Understanding the Composition Scheme Under GST

Dealing with Goods and Services Tax (GST) compliance can often feel overwhelming, especially for small business owners in India. The paperwork, calculations, and deadlines can seem complex. But what if there was a simpler way? Thankfully, the Indian GST regime offers an alternative designed specifically for smaller taxpayers: the composition scheme under GST.

Before diving into the scheme, let’s quickly recap GST. It’s an indirect tax applicable on the supply of goods and services across India. It comprises Central GST (CGST), State GST (SGST)/Union Territory GST (UTGST), and Integrated GST (IGST), depending on the nature of the transaction (intra-state or inter-state). While most businesses operate under the regular GST framework, involving detailed invoicing and monthly/quarterly returns, there’s a need for simplification for smaller players. To learn more about GST registration essentials for new businesses, check out our guide on Launching Your Startup Right – Mastering GST Registration in India.

This is where the composition scheme under GST comes in. It’s a simplified tax mechanism that allows eligible small taxpayers to pay tax at a fixed, lower rate on their turnover and follow much simpler compliance procedures. Understanding this scheme is crucial if you’re a small business owner or even a salaried individual with a side hustle, as it can significantly reduce your compliance burden and potentially lower your tax payments. This option, known widely as the composition scheme GST India, offers a breather from complex GST formalities.

This post will guide you through the composition scheme under GST eligibility, its benefits, the registration process, and the key rules for composition scheme GST. For those looking to set up a robust system around their business finances, consider reading Set Up An Accounting System for My Small Business.

Composition Scheme Under GST Eligibility: Who Can Opt In?

The primary goal of the composition scheme is to simplify life for small taxpayers. But who exactly qualifies? Let’s break down the composition scheme under GST eligibility criteria and clarify who can opt for composition scheme GST.

Aggregate Turnover Threshold

The main factor determining eligibility is your ‘Aggregate Turnover’ in the preceding financial year.

- For Goods & Restaurants: Businesses primarily supplying goods or restaurant services (not serving alcohol) can opt for the scheme if their aggregate turnover in the previous financial year did not exceed ₹1.5 Crore. (This limit is ₹75 Lakhs for certain special category states – Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Uttarakhand).

- For Service Providers: A separate scheme exists for certain service providers (or mixed suppliers where services are significant) with an aggregate turnover up to ₹50 Lakhs in the preceding financial year.

Important Note: These turnover limits are subject to change by the government. Always refer to the official GST Portal for the latest thresholds.

What is ‘Aggregate Turnover’? As per GST law, it includes the total value of:

- All taxable supplies

- Exempt supplies

- Exports of goods or services

- Inter-state supplies of persons having the same Permanent Account Number (PAN)

It is calculated on an all-India basis for the same PAN. However, it excludes Central tax (CGST), State tax (SGST), Union territory tax (UTGST), Integrated tax (IGST), cess, and the value of inward supplies on which tax is payable under the reverse charge mechanism (RCM).

Types of Eligible Businesses

Generally, the following taxpayers can opt for the composition scheme (subject to turnover limits and other conditions):

- Manufacturers: Producers of goods (with certain exceptions).

- Traders: Businesses buying and selling goods.

- Restaurants: Eateries that do not serve alcohol.

For more details around taxation services that might complement your business operations, you can visit our TAXATION SERVICES IN INDIA.

Specific Scheme for Service Providers

As mentioned, there’s a special composition scheme available under Notification No. 2/2019-Central Tax (Rate) dated 07.03.2019 (as amended) for taxpayers who were previously ineligible. This applies to:

- Suppliers of services (except restaurant services).

- Mixed suppliers (goods and services) where turnover doesn’t exceed ₹50 Lakhs.

Who Cannot Opt for the Scheme?

It’s equally important to know who is not eligible for the composition scheme under GST:

- Manufacturers of certain notified goods like ice cream, pan masala, tobacco products, aerated water, fly ash bricks, etc. (The list can be updated, so check official notifications).

- Businesses making any inter-state outward supplies of goods (i.e., selling goods outside their state).

- Businesses supplying goods through an e-commerce operator who is required to collect Tax at Source (TCS) under Section 52 of the CGST Act.

- Casual Taxable Persons or Non-Resident Taxable Persons.

- Suppliers of services other than restaurant services (unless eligible under the specific ₹50 Lakh scheme mentioned above).

- Suppliers of goods that are not taxable under GST, such as alcohol for human consumption.

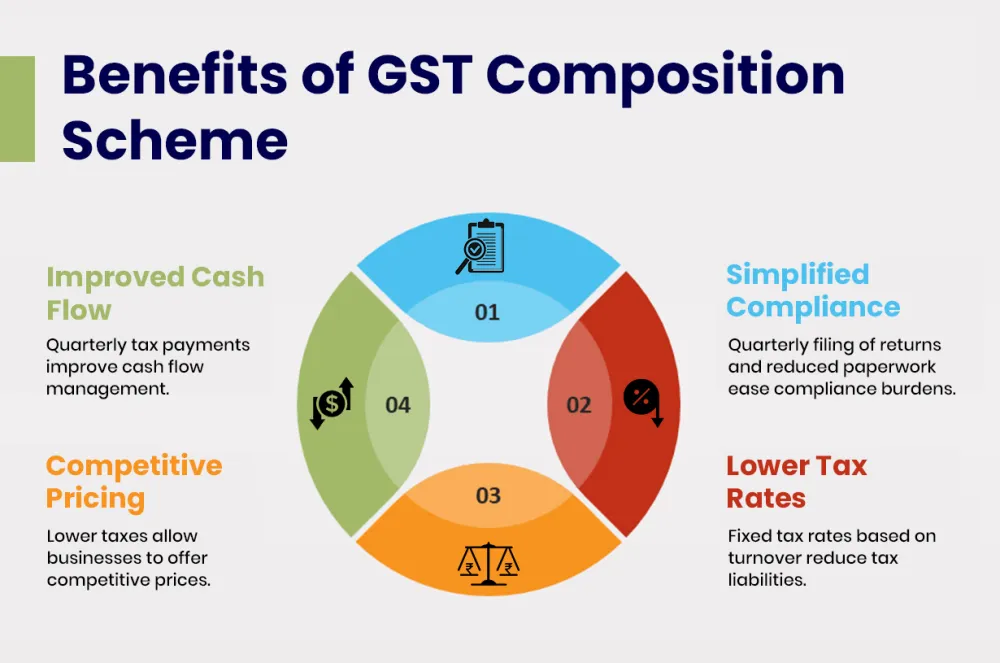

Key Benefits of the GST Composition Scheme

Opting for the composition scheme offers several advantages, making it an attractive option for eligible small businesses. Here are the primary GST composition scheme benefits:

Lower Tax Rates

Instead of dealing with multiple GST slabs (5%, 12%, 18%, 28%), composition dealers pay tax at a fixed, lower percentage of their turnover. The typical rates are:

- Manufacturers & Traders of Goods: 1% of the turnover of taxable supplies (0.5% CGST + 0.5% SGST/UTGST).

- Restaurants (not serving alcohol): 5% of turnover (2.5% CGST + 2.5% SGST/UTGST).

- Eligible Service Providers/Mixed Suppliers (under Notification 2/2019): 6% of the turnover of taxable supplies (3% CGST + 3% SGST/UTGST).

These lower rates can mean significant tax savings, especially for businesses with lower profit margins.

Simplified Compliance

This is perhaps the biggest draw. The compliance for composition scheme GST India is considerably less burdensome:

- Tax Payment: Instead of monthly payments, composition dealers pay tax quarterly using a simple challan-cum-statement, Form GST CMP-08.

- Return Filing: Instead of filing multiple monthly or quarterly returns like GSTR-1 (outward supplies) and GSTR-3B (summary return), composition dealers file just one Annual Return in Form GSTR-4.

Reduced Record-Keeping

While basic books of accounts are necessary, the level of detail required is less stringent compared to the regular scheme. Since composition dealers cannot issue tax invoices and don’t need to maintain detailed records for claiming Input Tax Credit (ITC), their accounting process is simpler.

Liquidity Advantage

Paying a lower percentage of tax and having simpler compliance procedures means less hassle and potentially more cash available for day-to-day business operations. This improved liquidity can be a significant advantage for small enterprises.

Understanding the Rules and Limitations

While the benefits are appealing, it’s crucial to understand the conditions and drawbacks associated with the composition scheme under GST. These rules for composition scheme GST define how you operate under this scheme:

No Input Tax Credit (ITC)

This is the most significant limitation. Businesses registered under the composition scheme cannot claim Input Tax Credit (ITC) on their purchases (inward supplies) of goods or services. This means the GST paid on purchases becomes a cost to the business. If your customers are businesses registered under the regular GST scheme, they also cannot claim ITC on purchases from you, which might make your offerings less attractive to them compared to suppliers under the regular scheme.

Cannot Collect Tax from Customers

Composition dealers are prohibited from charging or collecting GST from their customers. The tax liability (the 1%, 5%, or 6% rate) must be paid by the dealer out of their own pocket. It cannot be shown separately on the bill issued to the customer.

Restrictions on Supplies

- No Inter-State Sales: As mentioned in eligibility, composition dealers cannot make inter-state outward supplies (sales) of goods. They can only sell goods within their state. However, they can purchase goods from other states (inter-state inward supplies).

- E-commerce Restriction: They cannot supply goods through e-commerce operators who are required to collect Tax at Source (TCS).

Issuance of Bill of Supply

Since they cannot issue a Tax Invoice (which shows GST charged), composition dealers must issue a ‘Bill of Supply’ for their sales. This document does not contain a tax component.

Furthermore, every Bill of Supply issued must prominently mention the words: “composition taxable person, not eligible to collect tax on supplies”.

Display Requirements

Composition dealers must mention the words “composition taxable person” on every notice or signboard displayed prominently at their principal place of business and any additional place(s) of business.

How to Register for the Composition Scheme Under GST

If you’ve determined that the composition scheme is suitable for your business, here’s how the GST composition scheme registration process works for applying composition scheme GST India:

For New Taxpayers

If you are applying for a new GST registration and wish to opt for the composition scheme from the beginning:

- Go to the official GST Portal.

- While filling out the new registration application Form GST REG-01, navigate to Part B.

- Under Section 5, you will find the option “Option for Composition”. Select this option.

- Complete the rest of the registration process as usual.

For Existing Regular Taxpayers

If you are already registered under the regular GST scheme and want to switch to the composition scheme:

- You need to intimate your intention electronically by filing Form GST CMP-02 on the GST Portal.

- Timing is crucial: This form must be filed before the commencement of the financial year for which you wish to opt for the scheme. For example, to opt for the scheme from April 1st, 2024, you needed to file Form GST CMP-02 by March 31st, 2024.

- Additionally, you must file Form GST ITC-03 within 60 days from the commencement of the relevant financial year (i.e., by May 30th if opting from April 1st). This form is used to declare the details of Input Tax Credit relating to inputs held in stock, inputs contained in semi-finished or finished goods held in stock, and capital goods on the day immediately preceding the date from which you opt for the scheme. You essentially need to reverse the ITC already claimed on these items.

Always check the GST Portal for the latest forms and procedures.

Composition Scheme vs Regular Scheme: A Comparison

Choosing between the composition scheme and the regular GST scheme requires careful consideration. Here’s a quick GST composition scheme vs regular scheme comparison to help you decide:

| Basis | Composition Scheme | Regular Scheme |

|---|---|---|

| Eligibility (Turnover) | Lower Threshold (e.g., ₹1.5 Cr / ₹50 Lakhs) | Higher Threshold / No Upper Limit (beyond basic registration threshold) |

| Tax Rates | Lower, Fixed % of Turnover (1%, 5%, 6%) | Standard GST Rates (0%, 5%, 12%, 18%, 28%) |

| Tax Collection | Cannot Collect Tax from Customer | Can Collect Tax from Customer |

| Input Tax Credit (ITC) | Not Available | Available on eligible purchases |

| Invoicing | Bill of Supply | Tax Invoice |

| Return Filing | Quarterly Payment (CMP-08), Annual Return (GSTR-4) | Monthly/Quarterly (GSTR-1, GSTR-3B), Annual Return (GSTR-9/9C) |

| Inter-State Sales (Goods) | Not Allowed | Allowed |

| E-commerce Sales (via TCS Operator) | Not Allowed | Allowed |

| Compliance Burden | Lower | Higher |

| Ideal For | Small businesses, primarily B2C sales, lower margins where ITC loss isn’t critical, limited to intra-state goods supply. | Businesses with B2B sales, inter-state trade, e-commerce operations, higher margins, need ITC benefits. |

Compliance Requirements for Composition Dealers

Once registered under the composition scheme, you need to adhere to specific compliance requirements (compliance for composition scheme GST India):

Tax Payment

- Pay tax quarterly using Form GST CMP-08.

- Due Date: Payment must be made by the 18th day of the month succeeding the quarter.

- For Quarter April-June: Due Date is July 18th

- For Quarter July-September: Due Date is October 18th

- For Quarter October-December: Due Date is January 18th

- For Quarter January-March: Due Date is April 18th

Annual Return Filing

- File an Annual Return using Form GSTR-4.

- Due Date: This return must be filed by April 30th of the year following the financial year. (e.g., for FY 2023-24, the due date is April 30th, 2024).

Other Key Compliances

- Issue a Bill of Supply for all sales, clearly stating “composition taxable person, not eligible to collect tax on supplies”.

- Display “composition taxable person” on signboards at your place(s) of business.

- Maintain basic records of turnover, purchases, and stock.

- Pay GST under Reverse Charge Mechanism (RCM) on specified inward supplies, if applicable (this payment needs to be made monthly via Form GST PMT-06, though the reporting might be quarterly/annually).

Is the Composition Scheme Under GST Right for Your Business?

To summarize, the composition scheme under GST is a simplified GST framework designed for small taxpayers in India. It offers the significant advantages of lower, fixed tax rates and much easier compliance compared to the regular GST scheme.

However, the choice isn’t automatic. You must carefully weigh the trade-offs: the inability to claim Input Tax Credit (ITC) on your purchases and the prohibition on collecting GST from your customers. The inability to claim ITC means the tax paid on inputs becomes a cost, potentially impacting your pricing or margins. The inability to collect tax might be acceptable for B2C businesses but can be a disadvantage in B2B transactions where your customers expect a Tax Invoice to claim ITC themselves.

Your decision should depend heavily on your:

- Business Model: Primarily B2C or B2B?

- Profit Margins: Can you absorb the tax cost?

- Purchase Patterns: Do you buy a lot from registered dealers where ITC could be substantial?

- Turnover: Does it fall within the prescribed limits?

- Nature of Supply: Are you selling goods only within your state?

Evaluate these factors carefully before deciding if the composition scheme under GST is the right fit for your business.

Navigating GST options and ensuring compliance can be complex. If you need help determining your eligibility for the composition scheme under GST, assistance with the registration process, or ongoing support with your GST filings and compliance, contact TaxRobo’s expert team today. We offer personalized guidance to help you make the best choice for your business and manage your tax obligations efficiently. TaxRobo’s GST Services

Frequently Asked Questions about the Composition Scheme Under GST (FAQ)

Q1: Can I switch back from the composition scheme to the regular scheme?

A: Yes. You can opt-out of the composition scheme at any time during the financial year by electronically filing Form GST CMP-04 on the GST Portal. Once you opt-out, you must start complying with all the provisions of the regular scheme, including issuing tax invoices. You also need to file Form GST ITC-01 within 30 days of opting out to claim Input Tax Credit on the stock of inputs, semi-finished goods, finished goods, and capital goods held on the date of switching.

Q2: What happens if my turnover exceeds the composition scheme limit during the financial year?

A: You become ineligible to be registered under the composition scheme from the day your aggregate turnover crosses the prescribed threshold (e.g., ₹1.5 Crore or ₹50 Lakhs, as applicable). You must file an intimation for withdrawal from the scheme in Form GST CMP-04 within seven days of exceeding the limit. Subsequently, you need to start issuing tax invoices and comply with all provisions applicable to a regular taxpayer, including filing monthly/quarterly returns (GSTR-1, GSTR-3B etc.).

Q3: Can a service provider opt for the composition scheme?

A: Yes, under specific conditions. Pure service providers (other than restaurants not serving alcohol) or those involved in mixed supplies can opt for a composition scheme under Notification No. 2/2019-Central Tax (Rate) if their aggregate turnover in the preceding financial year was up to ₹50 Lakhs. The applicable tax rate is 6% (3% CGST + 3% SGST/UTGST) on the turnover of taxable supplies. Remember, composition scheme under GST eligibility rules are specific, so it’s best to verify the latest conditions on the GST Portal. Restaurants not serving alcohol have their own eligibility under the main scheme (up to ₹1.5 Cr turnover, 5% tax).

Q4: Do I need to pay composition tax on exempt supplies?

A: Generally, no. The composition tax (1%, 5%, or 6%) is typically payable on the turnover of taxable supplies of goods and services. However, the value of exempt supplies is included when calculating your ‘aggregate turnover’ to determine your eligibility for the scheme in the first place. For restaurants, the 5% tax is on the total turnover in the state/UT. Always check the precise calculation basis applicable to your category.

Q5: As a composition dealer, can I purchase goods/services from another state (inter-state inward supply)?

A: Yes. There is no restriction on making inter-state purchases (inward supplies) while registered under the composition scheme. You are free to buy goods or services from suppliers located in other states. The restriction under the composition scheme applies only to making inter-state outward supplies (i.e., selling goods to customers outside your state).