Blog Post: Documents Required for Incorporation of a Company in India: Your Complete Checklist

Ready to turn your business idea into a registered company in India? Congratulations! Taking this step signifies a major milestone in your entrepreneurial journey. However, before you can officially launch, the first crucial step is gathering the right paperwork. Having the correct documents required for company incorporation is absolutely vital for a smooth and quick registration process with the Ministry of Corporate Affairs (MCA). Missing or incorrect documents can lead to frustrating delays or even outright rejection of your application. This guide will walk you through the essential paperwork, covering documents related to the directors and shareholders, the registered office address, and the specific forms needed for the incorporation process itself. We understand that navigating these requirements can seem daunting, especially for first-time entrepreneurs. That’s why we’ve simplified the company incorporation checklist India for you, covering all the essential documents required for company incorporation to help you get started with confidence.

For a more comprehensive look at the registration process itself, you can explore our step-by-step guide on Company Registration in India.

What is Company Incorporation?

Company incorporation is the legal process defined under India’s Companies Act, 2013, through which a new business entity is formally created and recognized. This process transforms a business idea or an existing informal business into a distinct legal entity, such as a Private Limited Company, One Person Company (OPC), Limited Liability Partnership (LLP), or Public Limited Company. Once incorporated, the company gains its own legal identity, separate from its owners (shareholders) and managers (directors). This separation provides benefits like limited liability, perpetual succession (the company continues to exist even if owners change), and easier access to funding. The entire process is overseen by the Registrar of Companies (ROC), operating under the umbrella of the Ministry of Corporate Affairs (MCA), which is the governing body for corporate affairs in India. You can find more information directly on the official Ministry of Corporate Affairs (MCA) website.

Why Getting the Documentation Right Matters

Submitting incorrect or incomplete documentation during the company registration process can have significant negative consequences. Even minor errors, like a name mismatch between PAN and address proof or an outdated utility bill, can cause the Registrar of Companies (ROC) to raise queries or flag discrepancies. This inevitably leads to delays in the registration timeline, pushing back your operational start date and potentially disrupting business plans. In more severe cases, persistent errors or failure to provide the required documents can result in the outright rejection of your incorporation application, forcing you to restart the process, which means wasted time and potentially additional costs. Furthermore, issues arising from incorrect initial documentation can sometimes lead to compliance problems later in the company’s lifecycle. Conversely, ensuring all documents required for company registration are accurate, complete, and submitted correctly from the outset offers substantial benefits. It significantly speeds up the processing time, ensures your company starts on a solid foundation of legal compliance, and helps establish credibility with banks, investors, and clients right from day one. Therefore, thoroughly understanding and meticulously preparing the necessary paperwork is not just a procedural step but a critical factor for a successful company launch.

The complexities involved highlight the importance of having a proper understanding of legal and compliance aspects, which are detailed in the Legal and Compliance Checklist for NRIs Registering a Business in India.

Essential Documents Required for Company Directors & Shareholders

When incorporating a company in India, the identity and address verification of the individuals who will act as directors and initial shareholders (subscribers to the Memorandum of Association) are paramount. These foundational documents form the core verification checks performed by the Ministry of Corporate Affairs (MCA). The following are the essential company incorporation documents for Indian residents who are proposed as directors or shareholders. It’s crucial that all submitted copies are clear, legible, and self-attested (signed by the individual to certify its authenticity). Ensuring consistency in names and details across all documents is also vital to avoid processing delays.

Permanent Account Number (PAN) Card

The PAN card is a mandatory requirement for every proposed director and shareholder who is an Indian resident. It serves as a primary identification document and is uniquely linked to the individual for all financial transactions and tax-related matters in India. The Income Tax Department issues the PAN, and its details are verified electronically by the MCA during the incorporation process. You will need to provide a clear, self-attested copy of the PAN card for each director and shareholder involved in the company’s formation.

For more detailed insights on the importance and application of PAN, consider visiting our comprehensive guide on the Importance and Application of Permanent Account Number (PAN).

Identity Proof (Any One)

Alongside the PAN card, each director and shareholder must submit a valid identity proof. The name on the chosen identity proof must exactly match the name on the PAN card. Minor discrepancies can lead to rejection or queries from the ROC. Ensure the document provided is current and not expired (if applicable, like a passport or driving license). You need to provide a self-attested copy of any one of the following:

- Aadhaar Card

- Passport (must be valid)

- Voter ID Card (Election Commission Card)

- Driving License (must be valid)

Address Proof (Any One – Must be Recent)

Proof of the current residential address is required for every director and shareholder. Similar to the identity proof, the name on the address proof must match the name on the PAN card. Crucially, certain address proof documents have a validity period for the purpose of company incorporation – specifically, bank statements and utility bills must be recent. You need to provide a self-attested copy of any one of the following, ensuring it meets the recency criteria where applicable:

- Latest Bank Statement (Savings Account or Current Account): Must not be older than 2 months from the filing date.

- Latest Utility Bill (Electricity Bill, Telephone Bill, Mobile Bill): Must not be older than 2 months from the filing date and should be in the individual’s name.

- Valid Passport (if the address is current and matches)

- Aadhaar Card (if the address is current and matches)

- Voter ID Card (if the address is current and matches)

- Valid Driving License (if the address is current and matches)

The “not older than 2 months” rule for bank statements and utility bills is strictly enforced by the MCA.

Passport Size Photograph

A recent passport-size photograph is needed for each proposed director and shareholder. This photograph is used in various incorporation forms and for the Director Identification Number (DIN) application process. Ensure the photograph is clear, with a plain background, and shows the individual’s face prominently. Typically, digital copies are sufficient for the online application process.

Contact Details

Accurate and active contact information is essential for communication and verification during the incorporation process. The MCA uses email addresses and mobile numbers to send One-Time Passwords (OTPs) for verifying filings and applications. Therefore, you must provide a valid Email ID and Mobile Number for each proposed director and shareholder. Ensure these are accessible as OTPs are time-sensitive.

Proving Your Company’s Registered Office Address

Every company incorporated in India must have a designated registered office address within the country from the date of incorporation onwards. This address serves as the official correspondence address for the company, where all communications and notices from government departments, including the MCA and ROC, will be sent. It’s legally mandatory to maintain this registered office and provide valid proof of its address during the incorporation process. These are critical documents needed to register a company in India, as they establish the company’s physical location and jurisdiction. The specific documents required depend on whether the proposed registered office premises are owned by one of the promoters/directors or if they are rented/leased from a third party.

If the Premises are Owned by a Director/Promoter or Related Entity

If the property intended to be used as the registered office is owned by one of the company’s directors, promoters, or even another company within the same group (provided proper consents are in place), the documentation requirements are relatively straightforward. You will need to furnish proof of ownership, clearly indicating the owner’s name, which should ideally match the name of the director/promoter providing the space. Additionally, a recent utility bill is required to confirm the address is active and operational. The specific documents are:

- Proof of Ownership: A copy of the Conveyance Deed or Sale Deed for the property. Alternatively, the latest Property Tax Receipt showing the owner’s name and address can also be accepted.

- PLUS: A copy of a recent Utility Bill (such as Electricity Bill, Gas Bill, Telephone Bill, or Water Bill) that is not older than 2 months. This bill must be in the name of the property owner as mentioned in the ownership document.

If the Premises are Rented/Leased

When the proposed registered office premises are taken on rent or lease from a landlord (who could be an individual or another entity not directly related to the company’s initial directors/promoters), the documentation needs to establish the company’s right to use the property and the landlord’s consent. This involves providing the rental agreement, a specific consent letter from the owner, and proof of the address’s validity via a recent utility bill in the landlord’s name. The required documents are:

- Rent Agreement or Lease Deed: A copy of the duly executed Rent Agreement or Lease Deed between the landlord and the company (or promoter acting on behalf of the proposed company). It’s highly recommended, though not always mandatory, for this agreement to be notarized for added legal validity.

- No Objection Certificate (NOC): A formal letter signed by the property owner (Landlord) explicitly stating that they have ‘no objection’ to the company using their premises as its registered office address. This NOC is a crucial document confirming the landlord’s permission.

- PLUS: A copy of a recent Utility Bill (Electricity Bill, Gas Bill, Telephone Bill, or Water Bill) that is not older than 2 months. This bill must be in the name of the property owner (Landlord) and correspond to the address mentioned in the Rent Agreement and NOC. This serves as proof that the address provided is genuine and currently serviced.

Here’s a quick comparison:

| Scenario | Proof of Right to Use Premises | Supporting Address Proof (Recent Utility Bill < 2 months) |

|---|---|---|

| Owned Premises | Conveyance/Sale Deed OR Prop. Tax Receipt | In the name of the Property Owner |

| Rented Premises | Rent/Lease Agreement + Landlord NOC | In the name of the Landlord (Property Owner) |

Essential Forms and Declarations for Company Registration India

Beyond the personal identity, address proofs of directors/shareholders, and the registered office documentation, the company incorporation process in India heavily relies on specific electronic forms, digital tools, and legal declarations filed through the Ministry of Corporate Affairs (MCA) portal. These instruments are integral to the modern, digitized incorporation framework and constitute a significant part of the documents for company registration India. Understanding these components is crucial for navigating the online filing system effectively. They encapsulate the company’s foundational structure, directorial appointments, and compliance confirmations.

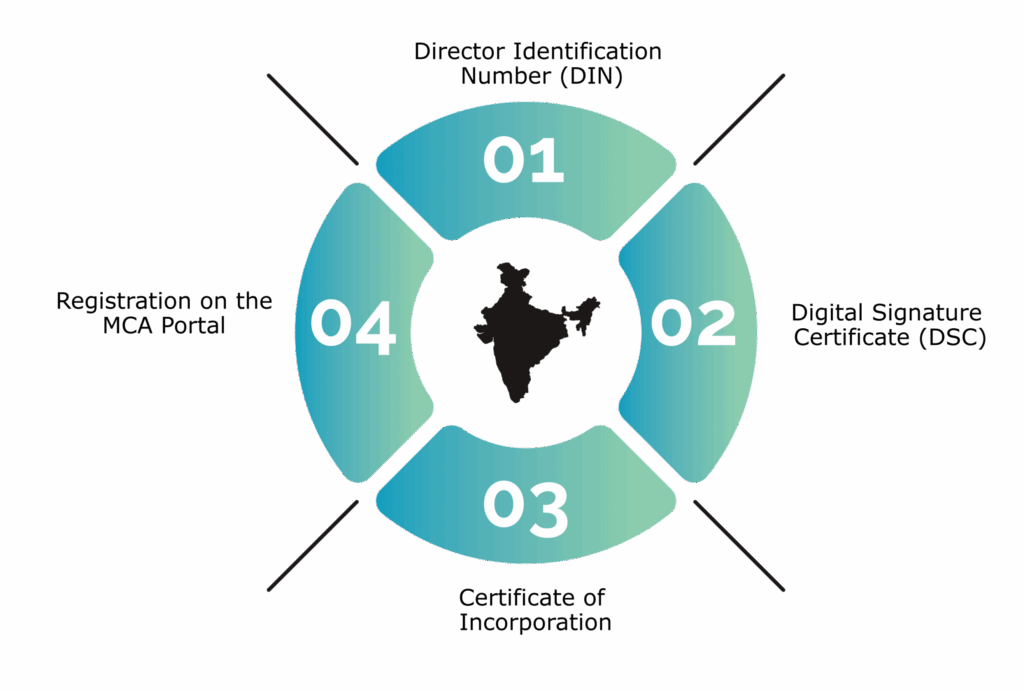

Digital Signature Certificate (DSC)

A Digital Signature Certificate (DSC) is the electronic equivalent of a physical or handwritten signature. It serves as a secure digital key to authenticate the identity of the signatory for online transactions and filings. For company incorporation, obtaining a Class 3 DSC is mandatory for at least one director, who will typically be one of the subscribers to the Memorandum of Association (MoA). This DSC is required to digitally sign the electronic forms (like SPICe+) submitted on the MCA portal. Multiple directors can obtain DSCs, which is often advisable for future filing requirements. DSCs are issued by licensed Certifying Authorities (CAs).

Director Identification Number (DIN)

Every individual intending to be appointed as a director of a company must obtain a unique Director Identification Number (DIN). This is a lifetime identity number assigned by the MCA. Previously, DIN was applied for separately, but under the current integrated incorporation process, DIN for proposed directors (who do not already have one) is applied for directly within the main incorporation form, SPICe+ Part B. The required identity and address proof documents submitted for the director serve as supporting documents for the DIN application embedded within SPICe+.

Memorandum of Association (MoA)

The Memorandum of Association (MoA) is a fundamental charter document of the company. It defines the company’s constitution, its scope of activities, and its relationship with the outside world. The MoA outlines key details such as the company’s name, the state in which the registered office is situated, the main objects (business activities) the company is formed to pursue, the liability of its members (usually limited by shares), and the authorized share capital of the company along with the initial subscribers’ details and their shareholding. Under the current regime, the MoA is filed electronically as e-MoA (INC-33) through the SPICe+ form on the MCA portal.

Articles of Association (AoA)

The Articles of Association (AoA) complement the MoA and contain the internal rules, regulations, and bye-laws for the company’s management and day-to-day operations. It governs aspects like share allotment, transfer of shares, dividend declaration, board meeting procedures, directors’ appointment and powers, voting rights, and company accounts and audits. Similar to the MoA, the AoA is also filed electronically as e-AoA (INC-34) integrated within the SPICe+ form. Companies can adopt standard formats provided (Table F, G, H, I, J of Schedule I to the Companies Act, 2013) or customize their AoA according to specific needs, ensuring compliance with the Companies Act.

SPICe+ (Simplified Proforma for Incorporating Company Electronically Plus) Form

SPICe+ (pronounced ‘Spice Plus’) is the cornerstone of the modern company incorporation process in India. It’s an integrated web-based form (MCA Form No. INC-32) offering multiple services in a single application. It consists of two parts:

- Part A: Used for reserving the proposed name(s) for the new company.

- Part B: Used for the core incorporation application, covering details like registered office address, director/subscriber information, application for DIN, PAN and TAN allotment for the company, EPFO/ESIC registration (mandatory), Profession Tax registration (in applicable states like Maharashtra, Karnataka, West Bengal), and opening of a bank account for the company. E-MoA (INC-33) and e-AoA (INC-34) are filed as linked forms with SPICe+ Part B.

INC-9 Declaration

Form INC-9 is a declaration submitted by each subscriber to the Memorandum and each first director named in the Articles. In this declaration, they confirm that they are not convicted of any offence in connection with the promotion, formation, or management of any company, have not been found guilty of fraud or misfeasance, and that all the documents filed with the Registrar for registration of the company contain information that is correct and complete to the best of their knowledge and belief. This declaration is now auto-generated in PDF format based on the details filled in SPICe+ Part B and needs to be submitted electronically after affixing the DSCs of the subscribers/directors.

DIR-2 Consent (May be required for internal records)

Form DIR-2 represents the formal written consent provided by an individual agreeing to act as a director of the company. While the consent is captured digitally through the details provided and declarations made within the SPICe+ form itself for the initial directors, maintaining a physically signed DIR-2 form from each director for the company’s internal statutory records is considered good corporate governance practice. Though not always required to be separately uploaded during the SPICe+ filing unless specifically requested, having it ready ensures compliance with procedural requirements outlined in the Companies Act.

Your Complete Documents Required for Company Incorporation Checklist India

Navigating the paperwork can feel complex, so here’s a consolidated company incorporation checklist India summarizing the primary documents required for company registration. Having these ready will significantly streamline the process. Remember, this checklist primarily covers the required documents for private limited company registration for Indian residents; requirements might slightly differ for other company structures or if foreign nationals/NRIs are involved.

From Directors/Shareholders (Indian Residents):

- [ ] PAN Card: Clear, self-attested copy for each individual.

- [ ] Identity Proof: Self-attested copy of ONE (Aadhaar Card / Passport / Voter ID Card / Driving License). Must match PAN name.

- [ ] Address Proof: Self-attested copy of ONE (Latest Bank Statement / Latest Utility Bill – must be less than 2 months old, OR Passport / Aadhaar / Voter ID / Driving License if address is current & matches). Must match PAN name.

- [ ] Photograph: Recent passport-size photograph for each individual.

- [ ] Contact Details: Valid Email ID and Mobile Number for each individual (for OTP verification).

For Registered Office Address:

- [ ] If Owned by Director/Promoter:

- [ ] Proof of Ownership (Conveyance/Sale Deed OR Latest Property Tax Receipt).

- [ ] Recent Utility Bill (less than 2 months old) in the property owner’s name.

- [ ] If Rented/Leased:

- [ ] Executed Rent Agreement or Lease Deed.

- [ ] No Objection Certificate (NOC) signed by the Landlord.

- [ ] Recent Utility Bill (less than 2 months old) in the Landlord’s name.

Digital Requirements & Forms:

- [ ] Digital Signature Certificate (DSC): Class 3 DSC for at least one director/subscriber.

- [ ] Details for DIN Application: Information required will be filled within the SPICe+ form (if directors don’t have existing DINs).

- [ ] Details for e-MoA & e-AoA: Finalized objectives, capital structure, internal rules (to be filled in SPICe+ linked forms).

- [ ] Completed SPICe+ Form: Information gathered for both Part A (Name Reservation) and Part B (Incorporation).

This comprehensive list of documents for company registration forms the backbone of your application package.

Conclusion

Successfully registering your company in India hinges significantly on the meticulous preparation and submission of the correct documents required for company incorporation. As we’ve outlined, the process involves gathering personal identification and address proofs for all directors and shareholders, providing valid documentation for the company’s registered office address, and correctly utilizing the digital tools and electronic forms mandated by the Ministry of Corporate Affairs, primarily the SPICe+ form along with its linked components like e-MoA and e-AoA. Getting these key documents right from the start – director/shareholder proofs, registered office proof, and the necessary digital signatures and form details – is crucial not only for faster approval but also for ensuring long-term legal compliance and avoiding potential roadblocks. It saves valuable time, minimizes the chances of rejection, and sets a strong foundation for your new venture.

Feeling overwhelmed by the paperwork and procedural complexities? Let the experts at TaxRobo handle your company registration seamlessly. Our team ensures that all documents for registering company are accurately prepared, verified, and filed according to the latest MCA guidelines, making your incorporation journey smooth and hassle-free. Focus on building your business while we take care of the compliance. Contact us today!

Disclaimer: While this guide provides a comprehensive list of documents for company registration based on common requirements for private limited companies with Indian resident directors/shareholders, specific circumstances, business activities, or company structures might necessitate additional documentation. It is always advisable to seek professional advice tailored to your unique situation.

Frequently Asked Questions (FAQs) on Documents for Registering a Company

Q1: How recent do address proofs like utility bills or bank statements need to be?

A: For the purpose of company incorporation and director/shareholder address verification, utility bills (Electricity, Telephone, Mobile, Gas) and bank statements must not be older than two months from the date you file the incorporation application (SPICe+ form) with the Ministry of Corporate Affairs (MCA). This recency requirement is strictly checked by the ROC.

Q2: Can I use a residential address as the registered office address initially?

A: Yes, absolutely. You can use a residential address as the registered office for your company, provided it is located in India. You will need to furnish the appropriate documents as outlined above: if you own the residence, provide ownership proof and a recent utility bill; if you are renting, provide the rent agreement, an NOC from the landlord, and the landlord’s recent utility bill. Many startups begin by using a director’s residential address.

Q3: What’s the main difference between the Memorandum of Association (MoA) and Articles of Association (AoA)?

A: The MoA and AoA are the two charter documents of a company. The Memorandum of Association (MoA) defines the company’s objectives, powers, and scope – essentially what the company is authorized to do and its relationship with the outside world (e.g., main business activities, authorized capital). The Articles of Association (AoA) outline the internal rules, regulations, and procedures for the company’s governance and management – essentially how the company will operate internally (e.g., rules for share issuance, board meetings, director powers). Both are mandatory documents required for company incorporation.

Q4: Are the document requirements different if a director or shareholder is a foreign national or an NRI (Non-Resident Indian)?

A: Yes, the documentation requirements are different for foreign nationals and NRIs compared to Indian residents. Typically, they involve providing copies of their Passport (which serves as both ID and address proof), and these documents usually need to be notarized in their home country and then apostilled (if the country is a signatory to the Hague Apostille Convention) or consularized by the Indian embassy (if the country is not a signatory). Proof of address might require additional documents like recent bank statements or utility bills from their country of residence, also potentially needing notarization/apostille. Due to the complexities involving FEMA (Foreign Exchange Management Act) regulations and specific attestations, it’s highly recommended to consult experts like TaxRobo for accurate guidance in such cases.

Q5: Where can I find the official SPICe+ form and related information?

A: All official forms, including the SPICe+ web form, related guides, and information about company incorporation, are available on the official portal of the Ministry of Corporate Affairs (MCA): https://www.mca.gov.in/. The SPICe+ form is not a downloadable PDF for offline filling (except for the auto-generated INC-9); it is an integrated web form that needs to be filled and submitted online after logging into the MCA portal.

This design is spectacular! You obviously know how to keep a reader entertained. Between your wit and your videos, I was almost moved to start my own blog (well, almost…HaHa!) Fantastic job. I really enjoyed what you had to say, and more than that, how you presented it. Too cool!

Thanks for helping out, excellent information.