Section 144: Why Your Company Auditor Cannot Render Certain Services Under the Companies Act 2013

Introduction: Understanding Auditor Independence in India

For any business in India, having trustworthy financial statements is like having a strong foundation for a building. It builds credibility with banks, investors, and even customers. It shows that your business is transparent and well-managed. A key player in ensuring this trust is the statutory auditor, appointed under the Companies Act, 2013. The primary auditor roles under Indian law involve examining a company’s financial records and providing an independent opinion on whether they present a true and fair view of the company’s financial health.

However, to ensure this opinion is truly independent and unbiased, the law places certain restrictions. This brings us to Section 144 of the Companies Act, 2013. The core principle behind this section is simple but crucial: an auditor not to render certain services to the same company they are auditing. This rule exists to prevent conflicts of interest that could compromise the auditor’s judgment. Imagine a referee in a football match also coaching one of the teams – you wouldn’t trust their calls, right? Similarly, if an auditor is involved in preparing the financial data or making management decisions, how can they objectively check that same data or the results of those decisions?

Understanding and adhering to Section 144 is vital for business owners, especially when seeking companies act 2013 compliance services India. It’s not just about following the law; it’s about maintaining good corporate governance and ensuring the reliability of your financial reporting. This blog post will delve into the specifics of Section 144, outline the services your auditor is prohibited from providing, discuss the implications for your business, and explain how to ensure compliance.

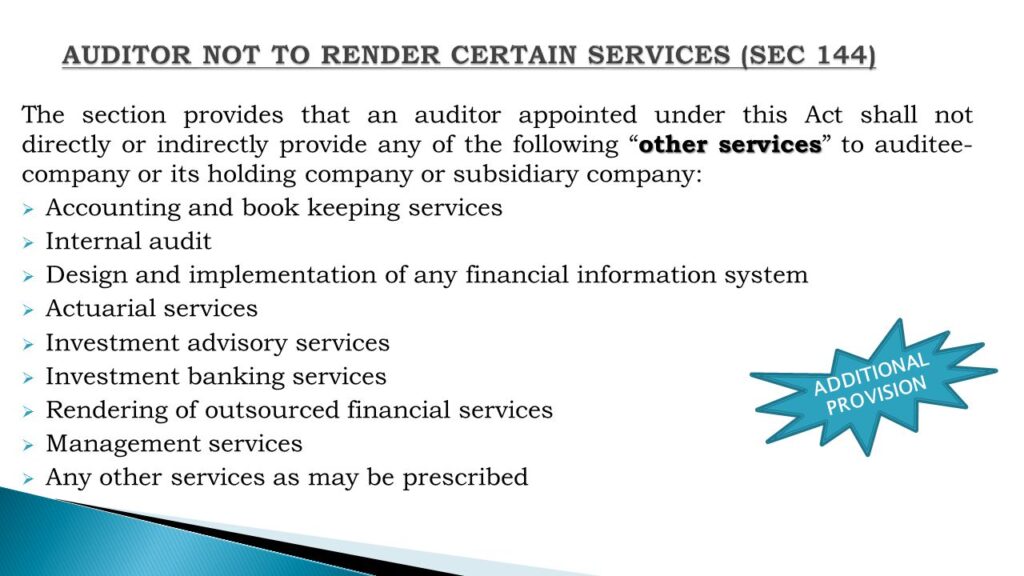

What is Section 144 of the Companies Act, 2013?

Section 144 of the Companies Act, 2013, specifically lists certain non-audit services that a statutory auditor is prohibited from providing to the company they audit, its holding company, or its subsidiary company. Think of it as a clear boundary line drawn by the law to protect the auditor’s independence. The main goal, or legislative intent, behind these Section 144 auditor services guidelines is to prevent situations where the auditor might face a conflict between their duty to provide an unbiased audit opinion and other interests arising from providing different services to the same client. By eliminating these potential conflicts, the law aims to enhance the quality and credibility of audit reports, which are crucial for stakeholders making financial decisions.

It’s important to understand the scope of these restrictions. Section 144 states that the auditor cannot provide these prohibited services either directly or indirectly. This means the restriction applies not just to the individual auditor signing the report, but also to:

- The audit firm itself.

- Any partners of the audit firm.

- The audit firm’s parent company, subsidiary company, or associate company.

- Any other entity in which the audit firm or its partners have a significant interest.

This wide scope ensures that independence is maintained across the auditor’s network, preventing conflicts from arising through related entities. For those wanting to read the precise legal text, the full details of Section 144 can be found within the Companies Act, 2013, accessible on the official Ministry of Corporate Affairs (MCA) website. Understanding these rules under the companies act 2013 is fundamental for compliant business operations in India.

The Prohibited List: Services an Auditor Cannot Provide

Section 144 clearly lists specific services that fall under the rule that an auditor not to render certain services. This limitation on auditor services under companies act is not arbitrary; each prohibited service carries a potential conflict of interest that could impair the auditor’s objectivity. Let’s break down these services and understand why they are restricted:

Accounting and Book Keeping Services

This is perhaps the most obvious conflict. If an auditor or their firm is responsible for recording transactions, maintaining ledgers, and preparing the basic financial statements (bookkeeping), they cannot then independently audit those same records. It’s like asking a student to grade their own exam paper – the objectivity is immediately compromised. The auditor must review work done by others, not their own.

For small businesses seeking to avoid conflicts like these, consider checking out our guide on Set Up An Accounting System for My Small Business.

Internal Audit Services

Internal audit involves reviewing a company’s internal controls, processes, and risk management systems from within, akin to the Primary Purpose of Internal Audit in the Modern Organization. A statutory (external) auditor’s role is to provide an independent opinion on the financial statements, which includes assessing the effectiveness of internal controls relevant to financial reporting. If the same firm performs both internal and external audits, they would essentially be auditing systems and controls they might have helped design or evaluate internally, creating a self-review threat.

Design and Implementation of Financial Information Systems

Financial information systems are the backbone of a company’s accounting and reporting. If an audit firm designs or implements the system (like accounting software setup and integration) used to generate financial data, they cannot objectively audit the output of that system. They might be biased towards concluding the system works perfectly, or they might overlook flaws they were responsible for creating.

Actuarial Services

Actuarial services involve complex calculations and assumptions, often related to employee benefits (like pensions and gratuities), insurance liabilities, or other long-term financial projections. These calculations heavily influence the financial statements. If the auditor provides these services, they are essentially setting the assumptions and figures they are later required to audit, leading to a clear conflict.

Investment Advisory Services

Providing advice on investments for the company creates a significant conflict. The auditor’s recommendations could impact the company’s financial position and performance, which they are supposed to review objectively. Furthermore, the success or failure of these investments could influence the auditor’s judgment when reviewing the financial statements.

Investment Banking Services

Investment banking activities include services like underwriting securities issues, advising on mergers and acquisitions, or acting as a broker. Participating in these activities aligns the auditor with the financial success of specific transactions or ventures of the company. This advocacy role is fundamentally incompatible with the independent, objective stance required for an audit.

Rendering of Outsourced Financial Services

This refers to the auditor taking over core financial functions of the company, such as managing payroll, handling accounts payable/receivable, or treasury functions. If the auditor is performing these operational roles, they are essentially part of the management process and cannot maintain the independence needed to audit the outcomes of these activities.

Management Services

This is a broad category prohibiting the auditor from performing any function that is typically considered a management role or involves making decisions on behalf of the company’s management. An auditor’s role is to audit the decisions and results of management, not to be the management itself.

Other Prescribed Services

The Act also includes a provision allowing the Central Government to prescribe any other services that could pose a conflict. This makes the list potentially expandable based on evolving business practices and potential threats to auditor independence.

Understanding this prohibited list is crucial for ensuring compliance with auditor services under companies act India. Businesses need to ensure they engage separate professionals for these specific non-audit services.

Implications for Your Business: Compliance and Consequences

Understanding Section 144 is one thing, but knowing what it means practically for your business registered in India is crucial. Compliance isn’t optional, and non-compliance can lead to serious issues. Here’s how Section 144 impacts your company and what you need to do:

Ensuring Compliance with Section 144

Proactive steps are necessary to ensure your company adheres to these rules. It’s not just the auditor’s responsibility; the company management and board play a key role.

- Review Engagement Letters: Carefully examine the engagement letters with your statutory auditors. Ensure the scope of work is clearly defined and strictly limited to the audit function and any permissible non-audit services (which must still be approved appropriately).

- Segregate Service Providers: Make a clear distinction between your statutory auditor and providers of other professional services. For services listed under Section 144 (like bookkeeping, internal audit, specific consulting), you must engage different, independent firms.

- Role of Audit Committee / Board: For companies required to have an Audit Committee, this committee (or the Board of Directors otherwise) must pre-approve all services provided by the auditor, including permissible non-audit services. They must satisfy themselves that providing such permissible services does not compromise the auditor’s independence.

- Maintain Documentation: Keep clear records of all services obtained from the audit firm, along with approvals granted by the Audit Committee or Board. This documentation is vital proof of compliance during scrutiny. Proper handling of

companies act 2013 compliance services Indiaincludes diligent record-keeping regarding auditor engagements.

Consequences of Non-Compliance

Ignoring the restrictions under Section 144 can lead to significant negative consequences for both the auditor and the company:

- Auditor Disqualification: If an auditor is found rendering prohibited services, they can be disqualified from acting as an auditor for the company. They may be required to resign, and finding a replacement mid-term can be disruptive. Regulatory bodies like the National Financial Reporting Authority (NFRA) can also debar the auditor or audit firm.

- Penalties: The Companies Act, 2013 imposes penalties for non-compliance. The auditor may be required to refund the fees received for the prohibited services and face hefty fines. The company and its officers who are in default can also be subject to penalties. These

companies act professional limitations in Indiaare enforced strictly. - Reputational Damage: Perhaps the most significant long-term impact is the loss of credibility. If stakeholders (investors, lenders, regulators, customers) learn that the company’s auditor lacked independence, trust in the financial statements and the company’s governance practices erodes quickly. This can damage the company’s reputation and make it harder to raise capital or conduct business.

Finding Alternatives for Non-Audit Services

Since your statutory auditor cannot provide the prohibited services, your company needs to find alternative providers. This often means engaging specialized professional firms for tasks such as:

- Accounting and Bookkeeping: Engaging firms like TaxRobo Accounts Service or other professional accountants.

- Internal Audit: Hiring a separate internal audit firm or building an in-house team.

- Financial System Design: Using IT consultants or specialized software implementation firms.

- Investment Advisory/Banking: Engaging dedicated financial advisors or investment banks.

- Tax Advisory: While routine tax filing might be permissible, complex advisory involving management decisions may require a separate tax consultant.

This separation of duties, although requiring coordination with multiple service providers, ultimately strengthens your company’s financial governance framework. Firms specializing in financial and legal compliance can often assist with navigating these distinct needs effectively. For more information on applicable taxation services, you might want to explore TAXATION SERVICES IN INDIA.

Conclusion: Upholding Auditor Independence is Key

The message from Section 144 of the Companies Act, 2013 is clear: maintaining auditor independence is non-negotiable for ensuring reliable financial reporting in India. The core principle that an auditor not to render certain services to their audit clients is a cornerstone of corporate governance, designed to prevent conflicts of interest and bolster stakeholder confidence. Adhering to the companies act 2013 isn’t just about ticking a legal box; it’s fundamental to the integrity of your business and the trust placed in it by investors, lenders, and the market.

Compliance requires businesses to be vigilant about the scope of services provided by their auditors. Remember the key prohibited areas: accounting, internal audit, financial system design, actuarial services, investment advisory or banking, outsourced financial functions, and management services. By ensuring these services are handled by separate, independent professionals, you safeguard the objectivity of your statutory audit.

Ultimately, respecting the boundaries set by Section 144 strengthens your company’s governance framework. We encourage all businesses to review their current auditor engagements carefully to ensure full compliance with companies act 2013 compliance services India. If you have doubts or need clarity on how these rules apply to your specific situation, seeking professional advice is always recommended.

Navigating Companies Act rules can be complex. Ensure your business is compliant. Contact TaxRobo for expert guidance on your financial and legal compliance needs via our TaxRobo Online CA Consultation Service.

Frequently Asked Questions (FAQs) about Section 144

-

Q1: Can our company’s statutory auditor provide tax filing or basic tax advisory services?

Answer: Generally, routine tax compliance services, such as preparing and filing income tax returns based on the financial statements prepared by management, are often considered permissible

auditor services under companies act India. This is because they are typically compliance-oriented rather than decision-making roles. However, if the tax advisory involves complex structuring, planning that significantly impacts financial reporting, or requires the auditor to make management-level decisions, it could potentially fall into the prohibited category (e.g., management services). The key is whether the service creates a conflict of interest or requires the auditor to audit their own advisory work. It’s wise to carefully evaluate the nature of the tax services and consult experts if unsure, keeping theSection 144 auditor services guidelinesin mind. -

Q2: Does Section 144 apply to auditors of all types of companies in India (Private Limited, Public Limited, OPC)?

Answer: Section 144 applies to statutory auditors appointed under the Companies Act, 2013. This covers companies that are required by the Act to undergo a statutory audit. While One Person Companies (OPCs) below certain thresholds might have exemptions from some requirements, most Private Limited and all Public Limited companies fall under the purview of statutory audit and hence, the restrictions of Section 144 apply to their auditors. The applicability depends on whether the company is mandated to appoint a statutory auditor under the Act.

-

Q3: Who is primarily responsible for ensuring the auditor does not provide prohibited services?

Answer: The responsibility for compliance is shared. The auditor and their firm have a professional and ethical duty to avoid providing prohibited services and maintain independence. However, the company’s management, Board of Directors, and (if applicable) the Audit Committee hold significant responsibility. The Act specifically requires the Audit Committee (or the Board in its absence) to approve the appointment and remuneration of the auditor and also to review and monitor the auditor’s independence and performance. This includes approving any permissible non-audit services and ensuring the

limitation on auditor services under companies actis strictly followed. -

Q4: What happens if our auditor is found providing prohibited services after the audit report is signed?

Answer: Discovering non-compliance after the audit report is issued can have serious repercussions. Regulatory bodies like the Ministry of Corporate Affairs (MCA) or the National Financial Reporting Authority (NFRA) can initiate proceedings against the auditor, leading to penalties (including refund of fees, fines) and potential debarment from practice. The company and its officers could also face penalties. Importantly, such a finding casts significant doubt on the auditor’s independence and, consequently, on the reliability and validity of the audit report itself, potentially requiring corrective actions or even a re-audit.

-

Q5: Where can I read the exact wording of Section 144 of the Companies Act, 2013?

Answer: The official and most accurate source for the legislative text is the Ministry of Corporate Affairs. You can access the complete Companies Act, 2013, including Section 144, through the e-book or legislative sections available on the Ministry of Corporate Affairs (MCA) website. It’s always best to refer to the official source for precise legal language and any subsequent amendments.

Internal Links:

- Need help setting up your company correctly? Explore TaxRobo Company Registration Service.

- Looking for independent accounting services? Check out TaxRobo Accounts Service.

- Require assistance with statutory audits (conducted independently)? Learn about TaxRobo Audit Service.

- Get expert advice on compliance: TaxRobo Online CA Consultation Service.