How do financial planning strategies differ for various life stages (e.g., young professionals vs. retirees)?

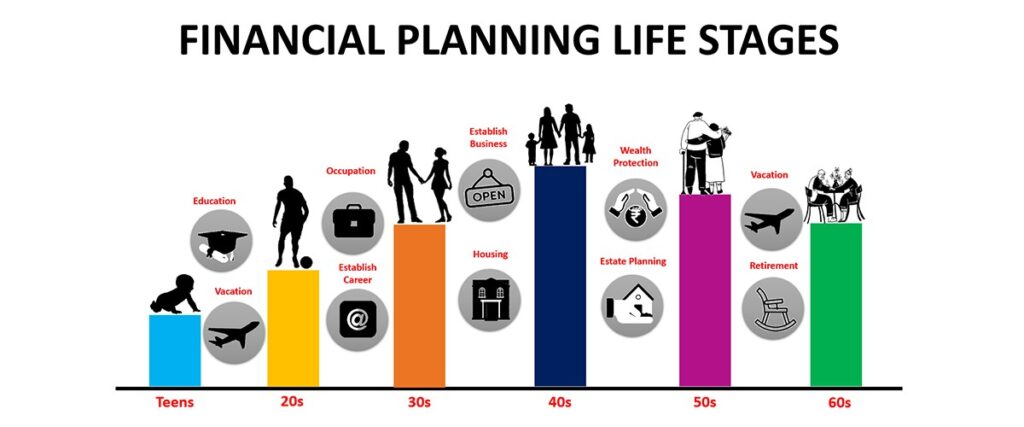

Your life is a journey, constantly evolving with new chapters, changing priorities, and different destinations. Think of your financial plan as the roadmap for this journey. Just as you wouldn’t use the same map to navigate your neighbourhood as you would for a cross-country trip, your financial strategy needs to adapt as you move through different life stages. What worked in your energetic 20s might not be suitable in your experienced 60s. This tailored approach is the essence of life stage financial planning in India – a crucial practice for securing your financial future. Generic advice simply doesn’t cut it; understanding and implementing personalized financial planning strategies for various life stages is vital for achieving long-term financial well-being, managing risks effectively, and ensuring security, especially within the unique economic landscape of India. This post will provide actionable insights for both salaried individuals and small business owners across India, helping you navigate your financial journey with confidence at every turn.

Understanding Life Stage Financial Planning in India

Embarking on a successful financial journey requires more than just saving money; it demands a dynamic strategy that evolves alongside your life. Understanding why this adaptability is crucial and identifying the factors that shape your financial needs at different points are the first steps towards building lasting wealth and security. This adaptive approach ensures you make the most of opportunities while mitigating potential risks associated with changing circumstances.

Why tailor financial planning strategies at different life stages?

Tailoring your financial planning strategies at different life stages is not just advisable; it’s essential for optimal outcomes. As you progress through life, several key aspects change significantly, impacting your financial decisions. Your income potential typically grows during your early career, plateaus in mid-career, and may decrease or become fixed post-retirement. Simultaneously, your expenses fluctuate – from education loans and lifestyle costs when young, to home EMIs, children’s education, and family responsibilities in the middle years, and healthcare costs in later life. Your risk tolerance also naturally shifts; younger individuals with a longer time horizon can often afford to take more risks for potentially higher returns, while those nearing retirement usually prioritize capital preservation. The time available to achieve goals also shrinks, making early planning incredibly powerful due to compounding. Failing to adapt your strategy can lead to significant consequences: young professionals might miss out on the immense benefits of early compounding, while those nearing retirement might take unnecessary risks trying to catch up, potentially jeopardizing their accumulated corpus. Therefore, a life-stage approach ensures your plan remains relevant, effective, and aligned with your current reality.

Key Factors Influencing Financial Needs Across Life Stages

Several interconnected factors dictate your financial needs and shape the appropriate strategies throughout your life. Recognizing these influences helps in creating a truly personalized financial plan:

- Age: This is the most fundamental factor. Your age directly determines your investment time horizon – the length of time you have until you need the money, particularly for long-term goals like retirement. A longer horizon allows for greater risk-taking and harnessing the power of compounding.

- Income: Your earning capacity generally changes with career progression for salaried individuals or business cycles for entrepreneurs. Higher income allows for increased savings and investments, while periods of lower income might necessitate tighter budgeting and focusing on essential goals. Income stability also plays a role in investment choices.

- Family Structure: Your personal situation – whether you are single, married, have young children, teenage children, or dependent parents – significantly impacts your expenses, financial goals, and responsibilities. Each structure brings unique needs, from funding education and weddings to providing care for elders.

- Financial Goals: Your specific aspirations drive your financial planning. These goals evolve – from buying a first car or gadget in your 20s, to purchasing a home and funding children’s education in your 30s and 40s, planning for retirement in your 50s, and ensuring wealth transfer in your later years. Business owners also have goals like expansion or succession planning.

- Risk Tolerance: Your willingness and ability to take investment risks change. Typically, younger individuals with stable income and a long time horizon have higher risk tolerance. As responsibilities increase and retirement approaches, risk tolerance generally decreases, shifting focus towards safer investments to protect accumulated capital.

Financial Planning Strategies for Young Professionals (Ages 20s-Early 30s)

The early years of your career, typically spanning your 20s to early 30s, represent a unique window of opportunity in your financial life. With potentially fewer responsibilities and decades of earning potential ahead, this stage is crucial for laying a robust groundwork for future financial success. The primary focus should be on building disciplined financial habits and harnessing the power of time through early wealth accumulation.

Core Focus: Building a Strong Foundation & Early Wealth Accumulation

This life stage is defined by the immense advantage of time. Even small amounts saved and invested regularly can grow significantly over decades, thanks to the magic of compounding – where your returns start generating their own returns. Establishing sound financial practices now, such as budgeting, saving consistently, and starting investments early, creates momentum that will benefit you throughout your life. It’s about building the financial muscles you’ll rely on later. Delaying these actions means losing out on the most potent factor in wealth creation: time. Embracing financial discipline early sets the stage for achieving significant long-term goals with less financial stress later on.

Key Financial Planning Strategies for Young Professionals:

Here are the essential financial planning strategies for young professionals to focus on:

- Budgeting & Cash Flow Management: Get a clear picture of your income and expenses. Create a realistic budget – the 50/30/20 rule (50% Needs, 30% Wants, 20% Savings/Investments) is a popular starting point. Track your spending diligently using apps or spreadsheets to identify areas where you can save more. Understanding your cash flow is the bedrock of effective financial management.

- Debt Management: Many young professionals start their careers with education loans. Develop a clear strategy to repay them efficiently. Be extremely cautious with credit card debt; high-interest rates can quickly derail your financial progress. Avoid taking on unnecessary loans for depreciating assets or lifestyle expenses. Prioritize becoming debt-free or managing existing debt wisely.

- Building an Emergency Fund: Life is unpredictable. An emergency fund acts as a financial safety net for unexpected events like job loss, medical emergencies, or urgent repairs, preventing you from dipping into your investments or taking on high-interest debt. Aim to save 3-6 months’ worth of essential living expenses in a safe and easily accessible place, such as a high-yield savings account or a liquid mutual fund.

- Starting Investments: Don’t wait for a ‘large’ sum to start investing. Begin early with whatever amount you can afford.

- Systematic Investment Plans (SIPs): Invest a fixed amount regularly (usually monthly) in mutual funds. Equity or equity-oriented hybrid funds are often suitable for long-term goals at this stage due to the potential for higher growth, aligned with a higher risk tolerance and long time horizon. SIPs promote discipline and benefit from rupee cost averaging.

- Public Provident Fund (PPF): A government-backed scheme offering tax-free returns and capital safety. It’s excellent for long-term goals like retirement, with contributions eligible for Section 80C tax deductions. Learn more about PPF on the India Post website.

- Equity Linked Savings Scheme (ELSS): These are diversified equity mutual funds that offer tax benefits under Section 80C of the Income Tax Act, with a lock-in period of just 3 years. They provide both equity exposure for potential growth and tax savings.

- Insurance Essentials: Insurance is about protection, not investment, at this stage.

- Term Life Insurance: If you have financial dependents (parents, spouse, future children), a term insurance policy is crucial. It provides a high sum assured at a relatively low premium, ensuring your family’s financial security in your absence. Buy early to lock in lower premiums.

- Health Insurance: Don’t rely solely on your employer’s group health insurance. Get a personal health insurance policy (or a top-up plan) for adequate coverage, continuity (if you change jobs), and comprehensive benefits tailored to your needs.

- Early Retirement Planning: While retirement seems distant, starting early makes a massive difference. Understand your Employee Provident Fund (EPF) contributions – this is mandatory saving deducted from your salary. Explore the National Pension System (NPS), a voluntary contribution scheme offering tax benefits and market-linked returns, specifically designed for retirement. Even small, early contributions mark the beginning of retirement financial planning for Indians.

- Basic Tax Planning: Understand how to legally reduce your tax liability. Maximize deductions under Section 80C (up to ₹1.5 lakh via PPF, EPF, ELSS, life insurance premiums, etc.). Understanding Section 80C: Benefits and Investment Options If you live in rented accommodation, claim House Rent Allowance (HRA) exemption correctly. Familiarize yourself with the basics on the Income Tax India Website.

Financial Planning Tips for Millennials:

As a millennial navigating this stage, it’s often about finding equilibrium. You likely have aspirations for travel, upgrading gadgets, or enjoying experiences, which is perfectly fine. The key is balance. Allocate funds for these short-term ‘wants’ within your budget (perhaps from the 30% ‘Wants’ category) without sacrificing your long-term ‘needs’ and ‘savings’ (the 50% and 20%). Prioritize major early goals like accumulating a down payment for a first home – factor this into your savings plan. Similarly, if higher education or professional certifications are on the horizon to boost your career, plan and save for these expenses proactively. Conscious spending and goal-based saving are paramount. This involves making deliberate choices about where your money goes, ensuring it aligns with both immediate desires and future aspirations, making financial planning for millennials and seniors a continuous adaptation process.

Financial Planning for Established Professionals & Young Couples (Ages Mid 30s-40s)

This phase of life, typically from the mid-30s through the 40s, often marks a period of significant career growth and increasing income. However, it usually coincides with expanding responsibilities – settling down, raising a family, managing larger financial commitments like home loans, and planning for children’s future needs. The financial focus naturally shifts towards managing these complexities, accelerating wealth growth, and diligently planning for major life goals.

Core Focus: Growth, Managing Increased Responsibilities & Goal Achievement

During these peak earning years, the primary objective is to leverage higher income for accelerated wealth creation while carefully managing escalating expenses and liabilities. It’s a balancing act between enjoying the fruits of your hard work and securing the future for yourself and your family. Responsibilities like paying home EMIs, funding children’s education and activities, supporting parents, and maintaining an improved lifestyle demand meticulous planning. The core focus is on disciplined investment growth, optimizing resource allocation to meet multiple, often competing, financial goals, and ensuring adequate protection against life’s uncertainties through enhanced insurance coverage. This stage requires a more structured and diversified approach than the earlier years.

Key Strategies:

Implementing robust strategies is key to navigating this demanding life stage successfully:

- Upscaling Investments & Diversification: With increased income, it’s crucial to proportionally increase your investment contributions.

- Increase SIP Amounts: Regularly review and enhance your SIP contributions to mutual funds to align with your income growth and accelerate corpus building.

- Diversification: Don’t put all your eggs in one basket. Diversify your investments across different asset classes – equity (for growth), debt (for stability), real estate (consider carefully, factoring in liquidity and costs), and gold (as a hedge). Diversification helps mitigate risk and potentially improve overall portfolio returns.

- Direct Equity: If you have gained sufficient knowledge, have the time for research, and possess the required risk appetite, you might consider investing directly in stocks. However, proceed with caution and perhaps limit it to a smaller portion of your portfolio initially.

- Financial Planning for Young Couples in India: Managing finances as a couple requires open communication and joint planning.

- Set Joint Financial Goals: Discuss and agree on shared goals, such as buying a larger home, saving for children’s higher education or marriage, planning international vacations, or achieving early retirement. Clear goals provide direction for your combined financial efforts.

- Account Management: Decide on an approach for managing bank accounts – maintaining individual accounts, opening a joint account for household expenses, or a combination. Understand the pros and cons of each regarding transparency, autonomy, and ease of management.

- Align Strategies: Ensure your individual investment choices and risk tolerances are aligned with your joint goals. A mismatch can lead to conflicts or suboptimal outcomes. Regular financial ‘dates’ can help stay synchronised.

- Planning for Major Goals: This stage often involves planning for significant, specific future expenses.

- Children’s Education Funding: Estimate the future cost of higher education (factoring in inflation) and start dedicated investment plans early. Options include specific children-focused mutual funds or schemes like the Sukanya Samriddhi Yojana (for girl child education and marriage), which offers tax benefits and attractive interest rates.

- Children’s Marriage Fund Planning: Similar to education, plan separately for marriage expenses if desired, starting early with goal-specific investments.

- Home Loan Management: If you have a home loan, explore strategies to reduce the interest burden. Consider making partial prepayments whenever you have surplus funds (e.g., bonus, business windfall) to shorten the loan tenure or reduce EMIs. Carefully evaluate the interest rates and terms before opting for loan top-ups versus taking separate personal loans if additional funds are needed.

- Enhancing Insurance Cover: As your income and liabilities (like home loans, dependents) increase, your insurance needs also grow.

- Life Insurance: Re-evaluate your term life insurance cover. Ensure the sum assured is adequate to cover outstanding loans and provide for your family’s needs for several years in your absence. Consider increasing the cover significantly compared to what you had in your 20s.

- Health Insurance: Upgrade your family’s health insurance. A family floater plan covering all members might be cost-effective. Consider increasing the sum insured to cover rising medical costs and look into critical illness riders or super top-up plans for enhanced protection.

- Advanced Tax Planning: Look beyond the basic Section 80C deductions to optimize tax savings.

- Explore the additional deduction of ₹50,000 available under Section 80CCD(1B) by investing in the National Pension System (NPS) Tier 1.

- Utilize deductions available for home loan interest (Section 24b) and principal repayment (Section 80C).

- Maximize deductions for health insurance premiums paid for self, family, and dependent parents under Section 80D.

- For Business Owners: This is a crucial time to review your business structure (Sole Proprietorship, Partnership, LLP, Private Limited Company) for tax efficiency. Optimize deductible business expenses and explore tax-advantaged investment routes. Continuously reviewing financial planning strategies at different life stages is vital for both personal and business financial health. TaxRobo offers expert advice on optimizing tax planning for individuals and businesses (TaxRobo Online CA Consultation Service).

Financial Planning Strategies for Pre-Retirement (Ages 50s)

As you enter your 50s, retirement is no longer a distant concept but a visible milestone on the horizon. This decade marks a critical transition phase in your financial life. The primary focus shifts significantly from aggressive wealth accumulation towards consolidating your gains, preserving the capital you’ve diligently built, and ensuring you are fully prepared for a comfortable and financially independent retirement. Decisions made during this stage have a profound impact on your quality of life post-retirement.

Core Focus: Corpus Consolidation, Capital Preservation & Retirement Readiness

The overarching goal in your 50s is to solidify your financial position for retirement. This involves ensuring your accumulated retirement corpus is substantial enough to meet your anticipated needs and taking steps to protect that corpus from significant market downturns or erosion due to poor planning. Aggressive growth strategies that were suitable earlier now take a backseat to capital preservation. It’s about reducing risk, ensuring financial stability, and methodically ticking off the final checklist items for retirement readiness, including debt elimination and healthcare planning. This phase requires careful assessment, strategic adjustments, and disciplined execution to ensure a smooth transition into retirement.

Key Strategies:

Implementing the right strategies during this pre-retirement phase is crucial for securing your financial future:

- Accelerating Retirement Savings: If you feel your retirement corpus is falling short, this is the last crucial decade to make significant contributions.

- Maximize Contributions: Make full use of available retirement savings avenues. Maximize your contributions to the Employee Provident Fund (EPF) or Voluntary Provident Fund (VPF), Public Provident Fund (PPF), and National Pension System (NPS) up to the permissible limits.

- Catch-up Contributions: If possible, allocate any surplus funds, bonuses, or windfall gains towards your retirement accounts to bridge any existing gaps in your savings. Aggressively save as much as possible during these final peak earning years.

- Debt Elimination: Entering retirement with significant debt, especially high-interest loans like personal loans or credit card dues, can severely strain your finances. Make a concerted effort to pay off all outstanding loans before you retire. Prioritize eliminating high-cost debt first. Being debt-free provides immense financial peace of mind during retirement.

- Investment Portfolio Rebalancing: Your investment strategy needs a significant shift to align with your reduced risk tolerance and shorter time horizon.

- Reduce Equity Exposure: Gradually decrease the allocation to volatile assets like equities in your portfolio. While some equity exposure might be needed to beat inflation even in retirement, its proportion should be considerably lower than in earlier stages.

- Increase Debt Allocation: Shift a larger portion of your portfolio towards safer, fixed-income instruments. Options include Debt Mutual Funds (like short-duration funds or corporate bond funds, depending on risk profile), Fixed Deposits (FDs), Senior Citizen Savings Scheme (SCSS – available upon eligibility), RBI Bonds, or Post Office schemes. The focus is on stability and predictable, albeit lower, returns.

- Estimating Retirement Needs: This is a critical exercise. Calculate how much money you’ll realistically need annually during retirement. Factor in your expected lifestyle, regular expenses (household, utilities, travel), potential healthcare costs, and crucially, inflation (which erodes purchasing power over time). Also, consider your expected lifespan. This detailed calculation determines your target retirement corpus and informs withdrawal strategies. This is a cornerstone of effective retirement financial planning for Indians.

- Healthcare Planning: Healthcare costs tend to rise significantly with age and can be a major drain on retirement funds if not planned for.

- Review Health Insurance: Ensure your health insurance coverage is adequate for post-retirement needs. Porting your corporate policy to an individual one (if allowed) or having a robust personal policy is essential. Consider increasing the sum insured or buying a super top-up plan.

- Critical Illness Cover: Evaluate the need for a critical illness policy that provides a lump sum payout on diagnosis of major ailments, helping cover treatment costs and potential income loss for your spouse.

- Medical Corpus: Consider building a separate contingency fund specifically earmarked for medical expenses not covered by insurance.

- Basic Estate Planning: While comprehensive estate planning might happen later, ensure the basics are in place.

- Write a Will: Prepare a clear Will outlining how you wish your assets to be distributed after your demise. This avoids potential disputes among heirs and ensures your wishes are followed. Consult a legal expert if needed.

- Update Nominations: Check and update nominations across all your bank accounts, fixed deposits, mutual funds, insurance policies (life and health), PPF, EPF, and NPS accounts. Ensure the nominee details are current and correct. This facilitates a smoother transfer of funds/assets to your chosen beneficiaries.

Financial Planning for Retirees in India (Ages 60+)

Retirement marks a significant life transition, bringing newfound freedom but also unique financial challenges. Having stopped active earning, the primary financial focus shifts dramatically towards protecting the accumulated wealth (the retirement corpus), generating a steady and reliable income stream to cover living expenses throughout retirement, and planning for the eventual transfer of assets. Managing finances wisely during this stage is crucial for maintaining financial independence and peace of mind.

Core Focus: Capital Preservation, Regular Income Generation & Legacy Planning

In retirement, the game changes from accumulating wealth to making it last. The foremost priority is capital preservation – safeguarding your retirement corpus from erosion due to inflation, market volatility, or poor investment choices. Simultaneously, you need strategies for regular income generation to replace your salary and cover monthly expenses comfortably. This involves structuring investments to provide predictable cash flows. Lastly, legacy planning becomes more prominent, focusing on ensuring your assets are transferred smoothly to your heirs according to your wishes and potentially exploring philanthropic goals. Navigating these requires careful consideration of safety, liquidity, and inflation-adjusted returns.

Key Strategies: Financial Planning for Retirees in India:

Here are key financial planning strategies for retirees in India to ensure financial security and comfort:

- Generating Regular Income: Setting up reliable income streams from your corpus is paramount. Explore a combination of these options:

- Systematic Withdrawal Plans (SWPs): Withdraw a fixed amount regularly (e.g., monthly) from your mutual fund investments (preferably from lower-risk debt or hybrid funds). This offers flexibility and potential for some capital appreciation, though returns aren’t guaranteed.

- Annuity Plans: Purchase an annuity plan from an insurance company, which provides a guaranteed income for life (or a specific period). Evaluate different annuity options (e.g., immediate vs. deferred, life annuity vs. return of purchase price) carefully, considering factors like annuity rates, inflation impact, and insurer credibility.

- Government Schemes: Utilize government-backed schemes designed for seniors:

- Senior Citizen Savings Scheme (SCSS): Offers high safety and attractive interest rates (paid quarterly), currently one of the best options for retirees (subject to investment limits). Available at banks and post offices.

- Pradhan Mantri Vaya Vandana Yojana (PMVVY): Another government-backed scheme providing regular pension income, managed by LIC. Check for current availability and terms.

- Bank Fixed Deposits (FDs) & Post Office Monthly Income Scheme (POMIS): Traditional and safe options providing fixed interest income. Senior citizens often get slightly higher FD rates. POMIS provides monthly interest payouts.

- Rental Income: If you own additional property, rental income can provide a regular cash flow, though it requires property management and is subject to tenant risks and maintenance costs.

- Managing Retirement Corpus: The core investment strategy should revolve around balancing three key needs:

- Safety: Prioritize protecting your principal amount. Avoid high-risk investments, speculative ventures, or schemes promising unrealistically high returns. Stick largely to fixed-income instruments.

- Liquidity: Ensure you have access to funds for emergencies or unexpected expenses without penalties or delays. Maintain a portion of your corpus in liquid instruments like savings accounts or liquid funds.

- Inflation-Beating Returns: While safety is key, your investments still need to generate returns that ideally beat inflation over the long term to maintain purchasing power. A small allocation to conservative hybrid funds or potentially dividend-paying large-cap stocks might be considered cautiously, depending on the corpus size and risk tolerance.

- Healthcare Management: Healthcare costs are a major concern in retirement.

- Ensure you have adequate health insurance cover, as premiums increase with age. Understand the policy terms, coverage limits, exclusions, and claim process thoroughly.

- Manage routine medical expenses efficiently. Explore discounts available for seniors. Maintain a separate contingency fund for medical emergencies or expenses not covered by insurance.

- Taxation for Seniors: Understand and utilize the tax benefits available to senior citizens (age 60+) and super senior citizens (age 80+) in India.

- Higher Basic Exemption Limit: Senior citizens enjoy a higher income threshold before tax becomes payable compared to non-seniors. Filing Income Tax Returns for Senior Citizens & Pensioners

- Section 80TTB: Deduction up to ₹50,000 on interest income earned from savings accounts and deposits (bank FDs, post office schemes).

- Section 80D: Higher deduction limits for health insurance premiums paid for self and spouse. Also, deduction for medical expenditure incurred if no health insurance is available (for super senior citizens). Keep track of changes announced in the Union Budget via the Income Tax India Website.

- Estate Planning & Wealth Transfer: Finalize your estate planning arrangements.

- Review and update your Will periodically, especially if circumstances change (e.g., birth of grandchildren, demise of a beneficiary).

- Explore options like creating a private trust for managing assets, especially for larger estates or specific beneficiary needs (e.g., dependents with special needs).

- Ensure all nominations are up-to-date. Organize your financial documents and inform your spouse or trusted family member about their location and details to ensure a smooth transition of assets. Applying specific financial planning tips for various age groups in India tailored for seniors is essential for managing this final stage effectively.

Financial Advice for Different Life Stages: Specific Considerations for Small Business Owners

Running a small business in India presents unique financial challenges and opportunities that intertwine closely with personal financial planning. Unlike salaried individuals with predictable income streams, business owners often face fluctuating revenues, the need for reinvestment, and distinct retirement planning considerations. Applying tailored financial advice for different life stages is crucial for entrepreneurial success and personal financial security.

Integrating Business & Personal Finances

One of the most critical disciplines for small business owners at any stage is maintaining a clear separation between business and personal finances. Co-mingling funds can lead to accounting nightmares, tax complications, and poor decision-making for both the business and personal life. Establish separate bank accounts, credit cards, and bookkeeping systems right from the start. Set Up An Accounting System for My Small Business Decide on a structured way to draw funds for personal use, whether as a salary (for directors in a Pvt Ltd company), drawings (for proprietors/partners), or dividends. This clarity is fundamental for effective budgeting, tracking business profitability, tax planning, and securing personal financial goals independent of business volatility.

Managing Cash Flow & Reinvestment

The lifeblood of any small business is cash flow. Throughout the business lifecycle, owners constantly face the decision of how much profit to reinvest back into the business for growth (e.g., buying new equipment, hiring staff, marketing) versus how much to draw out for personal savings, investments, and lifestyle needs. In the early stages (akin to the ‘young professional’ phase), significant reinvestment might be necessary, limiting personal draws. As the business matures and stabilizes (like the ‘mid-career’ phase), owners can potentially draw more substantial amounts. Finding the right balance requires careful cash flow forecasting, budgeting for both business and personal needs, and aligning withdrawals with long-term personal financial goals, ensuring that personal savings aren’t perpetually sacrificed for business growth.

Retirement Planning via Business

Small business owners lack the structured retirement benefits often available to salaried employees, like mandatory EPF contributions. Therefore, proactive retirement financial planning for Indians running businesses is essential. Don’t solely rely on the potential future sale of the business as your retirement plan – this carries significant risk. Instead, consistently allocate a portion of business profits or personal drawings towards established retirement vehicles like Public Provident Fund (PPF), National Pension System (NPS), or mutual fund SIPs, treating these contributions as a non-negotiable personal expense. Additionally, explore structuring business assets or investments (like property owned by the business) in a way that could potentially generate retirement income or contribute to the corpus upon sale, but treat this as supplementary, not primary.

Business Succession Planning

As business owners approach the pre-retirement stage (their 50s and beyond), succession planning becomes critical. This involves deciding the future of the business: will it be passed on to the next generation, sold to employees or an external party, or gradually wound down? This decision profoundly impacts the owner’s personal retirement corpus and timeline. A well-planned succession ensures business continuity (if desired), maximizes the potential value realized from the business, and provides clarity for the owner’s retirement finances. Starting this planning process early allows for grooming successors, preparing the business for sale, or making alternative arrangements, preventing last-minute stress and potentially suboptimal financial outcomes.

Tax Efficiency

The choice of business structure (Sole Proprietorship, Partnership Firm, Limited Liability Partnership (LLP), Private Limited Company) has significant implications for liability, compliance, and taxation, impacting both the business’s bottom line and the owner’s personal tax outgo. Optimizing this structure and diligently managing business expenses to claim legitimate deductions are key across all life stages. For instance, incorporating might offer benefits like limited liability and potentially more favourable tax treatment on retained earnings compared to drawings from a proprietorship, but comes with higher compliance costs. Regularly reviewing the structure and leveraging expert advice ensures maximum tax efficiency for both business profits and personal income drawn from the enterprise. TaxRobo specializes in helping small businesses navigate these complexities, offering services from Company Registration to ongoing Accounting and Tax Filing.

Conclusion

Navigating your financial life without adapting your strategy is like sailing without adjusting your sails to the changing winds. As we’ve explored, the financial focus shifts dramatically across life’s journey: young professionals prioritize building a foundation and leveraging compounding; established professionals concentrate on growth, managing increasing responsibilities, and funding major goals; those nearing retirement focus on consolidating wealth and preserving capital; and retirees concentrate on generating steady income and ensuring their corpus lasts. For small business owners, integrating business planning with personal financial goals adds another layer of complexity at each stage.

The core message is undeniable: proactive, dynamic, and adaptive financial planning strategies for various life stages are not just beneficial, they are fundamental to achieving your unique financial goals and securing long-term financial well-being in the Indian context. Generic advice falls short because your circumstances, priorities, income, and risk tolerance evolve. Regularly reviewing and adjusting your financial plan – ideally annually, or after significant life events like marriage, childbirth, career changes, business milestones, or approaching retirement – is crucial to keep it aligned with your current reality and future aspirations.

Navigating the nuances of financial advice for different life stages can feel overwhelming. Seeking professional guidance can provide clarity, personalized strategies, and peace of mind. At TaxRobo, our experts offer personalized financial planning, tax advisory, retirement planning support, and specialized services for small business owners tailored to your specific life stage and goals. Take control of your financial future today. Contact TaxRobo for an Online CA Consultation to discuss your personalized financial roadmap.

FAQ Section

- Q1: At what age should I seriously start financial planning in India?

A: As early as possible, ideally when you start earning your first income in your 20s. The earlier you begin, the more time your money has to grow through the power of compounding. Even small, consistent savings and investments started early can build a substantial corpus over the long term, making future goals much easier to achieve. It’s never too early to build good financial habits. - Q2: How often should I review and update my financial plan?

A: It’s advisable to conduct a thorough review of your financial plan at least once a year. This allows you to assess progress towards your goals, rebalance your investments if needed, and adjust for changes in income or expenses. Additionally, you must revisit and potentially revise your plan after any significant life event, such as marriage, the birth of a child, buying a property, a major promotion or job change, significant business growth or downturn, or as you get closer to retirement (e.g., 5-10 years out). - Q3: What are some common financial mistakes people make at different life stages?

A: Common mistakes vary by stage:- Young Professionals (20s-30s): Delaying investments (“I’ll start when I earn more”), excessive lifestyle spending fueled by debt (credit cards, personal loans), neglecting to build an emergency fund, and inadequate insurance coverage (especially health and term life if dependents exist).

- Mid-Career (30s-40s): Mixing insurance and investment (buying traditional plans with low returns/cover), underestimating the funds needed for children’s future goals, not increasing investments in line with income growth, and insufficient focus on retirement planning despite higher earnings.

- Pre-Retirement (50s): Maintaining excessively high exposure to equity investments close to retirement, failing to adequately plan and save for post-retirement healthcare costs, not having a clear debt elimination plan, and neglecting basic estate planning (Will, nominations).

- Retirees (60+): Falling for high-risk schemes promising unrealistic returns, underestimating the impact of inflation on their expenses over 20-30 years, prioritizing guaranteed income over potential growth completely (leading to corpus erosion), and inadequate health insurance coverage.

- Q4: As a small business owner, how do I balance investing in my business with my personal retirement financial planning for Indians?

A: This requires discipline and clear boundaries. Firstly, strictly separate business and personal finances. Secondly, determine a sustainable amount or percentage of profit/drawings that you will consistently allocate towards your personal long-term goals, particularly retirement. Treat this personal investment (e.g., SIPs, PPF, NPS contributions) as a mandatory ‘business expense’ or ‘owner payout’ in your budgeting. While reinvesting in the business is vital for growth, systematically building your personal retirement fund safeguards your future independent of the business’s eventual fate or sale value. Don’t rely solely on the business as your retirement nest egg. - Q5: Are the financial planning strategies for various life stages significantly different based on gender in India?

A: While the fundamental principles of budgeting, saving, investing, and insuring apply universally, certain factors necessitate nuanced adjustments in financial planning strategies for various life stages based on gender in India. Women, on average, have a longer life expectancy, meaning their retirement corpus needs to last longer. Potential career breaks for childcare or eldercare can impact earning and saving capacity, requiring proactive planning to compensate. Addressing the gender pay gap’s impact is also crucial. Financial planning should explicitly account for these factors. Additionally, awareness of specific investment options sometimes targeted towards women (like the Mahila Samman Savings Certificate) can be incorporated, though core long-term planning should rely on mainstream diversified investments.