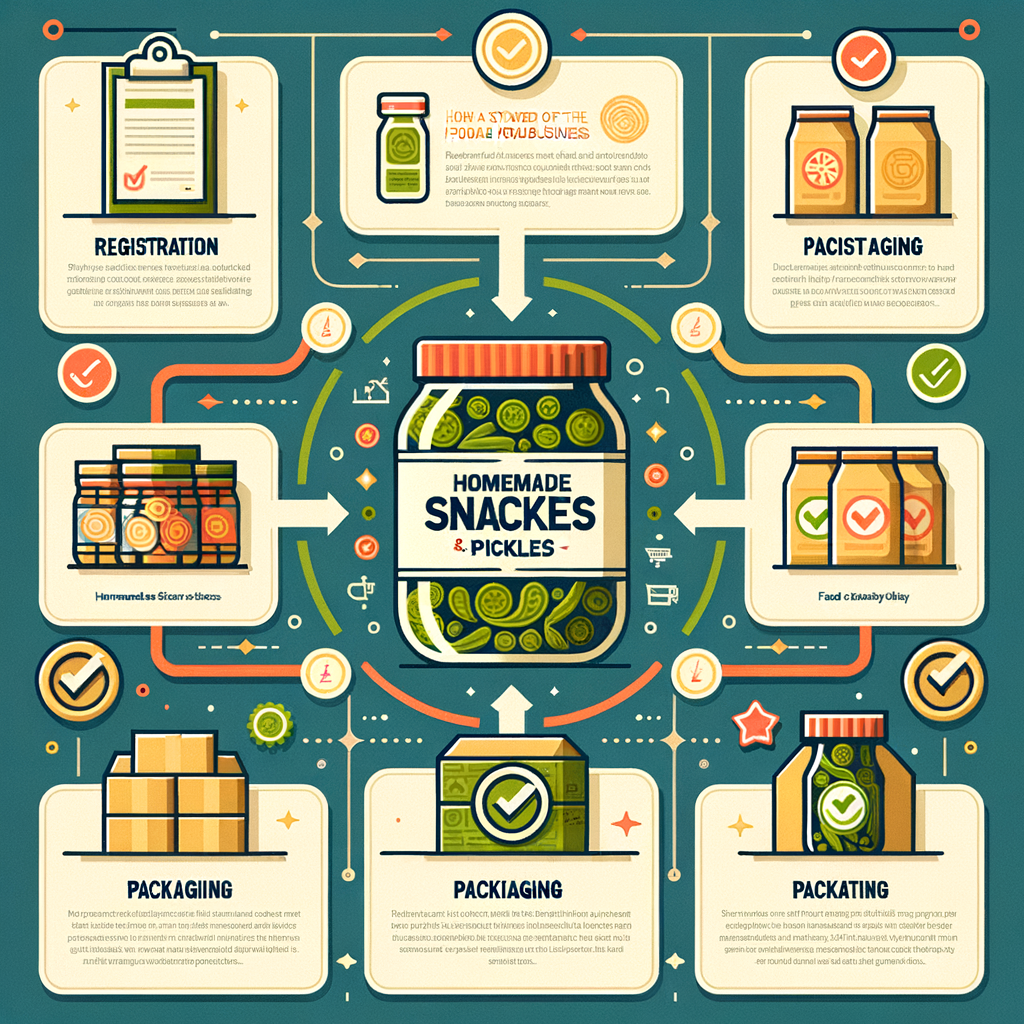

Homemade Snacks / Pickles Business – Registration, Packaging & FSSAI Guide

The sizzle of spices, the comfort of a familiar recipe, and the joy of sharing your culinary creations—these are the ingredients of a dream for many aspiring food entrepreneurs. The booming homemade snacks market in India is a testament to a growing consumer demand for authentic, preservative-free food that tastes like home. Thinking of turning your passion for cooking delicious snacks and pickles into a business? You’re in the right place. Starting a food business, however, involves more than just a great recipe; it requires a solid legal foundation to thrive. This comprehensive guide will walk you through every critical step, from the initial homemade snacks business registration and licensing to packaging and FSSAI compliance, ensuring your venture starts on the right foot and is poised for success.

Why a Homemade Snacks & Pickles Business is a Winning Idea in 2024

The appeal of a homemade food business is undeniable. It often starts with a low initial investment, allowing you to begin from your own kitchen, and can scale up to offer high-profit margins. More importantly, there has been a significant cultural shift. Consumers are increasingly turning away from mass-produced goods in favour of local, artisanal products made with care and quality ingredients. They are seeking transparency, authenticity, and flavours they can trust. This creates a fertile ground for home-based entrepreneurs. However, the key to transforming this passion from a hobby into a sustainable, scalable business lies in understanding and adhering to legal compliance. Getting your registrations and licenses in order from day one not only prevents legal troubles but also builds immense trust with your customers and opens doors to bigger opportunities like selling on e-commerce platforms and supplying to retail stores.

Step 1: Choose the Right Business Structure for Your Venture

The very first legal step in your pickles business setup in India is selecting a formal business structure. This decision is foundational, as it directly impacts your personal liability, the amount of compliance paperwork you’ll handle, your tax obligations, and your ability to secure funding in the future. Each structure has its own set of advantages and disadvantages, and the right choice depends entirely on your vision, scale, and whether you are starting solo or with partners. For a detailed comparison, see our guide on Choosing the Right Legal Structure for Your Business.

Sole Proprietorship

- What it is: This is the simplest business structure, where the business is owned and operated by a single individual. Legally, there is no distinction between the owner and the business itself.

- Best for: It is the ideal starting point for beginners, single founders, or anyone looking to test their business idea in the market with minimal initial complexity and cost.

- Pros: It is incredibly easy and inexpensive to set up. You have complete control over all decisions, and the compliance requirements are the lowest among all structures.

- Cons: The biggest drawback is unlimited liability. This means if the business incurs debt or faces a lawsuit, your personal assets—like your car, house, or savings—could be at risk to settle those claims.

One Person Company (OPC)

- What it is: An OPC is an innovative structure that combines the benefits of a sole proprietorship with those of a private limited company. It is a private company with just one person as its member.

- Best for: This is perfect for a solo entrepreneur who wants the legal protection of a company structure without the need for partners.

- Pros: The primary advantage is limited liability, which means your personal assets are protected from business debts. It also has a separate legal identity, which enhances its credibility with suppliers and lenders.

- Cons: The compliance requirements are higher than a proprietorship, involving mandatory filings with the Registrar of Companies (ROC).

Limited Liability Partnership (LLP)

- What it is: An LLP is a corporate business structure that offers the flexibility of a traditional partnership but with the crucial benefit of limited liability for its partners.

- Best for: This is the go-to option for businesses started by two or more partners who want to protect their personal assets while maintaining a flexible management structure.

- Pros: Partners are not personally responsible for the business’s debts or another partner’s negligence. It’s easier and cheaper to manage compared to a private limited company.

Unsure which structure fits your vision? TaxRobo’s experts can guide you through the pros and cons. TaxRobo Company Registration Service.

Step 2: The Core of Your Business Setup – Essential Registrations

Once you have decided on a business structure, the next phase is to secure the necessary registrations to operate legally. This stage is the core of your homemade snacks business registration and ensures you are compliant with various government regulations from the very beginning. Each registration serves a specific purpose, from providing a unique identity to your business to enabling tax compliance and unlocking government benefits.

Udyam Registration (MSME)

- What it is: Udyam Registration is a modern, online system for registering your business as a Micro, Small, or Medium Enterprise (MSME). It is a free-of-cost registration that provides your business with a recognition certificate and a unique identification number.

- Why it’s important: Holding an MSME certificate unlocks a plethora of benefits. These include access to government schemes designed for small businesses, priority sector lending from banks at lower interest rates, subsidies on patents and trademarks, and protection against delayed payments from buyers.

- How to apply: The process is entirely digital and can be completed on the official Udyam portal using just your Aadhaar number.

- External Link: Udyam Registration Portal

GST Registration

- When is it mandatory?: Under the Goods and Services Tax (GST) law, it is mandatory for any business involved in the supply of goods to register for GST if their aggregate annual turnover exceeds ₹40 lakhs. For service providers, this threshold is ₹20 lakhs.

- Why consider it even if not mandatory?: Even if your turnover is below the threshold, voluntary GST registration is highly recommended. It is a mandatory requirement to sell your products on major e-commerce platforms like Amazon, Swiggy, or Zomato. It also allows you to work with B2B clients who can claim tax credits on your invoices and enables you to claim Input Tax Credit (ITC) on your own purchases, such as raw materials, packaging, and machinery, thereby reducing your overall costs. For a complete walkthrough, refer to our Ultimate Guide to GST Registration for Small Businesses.

- GST Explained: GST is a unified tax system. For sales within your state, you’ll deal with CGST (Central GST) and SGST (State GST). For sales to customers in other states, IGST (Integrated GST) is applicable.

- External Link: GST Portal

Local Municipal Licenses (Shop and Establishment Act)

- What it is: This is a state-specific license that governs the working conditions and rights of employees. It is generally required if you are operating from a commercial space, even a small one, rather than purely from your home kitchen. The rules and application process vary from state to state.

Step 3: FSSAI License – The Non-Negotiable Stamp of Trust

For any business that manufactures, processes, stores, or sells food products in India, obtaining a license from the Food Safety and Standards Authority of India (FSSAI) is absolutely mandatory. This is the single most important aspect of your homemade snacks licensing in India. An FSSAI license is not just a legal requirement; it is a seal of quality and safety that communicates to your customers that your products are hygienic and safe for consumption. This builds immense trust and credibility for your brand.

Which FSSAI License Do You Need?

The FSSAI has a tiered licensing system based on the size and turnover of your business. It is crucial to apply for the correct category.

- FSSAI Basic Registration: This is the entry-level registration designed for small food businesses. It is applicable to businesses with an annual turnover of up to ₹12 Lakh. This is the most common starting point for home-based bakers, pickle makers, and snack businesses.

- FSSAI State License: As your business grows, you will need to upgrade your license. A State License is required for businesses with an annual turnover between ₹12 Lakh and ₹20 Crore.

- FSSAI Central License: This is for very large-scale operators, importers, exporters, and businesses operating in multiple states. This license becomes relevant when you are planning a major expansion.

The Process for FSSAI Registration for Snacks

The application process has been streamlined and is now done online through the FoSCoS (Food Safety Compliance System) portal. The process involves filling out an application form, uploading the required documents, and paying a nominal fee. An important part of maintaining compliance is adhering to the Schedule 4 guidelines of the FSSAI, which lay out strict rules for sanitary and hygienic practices in food preparation and handling. Ensuring homemade pickles FSSAI compliance means maintaining a clean kitchen, using potable water, storing ingredients properly, and following personal hygiene protocols.

- External Link: FSSAI FoSCoS Portal

Step 4: Checklist: Document Requirements for Homemade Snacks Business

Having all your documents ready before you start the registration process can save you a lot of time and effort. Here is a clear, scannable checklist to help you prepare for the various applications.

For Business & GST Registration:

- PAN Card of the owner (for proprietorship) or all partners/directors.

- Aadhaar Card of the owner/partners/directors.

- Passport-sized photograph of the applicant(s).

- Proof of business address: This can be a recent electricity bill, property tax receipt, or a notarized rent agreement if the premises are rented.

- Bank account details: A copy of a bank statement or a cancelled cheque to verify your business bank account.

For FSSAI Basic Registration:

- Photo ID proof of the food business operator (Aadhaar Card, Voter ID, etc.).

- Proof of business address (same as above).

Step 5: Your Ultimate Pickles & Snacks Packaging Guide India

In the food business, packaging is much more than just a container to hold your product. It is your silent salesperson on the shelf, your first point of contact with the customer, and a critical tool for legal compliance. Great packaging protects the product, extends its shelf life, communicates your brand story, and provides essential information as mandated by snacks manufacturing regulations in India.

Choosing the Right Material

- Glass Jars: This is the classic choice for pickles, jams, and preserves. Glass is non-reactive, so it doesn’t affect the taste of the product. It offers a premium look and feel, is reusable, and allows customers to see the product inside.

- Food-Grade Plastic Pouches/Containers: For dry snacks like chips, namkeens, and baked goods, food-grade plastic is a cost-effective and lightweight option. Look for high-quality, resealable pouches to maintain freshness.

- Vacuum-Sealed Packs: This method involves removing air from the package before sealing. It significantly increases the shelf life of snacks by preventing oxidation and microbial growth, making it an excellent choice for preserving crispness and flavour.

Mandatory Labelling Information (As per FSSAI)

Your product label is a legal document. As per FSSAI regulations, every pre-packaged food item must contain the following information clearly and legibly:

- Name of the Food: The common or trade name of the product.

- List of Ingredients: All ingredients must be listed in descending order by weight.

- Nutritional Information Panel: Details on energy (calories), protein, carbohydrates, fat, etc., per 100g/100ml.

- FSSAI Logo and License Number: This is mandatory and must be clearly displayed.

- Net Quantity: The weight or volume of the product.

- Manufacturing Date (MFG) & Best Before/Expiry Date: Clearly stated to ensure consumer safety.

- Vegetarian/Non-Vegetarian Logo: The green dot for vegetarian products and a brown dot for non-vegetarian products.

- Name and Address of the Manufacturer: Your business name and address for traceability.

- MRP (Max Retail Price): The maximum price at which the product can be sold.

Step 6: Protect Your Brand with Trademark Registration

As your homemade snacks or pickles start gaining popularity, your brand name and logo become your most valuable assets. They represent your quality, reputation, and the trust you’ve built with your customers. This is where trademark registration becomes essential for long-term growth and protection. To understand the process in detail, read our guide to Secure Your Brand’s Future Trademark Your Brand – Registration, Benefits & The Cost of Neglect.

- What it is: A trademark is a unique sign, symbol, logo, or name that distinguishes your products from those of your competitors. Registering your trademark gives you the exclusive legal right to use that mark for your goods and services.

- Why it’s important: Imagine spending years building a beloved brand, only to find someone else using a similar name and benefiting from your hard-earned reputation. A registered trademark prevents this. It gives you the legal power to stop others from copying your brand, builds brand value, and is an intangible asset that can be sold or licensed. It is a proactive step to secure your business’s future identity.

Don’t let someone else cash in on your hard work. Protect your brand identity from day one. TaxRobo offers expert Trademark Registration services. TaxRobo Intellectual Property Service.

Conclusion

Starting your own homemade food business is an exciting and rewarding journey. By following these steps, you can build a strong foundation for your venture. The path involves choosing the right business structure, completing your homemade snacks business registration like Udyam and GST, securing the mandatory FSSAI license, mastering the art of compliant packaging, and finally, protecting your unique brand with a trademark. While it may seem like a lot of paperwork, each step is designed to protect you and your customers, paving the way for sustainable growth. The future of the homemade food industry is incredibly bright, and with the right legal framework in place, your delicious creations can become a household name.

Navigating the legal landscape can be complex. Let TaxRobo be your trusted partner. We handle all the paperwork for company registration, GST, and FSSAI licensing, so you can focus on what you do best—creating delicious food. Contact us today for a free consultation!

Frequently Asked Questions (FAQs)

Q1. Is FSSAI registration mandatory to sell homemade pickles online in India?

A: Absolutely. Whether you are selling your products through your own website, social media, e-commerce platforms, or a physical store, an FSSAI license is non-negotiable. If your annual turnover is up to ₹12 lakh, you must obtain a Basic FSSAI Registration. This ensures homemade pickles FSSAI compliance, confirms your adherence to safety standards, and is a key factor in building customer trust.

Q2. What are the essential document requirements for a homemade snacks business starting from home?

A: For a sole proprietor starting from home, the process is quite simple. The key document requirements for a homemade snacks business are your PAN card (which also serves as the business PAN), your Aadhaar card for identity verification, and a utility bill (like an electricity or water bill) or a rental agreement as proof of your business address, which would be your home address in this case.

Q3. Do I need GST if I sell only on Instagram or WhatsApp?

A: GST registration is linked to your annual turnover, not the platform you sell on. It becomes legally mandatory only if your annual sales of goods cross the threshold of ₹40 lakh. However, if you plan to use a formal payment gateway to accept online payments or want to list on platforms like Amazon in the future, they will almost certainly require you to have a GSTIN, regardless of your turnover.

Q4. How much does the entire homemade snacks licensing in India cost?

A: The government fees for initial licenses are very minimal, making it affordable to start. The fee for a Basic FSSAI Registration is just ₹100 per year, and the Udyam Registration for MSMEs is completely free. The primary costs you might incur are professional fees if you choose to hire an expert like TaxRobo. Investing in professional help can be worthwhile to ensure the entire process is completed accurately and efficiently, saving you from potential errors and future complications.