process of actually claiming the Section 80DDB deductions happens during your annual income tax filing. Here’s how to claim 80DDB deductions in your ITR:

- Calculate the Eligible Amount: First, determine the net amount of expenditure after reducing any insurance or employer reimbursements. Then, compare this net amount with the applicable age-based limit (₹40,000 or ₹1,00,000). The lower of the two is your eligible deduction amount.

- Identify the Correct ITR Form: Choose the ITR form applicable to your income sources (e.g., ITR-1 Sahaj for simple salaries, ITR-2, ITR-3 for business income, etc.). For salaried individuals looking for detailed guidance on this topic, you can reference our Step-by-Step Guide to Filing Income Tax Returns for Salaried Individuals in India.

- Locate the Deduction Schedule: Within the ITR form, find the schedule related to deductions under Chapter VI-A. This is where you report various tax-saving deductions like 80C, 80D, 80G, etc.

- Enter the 80DDB Amount: Specifically find the field designated for Section 80DDB (Deduction in respect of medical treatment, etc.). Enter the calculated eligible deduction amount here.

- Verify Total Deductions: Ensure the amount entered under Section 80DDB is correctly included in the total calculation of Chapter VI-A deductions, which will then be subtracted from your Gross Total Income to arrive at your Net Taxable Income.

Crucial Note: Remember, while Form 10-I and the supporting expense proofs are mandatory for the claim’s validity, you are not required to attach or upload them when filing your ITR electronically or physically (unless specifically asked for). However, the Income Tax Department has the right to ask for these documents later during assessment, scrutiny, or inquiry. Therefore, preserving these documents carefully for several years (typically up to 6-7 years after the relevant assessment year) is absolutely essential.

Key Considerations & Common Mistakes to Avoid

Claiming the Section 80DDB deduction requires careful attention to detail. Overlooking certain aspects or making common errors can lead to disallowed claims or queries from the tax department. Here are some key points to consider:

- Confirm Dependency Status: If claiming for a dependent, ensure they genuinely qualify as ‘wholly or mainly dependent’ on you financially during the financial year. Misrepresenting dependency can invalidate the claim. Maintain basic proof if possible.

- Obtain Certificate from the Correct Specialist: Ensure the Form 10-I is obtained from the specific type of medical specialist prescribed in Rule 11DD for the particular disease. A certificate from an incorrect specialist might not be accepted.

- Accurate Insurance/Employer Reimbursement Adjustment: This is a frequent point of error. Always deduct the full amount received from insurance or your employer for the specific treatment before calculating your claimable 80DDB amount. Only the net out-of-pocket expense is eligible, up to the limit.

- Avoid Double Dipping: Expenses claimed as a deduction under Section 80DDB cannot be claimed again under any other section of the Income Tax Act. For example, you cannot claim the same treatment cost under Section 80D (which primarily covers health insurance premiums and preventive health check-ups, not specific treatment costs beyond these). While you can claim both 80D (for premiums) and 80DDB (for eligible treatment costs net of insurance) for the same person, the expense itself cannot be claimed twice.

- Check the Latest Rules and Disease List: Tax laws and rules, including the list of specified diseases under Rule 11DD, can be amended. Always refer to the rules applicable for the specific financial year for which you are claiming the deduction. Relying on outdated information can lead to errors. Check the Income Tax India Website for updates.

- Maintain All Records: As emphasized before, keep Form 10-I and all original bills and receipts safely. The burden of proof lies with the taxpayer if the claim is questioned.

Being mindful of these points will help ensure your claim for Section 80DDB deductions is accurate and compliant.

Conclusion: Maximize Your Tax Savings with Section 80DDB

Managing the costs associated with critical illnesses listed under Rule 11DD is undoubtedly challenging. Section 80DDB deductions under the Income Tax Act offer a significant measure of financial relief to taxpayers facing these high medical expenditures for themselves or their dependents. By allowing a deduction of up to ₹40,000 or ₹1,00,000 (depending on the patient’s age) from the gross total income, this provision can lead to substantial tax savings on specified diseases treatment. Understanding the nuances of eligibility, specified diseases, documentation requirements (especially Form 10-I), deduction limits, and the correct claim process is paramount to leveraging these Indian tax deductions for medical expenses effectively. We encourage all eligible small business owners and salaried individuals to review their medical expenses, cross-reference the patient’s condition with the Section 80DDB eligible diseases India list, and diligently gather the necessary documents.

Dealing with complex tax provisions like Section 80DDB, especially during emotionally and financially taxing times, can be overwhelming. If you need assistance understanding your eligibility, calculating the deduction, ensuring compliance, or managing other tax complexities, TaxRobo is here to help. Contact TaxRobo’s experts (TaxRobo Online CA Consultation Service) for personalized guidance on claiming Section 80DDB deductions and navigating your tax obligations with confidence.

Frequently Asked Questions (FAQs) about Section 80DDB

Here are answers to some common questions regarding Section 80DDB:

- FAQ 1: Can I claim Section 80DDB deduction for medical expenses incurred on my independent parents?

Answer: No. The deduction under Section 80DDB for expenses incurred on parents is allowed only if they are ‘wholly or mainly dependent’ on you for their support and maintenance. If your parents have their own independent income sources and are not financially dependent on you, you cannot claim this deduction for their medical treatment expenses under this section. - FAQ 2: What if my actual medical expenses are higher than the Section 80DDB limit (₹40,000 / ₹1,00,000)?

Answer: The deduction under Section 80DDB is capped at the maximum permissible limit for the relevant age group. If your actual eligible expenditure (after reducing insurance/employer reimbursements) is higher than ₹40,000 (for patients below 60) or ₹1,00,000 (for patients 60 or above), your deduction will be restricted to ₹40,000 or ₹1,00,000, respectively. You cannot claim the excess amount spent above the statutory limit under this section. - FAQ 3: Is it mandatory to submit Form 10-I along with my Income Tax Return?

Answer: No, it is generally not mandatory to attach or upload Form 10-I (or other proofs of expenditure) when filing your Income Tax Return (ITR). However, you must possess a valid Form 10-I obtained from the specified medical specialist *before* claiming the deduction in your ITR. You are required to keep this form and supporting bills safe and produce them if the Income Tax Department asks for verification during assessment or scrutiny proceedings later. - FAQ 4: Can I claim both Section 80D (for health insurance premium) and Section 80DDB (for treatment cost) for the same person/illness?

Answer: Yes, absolutely. Section 80D and Section 80DDB are distinct deductions covering different types of expenses. Section 80D primarily allows deductions for health insurance premiums paid and expenses on preventive health checkups. Section 80DDB allows deductions for actual medical treatment costs incurred for specified diseases. You can claim both deductions in the same year, even for the same person, provided you meet the conditions for each section independently. However, remember that the amount claimed under 80DDB must be the expenditure *net* of any insurance reimbursement received for that specific treatment. - FAQ 5: Where can I find the official list of specified diseases and medical specialists for Section 80DDB eligible diseases India?

Answer: The definitive list of specified diseases and the required qualifications for medical specialists are detailed in Rule 11DD of the Income Tax Rules, 1962. This rule is subject to amendment, so it’s crucial to refer to the latest version. You can find the Income Tax Rules, including Rule 11DD, on the official website of the Income Tax Department of India: Income Tax India Website. Look under ‘Tax Laws & Rules’.