What documents are required to obtain a bank loan for business?

Starting or growing a business is an exciting journey, but accessing the necessary funds can often feel like a major hurdle. Many small business owners and aspiring entrepreneurs find themselves needing financial support, and bank loans are a common avenue. However, the application process, particularly gathering all the required paperwork, can seem overwhelming and confusing. Knowing exactly what documentation banks need is the first crucial step towards a successful loan application. This vital preparation can save you significant time and prevent potential roadblocks.

This guide is designed specifically for small business owners and salaried individuals planning their business ventures in India. We will clearly outline the essential documents required to obtain a bank loan for your business. Understanding these requirements beforehand streamlines the process, allowing you to focus on building your dream. Being prepared with the right documents for bank loan in India demonstrates professionalism and seriousness to the lender, significantly improving your chances of securing the funds you need for growth and operations.

Why Proper Documentation Matters for Business Loans

Banks don’t ask for piles of paperwork just to create hassle. There are critical reasons behind their meticulous document checks, primarily centred around managing risk and ensuring compliance. When you apply for a business loan, the bank needs to assess several key factors: your identity and the legitimacy of your business, your business’s financial health and stability, its ability to generate enough profit to repay the loan, and adherence to legal and regulatory requirements. Each document serves as a piece of evidence helping the bank build a comprehensive picture of your business and its principals.

Failing to provide complete or accurate documentation is one of the most common reasons for loan application delays or even outright rejection. Missing paperwork can halt the evaluation process, while discrepancies between documents can raise red flags about the business’s credibility or financial standing. Therefore, understanding the bank loan requirements for businesses India and meticulously preparing all necessary documents isn’t just about ticking boxes; it’s about presenting a clear, credible, and compelling case for why your business is a worthy investment for the bank. Proper documentation reflects good business management and significantly enhances your loan approval prospects.

Core Documents Required to Obtain a Bank Loan (Common Across Business Types)

While specific requirements might slightly differ based on the bank and the loan type, there’s a core set of documents required to obtain a bank loan that virtually every applicant in India needs to furnish. These fundamental documents help the bank verify the identity of the individuals involved, confirm the business’s existence and operational address, and understand its legal structure. Preparing these basic documents meticulously is the foundation of a strong loan application. Think of these as the non-negotiables that establish the who, what, and where of your business entity for the lender.

Identity Proof (Promoters/Partners/Directors)

Banks need to know exactly who they are lending to and who stands behind the business. This involves verifying the identity of the key individuals associated with the business entity. The specific individuals whose proofs are required depend on the business structure: the sole proprietor for a proprietorship, all partners for a partnership firm, and the main directors for a private limited company or LLP.

Commonly Accepted Documents:

- PAN Card: This is mandatory for all key individuals and the business entity itself (except sometimes for sole proprietors where individual PAN suffices initially).

- Aadhaar Card: Widely accepted and often preferred.

- Passport: Valid passport copy.

- Voter ID Card: Election Commission issued ID card.

- Driving License: Valid driving license copy.

Ensure the names and details on the identity proofs match exactly across all submitted documents and the loan application form to avoid discrepancies.

Address Proof (Individual & Business)

Alongside identity, banks need to verify the residential address of the key individuals (promoters/partners/directors) and the official operating address of the business. This confirms the physical location and helps in communication and legal verification processes. Separate proofs are usually needed for personal residence and the business premises. These bank loan application documents India are crucial for establishing the legitimacy of both the individuals and the business operations.

Examples of Personal Address Proof:

- Aadhaar Card (if it has the current address).

- Latest Utility Bill (Electricity, Telephone, Water, Gas – usually not older than 2-3 months) in the individual’s name.

- Valid Passport.

- Recent Bank Account Statement or Passbook copy showing the address.

- Valid Rent Agreement.

Examples of Business Address Proof:

- Latest Utility Bill in the name of the business entity.

- Registered Rent Agreement or Lease Deed for the business premises.

- Property Ownership Documents if the business premises are owned by the entity or promoters.

- Municipal Property Tax Receipt.

- GST Registration Certificate showing the business address.

Business Existence & Structure Proof

This set of documents validates that your business is a legally recognized entity and clarifies its structure (e.g., sole proprietorship, partnership, company). The specific documents vary significantly based on how your business is legally set up. Banks review these business loan eligibility documents India to understand the legal framework, ownership, and compliance status of your enterprise.

For Sole Proprietorship:

- Registration Certificate under relevant laws (e.g., Shop and Establishment Act License, Gumasta License).

- Udyam Registration Certificate (formerly MSME/SSI Registration). You can register on the Udyam Registration Portal.

- GST Registration Certificate (if applicable).

- Recent Bank Account Statement in the name of the proprietorship firm.

- PAN card and address proof of the proprietor.

For Partnership Firm:

- Registered Partnership Deed.

- Firm’s PAN Card copy.

- Address Proof of the firm (Utility Bill, Rent Agreement).

- GST Registration Certificate (if applicable).

- Udyam Registration Certificate (if applicable).

- KYC documents (Identity & Address Proof, PAN) of all partners.

- List of partners with their profit/loss sharing ratio.

For Private Limited Company / Limited Liability Partnership (LLP):

- Certificate of Incorporation issued by the Registrar of Companies (RoC).

- Memorandum of Association (MoA) & Articles of Association (AoA).

- Company PAN Card copy.

- Company Address Proof (Utility Bill, Rent Agreement).

- List of Directors (with DIN) / Partners (with DPIN) and their KYC documents (PAN, Address Proof).

- Latest Shareholding Pattern (for Companies).

- Board Resolution (for Companies) or Partner Consent Letter (for LLPs) authorizing the loan application and the signatories.

- LLP Agreement (for LLPs).

- GST Registration Certificate (if applicable).

- Udyam Registration Certificate (if applicable).

Having these foundational documents ready and organized is the first major step in preparing your loan application.

Financial Documents: Demonstrating Your Business Health

Once the bank verifies who you are and the legal existence of your business, the focus shifts sharply to your financial standing. Financial documents are arguably the most critical part of your loan application, as they provide concrete evidence of your business’s performance, profitability, and, most importantly, its ability to repay the loan amount with interest. Lenders meticulously analyze this documentation needed for business loans in India to gauge the financial health and stability of your enterprise. In essence, these papers tell the story of your business’s financial journey and its potential for future success. Without strong financial documentation, securing a business loan becomes significantly more challenging.

Bank Account Statements

Your business’s bank account statements are a direct window into its day-to-day financial activities and cash flow management. Banks typically require the statements for your primary business current account(s) for the last 6 to 12 months. These statements show sales receipts, payments to suppliers, operational expenses, and the general flow of funds, helping the bank understand your business volume, transaction patterns, and financial discipline. In some cases, especially for smaller businesses or proprietorships, banks might also request the personal bank account statements of the promoters or partners to get a holistic view of their financial behaviour. Ensure the statements are complete, sequential, and preferably downloaded directly from the bank’s portal or stamped by the bank branch.

Income Tax Returns (ITR)

Income Tax Returns are official declarations of income earned by the business entity and its owners/promoters to the government. Banks rely heavily on ITRs to verify the declared income and profitability over a period, typically asking for the last 2 to 3 financial years’ returns. This includes the ITR forms filed, along with the computation of income statement, balance sheet, and profit & loss account schedules attached to the return. It’s crucial to submit ITRs for both the business entity (Firm/Company/LLP) and the individual promoters/partners/directors. Also, include the ITR-V (acknowledgment receipt) as proof of filing. Timely filing and consistency in declared income across years strengthen your application. You can access filed returns via the Income Tax Department portal.

Audited Financial Statements

For Private Limited Companies, LLPs, and sometimes larger Partnership Firms or Proprietorships (depending on turnover thresholds defined by law or bank policy), audited financial statements are mandatory. These are financial statements (Balance Sheet, Profit and Loss Account, Cash Flow Statement) prepared by the business and examined and certified by an independent Chartered Accountant (CA). An audit adds a significant layer of credibility and assurance to the financial figures presented. Banks usually require audited financials for the last 2 to 3 financial years. These statements provide a detailed, standardized view of the company’s assets, liabilities, equity, revenues, expenses, and profitability, accompanied by the auditor’s report and notes to accounts which offer further insights and context.

GST Returns & Filings

For businesses registered under the Goods and Services Tax (GST) regime, GST returns serve as crucial evidence of actual sales turnover and tax compliance. Banks often ask for the GST Registration Certificate and copies of filed GST returns (like GSTR-1 detailing outward supplies and GSTR-3B summarizing monthly transactions and tax paid) for the last 1 year, or since registration if the business is newer. Consistent GST filings that align with the turnover reported in bank statements and financial statements add significant weight to your application. Discrepancies between GST data and other financial documents can raise serious concerns for the lender. Ensure your filings are up-to-date via the GST Portal.

Business-Specific & Loan-Related Documents

Beyond the core identity, address, legal, and financial proofs, banks often require additional documents tailored to the nature of your business, the specific purpose of the loan, and whether you are offering any security. These documents provide deeper insights into your business operations, market viability, how the loan funds will be utilized, and the collateral available to secure the loan, if applicable. Gathering these essential documents for business loans in India helps the bank make a more informed decision about the loan’s viability and risk profile.

Detailed Business Plan or Project Report

This document is especially crucial if you are starting a new business, seeking funds for significant expansion, or launching a new project. A well-structured Business Plan or Project Report acts as your business’s roadmap. It should comprehensively detail:

- Business Description: What your business does, its mission, vision, and legal structure.

- Management Team: Background and experience of the promoters/key personnel.

- Market Analysis: Target market size, customer segments, competitor analysis, and your unique selling proposition (USP).

- Products/Services: Detailed description of offerings.

- Marketing and Sales Strategy: How you plan to reach customers and generate sales.

- Operations Plan: Location, premises, equipment, production process (if applicable).

- Funding Request: Clearly state the loan amount required and its specific purpose (e.g., working capital, machinery purchase, expansion).

- Fund Utilization Plan: Detailed breakdown of how the loan amount will be spent.

- Financial Projections: Realistic forecasts of revenue, expenses, profit and loss, and cash flow for the next 3-5 years, including the assumptions behind the projections.

- Repayment Strategy: How the business will generate sufficient cash flow to repay the loan installments on time.

A convincing and data-backed business plan significantly strengthens applications, particularly for newer ventures.

Collateral / Security Documents (If applying for a Secured Loan)

If you are applying for a secured business loan, the bank will require documents related to the asset(s) you are offering as collateral. This collateral acts as security for the bank – if the borrower defaults, the bank can claim the asset to recover the loan amount. The documentation needed depends on the type of asset being pledged:

- Immovable Property (Land, Building): Original Title Deeds, Sale Deed, Property Tax Receipts, Encumbrance Certificate, Approved Building Plan (if applicable), Land Records (like Khatauni/7/12 extract), Valuation Report from a bank-approved valuer.

- Fixed Deposits: Original FD receipts along with a letter of pledge/lien marked to the bank.

- National Savings Certificates (NSCs), Kisan Vikas Patra (KVP): Original certificates with a pledge form.

- Life Insurance Policies: Original policy documents assigned in favour of the bank.

- Shares/Mutual Funds: Demat account statements, pledge forms.

- Machinery/Equipment: Invoice copies, valuation reports (if applicable).

The bank will conduct due diligence and valuation for the offered collateral.

Other Relevant Registrations & Licenses

Depending on your industry and the specific nature of your business operations, you might need to provide copies of various licenses and registrations required to operate legally. This demonstrates compliance and operational readiness.

Examples:

- Trade License from the local municipal authority.

- Food Safety and Standards Authority of India (FSSAI) license (for food-related businesses).

- Import Export Code (IEC) (for businesses involved in international trade).

- Industry-specific permits (e.g., pollution control board clearance for manufacturing units).

- Udyam Registration Certificate (mentioning this can sometimes unlock access to specific government-backed loan schemes or priority sector lending benefits).

- Professional licenses (e.g., for doctors, CAs setting up practices).

Having these specific documents ready showcases your preparedness and understanding of the regulatory landscape for your business.

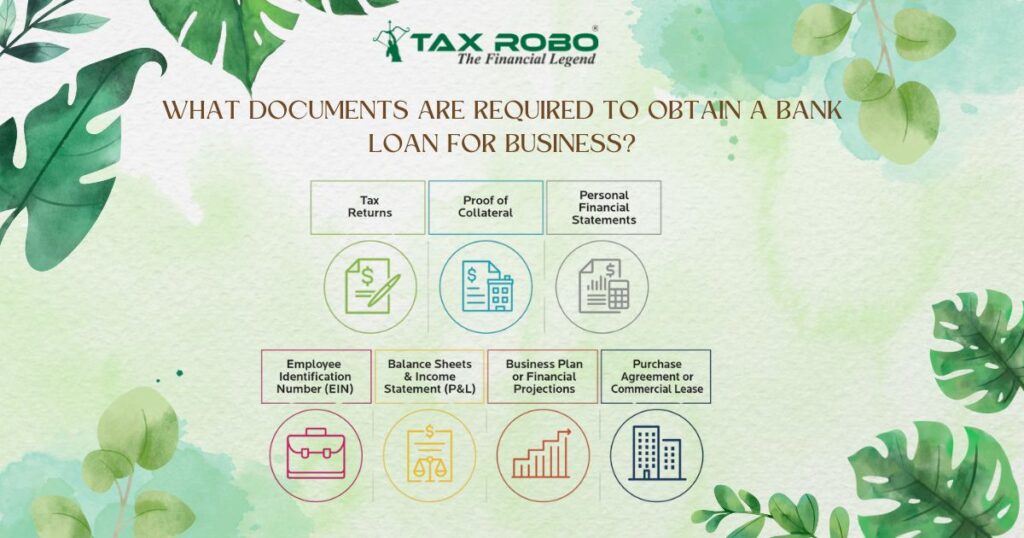

Checklist: Key Documents Required to Obtain a Bank Loan

Navigating the documentation process can feel complex. To simplify, here’s a quick checklist summarizing the core documents required to obtain a bank loan for your business in India. Remember that specific requirements might slightly vary depending on the bank and loan scheme, so always refer to the bank’s official checklist as well.

- Application Form: Duly filled and signed loan application form provided by the bank.

- Photographs: Recent passport-size photographs of all applicants/promoters/partners/directors.

- Identity Proof: PAN Card (mandatory), Aadhaar Card, Passport, Voter ID, Driving License of promoters/partners/directors.

- Address Proof (Personal): Aadhaar Card, Utility Bills, Passport, Bank Statement for promoters/partners/directors.

- Address Proof (Business): Utility Bills, Rent Agreement, Lease Deed, Property Ownership Documents for the business premises.

- Business Existence Proof:

- Proprietorship: Shop Act License, Udyam Certificate, GST Certificate (if applicable).

- Partnership: Registered Partnership Deed, Firm PAN, Firm Address Proof, Partner KYC.

- Company/LLP: Certificate of Incorporation, MoA, AoA, Company PAN, Board Resolution/Partner Consent, LLP Agreement (for LLP), Shareholding Pattern.

- Bank Account Statements: Last 6-12 months’ statements for the primary business current account(s) (and sometimes personal accounts of promoters).

- Income Tax Returns (ITR): Last 2-3 years’ ITRs with computation of income, Balance Sheet, P&L for the business and individual promoters/partners/directors. Include acknowledgment receipts.

- Audited Financial Statements: Last 2-3 years’ audited Balance Sheet, Profit & Loss Account with schedules and audit report (mandatory for Companies, LLPs, and others above certain thresholds).

- GST Registration & Returns: GST Registration Certificate and filed returns (GSTR-1, GSTR-3B) for the last year (or since registration).

- Business Plan / Project Report: Detailed plan outlining business model, market, operations, fund utilization, and financial projections (especially crucial for new businesses or specific projects).

- Collateral Documents: Property Title Deeds, FD Receipts, Insurance Policies, etc., along with valuation reports (required only for secured loans).

- Industry-Specific Licenses/Registrations: Trade License, FSSAI, IEC, Udyam Certificate, etc., as applicable to your business sector.

Using this checklist can help ensure you have gathered the majority of the commonly requested documents before approaching the bank.

Conclusion

Securing a business loan is a significant step towards realizing your entrepreneurial ambitions or taking your existing business to the next level. While the process involves scrutiny, being thoroughly prepared is half the battle won. Understanding and organizing the documents required to obtain a bank loan well in advance not only demonstrates your professionalism and seriousness but also significantly speeds up the evaluation process and increases your chances of getting approved. From proving your identity and your business’s legal standing to showcasing its financial health through bank statements, ITRs, and audited financials, each document plays a crucial role in building the bank’s confidence.

Don’t underestimate the importance of a solid business plan and having all necessary licenses and registrations in place. We know that managing finances, ensuring compliance with GST and Income Tax regulations, and keeping accurate books can be challenging, especially when you’re focused on running your business. The list of required documents to apply for business loan India can seem daunting.

This is where TaxRobo can help. Our expert team specializes in simplifying financial compliance for small businesses. We can assist you with maintaining accurate Accounting Records, timely GST Filing, precise ITR Filing, and obtaining necessary Audits. By ensuring your financial documents are accurate, compliant, and professionally organized, TaxRobo can make your loan application process significantly smoother. Let us handle the complexities of financial documentation so you can focus on what you do best – building your business. Contact TaxRobo today to learn how we can support your financial needs.

Frequently Asked Questions (FAQ)

Q1: Do the required documents vary significantly between different banks in India?

Answer: While the core list of essential documents for business loans in India (like KYC, business proof, basic financials) remains largely consistent across most banks, there can be variations. Some banks might ask for financial statements covering a longer period (e.g., 3 years instead of 2), request specific formats for projections, have slightly different requirements for collateral valuation, or need additional industry-specific documents based on their internal credit policies. It’s always best practice to obtain the specific document checklist from the bank you intend to apply to.

Q2: What documents are needed if I am starting a brand new business?

Answer: For a brand new business with no operational history, banks place greater emphasis on the promoters and the business idea itself. Key documents include:

- Promoters’ KYC: Identity and address proofs.

- Promoters’ Financial History: Personal ITRs for the last 2-3 years, personal bank account statements (6-12 months), and a good personal Credit Score (CIBIL).

- Detailed Business Plan/Project Report: This is extremely critical. It must convincingly outline the business model, market potential, execution strategy, realistic financial projections (revenue, costs, profitability, cash flow), and repayment plan.

- Proof of Promoter Contribution: Evidence of the capital invested by the promoters.

- Collateral Documents: If applying for a secured loan, details of the security offered are crucial.

- Pro-forma Invoices: For loans intended for asset purchase (like machinery).

- Rent Agreement: For the proposed business premises.

Q3: Is collateral always mandatory for a business loan?

Answer: No, collateral is not always mandatory. Several options exist:

- Unsecured Business Loans: Banks and NBFCs offer unsecured loans based primarily on the business’s turnover, profitability, stability, and the promoters’ creditworthiness. These often have faster processing times but may come with higher interest rates and lower loan amounts compared to secured loans.

- Government Schemes: Schemes like the Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) under MUDRA Yojana provide collateral-free loans up to certain limits (e.g., up to ₹10 lakhs under MUDRA, and potentially higher under CGTMSE for eligible MSEs) by offering a guarantee to the lending institution. Check eligibility criteria for these schemes.

- Secured Loans: These require pledging assets (property, FDs, machinery, etc.) as security and generally offer higher loan amounts and potentially lower interest rates due to the reduced risk for the bank.

Q4: How important is my personal credit score (CIBIL) when applying for a business loan?

Answer: Your personal credit score (often referred to as CIBIL score, though CIBIL is one of the credit bureaus) is very important, especially for sole proprietorships, partnership firms, new businesses, and even for directors of private limited companies. Banks view the promoters’ personal credit history as a reflection of their financial discipline and reliability. A good CIBIL score (typically 750+) significantly improves your loan eligibility, increases the chances of approval, and may help secure better interest rates. A poor score can be a major hurdle in obtaining a loan.

Q5: Can TaxRobo help me prepare all these documents?

Answer: TaxRobo excels in helping businesses prepare and organize the crucial financial and compliance documents that form the backbone of a strong loan application. We provide expert services for:

- Accurate Accounting & Bookkeeping: Ensuring your financial records are clean and up-to-date (TaxRobo Accounts Service).

- Timely ITR Filing: Preparing and filing accurate Income Tax Returns for your business and personally (TaxRobo Income Tax Service).

- Compliant GST Filings: Managing your GST registration and filing regular returns (TaxRobo GST Service).

- Audited Financial Statements: Arranging for statutory or tax audits and preparation of certified financial statements (TaxRobo Audit Service).

While we don’t directly prepare business plans or arrange collateral valuations, ensuring your core financial and tax documents are impeccable through our services significantly strengthens your overall loan application package and demonstrates financial diligence to lenders.