How do family offices differ from traditional wealth management firms? Understanding Your Options in India

As India’s economy grows, more individuals and small business owners are achieving significant financial success. This naturally leads to the question of how best to manage and preserve this hard-earned wealth. You might hear terms like “wealth management” and “family offices” discussed, but what do they really mean, and how do they differ? Understanding the landscape of financial advisory services is crucial, even if you’re just starting your wealth-building journey. Two distinct approaches dominate this space: traditional wealth management firms and the more exclusive family offices. The family offices vs traditional wealth management debate often causes confusion, but clarifying this difference is vital for effective long-term financial planning. This post aims to demystify these concepts within the Indian context. Knowing the difference between family offices and wealth management helps you understand the spectrum of services available and choose the right partners as your financial needs evolve. While family offices typically serve ultra-high-net-worth individuals (UHNWIs), understanding their function provides valuable perspective for anyone serious about managing their financial future in India, highlighting the importance of structured advice and planning at every level.

What are Traditional Wealth Management Firms in India?

When people in India talk about managing significant assets, they are often referring to the services provided by traditional wealth management firms in India. These firms form the backbone of the financial advisory industry for a large segment of the population that has accumulated wealth beyond basic savings and requires professional guidance. Making a wealth management firm comparison India often starts with understanding what these traditional players offer.

Defining Traditional Wealth Management

At its core, traditional wealth management involves providing professional financial advice and investment management services to help clients achieve their financial goals. These firms act as advisors, analysing a client’s financial situation, risk tolerance, and objectives to recommend suitable investment strategies and financial products. Their services typically encompass a range of financial needs, including comprehensive financial planning, building and managing investment portfolios (often using mutual funds, stocks, bonds), retirement planning projections and strategies, coordination for basic tax planning (working alongside CAs), and advising on appropriate insurance coverage to mitigate risks. The focus is primarily on growing and protecting the client’s financial assets through structured investment processes.

Target Clientele

Traditional wealth management firms generally cater to a broad audience, including High Net Worth Individuals (HNIs – often defined as those with investable assets above ₹1 Crore or ₹5 Crore, depending on the firm), affluent professionals (like doctors, lawyers, senior executives), successful small business owners, and sometimes the ‘mass affluent’ segment (individuals with substantial savings but below the HNI threshold). This contrasts significantly with the highly exclusive nature of family offices. These firms aim to provide scalable advice to a larger number of clients compared to the dedicated service model of a family office.

Key Characteristics of Traditional Wealth Management Firms in India

Several characteristics define traditional wealth management firms in India. Structurally, they are often large organizations, sometimes operating as divisions within major banks (like HDFC, ICICI, Kotak) or established brokerage houses (like Motilal Oswal, IIFL Wealth), or as independent advisory firms. Their service model can vary; some offer standardized portfolios or tiered service levels based on asset size, while others provide more personalized advisory services. The approach can sometimes be product-focused, where advisors might recommend specific mutual funds or insurance policies from which the firm earns commissions, or purely advisory, where advice is the primary service. Their fee structure commonly involves charging a percentage of Assets Under Management (AUM), earning commissions on financial products sold, offering fee-based financial plans, or using a hybrid model combining these elements. Crucially, firms offering investment advice or portfolio management services are typically regulated by the Securities and Exchange Board of India (SEBI) as Registered Investment Advisers (RIAs) or Portfolio Management Services (PMS), ensuring adherence to specific compliance and disclosure standards. You can find general information about SEBI regulations on their official website: SEBI.

What are Family Offices in India?

While traditional wealth management serves a broad affluent segment, family offices represent a different echelon of wealth management, designed specifically for the unique and complex needs of ultra-high-net-worth (UHNW) families. The concept of family offices in India has gained significant traction over the last decade as the number of UHNW families has grown. These entities offer a far more comprehensive and integrated approach compared to traditional firms, acting essentially as the private wealth management arm and “chief financial officer” for the entire family. Understanding their role requires looking beyond just investments to the holistic management of substantial family fortunes, often across multiple generations. Key characteristics of family offices in India include their bespoke nature and deep integration into the family’s financial life.

Defining Family Offices

A family office is essentially a private company established by an UHNW family (or a group of families) to manage their entire financial and personal affairs. The core idea is centralization – bringing the oversight of investments, taxes, estate planning, philanthropy, and sometimes even lifestyle management under one roof. Unlike traditional wealth managers who focus primarily on investment portfolios, family offices take a 360-degree view of the family’s wealth, coordinating various experts (lawyers, accountants, investment managers) to ensure all aspects work together seamlessly towards the family’s long-term goals, values, and legacy preservation. The emphasis is on providing objective advice and integrated solutions tailored specifically to that family’s unique circumstances.

Types of Family Offices

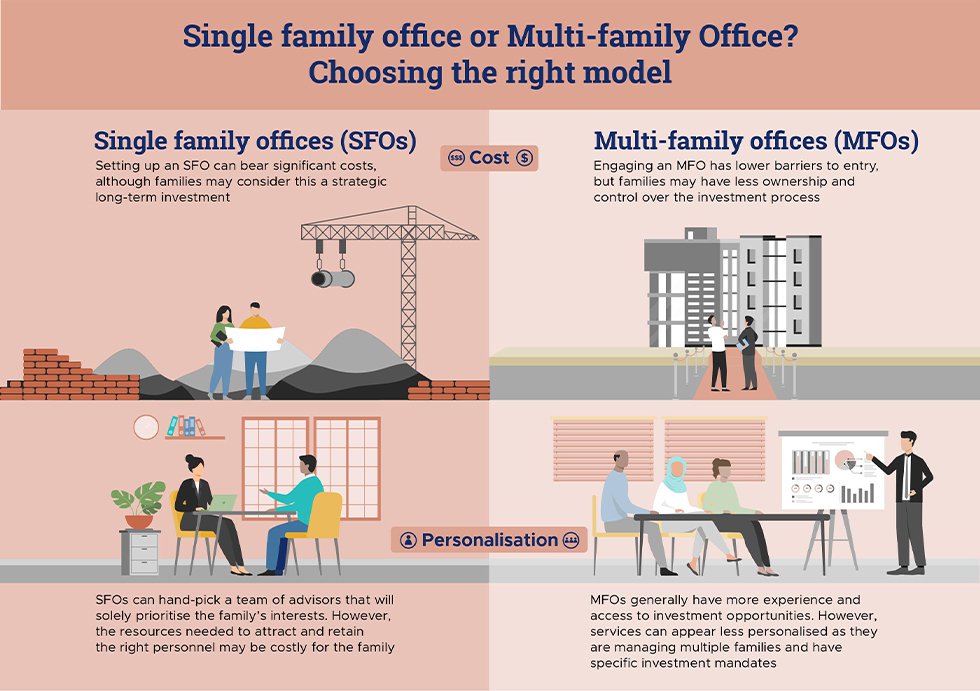

There are primarily two types of family offices:

- Single-Family Offices (SFOs): These are dedicated entities established by and serving exclusively one UHNW family. They offer the highest degree of customization, control, and privacy but also entail significant setup and operational costs. SFOs are typically viable only for families with exceptionally large asset bases (often upwards of ₹500 Crore or more).

- Multi-Family Offices (MFOs): These firms serve multiple UHNW families, pooling resources and expertise to offer a similar range of comprehensive services but at a potentially lower cost threshold compared to an SFO. MFOs have seen substantial growth in India, providing access to sophisticated family office services for a wider range of UHNW families (perhaps starting from ₹100-200 Crore AUM). They offer economies of scale while still aiming for a high degree of personalized service.

Core family offices services for wealthy families India

The scope of family offices services for wealthy families India extends far beyond typical investment management. While investment oversight remains crucial, it’s just one piece of the puzzle. Key services often include:

- Consolidated Financial Reporting: Aggregating data across all asset classes, entities, and family members for a clear, comprehensive view of the family’s total wealth.

- Investment Management Oversight: Defining overall asset allocation, selecting and monitoring external managers, conducting due diligence on direct investments (private equity, real estate).

- Risk Management: Assessing and mitigating financial and non-financial risks across the family’s entire balance sheet.

- Tax and Legal Coordination: Working closely with specialized firms (like TaxRobo Online CA Consultation Service for tax expertise) to manage complex tax planning, compliance, and legal structuring across multiple entities and jurisdictions.

- Estate and Succession Planning: Developing strategies for wealth transfer, inheritance planning, and preparing the next generation.

- Philanthropy Management: Assisting the family in defining and executing their charitable giving goals and managing foundations or trusts.

- Family Governance: Facilitating family meetings, establishing governance structures, and helping manage intra-family communication regarding wealth.

- Lifestyle Services: Sometimes includes managing properties, travel arrangements, personal security, or other concierge-like services.

Key characteristics of family offices in India

Several distinct characteristics define family offices in India:

- Exclusivity: Access is limited to UHNW families meeting very high asset thresholds.

- Customization: Services are highly bespoke, tailored precisely to the individual family’s complex needs, values, and long-term objectives.

- Control: The family typically retains significant control over the overall strategy and decision-making, with the family office acting as implementer and advisor.

- Alignment of Interest: Often structured with transparent, fee-only models (fixed retainers, cost-plus, or AUM fees with full disclosure) designed to minimize conflicts of interest that can arise from commission-based selling.

- Long-Term Focus: The primary objective is often multi-generational wealth preservation and seamless transfer, rather than short-term investment gains alone.

- Integration: They provide a single point of coordination across all aspects of a family’s financial and related affairs.

Key Differences: Family Offices vs Traditional Wealth Management

Understanding the fundamental distinctions between these two models is crucial for anyone navigating the financial services landscape in India. The core family offices vs traditional wealth management comparison hinges on several key factors, revealing why they serve different clienteles and fulfill different roles. Clarifying the difference between family offices and wealth management helps set realistic expectations when seeking financial advice. A deeper wealth management firm comparison India requires looking at these specific areas:

Client Base & Exclusivity

- Traditional Wealth Management (TWM): Serves a relatively broader segment, including High Net Worth Individuals (HNIs), affluent professionals, and the mass affluent. Entry thresholds for assets under management are lower, making them accessible to a larger number of successful individuals and business owners.

- Family Offices (FO): Exclusively cater to Ultra-High-Net-Worth (UHNW) families. The entry barrier is significantly higher, often requiring investable assets upwards of ₹100-200 Crore in India, although this can vary. Single-Family Offices have even higher implicit thresholds due to setup costs. This exclusivity allows for a much deeper, more personalized engagement.

Scope of Services

- TWM: Primarily focused on financial planning and investment management. Services typically include portfolio construction, retirement planning, insurance advice, and basic tax coordination. While comprehensive within the financial realm, the scope is generally limited to financial assets.

- FO: Offers a holistic and integrated approach managing the entirety of a family’s complex financial and often non-financial affairs. This includes core investment management but extends significantly further into areas like sophisticated tax and estate planning, consolidated reporting across all assets (including illiquid ones), risk management, philanthropic coordination, family governance, succession planning, and sometimes even lifestyle management. They act as the central command center for the family’s wealth.

Service Model & Approach

- TWM: Can often involve more standardized processes and service tiers, especially in larger firms or bank-led wealth divisions. While personalization exists, the model needs to be scalable to serve a larger client base. The approach might sometimes be influenced by the products the firm distributes.

- FO: Highly customized and relationship-driven. The family office acts as a dedicated team, often considered an extension of the family itself, functioning like the family’s private CFO. Solutions are bespoke, built from the ground up based on the family’s specific needs, values, and long-term vision. The focus is purely on providing objective advice and coordination.

Fee Structures

- TWM: Common fee models include a percentage of Assets Under Management (AUM), commissions earned on selling financial products (like mutual funds or insurance), fixed fees for financial plans, or a hybrid combination. Potential conflicts of interest can sometimes arise in commission-based models.

- FO: Fee structures are typically designed for maximum transparency and alignment with the family’s interests. Common models include fixed annual retainers, a cost-plus model (covering operational expenses plus a margin), or AUM-based fees (often lower percentages than TWM due to scale and scope). The emphasis is on minimizing conflicts of interest, often operating on a fee-only basis.

Control & Customization

- TWM: Clients generally choose from the firm’s existing strategies, model portfolios, or recommended product lists. While portfolios are tailored to risk profiles, the level of deep customization and client control over underlying strategy is moderate.

- FO: The family usually maintains significant control, often dictating the overall strategic direction, risk appetite, and specific mandates. The family office provides advice and execution capabilities, creating highly bespoke solutions. The degree of customization is maximal, reflecting the unique DNA of the family.

Investment Approach (family office investment strategies India)

- TWM: Investment strategies often rely on publicly traded securities like stocks, bonds, and mutual funds, often using model portfolios tailored to different risk profiles. Access to alternative investments might be limited or standardized.

- FO: Family office investment strategies India are typically more sophisticated and customized. They often have the scale and expertise to access a wider range of investments, including direct investments in private companies (private equity), venture capital, real estate development projects, hedge funds, structured products, and co-investment opportunities alongside other large investors. Investment decisions are deeply integrated with the family’s overall long-term goals, tax situation, and legacy objectives, often focusing on multi-generational wealth preservation and growth.

Here’s a table summarizing the key differences:

| Feature | Traditional Wealth Management (TWM) | Family Office (FO) |

|---|---|---|

| Primary Client | HNI / Affluent Individuals & Families | Ultra-High-Net-Worth (UHNW) Families |

| Exclusivity | Moderate; Lower AUM thresholds | High; Very high AUM thresholds (₹100-200 Cr+) |

| Scope of Services | Primarily Investment Management & Financial Planning | Holistic Financial & Non-Financial Wealth Management |

| Service Model | Often Standardized/Tiered; Scalable | Highly Bespoke; Integrated; Deep Relationship |

| Approach | Can be Product or Advisory Focused | Advisory Focused; Acts as Family’s “CFO” |

| Fee Structure | AUM Fees, Commissions, Hybrid | Retainers, Cost-Based, AUM Fees; Focus on Alignment |

| Control | Moderate Client Control; Adopt Firm Strategies | High Family Control; Dictates Strategy |

| Customization | Moderate; Tailored Risk Profiles | Maximal; Solutions Built Around Family Needs/Values |

| Investment Strategy | Public Markets Focus (Stocks, Bonds, MFs) | Broad Mandate: Public, Private, Alternatives, Directs |

| Regulation (India) | Typically SEBI Regulated (RIA/PMS) | Regulatory status depends on structure/activities |

| Focus | Asset Growth & Financial Goal Achievement | Multi-Generational Wealth Preservation & Legacy |

Which is Right for You? Navigating Your Wealth Journey in India

Having explored the distinct worlds of family offices and traditional wealth management, the practical question arises: which path is relevant for you as a small business owner or salaried professional in India? While the allure of a family office’s comprehensive service is undeniable, it’s crucial to align your choice with your current situation and future trajectory. Making an informed wealth management firm comparison India starts with self-assessment.

Assessing Your Current Needs

For the vast majority of individuals, including successful small business owners and well-compensated salaried employees who are building wealth, the journey typically begins with financial advisors or traditional wealth management firms in India. At this stage, the primary needs often revolve around establishing good financial hygiene, disciplined savings and investment habits, effective tax planning, and securing basic financial protection through insurance. Getting the foundations right is paramount. This includes meticulous record-keeping, timely tax filing, and smart tax-saving strategies – areas where professional help, such as services offered by TaxRobo Income Tax Service or TaxRobo Accounts Service, can be invaluable. A traditional wealth manager or a qualified independent financial advisor can provide the necessary guidance on building an investment portfolio suited to your goals and risk tolerance, planning for retirement, and managing cash flow effectively.

Small business owners looking to efficiently manage their finances from the start can benefit from reading Set Up An Accounting System for My Small Business.

Planning for the Future

Understanding the family offices vs traditional wealth management distinction is valuable even if a family office isn’t immediately relevant. Think of it as aspirational knowledge – knowing what advanced wealth management looks like helps you appreciate the principles of holistic planning as your own wealth potentially grows towards HNI or even UHNW levels in the future. The core concepts employed by family offices – integrated planning, long-term perspective, coordinating multiple specialists (legal, tax, investment), and focusing on legacy – are valuable principles to aspire to, even if implemented through a network of individual advisors rather than a single entity initially. As your business expands or your career progresses, your financial life will inevitably become more complex, potentially involving business succession planning, managing wealth across different structures, or considering philanthropic activities. Knowing the family office model provides a blueprint for how these elements can eventually be managed cohesively.

Making an Informed Choice

Whether you are engaging your first financial advisor or considering upgrading your existing arrangements, the key is to make an informed choice based on your current needs and realistic future goals. When evaluating traditional wealth management firms in India or independent advisors, consider factors like:

- Scope of Services: Do they offer the specific advice you need right now (e.g., investment management, retirement planning, basic tax coordination)?

- Fee Structure: Is it transparent? Do you understand how the advisor is compensated (AUM fees, commissions, fixed fees)? Are there potential conflicts of interest?

- Credentials and Regulation: Is the advisor/firm appropriately qualified and registered with SEBI (if providing investment advice)?

- Client Fit: Do you feel comfortable with the advisor? Do they understand your goals and risk appetite?

- Track Record and Reputation: What is their experience and standing in the market?

Start with advisors who meet your current requirements effectively. As your wealth and complexity grow, you can re-evaluate and potentially transition to firms or structures offering more comprehensive services.

For those considering the first steps into structured business operations in India, exploring Company Registration in India might be the next logical step.

Conclusion

The distinction between family offices and traditional wealth management firms lies primarily in the clientele they serve, the breadth and depth of their services, and the level of customization and control offered. While traditional wealth management provides essential financial planning and investment services to a broader affluent segment in India, family offices offer a highly exclusive, bespoke, and holistic approach for managing the complex affairs of ultra-high-net-worth families. Understanding the family offices vs traditional wealth management landscape is empowering. It allows small business owners and salaried individuals to recognize the type of advisory support they currently need while understanding the spectrum of services available as their financial success grows. Making informed decisions about financial partners is critical at every stage of wealth creation, preservation, and transfer in India. Choosing the right advisor ensures your financial strategy aligns with your evolving needs and long-term aspirations.

As you build your wealth, remember that strong foundations are key. This includes robust accounting, diligent tax planning, and ensuring your business or personal finances are compliant and optimized. For comprehensive support, you can explore Taxation Services in India for reliable solutions.

Need expert help with managing your finances, ensuring tax compliance, or structuring your business effectively? Contact TaxRobo today for reliable Tax Planning, Accounting, Business Registration, and Compliance Services tailored for individuals and businesses in India.

Frequently Asked Questions about Family Offices and Wealth Management in India

Q1: What is the typical minimum asset requirement for a family office in India?

A: There’s no official minimum, but family offices generally serve Ultra-High-Net-Worth (UHNW) families. For Multi-Family Offices (MFOs) in India, the entry point often starts around ₹100-200 Crore (approx. USD 12-25 million) in investable assets. Establishing a dedicated Single-Family Office (SFO) usually requires a significantly higher asset base (potentially ₹500 Crore or more) to be cost-effective due to the high operational overheads.

Q2: Can a successful small business owner use a family office?

A: A small business owner would typically only engage a family office once their personal family wealth reaches UHNW levels, separate from the business’s operating capital. However, even if not using a formal family office, successful entrepreneurs can apply the principles of integrated wealth management. This involves coordinating closely with different advisors – such as their business accountant or CA (like those providing services via TaxRobo Accounts Service), a personal wealth manager, lawyers specializing in estate planning, and tax experts – to create a holistic financial strategy.

Q3: Are Multi-Family Offices (MFOs) more accessible than Single-Family Offices (SFOs)?

A: Yes, generally. MFOs serve multiple UHNW families, allowing them to share operational costs and access specialized expertise more efficiently. This typically results in lower minimum asset requirements compared to setting up a dedicated SFO. MFOs represent a significant and growing segment of family offices in India, making comprehensive wealth management services accessible to a broader range of wealthy families.

Q4: How regulated are family offices compared to traditional wealth managers in India?

A: Traditional wealth management firms acting as Investment Advisers (RIAs) or Portfolio Managers (PMS) are directly regulated by SEBI (SEBI), requiring specific registrations, compliance adherence, and disclosures. The regulatory status of family offices in India is more complex and depends heavily on their specific structure and the activities they undertake. If a family office provides investment advice directly, certain SEBI regulations might apply. However, many family offices are structured primarily as advisory coordinators or operate under exemptions, focusing on oversight rather than direct regulated activities. Families often rely heavily on legal and compliance experts to ensure their specific family office structure adheres to all relevant Indian laws and regulations.