Section 100.Calling of extraordinary general meeting under the companies act 2013

In the dynamic world of business, timely decision-making is paramount. Companies often face situations requiring urgent shareholder approval that cannot wait for the next Annual General Meeting (AGM). This is where the concept of an Extraordinary General Meeting (EGM) becomes crucial. An EGM serves as a vital mechanism under the Companies Act, 2013, allowing companies to address pressing matters efficiently. The primary framework governing the convening of such meetings is laid out in Section 100 of the Act. This post aims to provide a comprehensive guide on Section 100 and the detailed process for calling an extraordinary general meeting under the companies act 2013, offering essential insights for small business owners, directors, and shareholders operating in India. Understanding these provisions is key to ensuring good corporate governance and compliance.

What Exactly is an Extraordinary General Meeting (EGM)?

An Extraordinary General Meeting, or EGM, is essentially any general meeting of the members (shareholders) of a company that is not the mandatory Annual General Meeting (AGM). While AGMs are held once every year to discuss routine matters stipulated by the Act, EGMs are convened on an as-needed basis to transact specific, urgent business that arises between AGMs. The companies act 2013 general meeting provisions recognize the necessity for such meetings to ensure that critical decisions are not unduly delayed.

The purpose of an EGM is manifold. It provides a platform for shareholders to consider and vote on matters that require their approval but fall outside the scope of ordinary AGM business or cannot wait until the next AGM. Common reasons for calling an EGM include:

- Making significant changes to the company’s Memorandum of Association (MoA) or Articles of Association (AoA).

- Discussing and approving major strategic decisions like mergers, acquisitions, or sale of substantial assets.

- Considering the removal or appointment of a director outside the regular AGM cycle.

- Appointment of Director to Your Private Limited Company

- Approving proposals for further issuance of shares or alteration of share capital.

- Addressing specific financial matters or operational issues requiring immediate shareholder attention.

It’s important to distinguish an EGM from an AGM. AGMs are mandatory annual events with a defined timeframe and agenda covering ‘Ordinary Business’ (like adopting financial statements, declaring dividends, appointing directors retiring by rotation, appointing auditors). EGMs, conversely, are called only when necessary and exclusively deal with ‘Special Business’ – the specific items listed in the notice calling the meeting.

Understanding Section 100: Power to Call an Extraordinary General Meeting under the Companies Act 2013

Section 100 of the Companies Act, 2013, is the cornerstone provision that details the authority and procedures for calling an extraordinary general meeting under the companies act 2013. It clearly outlines who can initiate the process and the circumstances under which an EGM must be convened. Understanding these extraordinary general meetings provisions companies act is crucial for ensuring the validity of the meeting and the resolutions passed therein.

Section 100 primarily addresses three main scenarios under which an EGM can be called:

- By the Board of Directors: The company’s Board has the inherent power to call an EGM whenever they deem it necessary for the company’s affairs.

- By Requisitionists: Shareholders meeting a specific threshold have the statutory right to demand (requisition) that the Board call an EGM.

- By Requisitionists Themselves: If the Board fails to act upon a valid requisition from shareholders within the prescribed time limits, the requisitionists themselves gain the power to call the EGM.

While Section 100 focuses on the Board and requisitionists, it’s worth noting contextually that the National Company Law Tribunal (NCLT) also possesses powers (under Section 98) to order a meeting if calling or conducting it in the standard manner becomes impracticable, although this falls outside the direct scope of Section 100’s procedures initiated by the Board or members.

Who Holds the Power to Convene an EGM?

The Board of Directors (Suo Motu)

The Board of Directors holds the primary authority to convene an EGM. They can decide to call such a meeting suo motu (on their own initiative) whenever they believe there are matters requiring discussion and approval from the shareholders that cannot wait for the next AGM. This power is fundamental to the Board’s role in managing the company’s affairs effectively. Examples of situations where the Board might call an EGM include proposing a significant corporate restructuring, seeking approval for a related party transaction above certain thresholds, deciding on an alteration of the company’s objectives clause in the Memorandum of Association, or seeking approval for issuing debentures or borrowing funds beyond prescribed limits. The decision to call an EGM is typically made via a Board resolution passed at a duly convened Board Meeting.

Requisition by Members (Shareholders)

The Act empowers shareholders, ensuring they have a voice in critical matters even outside the AGM schedule. Members have the right to demand that the Board convene an EGM. However, this right is subject to meeting a specific eligibility threshold to prevent frivolous requests. According to Section 100(2), the Board must call an EGM upon receiving a valid requisition from:

- For companies having a share capital: Members who, as of the date the requisition is deposited, hold at least one-tenth (1/10th) of the company’s paid-up share capital that carries voting rights.

- For companies not having a share capital: Members who, as of the date the requisition is deposited, hold at least one-tenth (1/10th) of the total voting power of all members.

For a requisition to be considered valid, it must meet certain requirements:

- It must clearly state the specific matters that need to be considered at the proposed EGM.

- It must be signed by all the requisitioning members or their duly authorized agents.

- It can be in writing or sent via electronic mode.

- It must be deposited at the company’s registered office.

This process ensures that shareholders have a formal mechanism to bring important issues to the forefront for collective decision-making in an extraordinary general meeting under the companies act 2013 India.

By the Requisitionists Themselves

What happens if the Board receives a valid requisition but fails to act? Section 100 provides a remedy for shareholders in such a situation. The Board is obligated to act promptly upon receiving a valid requisition. Specifically, the directors must, within 21 days from the date of receiving the valid requisition, take steps to call a meeting. This meeting must then be held not later than 45 days from the date the original requisition was deposited. If the Board fails to call the meeting within this 21-day period or fails to ensure it’s held within the 45-day window, the power shifts to the requisitionists. The requisitionists themselves can then proceed to call the EGM. However, this meeting called by the requisitionists must be held within 3 months from the date the original requisition was deposited at the company’s office. The requisitionists are entitled to recover any reasonable expenses they incur in calling this meeting (such as costs for printing and sending notices) from the company. The company, in turn, can deduct these amounts from any fees or remuneration payable to the directors who were in default.

By the National Company Law Tribunal (NCLT) (Brief Mention)

Although Section 100 primarily deals with EGMs called by the Board or requisitionists, it’s relevant to mention Section 98 of the Companies Act, 2013. This section empowers the National Company Law Tribunal (NCLT) to order the calling of a general meeting (AGM or EGM) if, for any reason, it is impracticable to call the meeting or conduct it according to the Act or the company’s articles. This power can be exercised either on the NCLT’s own motion or upon application by a director or any member entitled to vote. The NCLT can give directions on how the meeting should be called, held, and conducted, including modifying quorum requirements if necessary. This serves as a safety net when standard procedures fail.

The Step-by-Step Guide: Calling Extraordinary General Meeting Process India

Successfully convening an EGM involves a series of steps that must be meticulously followed to ensure legal validity. Here’s a breakdown of how to call extraordinary general meeting in India, based on Section 100 and related provisions like Section 101 (Notice) and Section 102 (Explanatory Statement):

Step 1: Initiation – Board Decision or Valid Requisition

The process begins either with the Board of Directors resolving to call an EGM or upon the receipt of a valid requisition from eligible members (shareholders). If a requisition is received, the company secretary or relevant officials must first verify its validity: checking if the signatories meet the required shareholding/voting power threshold (1/10th), ensuring the matters proposed are clearly stated, confirming the signatures, and verifying it has been deposited at the registered office. If the Board decides suo motu, a resolution to this effect, specifying the business to be transacted, must be passed at a properly convened Board meeting.

Step 2: Board’s Action on Requisition (If Applicable)

If the EGM is initiated by a members’ requisition, the Board must convene a meeting within 21 days of receiving the valid requisition. At this Board meeting, they must formally decide to call the EGM, fix the date, time, and place for the meeting, and approve the notice to be sent to members. Critically, the date fixed for the EGM must be within 45 days from the date the requisition was originally received by the company. Failure to adhere to these timelines triggers the right of the requisitionists to call the meeting themselves.

Step 3: Issuing the Notice of EGM (Section 101)

Once the decision to hold the EGM is made (either by the Board suo motu or following a requisition), a formal notice must be issued as per Section 101.

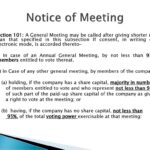

- Notice Period: A clear notice of at least 21 days must be given to all entitled persons. “Clear days” means the date of sending the notice and the date of the meeting are excluded. Notice can be given in writing or through electronic mode (email, etc.), as permitted by the Act and the company’s Articles.

- Shorter Notice: An EGM can be called with shorter notice if consent is obtained in writing or electronic mode from members holding not less than 95% of the paid-up share capital carrying voting rights (or 95% of total voting power for companies without share capital).

- Contents of Notice: The notice must specify the place, date, day, and the hour of the meeting. Most importantly, it must contain a statement of the business to be transacted (the agenda).

- Explanatory Statement (Section 102): This is a crucial requirement. For all items of Special Business (which includes essentially all business transacted at an EGM), an explanatory statement must accompany the notice. This statement must set out all material facts concerning each item, including the nature of concern or interest (financial or otherwise), if any, of every director, manager, key managerial personnel (KMP), and their relatives. This ensures members have sufficient information to make an informed decision.

- Recipients: The notice must be sent to:

- Every member of the company.

- The legal representative of any deceased member.

- The assignee of an insolvent member.

- The statutory auditor(s) of the company.

- Every director of the company.

Step 4: Holding the Meeting (Section 103 – Quorum)

On the appointed day, the EGM must be held according to the notice.

- Quorum (Section 103): The presence of a minimum number of members (quorum) is essential for the meeting to be validly conducted. Quorum Requirements for General Meetings are specified in this section:

- Public Company:

- 5 members personally present if the total number of members is not more than 1000.

- 15 members personally present if the number of members is more than 1000 but up to 5000.

- 30 members personally present if the number of members exceeds 5000.

- Private Company: 2 members personally present.

- Consequences of No Quorum: If the quorum is not present within half an hour of the scheduled time:

- If the meeting was called on the requisition of members, it stands cancelled.

- In any other case (i.e., called by the Board), the meeting stands adjourned to the same day in the next week, at the same time and place, or to such other date, time, and place as the Board may determine. If at the adjourned meeting also quorum is not present, the members present shall constitute the quorum.

- Public Company:

- Conduct: The meeting proceeds with the appointment of a Chairman (usually the Chairman of the Board, unless the Articles state otherwise). The business items listed in the notice are discussed. Voting typically happens by a show of hands, unless a poll is demanded or e-voting is applicable (mandatory for certain listed companies/companies with a large number of members).

Step 5: Post-Meeting Compliance

After the EGM concludes, certain compliance actions are necessary.

- Minutes: Detailed minutes of the proceedings of the EGM must be prepared, entered into the designated Minutes Book, and signed by the Chairman of the meeting (or the chairman of the next succeeding meeting) within 30 days of the EGM’s conclusion. Minutes serve as the official record of decisions taken.

- Filings with RoC: Certain resolutions passed at the EGM require filing with the Registrar of Companies (RoC). Notably, all Special Resolutions must be filed within 30 days of being passed, using Form MGT-14. This form should be accompanied by a certified copy of the resolution and the explanatory statement under Section 102. Other specific ordinary resolutions may also require filing as per Section 117. You can find relevant forms and filing procedures on the Ministry of Corporate Affairs portal: https://www.mca.gov.in/.

Following this calling extraordinary general meeting process India diligently ensures adherence to the companies act 2013 general meeting provisions.

Ensuring Compliance: Why Getting the EGM Process Right Matters

Strict adherence to the procedures outlined in the Companies Act, 2013, particularly the extraordinary general meetings provisions companies act, is not merely a procedural formality; it is fundamental to the legitimacy of corporate actions. Getting the EGM process wrong can lead to significant adverse consequences for the company and its management. If the notice requirements (period, content, explanatory statement) are flawed, or if quorum requirements are not met, or if the meeting is not convened by the proper authority (Board or requisitionists under specific conditions), the entire meeting can be declared invalid by a court or the NCLT.

Consequently, any resolutions passed at such an improperly convened or conducted meeting would become void and unenforceable. This could halt critical business decisions, unravel transactions approved at the meeting, and expose the company to legal challenges from dissenting shareholders or third parties. Furthermore, non-compliance with provisions relating to general meetings, including notice and explanatory statements, can attract penalties for the company and the officers who are in default (such as directors or the company secretary). The Act prescribes specific fines for various procedural lapses. Additionally, as mentioned earlier, if the requisitionists are forced to call the EGM due to the Board’s failure, they are entitled to recover their reasonable expenses from the company, adding a direct financial cost to the company due to the Board’s inaction or default. Given these potential pitfalls, ensuring procedural compliance is paramount.

If your business needs assistance navigating the complexities of corporate secretarial compliance, including convening EGMs, TaxRobo Secretarial Services can provide expert guidance and support to ensure everything is done correctly and efficiently.

Conclusion: Mastering the Extraordinary General Meeting under the Companies Act 2013

Extraordinary General Meetings are a powerful tool for corporate governance, enabling companies to address urgent and significant matters that require shareholder approval between the scheduled Annual General Meetings. Section 100 of the Companies Act, 2013, provides the essential framework, detailing who has the authority to call an EGM – primarily the Board of Directors and, under specific conditions, the company’s members (requisitionists). Understanding the purpose of EGMs, the powers vested by Section 100, and the critical steps involved in the convening process – from initiation and notice issuance (with a proper explanatory statement) to holding the meeting (ensuring quorum) and post-meeting compliance (minutes and filings) – is vital.

Correctly executing the extraordinary general meeting under the companies act 2013 procedure is not just about following rules; it’s about upholding shareholder rights, ensuring transparency, and maintaining the legal validity of crucial corporate decisions. For small business owners and directors in India, mastering this process is key to effective management and avoiding potential legal complications and penalties. If you find the calling extraordinary general meeting process India challenging or require assistance with any aspect of corporate compliance, don’t hesitate to reach out. Contact TaxRobo today for expert guidance and support tailored to your business needs.

Frequently Asked Questions (FAQs)

Q1. What’s the difference between business transacted at an AGM vs. an EGM?

Answer: AGMs (Annual General Meetings) are primarily for transacting ‘Ordinary Business’ as defined by the Companies Act, which includes: adopting financial statements, declaring dividends, appointing directors retiring by rotation, and appointing/fixing remuneration of auditors. AGMs can also transact ‘Special Business’. EGMs (Extraordinary General Meetings), on the other hand, are called specifically to transact ‘Special Business’ only – items that are urgent or specific and require shareholder approval outside the AGM cycle. Any business that is not ‘Ordinary Business’ is considered ‘Special Business’.

Q2. Can an EGM be held outside India?

Answer: Generally, general meetings (including EGMs) of a company registered in India must be held within India. Section 96(2) allows the government to exempt certain companies or prescribe conditions under which AGMs can be held outside India (e.g., for unlisted companies with specific approvals). However, Section 100, dealing with EGMs, does not contain a similar explicit provision allowing EGMs outside India as a general rule. While Articles of Association might contain specific clauses, the standard practice and legal interpretation lean towards holding EGMs within India, typically at the registered office or within the city/town/village where the registered office is situated. Disclaimer: Given the complexities, it’s strongly recommended to seek specific legal advice based on your company’s structure and Articles if considering holding any meeting outside India.

Q3. What happens if the quorum is not present at an EGM called by requisitionists?

Answer: The rules differ slightly depending on who called the EGM. As per Section 103(2)(b) of the Companies Act, 2013, if the quorum is not present within half an hour from the time appointed for holding a meeting called by requisitionists under Section 100, the meeting shall stand cancelled. It is not adjourned. This contrasts with an EGM called by the Board, where if quorum is not present, the meeting is typically adjourned to a future date.

Q4. Is an explanatory statement always required with the EGM notice?

Answer: Yes. Section 102 of the Companies Act, 2013, mandates that an explanatory statement setting out all material facts must accompany the notice for all items of special business to be transacted at any general meeting (AGM or EGM). Since EGMs are convened specifically to transact special business, an explanatory statement detailing the purpose, implications, and any director/KMP interest for each agenda item is always required for an EGM notice to be compliant.

Q5. Do we need to file minutes of the EGM with the RoC?

Answer: No, the minutes book containing the record of the EGM proceedings itself is not filed with the Registrar of Companies (RoC). However, the company is legally required to record the minutes within 30 days and maintain the minutes book permanently at its registered office for inspection. What does need to be filed are certain resolutions passed at the EGM. Specifically, if any Special Resolutions are passed, or certain other resolutions as specified under Section 117 are approved, the company must file Form MGT-14 with the RoC within 30 days of passing the resolution. This filing must include a certified copy of the resolution passed and the accompanying explanatory statement. You can manage these filings through the Ministry of Corporate Affairs (MCA) website. For assistance with RoC filings and annual compliance, consider TaxRobo Compliance Services.