Blog Title: How can I create a diversified investment portfolio for long-term growth?

Introduction

Many small business owners and salaried individuals in India share common financial aspirations – securing a comfortable retirement, funding children’s education, expanding a business, or simply building wealth for the future. However, navigating the world of investments amidst market volatility and rising inflation can feel daunting. This is where the concept of a diversified investment portfolio becomes incredibly important. Simply put, it means spreading your investments across different types of assets rather than concentrating your money in one place. This strategy is fundamental for managing risk and is a cornerstone of successful long-term growth investment strategies India, especially given the dynamic nature of the Indian economy. Understanding how to build and manage such a portfolio is crucial for achieving financial security and peace of mind, whether you’re running your own business or earning a steady salary. This guide will provide a clear, step-by-step approach on how to create investment portfolio India, tailored for your needs. We’ll explore how a diversified investment portfolio can help you weather market storms and steadily grow your wealth over time.

Body

Understanding Diversification: Why It Matters for Indian Investors

Understanding the ‘why’ behind diversification is the first step towards building a robust financial future. It’s more than just investment jargon; it’s a practical strategy designed to protect and grow your hard-earned money, particularly relevant in the context of the Indian market which experiences its own unique cycles and economic shifts. Without diversification, your entire savings could be vulnerable to the poor performance of a single investment or asset class, making your financial journey unnecessarily stressful and potentially derailing your long-term goals. Embracing diversification strategies for Indian investors allows you to build a more resilient financial foundation.

What Exactly is a Diversified Investment Portfolio?

At its core, building a diversified investment portfolio follows the age-old wisdom: “Don’t put all your eggs in one basket.” It involves spreading your investment capital across various asset classes like stocks (equity), bonds (debt), gold, real estate, and potentially others. The magic lies in how these different asset classes behave under various market conditions. For instance, when the stock market is booming, certain debt instruments might offer lower returns, and vice-versa. By holding a mix, the potential losses in one area can be offset by gains in another, leading to a smoother overall investment journey. The goal is to select assets that have low or even negative correlation – meaning they don’t all move in the same direction at the same time – thus reducing the overall volatility of your portfolio compared to investing in a single asset type.

Key Benefits of Diversification Strategies for Indian Investors

Employing effective diversification strategies for Indian investors offers several compelling advantages, making it a non-negotiable aspect of sound financial planning:

- Risk Reduction: This is the most significant benefit. The Indian market, like any other, can experience downturns affecting specific sectors (like IT or Pharma) or the broader economy. A diversified portfolio cushions the impact, as it’s unlikely all asset classes will perform poorly simultaneously. If your equity investments dip, your debt or gold holdings might hold steady or even appreciate, lessening the overall blow to your capital.

- Potential for Stable Returns: While diversification aims to reduce risk, it doesn’t necessarily mean sacrificing returns entirely. By balancing potentially high-growth (but volatile) assets like equities with more stable, income-generating assets like bonds or FDs, you can aim for more consistent, predictable returns over the long term, aligning better with steady wealth creation goals.

- Inflation Hedging: Inflation erodes the purchasing power of money over time, a significant concern in India. Certain assets, traditionally gold and sometimes real estate, tend to perform well during inflationary periods, acting as a hedge. Including these in your portfolio can help preserve the real value of your investments against rising prices.

- Achieving Long-Term Goals: Financial goals like retirement, buying property, or funding education require substantial capital accumulated over many years. Diversification makes your investment plan more robust and increases the probability of reaching these goals by reducing the risk of catastrophic losses that could derail your progress.

Step 1: Assess Your Investor Profile – The Foundation for Your Portfolio

Before diving into specific investment options, you must first understand yourself as an investor. Just like a doctor diagnoses a patient before prescribing medicine, you need to assess your financial situation, goals, and comfort level with risk. This self-assessment forms the bedrock upon which your entire diversified investment portfolio will be built. Skipping this step is like building a house without a blueprint – you might end up with something that doesn’t suit your needs or withstand challenges. This foundational work is crucial for effective investment portfolio management for Indians, ensuring your strategy aligns perfectly with your individual circumstances.

Define Your Financial Goals

What are you saving and investing for? Be specific. Simply aiming for “wealth creation” isn’t enough. You need clearly defined financial goals, categorized by their time horizon. Think about:

- Short-term Goals (typically within 1-3 years): Examples include building an emergency fund, saving for a down payment on a car, planning a major vacation, or managing upcoming business cash flow needs. These goals usually prioritize capital preservation over high growth.

- Medium-term Goals (typically 3-10 years): This could involve saving for a house down payment, funding your child’s undergraduate education, accumulating capital for business expansion, or planning a significant renovation. A balance between growth and safety might be needed.

- Long-term Goals (typically 10+ years): Retirement planning is the classic example, but it also includes goals like funding postgraduate studies for children, leaving a legacy, or achieving complete financial independence. These goals allow for a greater focus on growth, as there’s more time to recover from potential market downturns.

Actionable Step: List down your financial goals. For each goal, estimate the amount needed and the timeframe you have to achieve it. This clarity will directly influence your investment choices later.

Determine Your Risk Tolerance

Risk tolerance refers to your ability and willingness to withstand potential losses in your investment value in exchange for the possibility of higher returns. It’s a combination of psychological comfort and financial capacity. Ask yourself: How would you react if your portfolio value dropped by 10%, 20%, or even 30% in a short period? Your risk tolerance generally falls into one of these categories:

- Conservative: You prioritize capital safety above all else and are uncomfortable with significant fluctuations in value. You prefer stable, predictable returns, even if they are modest.

- Moderate: You are willing to accept some level of risk and potential short-term losses for moderate growth potential. You seek a balance between safety and returns.

- Aggressive: You are comfortable with high volatility and the possibility of substantial short-term losses in pursuit of potentially higher long-term returns. You understand that higher rewards often come with higher risks.

Several factors influence your risk tolerance:

- Age: Younger investors generally have a higher risk tolerance as they have more time to recover from losses.

- Income Stability: A salaried individual with a secure job might have a higher tolerance than a small business owner with fluctuating income.

- Financial Dependents: Supporting family members might lower your willingness to take risks.

- Existing Liabilities: High debt levels (like loans) can reduce your capacity for risk.

- Investment Knowledge: Understanding investments can increase your comfort with calculated risks.

Your risk tolerance is a key determinant of your asset allocation strategy.

Establish Your Investment Horizon

Your investment horizon is simply the length of time you expect to keep your money invested before you need it back. This is closely linked to your financial goals. Short-term goals naturally have short investment horizons, while long-term goals like retirement have very long horizons (often decades). The longer your investment horizon, the more risk you can generally afford to take. This is because you have more time for your investments to potentially recover from market dips and benefit from the power of compounding. For instance, investing in equities might be too risky for a goal just two years away, but it’s often suitable for a retirement goal that’s 25 years in the future. Clearly defining your horizon for different goals helps in selecting the right asset classes.

Step 2: Explore Diversified Investment Options India

Once you understand your investor profile, the next step is to familiarize yourself with the various diversified investment options India offers. Each asset class comes with its own risk-reward profile, liquidity characteristics, and tax implications. Knowing these options allows you to select the right building blocks for your portfolio, tailored to your goals and risk appetite. India provides a wide spectrum of choices catering to different investor needs, from traditional safe havens to avenues for aggressive growth.

Equity Investments

Equity represents ownership in a company. Investing in stocks (shares) means you become a part-owner of that business, hoping to benefit from its growth and profitability through capital appreciation (increase in share price) and potentially dividends.

- Types: You can invest directly in stocks listed on exchanges like the National Stock Exchange (NSE) or Bombay Stock Exchange (BSE). Stocks are often categorized by company size: Large-cap (large, established companies like those in the Nifty 50 or Sensex), Mid-cap (medium-sized companies with growth potential), and Small-cap (smaller companies, potentially high growth but also higher risk). Alternatively, you can invest via Equity Mutual Funds, where a fund manager pools money from many investors to buy a diversified basket of stocks.

- Risk/Reward: Equities offer the potential for the highest long-term returns but also come with the highest volatility and risk of loss, especially in the short term. They are generally most suitable for long-term goals (5+ years).

- Indian Context: Familiarize yourself with benchmark indices like Nifty 50 and Sensex 30, which represent the performance of the largest companies. Tools like stock screeners and research reports can help in direct equity selection, while mutual funds offer professional management.

Debt Instruments

Debt instruments represent loans made by investors to entities like the government, banks, or corporations. In return for lending money, investors receive periodic interest payments and the principal amount back at maturity. They are generally considered safer than equities.

- Types: Common options in India include:

- Fixed Deposits (FDs): Offered by banks and Non-Banking Financial Companies (NBFCs). Provide fixed interest rates for a specific tenure. Generally safe but returns may barely beat inflation.

- Public Provident Fund (PPF): A government-backed long-term savings scheme (15-year lock-in, extendable) offering tax benefits on investment, interest earned, and maturity amount (EEE status). Interest rates are set quarterly by the government. [Check current PPF details on official government savings scheme portals].

- National Savings Certificate (NSC): Another government savings instrument with a fixed tenure (usually 5 years) and fixed interest rate, offering tax deduction under Section 80C.

- Bonds: Issued by the government (G-Secs – very safe) or corporations (Corporate Bonds – carry credit risk depending on the issuer’s rating). Can be bought directly or through Debt Mutual Funds.

- Debt Mutual Funds: Pool investor money to invest in a portfolio of debt instruments. Offer diversification and professional management within the debt category, with varying risk levels based on the underlying bonds’ duration and credit quality.

- Risk/Reward: Debt instruments offer lower risk compared to equity and provide relatively stable income or returns. They are suitable for capital preservation, generating regular income, and achieving short-to-medium-term goals. Bank FDs are generally safer than corporate FDs/bonds, which offer potentially higher rates but carry default risk. PPF is considered very safe due to government backing.

- Resource: For information on government savings schemes like PPF and NSC, refer to the Department of Posts or authorized bank websites. For RBI bonds, visit the Reserve Bank of India website.

Gold

Gold has traditionally been considered a store of value and a safe-haven asset in India, often performing well during times of economic uncertainty or high inflation. It acts as a good diversifier because its price movements often have a low correlation with equity markets.

- Forms:

- Physical Gold: Jewellery, coins, bars. Comes with storage costs, security concerns, making charges (for jewellery), and potential purity issues. Liquidity involves selling it physically.

- Gold ETFs (Exchange Traded Funds): Units representing physical gold held by the fund house, traded on stock exchanges like shares. Offers convenience, transparency, and avoids storage hassles. Requires a Demat account.

- Sovereign Gold Bonds (SGBs): Government securities denominated in grams of gold. Issued by the RBI. Offer fixed interest (currently 2.5% p.a.) in addition to capital appreciation linked to gold prices. Held in Demat or paper form. Tax-efficient, as capital gains on maturity are tax-exempt. However, they have specific issuance windows and a lock-in period (early exit options available on exchanges after a certain period, but may attract capital gains tax).

- Role: Primarily acts as a hedge against inflation and currency devaluation, and provides portfolio diversification. It’s generally not expected to provide high growth like equity but adds stability.

- Comparison: SGBs are often considered the most efficient way to invest in gold due to the interest income and tax benefits on maturity, followed by Gold ETFs for liquidity and ease of trading. Physical gold serves dual purposes (investment and consumption) but is less efficient purely from an investment perspective.

Real Estate

Investing in property has always been popular in India, seen as a tangible asset providing security and potential for appreciation.

- Forms:

- Physical Property: Buying residential apartments, houses, commercial shops, offices, or land. Offers potential rental income and capital appreciation.

- Real Estate Investment Trusts (REITs): Companies that own, operate, or finance income-producing real estate. Units of REITs are listed on stock exchanges, allowing smaller investors to participate in large-scale real estate projects (like office parks, malls). They distribute a significant portion of their rental income as dividends.

- Considerations: Physical real estate requires a large capital outlay, involves high transaction costs (stamp duty, registration), is highly illiquid (takes time to sell), and requires maintenance. Location is paramount. REITs offer much lower ticket sizes, higher liquidity (tradable on exchanges), diversification across multiple properties, and professional management, but their returns are linked to the performance of the underlying assets and market conditions. Rental income and capital gains from both forms are taxable.

Mutual Funds (as a Diversification Tool)

Mutual funds are a powerful tool for achieving diversification easily, especially for retail investors. They pool money from many investors and invest it in a diversified portfolio of securities (stocks, bonds, gold, etc.) based on a specific investment objective.

- Types:

- Equity Funds: Invest primarily in stocks (large-cap, mid-cap, small-cap, multi-cap, sectoral).

- Debt Funds: Invest in fixed-income instruments (liquid funds, short-duration funds, corporate bond funds, gilt funds).

- Hybrid Funds: Invest in a mix of equity and debt (e.g., balanced advantage funds, aggressive hybrid funds). Offer built-in asset allocation.

- Index Funds: Passively managed funds that aim to replicate the portfolio and performance of a specific market index (like Nifty 50 or Sensex). Lower cost than actively managed funds.

- ELSS (Equity Linked Savings Scheme): Equity mutual funds offering tax deduction under Section 80C, with a 3-year lock-in period.

- Benefit: Provide instant diversification even with small investment amounts. Managed by professional fund managers who handle research and portfolio construction. Offer convenience and accessibility.

- Actionable: Systematic Investment Plans (SIPs) are an excellent method for salaried individuals and small business owners to invest regularly in mutual funds with a fixed amount (as low as ₹500-₹1000 per month). SIPs help average out purchase costs over time (rupee cost averaging) and instill investment discipline.

- Resource: The Association of Mutual Funds in India (AMFI) website offers comprehensive investor education material, fund performance data, and details about various schemes.

Step 3: Building a Diversified Portfolio in India – Asset Allocation

After understanding your profile and the available investment options, the crucial next step is deciding how to divide your investment capital among different asset classes. This process is called asset allocation, and it’s widely considered the single most important factor determining your portfolio’s long-term returns and risk level – even more so than picking individual winning stocks or funds. Getting the allocation right is fundamental to building a diversified portfolio in India that aligns with your specific needs and financial journey. This strategic decision bridges the gap between your goals and the investment vehicles you choose.

What is Asset Allocation?

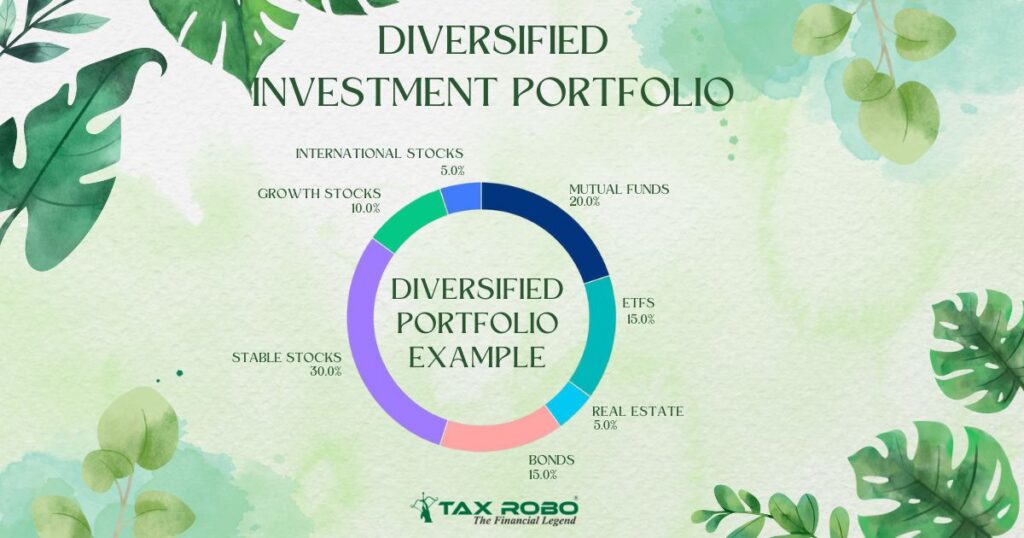

Asset allocation is the strategy of deciding what percentage of your total investment capital will be parked in each broad asset category – typically equity, debt, gold, and potentially real estate or other alternatives. For example, a moderate investor might decide on an allocation of 60% to Equity, 30% to Debt instruments, and 10% to Gold. This allocation isn’t arbitrary; it’s a direct reflection of the investor profile you defined in Step 1 – your financial goals, risk tolerance, and investment horizon. A younger investor with a high-risk tolerance and long-term goals might allocate a larger percentage to equities, while an older, conservative investor nearing retirement would likely have a higher allocation to safer debt instruments.

Strategies for Allocation

There are several approaches to determining your ideal asset allocation:

- Age-Based Rule (e.g., 100 – Age in Equity): A common rule of thumb suggests subtracting your age from 100 (or sometimes 110 or 120 for higher risk tolerance) to determine the percentage you should allocate to equities. For example, a 30-year-old might allocate 70% (100 – 30) to equity and 30% to debt. While simple, this is a very basic guideline and should be adjusted based on individual risk tolerance, goals, and financial situation.

- Goal-Based Allocation: This approach links specific asset allocations to particular financial goals. For a long-term goal like retirement (25 years away), you might adopt a more aggressive allocation (e.g., 70% equity, 20% debt, 10% gold). For a medium-term goal like a house down payment (5 years away), a more balanced or conservative allocation might be appropriate (e.g., 30% equity, 60% debt, 10% gold) to reduce volatility as the goal nears. Short-term goals (1-2 years) should ideally be funded through very safe debt instruments or cash equivalents.

- Risk Profile-Based Allocation: This directly uses your assessed risk tolerance:

- Conservative: Higher allocation to Debt (e.g., 60-75%), lower to Equity (e.g., 15-30%), moderate to Gold/Others (e.g., 10%).

- Moderate: Balanced allocation, e.g., Equity (40-60%), Debt (30-50%), Gold/Others (10-15%).

- Aggressive: Higher allocation to Equity (e.g., 65-80%), lower to Debt (e.g., 10-25%), moderate to Gold/Others (e.g., 10%).

Here’s a sample table illustrating potential allocations:

| Investor Profile | Equity Allocation | Debt Allocation | Gold/Other Allocation | Primary Focus |

|---|---|---|---|---|

| Conservative | 20% – 40% | 50% – 70% | 10% – 15% | Capital Preservation |

| Moderate | 40% – 60% | 30% – 50% | 10% – 15% | Balanced Growth |

| Aggressive | 60% – 80% | 10% – 30% | 10% | High Growth |

(Note: These are illustrative examples. Your ideal allocation may vary.)

Choosing Specific Investments

Once you’ve decided on your target asset allocation percentages, the final step in building the initial portfolio is selecting the specific investment products within each asset class. For example, within your 60% equity allocation, you might decide to invest 40% through diversified equity mutual funds (perhaps a mix of large-cap and flexi-cap funds) and 20% directly in a few well-researched stocks. Similarly, within your 30% debt allocation, you might choose a combination of PPF, bank FDs, and a short-duration debt mutual fund. Always conduct thorough due diligence before investing in any specific product. Research the fund’s track record, expense ratio, fund manager’s expertise (for MFs), the company’s fundamentals (for stocks), or the issuer’s credit rating (for bonds). Consider seeking advice from a qualified financial advisor if you’re unsure. Following these tips for diversified portfolio India ensures you not only allocate correctly but also choose quality investments within each category.

Step 4: Managing Your Portfolio – Monitoring and Rebalancing

Creating your diversified investment portfolio is just the beginning. The real work lies in managing it effectively over the long term. Markets change, your financial situation evolves, and your investments will perform differently over time. Therefore, ongoing monitoring and periodic adjustments are essential to ensure your portfolio stays aligned with your goals and risk tolerance. This active management phase involves keeping track of your investments and making necessary tweaks, primarily through rebalancing, ensuring your strategy remains effective throughout your investment journey.

The Importance of Regular Review

It’s crucial to review your investment portfolio periodically. A common recommendation is to conduct a thorough review at least once a year, perhaps around the same time each year (e.g., end of the financial year). You might also consider semi-annual check-ins. More frequent monitoring (like monthly or quarterly) might be necessary if you have very specific short-term goals or if market conditions are extremely volatile, but avoid obsessive daily tracking which can lead to impulsive decisions.

During your review, you should check:

- Performance: How have your investments performed relative to their respective benchmarks (e.g., Nifty 50 for large-cap equity funds, relevant debt indices)?

- Asset Allocation Drift: Has the performance of different asset classes caused your current allocation to deviate significantly from your target allocation? (More on this under rebalancing).

- Goal Alignment: Is your portfolio still on track to meet your financial goals based on current projections? Do your goals themselves need updating?

- Changes in Personal Circumstances: Have there been major life events like marriage, childbirth, job change, significant income increase/decrease, or inheritance that might necessitate a change in your risk tolerance or investment strategy?

Portfolio Rebalancing Explained

Portfolio rebalancing is the process of bringing your portfolio’s asset allocation back to its original target percentages. Over time, due to differing returns across asset classes, your allocation will naturally drift. For example, if equities have performed exceptionally well, your equity allocation might increase from a target of 60% to 70%, while your debt allocation might fall from 30% to 20%. This increased equity exposure means your portfolio is now riskier than you initially intended.

Why Rebalance?

- Risk Management: It ensures your portfolio’s risk level stays consistent with your tolerance. Letting equity allocation grow unchecked increases potential downside during market corrections.

- Disciplined Investing: It forces you to systematically “sell high” (trimming assets that have performed well and become overweight) and “buy low” (adding to assets that have underperformed and become underweight). This counterintuitive discipline is key to long-term success.

How to Rebalance?

There are two main ways:

- Sell & Buy: Sell some of the outperforming assets and use the proceeds to buy more of the underperforming assets until the target allocation is restored. (Be mindful of potential transaction costs and taxes).

- Adjust Future Investments: Direct new investments (like monthly SIPs) disproportionately towards the underperforming asset classes until the target allocation is reached over time. This avoids potential taxes from selling but might take longer.

Rebalancing is typically done when the allocation drifts significantly (e.g., by +/- 5% or 10% from the target) or during your scheduled annual review.

Tips for Diversified Portfolio India: Stay Disciplined

Managing your portfolio effectively requires discipline, especially in the face of market noise and volatility, which are common in the Indian context. Here are some crucial tips for diversified portfolio India management:

- Avoid Emotional Decisions: Fear and greed are investors’ worst enemies. Don’t panic sell during market dips or chase returns by jumping into assets that have recently soared. Market timing is notoriously difficult.

- Stick to Your Long-Term Plan: Remember why you created your diversified portfolio and asset allocation in the first place. Trust the process and your long-term strategy, which is designed to navigate market cycles.

- Automate Investments: Use SIPs for mutual funds and recurring deposits for debt instruments where possible. Automation removes the emotional element from regular investing and ensures consistency.

- Focus on What You Can Control: You can’t control market movements, but you can control your savings rate, your asset allocation, your investment costs (choosing low-cost funds like index funds where appropriate), and your own behavior.

- Keep Learning: Stay informed about basic financial concepts and market trends, but filter out the daily noise. Understand the investments you hold.

Step 5: Understanding Tax Implications on Your Investments in India

A crucial, yet often overlooked, aspect of investment portfolio management for Indians is understanding the tax implications of your investment decisions. Taxes can significantly impact your net returns, and being aware of the rules allows you to plan more effectively and potentially utilize tax-saving opportunities. Ignoring taxes can lead to unpleasant surprises and reduce the overall growth of your diversified investment portfolio. TaxRobo emphasizes integrating tax planning seamlessly into your investment strategy for optimal financial outcomes.

Taxation of Capital Gains

When you sell an investment (like stocks, mutual fund units, gold, or property) for a profit, the gain is typically subject to Capital Gains Tax. For a comprehensive overview, refer to our guide on Understanding Capital Gains Tax in India. The tax rate depends on the type of asset and how long you held it (holding period).

- Short-Term Capital Gains (STCG): Profit from selling an asset held for a short duration.

- Long-Term Capital Gains (LTCG): Profit from selling an asset held for a longer duration.

Here’s a simplified breakdown for common assets (Tax laws can change, always refer to the latest rules or consult a tax professional):

| Asset Type | Holding Period for LTCG | STCG Tax Rate (Typical) | LTCG Tax Rate (Typical) | Indexation Benefit on LTCG? |

|---|---|---|---|---|

| Equity Shares (Listed) & Equity MFs | > 1 year | 15% (plus cess & surcharge, if applicable) | 10% on gains exceeding ₹1 Lakh per FY (plus cess etc.) | No |

| Debt Mutual Funds | > 3 years | Added to income (taxed at slab rate) | 20% (plus cess etc.) | Yes |

| Bank FDs, Bonds (Interest Income) | N/A (Taxed as income) | Added to income (taxed at slab rate) | N/A | N/A |

| Gold (Physical, ETFs, Digital Gold) | > 3 years | Added to income (taxed at slab rate) | 20% (plus cess etc.) | Yes |

| Sovereign Gold Bonds (SGBs) | > 3 years (if sold on exchange) | Added to income (taxed at slab rate) if sold < 1 yr. If sold on exchange 1-5 yrs (complex – seek advice). If held till maturity (8 yrs) – Tax Exempt! | 20% (plus cess etc.) if sold on exchange after 3 years. | Yes (if sold on exchange) |

| Real Estate (Property) | > 2 years | Added to income (taxed at slab rate) | 20% (plus cess etc.) | Yes |

(Note: For specific details on property sales, see our article on Tax Implications When Selling Property: What to Know.)

Indexation Benefit: For assets eligible for indexation (like Debt MFs, Gold, Real Estate), the purchase price is adjusted upwards using the government’s Cost Inflation Index (CII). This effectively reduces your taxable long-term capital gain by accounting for inflation during the holding period.

Tax on Dividends and Interest Income

Income received in the form of dividends from stocks or mutual funds, and interest earned from FDs, bonds, savings accounts, PPF (interest is tax-free), etc., also has tax implications.

- Dividends: Dividends received from Indian companies or equity/debt mutual funds are now added to your total income and taxed according to your applicable income tax slab rate. Tax Deducted at Source (TDS) may apply if the dividend amount exceeds certain thresholds (e.g., ₹5,000 from a company or mutual fund).

- Interest Income: Interest earned from most sources like Bank FDs, Corporate Bonds, National Savings Certificates (NSC – accrued interest reinvested is eligible for 80C deduction but taxable on maturity), and savings accounts is also added to your total income and taxed at your slab rate. An exception is the interest earned on PPF, which is tax-free. A deduction up to ₹10,000 under Section 80TTA is available on savings bank interest (higher limit for senior citizens under 80TTB).

Tax-Saving Investment Options (Brief Recap)

Integrating tax planning involves strategically using investment options that offer tax benefits under the Indian Income Tax Act. For a detailed list, check the Top Tax-Saving Investment Options in India. Key options include:

- Section 80C: Offers deduction up to ₹1.5 Lakh per financial year for investments in specified instruments like:

- Equity Linked Savings Scheme (ELSS) Mutual Funds (3-year lock-in)

- Public Provident Fund (PPF)

- National Savings Certificate (NSC)

- Tax-saving Fixed Deposits (5-year lock-in)

- Life Insurance Premiums

- Home Loan Principal Repayment

- National Pension System (NPS): Offers additional deduction under Section 80CCD(1B) up to ₹50,000, over and above the 80C limit. Employer contributions also have tax benefits.

- Health Insurance Premiums: Deduction under Section 80D.

- Sovereign Gold Bonds (SGBs): As mentioned, LTCG on maturity is tax-exempt. Interest earned is taxable.

Effectively managing your diversified investment portfolio means being mindful of these tax rules when making investment and redemption decisions. For complex situations, seeking professional tax advice is highly recommended.

- Resource: For the latest and most accurate tax rules, always refer to the official Income Tax Department of India website.

Conclusion

Creating and managing a diversified investment portfolio is not a one-time task but an ongoing process that requires careful planning, discipline, and periodic review. By following the steps outlined – assessing your investor profile, exploring diverse investment options available in India, strategically allocating your assets, building your portfolio, diligently monitoring and rebalancing it, and understanding the associated tax implications – you lay a strong foundation for achieving your long-term financial goals. Remember, the core idea is to manage risk effectively while capturing growth opportunities across different market segments.

While building a diversified investment portfolio demands effort and commitment, the potential rewards in terms of financial security and steady wealth creation make it an indispensable part of long-term growth investment strategies India. Whether you are a small business owner planning for expansion or a salaried individual saving for retirement, a well-structured and managed portfolio can significantly enhance your ability to navigate India’s economic landscape and secure your financial future. Don’t let complexity deter you; start your investment journey today, even if it’s with small, regular contributions. For personalized guidance tailored to your unique circumstances and help integrating complex tax considerations into your financial plan, consider consulting a qualified financial advisor. Understanding the tax impact of investments is crucial, and services like TaxRobo Online CA Consultation Service can assist in ensuring your investment strategy is tax-efficient and compliant.

Frequently Asked Questions (FAQs)

Q1: How much money do I need to start building a diversified portfolio in India?

Answer: You don’t need a large sum to start! The beauty of modern investment options, especially Mutual Funds, is their accessibility. You can begin building a diversified portfolio in India with Systematic Investment Plans (SIPs) in diversified mutual funds (like index funds or balanced advantage funds) for as little as ₹500 or ₹1000 per month. The key is to start early and invest regularly, allowing the power of compounding to work for you. Consistency is more important than the initial amount when you’re just starting out.

Q2: How often should I review and rebalance my diversified investment portfolio?

Answer: A general best practice is to review your diversified investment portfolio thoroughly at least once a year. You should also rebalance annually, or sooner if your asset allocation drifts significantly from your target – for instance, if any asset class becomes overweight or underweight by more than 5% or 10%. Additionally, it’s wise to review your portfolio whenever you experience a major life event, such as a change in income, job loss, marriage, birth of a child, or receiving an inheritance, as these events might alter your financial goals or risk tolerance.

Q3: What are the most common mistakes Indian investors make when diversifying?

Answer: Some common pitfalls include:

- Over-diversification (Diworsification): Holding too many similar investments (e.g., multiple large-cap funds with overlapping stocks) which dilutes returns without significantly reducing risk further and makes portfolio tracking complex.

- Under-diversification: Concentrating too much wealth in a single stock, sector, or asset class, leading to excessive risk.

- Chasing Past Performance: Investing heavily in assets or funds solely because they performed well recently, without considering if that performance is sustainable or fits their risk profile.

- Ignoring Tax Implications: Making investment decisions without considering the impact of STCG, LTCG, or taxes on dividends/interest, which can erode net returns.

- Emotional Investing: Making impulsive buy/sell decisions based on market noise, fear, or greed, rather than sticking to a long-term plan.

- Not Rebalancing: Allowing asset allocation to drift significantly over time, inadvertently increasing portfolio risk.

Q4: Can I manage my diversified investment portfolio myself, or do I need an advisor?

Answer: Managing your own diversified investment portfolio (DIY investing) is certainly possible if you have the time, interest, and knowledge to research investments, monitor markets, understand asset allocation principles, track performance, and stay disciplined. However, for many busy small business owners or salaried individuals, a qualified financial advisor (like a SEBI Registered Investment Adviser – RIA) can add significant value. An advisor provides expertise, creates a personalized strategy based on your goals and risk profile, helps maintain investment discipline (especially during volatile times), handles the complexities of portfolio construction and rebalancing, and integrates tax planning, ultimately saving you time and potentially improving outcomes.

Q5: Are there specific diversified investment options India that are best for beginners?

Answer: Yes, beginners should typically start with simpler, inherently diversified products before venturing into more complex ones. Good starting points include:

- Diversified Mutual Funds: Consider Index Funds (tracking Nifty 50 or Sensex) for broad market exposure at low cost, or Balanced Advantage Funds / Dynamic Asset Allocation Funds which automatically adjust equity/debt mix based on market conditions. Flexi-cap funds that invest across market caps are also good options.

- Basic Debt Instruments: Start with relatively safe options like the Public Provident Fund (PPF) for long-term savings with tax benefits, or Bank Fixed Deposits (FDs) for short-term goals, understanding their interest rates and taxability.

- ELSS Funds: If seeking tax savings under Section 80C along with equity exposure (suitable for moderate/aggressive risk profiles with a 3+ year horizon).

- It’s generally advisable to gain experience with these before considering direct stock investing, complex derivatives, or alternative investments.