India, a vibrant and growing economy, is a land of opportunities for aspiring entrepreneurs. Starting a business here can be an incredibly rewarding journey, and the first crucial step is understanding the process of company registration. This guide unravels the complexities of registering a company in India, focusing primarily on the popular choice: the Private Limited Company (Pvt Ltd). We’ll address the frequently asked questions, covering eligibility, costs, procedures, and essential requirements to set you on the path to business success.

India offers various business structures, each with its own legal framework and compliance requirements. Choosing the right structure is paramount and depends on factors like the scale of operations, funding needs, and liability preferences. While Sole Proprietorships offer ease of setup, they lack legal distinction from the owner. Partnerships bring together multiple individuals but also carry unlimited liability. For businesses seeking formal recognition, limited liability, and potential for growth and investment, Private Limited Companies stand out as a preferred choice.

This guide will delve into the nuances of registering a Pvt Ltd company, providing a clear roadmap for Indian entrepreneurs.

1. Eligibility to Form a Private Limited Company in India: Who Can Embark on This Journey?

Before diving into the registration process, it’s vital to understand the eligibility criteria for forming a Pvt Ltd company. These requirements ensure a structured and legally sound entity.

- Single Person Ownership and the One Person Company (OPC) Alternative: A core characteristic of a Pvt Ltd company is its requirement for at least two members. Therefore, a single individual cannot directly form a Pvt Ltd company. However, Indian company law provides an excellent alternative for solo entrepreneurs: the One Person Company (OPC). An OPC allows a single person to establish a company with limited liability, enjoying the benefits of a corporate structure while retaining sole ownership and control. If you’re a solo founder, exploring the OPC structure is highly recommended as it offers a pathway to formal business registration with limited liability and separate legal entity status.

- Minimum and Maximum Members (Shareholders): A Pvt Ltd company must have at least two shareholders. These can be individuals or entities (like other companies or LLPs). The maximum limit for shareholders in a private limited company is 200. This structure allows for collective ownership and fundraising potential.

- Directors – The Guiding Force: Just as shareholders own the company, directors manage its affairs. A Pvt Ltd company mandates a minimum of two directors. Crucially, at least one director must be a resident of India. A “resident” is defined under the Income Tax Act as someone who has resided in India for 182 days or more during the immediately preceding financial year. This residency requirement ensures local accountability and governance within the company. Directors are responsible for the strategic direction and legal compliance of the company.

- Capital Requirement – Dispelling the Minimum Capital Myth: Contrary to some outdated notions, there is no mandatory minimum capital requirement to start a Pvt Ltd company in India. The concept of a minimum paid-up capital of ₹1 lakh has been abolished. This is a significant advantage for startups and small businesses. However, it’s important to define an Authorized Capital during registration, which is the maximum capital the company can raise by issuing shares. While no minimum, the authorized capital chosen influences the stamp duty applicable during incorporation. The company must have sufficient capital to fund its initial operations and growth plans.

- Single Person Ownership and the One Person Company (OPC) Alternative: A core characteristic of a Pvt Ltd company is its requirement for at least two members. Therefore, a single individual cannot directly form a Pvt Ltd company. However, Indian company law provides an excellent alternative for solo entrepreneurs: the One Person Company (OPC). An OPC allows a single person to establish a company with limited liability, enjoying the benefits of a corporate structure while retaining sole ownership and control. If you’re a solo founder, exploring the OPC structure is highly recommended as it offers a pathway to formal business registration with limited liability and separate legal entity status.

2. Navigating the Registration Process: A Step-by-Step Guide to Incorporating Your Pvt Ltd Company

Registering a Pvt Ltd company in India is now largely an online process, streamlined by the Ministry of Corporate Affairs (MCA). Here’s a detailed breakdown of the steps:

1. Name Reservation – Finding the Right Identity: The first step is to choose a unique and relevant name for your company. This name will be your company’s identity and must not be identical or deceptively similar to any existing company or trademark.

- Name Availability Check: Use the MCA portal (www.mca.gov.in ) to perform a name search and check for existing companies with similar names. The MCA provides a “Check Company/LLP Name” service.

- RUN (Reserve Unique Name) Form: File a RUN form on the MCA portal to reserve your chosen name. You can propose up to two names in order of preference. The MCA will examine the proposed names based on name availability guidelines, trademark conflicts, and undesirability criteria.

- Name Approval or Rejection: If your name is approved, it will be reserved for a specified period (typically 20 days), giving you time to complete the remaining registration formalities. If rejected, you’ll need to re-apply with new name options. Choosing a distinctive name, checking trademark databases, and understanding MCA’s name guidelines are crucial for a smooth name approval process.

2. Director Identification Number (DIN) – Identifying the Key Individuals: A Director Identification Number (DIN) is a unique identification number assigned to an individual who is intended to be a director of a company.

- DIN Application (through SPICe+): Previously, DIN was applied for separately. Now, the application for DIN for proposed directors is integrated into the company incorporation process through the SPICe+ form (Simplified Proforma for Incorporating Company Electronically Plus).

- Required Information: While submitting SPICe+, you will need to provide necessary details and documents of the proposed directors for DIN allotment, including identity and address proof.

- DIN Allotment: Upon successful verification of documents and information, DINs will be allotted to the directors. For individuals already holding a DIN, there’s no need to obtain a new one.

3. Preparation of Essential Documents – Laying the Foundation: Several crucial documents form the bedrock of your company and are required for registration.

- Memorandum of Association (MoA): The MoA is the company’s constitution, defining its objectives and the scope of its activities. It outlines the main business activities the company will undertake. Key clauses in the MoA include:

- Name Clause: The registered name of the company.

- Registered Office Clause: The state in which the registered office will be located.

- Objects Clause: Details the main and ancillary objects (business activities) of the company. Clearly defining the objects clause is important as it sets the boundaries for the company’s operations.

- Liability Clause: States that the liability of the members is limited.

- Capital Clause: Specifies the authorized share capital and its division into shares.

- Subscription Clause: Contains the declaration by the subscribers (initial shareholders) to the MoA that they wish to be associated with the company.

- Articles of Association (AoA): The AoA contains the rules and regulations for the internal management of the company. It governs the operational aspects and internal workings of the company. It covers aspects like:

- Share Allotment and Transfer: Procedures for issuing and transferring shares.

- Meetings (Board Meetings and General Meetings): Rules for conducting company meetings.

- Directors’ Powers and Responsibilities: Defines the powers, duties, and responsibilities of the directors.

- Dividend Distribution: Process for declaring and distributing dividends to shareholders.

- Accounting and Auditing: Provisions related to maintaining accounts and conducting audits.

- Identity, Address Proofs and PAN Card of Directors and Shareholders: Valid identity and address proofs are required for all directors and shareholders. These documents need to be self-attested and should be recent.

- PAN Card: Mandatory for all Indian directors and shareholders.

- Aadhaar Card: Acceptable as address and identity proof for Indian nationals.

- Passport, Driving License, Voter ID: Other acceptable identity proofs.

- Bank Statement, Utility Bills (Electricity, Telephone, Gas Bill): Acceptable address proofs not older than two months.

- For Foreign Nationals: Passport is the primary identity proof. Overseas address proof and apostilled or notarized documents may be required for foreign individuals.

- Registered Office Proof: You need to provide proof of the registered office address of the company. This address will be the official communication address for all regulatory purposes.

- Rental Agreement: If the registered office is rented, a valid rental agreement with a No Objection Certificate (NOC) from the landlord.

- Ownership Proof: If the premises are owned by a director or the company, ownership documents like property tax receipt or sale deed along with a NOC might be required.

- Utility Bill: A recent utility bill (electricity, telephone, gas bill) in the name of the owner or the company (if applicable) for the registered office address, not older than two months.

- Home Address as Registered Office: Yes, you can use a home address as the registered office. You will need to provide a utility bill in the name of the homeowner and a NOC from the homeowner if the property is not owned by a director of the company.

4. Filing Forms on the MCA Portal and SPICe+ Form – The Online Submission: The heart of the registration process is the online submission of forms through the MCA portal.

- SPICe+ Form (INC-32): SPICe+ is a comprehensive web form that integrates various services related to company incorporation. It streamlines the process and allows for single-window clearance for many aspects of company registration. SPICe+ is broadly divided into two parts:

- Part A: For name reservation (can be done independently before Part B).

- Part B: For company incorporation, DIN allotment (for proposed directors), PAN and TAN application, GSTIN (optional), EPFO/ESIC registration (optional), Bank Account opening (optional) and more.

- e-MoA (INC-33) and e-AoA (INC-34): These are electronic forms for the Memorandum of Association and Articles of Association, respectively, which are digitally signed and uploaded along with SPICe+.

- AGILE-PRO-S Form (INC-35): This form is also part of SPICe+ and is used for mandatory registrations like GSTIN, EPFO, ESIC, and Professional Tax registration (for Maharashtra-based companies). It aims to simplify and integrate these registrations during incorporation.

- Digital Signature Certificates (DSC): All forms submitted online must be digitally signed by the directors. Directors will need to obtain Class 2 or Class 3 Digital Signature Certificates from certified certifying authorities. DSCs are essential for secure online transactions and document signing on the MCA portal.

5. Payment of Registration Fees – The Monetary Aspect: Upon submission of forms, you need to pay the applicable registration fees.

- Fee Structure: The registration fee depends on various factors including authorized capital and the number of forms filed. The MCA fee structure is dynamic and updated from time to time. It’s no longer solely based on authorized capital but rather based on the forms being processed and stamp duty (applicable in some states).

- Online Payment: Payment is made online through the MCA portal using credit/debit cards, net banking, or other online payment modes.

- Stamp Duty: Stamp duty is applicable on the authorized capital as per the respective state laws where the registered office is located. This may vary from state to state and is usually payable electronically during the incorporation process.

6. Certificate of Incorporation – The Official Birth Certificate of Your Company: Once the Registrar of Companies (ROC) is satisfied with the documents and information submitted, and the fees are paid, the ROC will issue the Certificate of Incorporation.

- Proof of Legal Existence: This certificate is the conclusive proof of the company’s legal existence and the date of its incorporation. It contains the Corporate Identification Number (CIN), which is a unique identification number for the company.

- Commencement of Business: From the date mentioned on the Certificate of Incorporation, your Pvt Ltd company is officially registered and can commence its business operations.

- Digital and Physical Certificate: The Certificate of Incorporation is typically issued digitally and can be downloaded from the MCA portal. A physical copy is also dispatched by post in some cases.

3. Key Requirements and Costs – Understanding the Practicalities

Beyond the legal eligibility and procedures, understanding the practical aspects of requirements and costs is crucial for planning your company registration.

- Turnover – No Initial Threshold: There is no minimum turnover required to start a Pvt Ltd company. This makes it accessible for businesses of all sizes, including startups with initial low or no turnover. Turnover becomes relevant later for tax audits and other regulatory compliances as the business grows.

- Registration Cost – Estimating the Investment: The registration cost is generally in the range of ₹7,000–₹15,000 or more. This is an approximate estimate and can vary based on several factors:

- Government Fees: MCA registration fees, stamp duty (which can vary significantly depending on the state and authorized capital).

- Professional Fees: If you hire a Company Secretary (CS), Chartered Accountant (CA), or lawyer for assistance, their professional fees will be an added cost. These can vary based on the professional’s experience and complexity of the case. Professional help is recommended for ensuring accuracy and compliance, especially for first-time entrepreneurs.

- Digital Signature Certificate (DSC) Costs: Cost of obtaining DSCs for directors.

- Other Incidental Expenses: Notarization, printing, documentation charges.

- Authorized Capital and Stamp Duty: Stamp duty is often linked to the authorized capital and state regulations, influencing the overall cost.

- Timeline for Registration – How Long Does It Take? The standard timeline for online registration is approximately 10–15 working days. However, this is an indicative timeline, and the actual time may vary depending on:

- Name Availability and Approval: If your chosen name needs revisions or if there are queries from the MCA regarding name approval, it can extend the process.

- Document Accuracy and Completeness: Errors or incomplete documents can lead to rejections and delays. Ensuring accurate and complete documentation is crucial.

- MCA Processing Time: The processing time at the Registrar of Companies (ROC) can fluctuate based on workload and volume of applications.

Professional Assistance: Hiring experienced professionals can often expedite the process as they are familiar with the requirements and procedures.

4. Essential Documents Required – A Ready Reckoner

Having all the required documents ready beforehand is key to a smooth and timely registration process. Here’s a summary of the documents:

- PAN Cards of Directors and Shareholders: Mandatory for all Indian individuals. For foreign nationals, passport is essential.

- Identity Proof of Directors and Shareholders: Aadhaar Card, Passport, Driving License, Voter ID. (Self-attested and valid).

- Address Proof of Directors and Shareholders: Aadhaar Card, Passport, Bank Statement, Utility Bills (electricity, telephone, gas bill – not older than two months). (Self-attested and valid).

- Utility Bill or Rent Agreement with NOC for Registered Office Address: Electricity Bill, Telephone Bill, Gas Bill (not older than two months) or Rental Agreement and NOC from Landlord if rented. Ownership documents if owned.

- Digital Signature Certificates (DSC) for Directors: Class 2 or Class 3 DSC from a certified certifying authority.

- Passport-sized Photographs of Directors and Shareholders: May be required for certain forms or KYC processes.

5. Common Queries Answered – Addressing Your Concerns

Entrepreneurs often have similar questions regarding company registration. Let’s address some common queries:

1. Can I Start a Pvt Ltd Company from Home?Yes! A home address can absolutely serve as the registered office of your Pvt Ltd company. You simply need to provide valid registered office proof – typically a utility bill (electricity bill, for instance) in the name of the homeowner along with a No Objection Certificate from the homeowner if you are not the owner. However, consider if using a residential address aligns with your business image and future operations. Some businesses might prefer a commercial address for client meetings or credibility.

2. Is Company Registration Compulsory?Yes, for formal business structures like Pvt Ltd, LLP, and OPC. If you intend to operate as a Private Limited Company, Limited Liability Partnership (LLP), or One Person Company (OPC), registration with the Registrar of Companies (ROC) is mandatory under the Companies Act, 2013 or LLP Act, 2008.

1. Sole Proprietorship Exception: Sole proprietorships, on the other hand, do not require mandatory registration under company law. However, while simpler to set up, they lack the legal protection and benefits of a registered company, particularly limited liability.

2. Benefits of Registration: Registration provides numerous advantages including:

- Limited Liability: Protects personal assets from business debts.

- Separate Legal Entity: The company is legally distinct from its owners.

- Enhanced Credibility and Trust: Easier to secure funding, contracts, and build customer trust.

- Scalability and Growth Potential: Easier to raise capital, expand operations, and attract talent.

3. How to Convert a Proprietorship to a Pvt Ltd Company? You cannot directly “convert” a sole proprietorship into a Pvt Ltd company. Instead, you need to follow the process of fresh incorporation for a Pvt Ltd company as outlined above. Here’s a conceptual overview:

- New Incorporation: Apply for fresh incorporation of a Pvt Ltd company with ROC.

- Transfer of Assets and Liabilities: Once the Pvt Ltd company is incorporated, you will need to formally transfer the assets and liabilities of the existing proprietorship business to the newly formed Pvt Ltd company through appropriate agreements and documentation. This may involve transferring contracts, bank accounts, and other business assets.

- Closure of Proprietorship (Optional): You may choose to wind down the sole proprietorship after the transfer is complete.

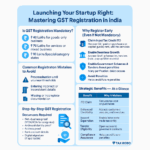

4. CST Registration – Understanding Sales Tax:Central Sales Tax (CST) is no longer applicable. CST was a tax on interstate sales but has been subsumed under the Goods and Services Tax (GST) regime. You will need to obtain GST registration if your company’s aggregate turnover exceeds the prescribed threshold (currently ₹40 lakhs for goods and ₹20 lakhs for services, with some exceptions and state-specific variations). GST registration allows you to legally collect GST on your sales and claim input tax credit, which is crucial for businesses involved in buying and selling goods or services. GST registration is obtained through the GST portal (www.gst.gov.in ).

5. Company Registration Certificate – Your Proof of Incorporation: The Company Registration Certificate (Certificate of Incorporation) is issued by the Registrar of Companies (ROC) after Successful completion of the registration process. It serves as the official and legally valid document confirming the incorporation of your Pvt Ltd company. It’s crucial to maintain this certificate safely as it will be required for various legal and operational purposes throughout the company’s existence. You can download a digital copy from the MCA portal and typically receive a physical copy as well.

6. DIY vs. Professional Help – Making an Informed Choice

You have the option to register your company yourself (“DIY”) by navigating the MCA portal and completing the necessary forms. Alternatively, you can engage professional help from a Company Secretary (CS) or Chartered Accountant (CA). Here’s a comparative look to help you decide:

- DIY (Do-It-Yourself):

- Pros: Cost-effective, learn the process firsthand.

- Cons: Time-consuming, potential for errors leading to rejection and delays, requires good understanding of legal and regulatory requirements, ongoing compliance might be overlooked.

- Professional Help (CS/CA):

- Pros: Expert guidance, saves time and effort, ensures accuracy and compliance, reduces risk of rejection, assistance with documentation and filing, can advise on initial and ongoing compliance requirements.

- Cons: Involves professional fees.

When is DIY Feasible?

- For straightforward cases with clear understanding of the process and documentation.

- If you have ample time and are comfortable researching and understanding legal requirements.

- For very simple company structures with minimal complexities.

When is Professional Help Recommended?

- For first-time entrepreneurs unfamiliar with the process.

- For complex cases like OPC registration, conversion of existing businesses, or specific regulatory requirements.

- When time is a constraint and you want to ensure a smooth and error-free registration process.

- To ensure compliance and avoid potential legal issues in the future.

- For guidance on post-incorporation compliances and ongoing regulatory requirements.

Role of Company Secretary (CS) and Chartered Accountant (CA):

- Company Secretary (CS): Experts in company law, corporate governance, and compliance. They assist with company formation, legal documentation, regulatory filings, and ensuring company secretarial compliance.

- Chartered Accountant (CA): Experts in accounting, taxation, and financial matters. They can assist with financial planning, tax registration (GST, PAN, TAN), accounting setup, and financial compliance. Both CS and CA professionals can significantly simplify the registration process and ensure ongoing compliance for your company.

Conclusion: Embark on Your Entrepreneurial Journey with Confidence

Registering a Pvt Ltd company in India is a structured and increasingly streamlined process. By understanding the eligibility criteria, meticulously preparing your documents, leveraging the online MCA portal, and choosing the right approach (DIY or professional help), you can successfully navigate the registration process. Remember to select a unique company name, gather all necessary documents in advance, and consider professional guidance for complex scenarios or to ensure seamless compliance.

With your Pvt Ltd company registered, you’ll be equipped with a robust legal structure, limited liability, and enhanced credibility, setting a strong foundation for your entrepreneurial success in the dynamic Indian market. Take the first step today, plan your registration process carefully, and embark on your exciting journey of building and growing your business in India.

What i don’t understood is actually how you’re not actually much more well-liked than you may be now. You’re so intelligent. You realize therefore significantly relating to this subject, produced me personally consider it from so many varied angles. Its like men and women aren’t fascinated unless it is one thing to do with Lady gaga! Your own stuffs great. Always maintain it up!