Taxation 101 for Small Business Owners in India

Introduction

Starting a business in India is an exciting venture, filled with opportunities and potential. However, alongside the thrill of entrepreneurship comes the responsibility of navigating the complex world of taxes. For many new business owners, the tax landscape can seem daunting and overwhelming. Understanding Taxation 101 for Small Business is not merely about fulfilling legal obligations; it’s absolutely fundamental for maintaining the financial health and ensuring the sustainable growth of your enterprise. Neglecting tax compliance can unfortunately lead to significant penalties, legal complications, and ultimately hinder your business progress. This guide aims to simplify things by breaking down the essential tax concepts that every Indian small business owner needs to grasp, covering critical areas like Income Tax, Goods and Services Tax (GST), Tax Deducted at Source (TDS), and basic compliance requirements. We strive to provide a clear and practical tax guide for Indian entrepreneurs. Whether you are already managing a small business or are a salaried individual carefully planning your transition into the entrepreneurial world, grasping the fundamentals of small business taxation India is absolutely crucial for success. Let’s dive into Taxation 101 for Small Business.

Choosing Your Business Structure: Impact on Taxation

One of the first and most crucial decisions you’ll make when starting your business is choosing its legal structure. This decision significantly impacts various aspects of your operations, including liability, compliance requirements, and, importantly, how your business profits are taxed. The primary structures available in India are Sole Proprietorship, Partnership Firm, Limited Liability Partnership (LLP), and Private Limited Company, each carrying distinct tax implications. Understanding these differences is a vital first step in effective tax management. For more detailed guidance on choosing the right legal structure for your business, consider reviewing additional resources.

Brief Tax Implications by Structure:

Choosing the right legal entity is not just a legal formality; it’s a strategic decision with long-term financial consequences. Here’s a brief overview of how taxes apply to different structures:

- Sole Proprietorship: This is the simplest structure, where the business is owned and controlled by one individual. There’s no legal distinction between the owner and the business. Consequently, all business profits are treated as the owner’s personal income and are taxed according to the individual income tax slab rates applicable to the owner. While easy to set up and manage with minimal compliance, the major drawback is unlimited liability – the owner is personally responsible for all business debts and losses.

- Partnership Firm: Formed by two or more individuals who agree to share profits (or losses), a partnership firm is governed by the Indian Partnership Act, 1932. From a tax perspective, the firm itself is taxed at a flat rate of 30% on its profits, plus applicable surcharge and cess. A key advantage is that the share of profit received by the partners from the firm is exempt from tax in their individual hands (as the firm has already paid tax on it). Partners may receive remuneration or interest on capital, which is deductible for the firm (subject to limits) and taxable for the partners.

- Limited Liability Partnership (LLP): An LLP combines the benefits of a partnership (flexibility) and a company (limited liability). Governed by the Limited Liability Partnership Act, 2008, it’s treated as a separate legal entity. For tax purposes, LLPs are taxed similarly to Partnership Firms – a flat rate of 30% (plus surcharge/cess) on profits. Partners’ share of profit is exempt in their hands. The key advantage over a traditional partnership is that partners have limited liability, protecting their personal assets from business debts.

- Private Limited Company: A Private Limited Company is a separate legal entity distinct from its owners (shareholders), incorporated under the Companies Act, 2013. This structure offers limited liability to shareholders and makes raising funds easier. Companies are subject to corporate income tax. The rates can vary depending on factors like turnover and the date of incorporation (with concessional rates available for newer manufacturing companies and those below certain turnover thresholds). Profits distributed as dividends to shareholders are taxed in the hands of the shareholders at their applicable slab rates. Companies face higher compliance requirements compared to proprietorships or partnerships, including mandatory audits and filings with the Registrar of Companies (ROC).

Selecting the appropriate structure is a foundational step in your tax guide for Indian entrepreneurs, influencing both your tax outflow and compliance burden.

Income Tax Essentials: Your Core Responsibility

Understanding and complying with Income Tax regulations is a cornerstone of running a small business in India. The Income Tax Act, 1961, governs how the profits earned by your business are taxed. Failing to grasp these essentials can lead to incorrect filings, penalties, and unnecessary financial stress. This section delves into the core concepts of income tax relevant to small businesses, forming a vital part of Taxation 101 for Small Business. For assistance with online tax returns, check out this step-by-step guide to filing income tax returns for salaried individuals in India. Whether you operate as a proprietor, partner, or director of a company, knowing how income tax applies to your business earnings is non-negotiable for sound financial management and legal compliance.

What is Taxable Business Income?

The starting point for income tax calculation is determining your taxable business income. In simple terms, this is the profit your business makes during a financial year (April 1st to March 31st). It’s calculated by subtracting all allowable business expenditures from your total revenue or gross receipts.

Profit = Total Revenue – Allowable Business Expenditures

It’s crucial to understand what constitutes an ‘allowable’ expense under the Income Tax Act. These are expenditures incurred wholly and exclusively for the purpose of carrying out your business or profession. Common examples include:

- Rent paid for office premises

- Salaries and wages paid to employees

- Marketing and advertising costs

- Business travel expenses

- Depreciation on business assets (like machinery, computers, furniture)

- Office supplies and printing costs

- Internet and telephone bills

- Professional fees paid (e.g., to accountants or lawyers)

- Bank charges and interest on business loans

Crucially, you must maintain meticulous records – invoices, bills, receipts, bank statements – to substantiate these expenses. Without proper documentation, the Income Tax Department may disallow your expense claims, leading to a higher taxable income and tax liability.

Understanding Income Tax Slabs & Regimes

The rate at which your business income is taxed depends on your business structure and the applicable tax regime.

- For Sole Proprietors: Your business income is added to your other income (if any, like salary or interest), and the total taxable income is taxed as per the individual income tax slab rates. India currently offers taxpayers a choice between two tax regimes:

- Old Tax Regime: Offers various deductions and exemptions (like HRA, Section 80C, 80D, etc.) but has higher tax rates across slabs.

- New Tax Regime (Section 115BAC): Offers lower, concessional tax rates but requires forgoing most deductions and exemptions.

The choice between regimes should be made carefully based on your income level and potential deductions.

- For Partnership Firms & LLPs: As mentioned earlier, these entities are taxed at a flat rate of 30% on their net profit, plus applicable surcharge and health & education cess.

- For Private Limited Companies: Corporate tax rates apply. The standard rate is 30% (plus surcharge/cess), but lower rates are applicable for companies with turnover up to ₹400 Crore (currently 25%) and new manufacturing companies incorporated after October 1, 2019 (currently 15%, subject to conditions).

Action: For the latest, specific tax rates applicable in the current financial year, always refer to the official Income Tax Department website.

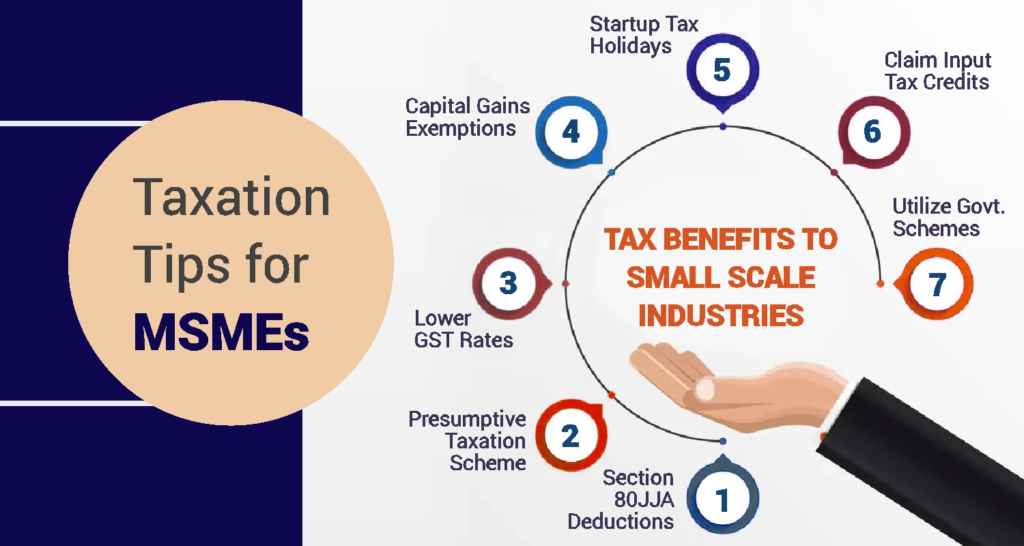

The Presumptive Taxation Scheme Advantage (Sec 44AD, 44ADA, 44AE)

To simplify tax compliance for small businesses and professionals, the Income Tax Act offers a Presumptive Taxation Scheme. Under this scheme, eligible taxpayers can declare income at a prescribed minimum percentage of their gross turnover or receipts, relieving them from the burden of maintaining detailed books of accounts (though maintaining basic records is still advisable) and getting them audited.

- Section 44AD: Applicable to eligible resident individuals, HUFs, and partnership firms (not LLPs) engaged in certain businesses. Income is presumed to be 8% of gross turnover/receipts. This rate is reduced to 6% for turnover received through banking channels (digital payments). Eligibility requires turnover not exceeding ₹2 Crore (proposed to be increased to ₹3 Crore if cash receipts are <=5% of total receipts from AY 2024-25).

- Section 44ADA: Applicable to resident individuals and partnership firms (not LLPs) engaged in specified professions (like legal, medical, engineering, accountancy, architecture, etc.). Income is presumed to be 50% of gross receipts. Eligibility requires gross receipts not exceeding ₹50 Lakh (proposed to be increased to ₹75 Lakh if cash receipts are <=5% of total receipts from AY 2024-25).

- Section 44AE: Applicable to taxpayers owning not more than 10 goods carriages, engaged in plying, hiring, or leasing them. Income is presumed based on the number and type of goods vehicles owned.

Benefit: This scheme significantly reduces the compliance burden. However, if your actual profit is lower than the presumed percentage, you can opt out, but then you’ll need to maintain books and potentially get them audited if your income exceeds the basic exemption limit. This scheme offers valuable small business tax tips Delhi-based businesses, as well as those across India, can leverage for easier compliance. For deeper insights, refer to the understanding the composition scheme under GST.

Advance Tax & Self-Assessment Tax Explained

Income tax isn’t just paid once a year. The concept of “pay as you earn” applies through Advance Tax.

- Advance Tax: If your estimated total tax liability for the financial year (after deducting TDS) is likely to be ₹10,000 or more, you are required to pay Advance Tax in installments throughout the year. The due dates are typically:

- 15% by June 15th

- 45% by September 15th

- 75% by December 15th

- 100% by March 15th

(Note: Taxpayers opting for the Presumptive Scheme under Sec 44AD/44ADA need to pay 100% by March 15th). Failure to pay Advance Tax or underpayment attracts interest under Section 234B and 234C.

- Self-Assessment Tax (SAT): After the financial year ends and before you file your Income Tax Return, you calculate your final tax liability. If, after accounting for all the Advance Tax paid and TDS deducted, there is still some tax due, you must pay this balance amount. This final payment is called Self-Assessment Tax (paid using Challan 280). Your ITR cannot be successfully filed until all due Self-Assessment Tax is paid.

Filing Your Income Tax Return (ITR)

Filing an Income Tax Return (ITR) annually is a mandatory legal requirement for all companies and firms, and for individuals/proprietors if their gross total income exceeds the basic exemption limit or if they meet certain other criteria (like high-value transactions, foreign assets, etc.). It’s the process of reporting your income, deductions, and tax paid to the Income Tax Department.

- Relevant ITR Forms: The specific ITR form depends on your business structure and income sources:

- ITR-3: For Individuals/HUFs having income from Profits and Gains of Business or Profession.

- ITR-4 (Sugam): For Individuals/HUFs/Firms (other than LLP) opting for the Presumptive Income Scheme under Sec 44AD, 44ADA or 44AE.

- ITR-5: For Firms, LLPs, AOPs (Association of Persons), BOIs (Body of Individuals).

- ITR-6: For Companies (other than companies claiming exemption under Section 11).

- Due Dates: Timely filing is crucial. The due dates typically are:

- July 31st: For individuals, HUFs, AOPs, BOIs whose accounts are not required to be audited.

- October 31st: For companies and taxpayers (including individuals/firms) whose accounts are required to be audited under the Income Tax Act or any other law.

- November 30th: For taxpayers subject to Transfer Pricing provisions.

***Disclaimer:** These are general dates. Always check the official notifications for the specific assessment year as deadlines can be extended.*

Timely and accurate ITR filing is among the core Mumbai business tax essentials and vital for businesses everywhere to avoid penalties and maintain a good compliance record.

Goods and Services Tax (GST): Navigating Indirect Tax

Goods and Services Tax (GST) transformed India’s indirect tax landscape when it was implemented in July 2017. It subsumed a multitude of central and state taxes like VAT, Service Tax, Central Excise Duty, etc., into a single, unified tax structure. Understanding GST is critical for almost every small business, whether you deal in goods or services, as it impacts pricing, supply chains, and compliance procedures. Navigating its requirements, from registration to return filing, is essential for smooth operations. For those starting new businesses, mastering the process is critical, as outlined in launching your startup right – mastering GST registration in India.

What is GST & When Do You Need to Register?

GST is a consumption-based tax levied on the supply of goods and services. It’s a destination-based tax, meaning the tax revenue generally accrues to the state where the goods or services are consumed. The fundamental question for any new business is: do I need to register for GST?

- Registration Threshold: GST registration is mandatory if your Aggregate Annual Turnover exceeds certain limits. Currently, the threshold is:

- ₹40 Lakhs for suppliers of goods exclusively (in most states).

- ₹20 Lakhs for suppliers of services (and suppliers of both goods and services).

- ₹10 Lakhs / ₹20 Lakhs for certain Special Category States (like North-Eastern states, Himachal Pradesh, Uttarakhand, etc. – check current list).

- Aggregate turnover includes taxable supplies, exempt supplies, exports, and inter-state stock transfers under the same PAN, calculated on an all-India basis.

- Mandatory Registration: Regardless of turnover, registration is compulsory in specific cases, including:

- Businesses making any inter-state taxable supply of goods.

- Casual taxable persons.

- Non-resident taxable persons.

- Persons required to deduct TDS under GST.

- E-commerce operators and persons supplying goods through them (except service providers below the threshold).

- Input Service Distributors (ISD).

- Voluntary Registration: Even if your turnover is below the threshold, you can opt for voluntary GST registration. The main benefit is that you can then collect GST from your customers and claim Input Tax Credit (ITC) on your business purchases and expenses. This can be advantageous if your suppliers are registered or if your customers require GST invoices to claim ITC themselves. Finding

Bangalore small business tax resourcesor local advisors can help you navigate the specific GST registration procedures efficiently.

CGST, SGST/UTGST, IGST: Understanding the Components

GST has different components depending on the nature of the supply (within a state or between states):

- CGST (Central Goods and Services Tax): Levied by the Central Government on intra-state supplies of goods and services (i.e., transactions within the same state). The revenue collected under CGST goes to the Central Government.

- SGST/UTGST (State Goods and Services Tax / Union Territory Goods and Services Tax): Levied by the respective State Government (SGST) or Union Territory Government (UTGST) on intra-state supplies of goods and services. The revenue collected under SGST/UTGST goes to the respective State/UT Government. In any intra-state transaction, both CGST and SGST/UTGST are levied simultaneously (e.g., if the GST rate is 18%, it will be 9% CGST + 9% SGST/UTGST).

- IGST (Integrated Goods and Services Tax): Levied by the Central Government on all inter-state supplies of goods and services (i.e., transactions between two different states or Union Territories) and also on imports and exports. The IGST rate is generally the sum of the applicable CGST and SGST/UTGST rates. The revenue is collected by the Centre but apportioned to the destination state. The system allows for the seamless flow of Input Tax Credit (ITC). For example, IGST credit can be used to pay IGST, CGST, and SGST/UTGST liability (in that order), while CGST credit can be used for CGST and then IGST, and SGST/UTGST credit can be used for SGST/UTGST and then IGST.

The GST Composition Scheme Option

Recognizing the compliance burden on small businesses, the GST law provides a simpler alternative: the Composition Scheme. Taxpayers opting for this scheme pay tax at a lower, fixed percentage of their turnover and have significantly reduced compliance requirements (like quarterly tax payment and simplified annual return).

- Eligibility: The scheme is generally available to taxpayers whose aggregate annual turnover in the preceding financial year did not exceed ₹1.5 Crore (₹75 Lakh for specified Special Category States). It’s applicable mainly to suppliers of goods (like manufacturers, traders) and restaurant services. Certain businesses, like service providers (other than restaurants), suppliers making inter-state outward supplies, or those supplying through e-commerce operators requiring TCS, are generally ineligible. (Note: A separate, similar scheme exists for service providers with turnover up to ₹50 Lakh).

- Tax Rates: Rates are low, typically 1% for traders/manufacturers, 5% for restaurants, and 6% for eligible service providers under the separate scheme (rates are split between CGST and SGST/UTGST).

- Limitations: Businesses under the Composition Scheme cannot collect tax from their customers on their invoices (they cannot issue tax invoices). Consequently, the buyers from a composition dealer cannot claim Input Tax Credit (ITC) on those purchases. The composition dealer also cannot claim ITC on their own inward supplies (purchases/expenses).

- Decision Point: Choosing the Composition Scheme involves a trade-off. You gain simplicity and lower tax rates, but lose the ability to claim ITC and might face challenges selling to businesses that require GST invoices for their own ITC claims. Evaluate carefully based on your business model, customer base, and purchase patterns.

GST Return Filing: Staying Compliant

Regular and accurate filing of GST returns is the backbone of GST compliance. It’s how businesses declare their sales, purchases, calculate tax liability, pay taxes, and pass on Input Tax Credit.

- Common Returns:

- GSTR-1: A monthly or quarterly (based on turnover and choice under QRMP scheme) statement of outward supplies (sales details). Due dates are typically the 11th (monthly) or 13th (quarterly) of the following month.

- GSTR-3B: A monthly summary return used for declaring summary GST liabilities, claiming ITC, and making tax payments. Due dates vary (typically 20th, 22nd, or 24th of the following month) depending on the taxpayer’s turnover and state.

- QRMP Scheme (Quarterly Return Monthly Payment): Taxpayers with aggregate turnover up to ₹5 Crore can opt to file GSTR-1 and GSTR-3B quarterly, while paying tax monthly through a simple challan.

- Annual Return (GSTR-9) & Reconciliation Statement (GSTR-9C): Required annually by taxpayers above a certain turnover threshold (currently ₹2 Crore for GSTR-9, ₹5 Crore for self-certified GSTR-9C).

- Importance: Timely filing is absolutely crucial. Delays lead to late fees and interest charges. Inaccurate filing can result in mismatches in ITC claims between suppliers and recipients, leading to disputes and potential denial of credit. A good compliance record is essential for business reputation and smooth functioning of the credit chain.

Action: For all GST-related activities, including registration, return filing, tax payment, and checking compliance status, use the official GST Portal. Effective Kolkata small business tax planning must incorporate a robust system for managing GST compliance accurately and on time.

Tax Deducted at Source (TDS): Your Role as a Deductor

Tax Deducted at Source (TDS) is a significant compliance area for many small businesses in India. It’s a mechanism implemented by the Income Tax Department to collect tax at the very source of income generation. As a business owner making certain types of payments, you may be obligated to deduct tax before releasing the full payment to the recipient (payee) and deposit that deducted tax with the government. Understanding your TDS obligations is crucial to avoid interest and penalties. For NRIs, understanding TDS on rental and property sales can be critical, detailed in understanding the TDS rules for NRIs on rental income and property sales.

What is TDS?

TDS operates on the principle of “pay as you earn.” The person or entity responsible for making specified payments (the deductor) is required to deduct a certain percentage of tax before making the payment to the recipient (the deductee). This deducted amount is then deposited with the government on behalf of the deductee. The deductee can later claim credit for this amount against their final income tax liability for the year, based on the TDS certificate issued by the deductor. It ensures a regular flow of revenue to the government and helps track income streams.

Common TDS Scenarios for Small Businesses

While the TDS provisions cover a wide range of payments, small businesses commonly encounter the following scenarios where they might need to deduct tax:

- Salaries (Section 192): If you employ staff and pay salaries exceeding the basic exemption limit, you must deduct TDS based on the employee’s applicable income tax slab rates after considering their declared investments and deductions.

- Rent Payments (Section 194I): If you pay rent for land, building, plant, or machinery, and the total annual rent exceeds the threshold (currently ₹2,40,000 per financial year), you need to deduct TDS. The rate is typically 2% for plant/machinery and 10% for land/building/furniture/fittings.

- Payments for Professional or Technical Services (Section 194J): If you pay fees for professional services (like legal, medical, engineering, accountancy, etc.) or technical services, and the total payment in a financial year exceeds the threshold (currently ₹30,000 per category), TDS at 10% (or 2% for technical services/royalty for sale/distribution/exhibition of cinematographic films) is applicable.

- Payments to Contractors/Sub-contractors (Section 194C): If you make payments to contractors or sub-contractors for carrying out any work (including supply of labour), and the single payment exceeds ₹30,000 or the aggregate payments during the financial year exceed ₹1,00,000, you need to deduct TDS. The rate is 1% for payments to resident individuals/HUFs and 2% for payments to other resident persons.

- Commission or Brokerage (Section 194H): If you pay commission or brokerage (excluding insurance commission) exceeding ₹15,000 in a financial year, TDS at 5% is applicable.

- Purchase of Goods (Section 194Q): If your total sales, gross receipts or turnover from the business exceeded ₹10 Crore during the preceding financial year, you are required to deduct TDS at 0.1% on purchases of goods exceeding ₹50 Lakh from a single resident supplier in the current financial year.

Note: Threshold limits and rates are subject to change. Always refer to the latest provisions.

TDS Compliance Steps

Complying with TDS involves a systematic process:

- Obtain TAN: First, you need to obtain a Tax Deduction and Collection Account Number (TAN) if you are liable to deduct TDS. PAN is not sufficient for TDS purposes.

- Deduction: Deduct the correct amount of tax at the applicable rate at the time of crediting the amount to the payee’s account or at the time of payment, whichever is earlier. Ensure you check if the payee has provided PAN; higher TDS rates apply if PAN is not available.

- Deposit: Deposit the TDS amount deducted with the government using Challan ITNS 281 by the due date. The usual due date is the 7th of the month following the month in which tax was deducted (e.g., tax deducted in June must be deposited by July 7th). For tax deducted in March, the due date is typically April 30th.

- Return Filing: File quarterly TDS returns electronically. The common forms are:

- Form 24Q: For TDS on Salary payments.

- Form 26Q: For TDS on all payments other than Salary.

- Form 27Q: For TDS on payments to non-residents (other than salary).

The due dates for quarterly returns are generally July 31st, October 31st, January 31st, and May 31st for the respective quarters.

- Issuing TDS Certificates: Issue TDS certificates to the deductees, which they use to claim tax credit.

- Form 16: Issued annually to employees for TDS on salary (by June 15th of the following financial year).

- Form 16A: Issued quarterly to deductees for TDS on non-salary payments (within 15 days from the due date of filing the quarterly TDS return).

Consequences of Non-Compliance: Failure to deduct TDS, deposit TDS on time, or file TDS returns by the due date attracts interest (u/s 201(1A)) and penalties (u/s 271C for non-deduction, late filing fees u/s 234E, penalty u/s 271H). Consistent default can even lead to prosecution. Adhering strictly to TDS rules is vital for effective Chennai small business tax strategies and overall financial discipline.

Essential Tax Compliance & Record Keeping Practices

Beyond understanding specific taxes like Income Tax, GST, and TDS, successful tax management for small businesses hinges on establishing robust compliance routines and meticulous record-keeping habits. These foundational practices not only ensure you meet legal requirements but also provide valuable insights for business decision-making and make interactions with tax authorities smoother. Neglecting these basics can lead to confusion, errors, penalties, and significant stress during audits or assessments.

The Importance of Maintaining Proper Books of Accounts

Maintaining accurate and organized financial records is not just good business practice; it’s often a legal requirement under various laws, including the Income Tax Act and Companies Act. Proper books of accounts are crucial for several reasons:

- Accurate Profit Calculation: They form the basis for calculating your true business profit or loss, which is essential for determining your correct income tax liability.

- Legal Compliance: The Income Tax Act mandates certain taxpayers (based on turnover/income thresholds) to maintain specified books of accounts. Failing to do so can attract penalties.

- Tax Filing & Audits: Well-maintained records are indispensable for preparing and filing accurate Income Tax Returns, GST Returns, and TDS Returns. They are the primary evidence required during any scrutiny, assessment, or audit by tax authorities.

- Informed Decision-Making: Financial records provide insights into your business’s performance, cash flow, receivables, and payables, helping you make informed strategic decisions.

- Claiming Deductions: Proper records are necessary to substantiate all the expenses you claim as deductions against your income.

- GST Compliance: Detailed records of sales, purchases, and expenses are essential for accurate GST liability calculation and claiming Input Tax Credit (ITC).

What to maintain? While specific requirements may vary based on your business structure and turnover, essential records generally include:

- Sales Invoices and Bills issued

- Purchase Invoices and Bills received

- Expense Vouchers and supporting documents

- Bank Statements (for all business accounts)

- Stock Records (inventory details, consumption, production)

- Asset Register (details of fixed assets and depreciation)

- Records of loans, investments, and liabilities

- Payroll records (if you have employees)

Using accounting software can greatly simplify record-keeping and ensure accuracy. For more steps to ensure your accounting is in place, see set up an accounting system for my small business.

Getting Your PAN and TAN

Two critical identification numbers for tax compliance in India are PAN and TAN:

- PAN (Permanent Account Number): This is a unique 10-digit alphanumeric identifier issued by the Income Tax Department. It is mandatory for:

- Filing Income Tax Returns.

- Opening bank accounts for the business.

- Entering into specified financial transactions.

- Registering under GST (PAN is used for GSTIN).

- Receiving payments where TDS is applicable (to avoid higher deduction rates).

Every legal entity (individual, company, firm, LLP) undertaking business needs a PAN. Proprietors use their individual PAN for business purposes.

- TAN (Tax Deduction and Collection Account Number): This is a 10-digit alphanumeric number required for all persons/entities responsible for deducting tax at source (TDS) or collecting tax at source (TCS). You cannot deposit TDS or file TDS returns without a valid TAN. If your business is liable to deduct TDS (e.g., on salaries, rent, contractor payments), obtaining TAN is mandatory.

Key Tax Due Dates Calendar (Illustrative)

Staying on top of numerous tax deadlines throughout the year can be challenging. Creating a compliance calendar is highly recommended. Below is an illustrative list of common due dates (remember these are general and can change):

| Compliance Task | Frequency | Typical Due Dates |

|---|---|---|

| Advance Tax Payment | Quarterly | June 15, Sep 15, Dec 15, Mar 15 (100% by Mar 15 for Presumptive Scheme) |

| TDS Deposit | Monthly | 7th of the following month (April 30th for March deductions) |

| TDS Return Filing | Quarterly | July 31 (Q1), Oct 31 (Q2), Jan 31 (Q3), May 31 (Q4) |

| GST Return Filing | Monthly/Quarterly | GSTR-1: 11th/13th; GSTR-3B: 20th/22nd/24th (Varies); QRMP tax payment monthly |

| Income Tax Return (ITR) | Annually | July 31 (Non-Audit); Oct 31 (Audit cases); Nov 30 (Transfer Pricing) |

Disclaimer: This table provides indicative dates only. Always verify the exact due dates for the specific financial year from the official websites (Income Tax Department and GST Portal) or consult with a tax professional, as deadlines are subject to change and government notifications. Keeping track of these dates is crucial Pune tax advice for businesses and essential for avoiding penalties across India.

Tax Planning & Seeking Professional Guidance

Merely complying with tax laws by filing returns and paying dues on time is just one part of the equation. Proactive tax planning involves strategically arranging your financial affairs to minimize your tax liability legally, while still remaining fully compliant. For small businesses, effective tax planning can free up valuable capital for growth and investment. However, navigating the complexities of small business taxation India requires careful consideration and often, expert help.

Simple Tax Planning Strategies

While complex tax avoidance schemes are illegal and risky, legitimate tax planning strategies can significantly reduce your tax burden. Some common approaches for small businesses include:

- Claiming All Legitimate Deductions: Ensure you are identifying and claiming every permissible business expense, from operational costs like rent and salaries to depreciation on assets. Maintain thorough documentation for all claims.

- Choosing the Right Business Structure: As discussed earlier, the tax implications vary significantly between a proprietorship, partnership, LLP, and company. Selecting the most tax-efficient structure for your business scale and profit level is a key planning decision.

- Utilizing Appropriate Tax Schemes: Evaluate if schemes like the Presumptive Taxation Scheme (Sec 44AD/44ADA) for Income Tax or the Composition Scheme for GST are beneficial for your business, considering the trade-offs.

- Tax-Saving Investments (for Proprietors/Individuals): If you operate as a sole proprietor, your business income is taxed at individual rates. You can reduce your overall tax liability by making investments eligible for deductions under sections like 80C (PPF, ELSS, Life Insurance Premium), 80D (Health Insurance), 80G (Donations), etc., within the specified limits.

- Timing of Income and Expenses: Strategically timing certain incomes or expenditures (where possible and legitimate) around the financial year-end can sometimes help manage taxable income for a particular year.

- Capital Gains Management: Plan the timing of selling capital assets to manage long-term and short-term capital gains tax implications effectively, including offsetting losses against gains where permitted.

Why and When to Hire Tax Professionals (TaxRobo CTA)

While basic understanding is essential, the intricacies of small business taxation India – with its frequent amendments, complex rules, and multiple compliance requirements (Income Tax, GST, TDS, ROC filings for companies/LLPs) – can quickly become overwhelming for a business owner focused on growth. This is where professional guidance becomes invaluable.

- Complexity: Tax laws are complex and constantly evolving. Professionals stay updated on the latest changes, ensuring you remain compliant.

- Accuracy & Compliance: Experts minimize the risk of errors in calculations and filings, helping you avoid costly penalties and interest charges.

- Time Savings: Outsourcing tax compliance frees up your valuable time, allowing you to focus on core business activities.

- Strategic Advice: Tax professionals offer more than just compliance; they provide strategic advice tailored to your business, helping you optimize your tax position legally. They can assist with choosing the right business structure, evaluating tax schemes, and planning major financial decisions.

Consider seeking professional help if:

- You find tax compliance consuming too much of your time.

- You are unsure about specific tax rules or their application to your business.

- Your business is growing rapidly, leading to more complex transactions.

- You are planning significant investments or restructuring.

- You face scrutiny or notices from tax departments.

TaxRobo offers comprehensive, expert assistance tailored for small businesses across India. Whether you need help with Company Registration, managing GST compliance, filing Income Tax Returns, maintaining Accounts, handling Audits, or strategic tax planning, our team is here to help. We provide dedicated support and resources, including small business tax tips Delhi, Bangalore small business tax resources, Mumbai business tax essentials, insights for Kolkata small business tax planning, Pune tax advice for businesses, and Chennai small business tax strategies. Let TaxRobo simplify your tax journey.

Conclusion

Navigating the tax system is an integral part of running a small business in India. This Taxation 101 for Small Business guide has provided a foundational overview of the key areas you need to be aware of: understanding how your chosen business structure impacts taxation, mastering Income Tax basics including calculating taxable income and filing returns, getting to grips with the Goods and Services Tax (GST) framework, complying with Tax Deducted at Source (TDS) obligations, the critical importance of diligent record-keeping, and the value of proactive tax planning.

Staying informed about tax regulations and ensuring timely compliance are non-negotiable for the long-term health and success of your enterprise. While the rules might seem complex initially, breaking them down into manageable parts – Income Tax, GST, TDS, and essential practices – makes the process less daunting. Remember, effective tax management goes beyond just paying taxes; it involves understanding the system, leveraging available schemes legally, and maintaining accurate records.

Don’t let tax complexities hinder your entrepreneurial spirit. Navigating the intricacies of small business taxation India can be challenging, but you don’t have to do it alone. For personalized guidance, expert handling of your tax obligations, and peace of mind, contact TaxRobo today. Let us be your trusted partner in simplifying taxes, offering comprehensive small business tax tips, and ensuring your business stays compliant and financially sound.

Frequently Asked Questions (FAQs)

- Q1: Do I need GST registration if my turnover is below the threshold in India?

A: Generally, no. If your aggregate annual turnover is below the prescribed limit (e.g., ₹40 Lakhs for goods, ₹20 Lakhs for services in most states), registration is not mandatory. However, you must register if you fall under specific compulsory registration criteria, such as making inter-state supplies of goods or selling through e-commerce platforms requiring TCS. You can also opt for voluntary registration, which allows you to collect GST and claim Input Tax Credit (ITC), potentially beneficial if your customers or suppliers are registered. - Q2: Can I claim expenses incurred at my home office as a business deduction?

A: Yes, it is possible under certain conditions. If you use a specific, clearly demarcated part of your home exclusively and regularly for your business activities, you can claim a proportionate deduction for expenses like rent (if applicable), electricity, internet, and depreciation on assets used in that space. It’s crucial to maintain meticulous records and have a reasonable basis for allocating the expenses between personal and business use. Documentation is key to justifying the claim. - Q3: What is the main difference between Advance Tax and Self-Assessment Tax?

A: The key difference lies in the timing and purpose. Advance Tax is an estimated tax paid in installments during the financial year based on your projected income for that year (applicable if estimated tax liability is ₹10,000 or more). It follows the ‘pay as you earn’ principle. Self-Assessment Tax is the final tax amount paid after the financial year ends but before filing your Income Tax Return (ITR). It covers any shortfall between your total assessed tax liability for the year and the sum of Advance Tax already paid and TDS already deducted. - Q4: What happens if I file my ITR or GST returns late?

A: Late filing of tax returns attracts consequences. For ITR, late filing incurs a late filing fee (under Section 234F) and interest (under Section 234A) on the unpaid tax amount. Furthermore, you might lose the ability to carry forward certain business losses (except unabsorbed depreciation and loss from house property) to future years. For GST returns (like GSTR-1 and GSTR-3B), late filing results in late fees (levied per day of delay, subject to maximum caps) and interest on the outstanding tax liability. It can also negatively impact your GST compliance rating and delay the ability of your customers to claim Input Tax Credit based on your invoices. - Q5: Is choosing the Presumptive Taxation Scheme (Sec 44AD/44ADA) always beneficial for small businesses?

A: Not necessarily. The Presumptive Scheme offers significant simplification by allowing you to declare income as a fixed percentage (6%/8% for 44AD, 50% for 44ADA) of your turnover/receipts, avoiding detailed bookkeeping and audit requirements (under certain conditions). However, it’s beneficial only if your actual profit margin is equal to or higher than the presumed percentage. If your actual business expenses are high and your net profit margin is lower than the presumed rate, opting out of the scheme, maintaining proper books of accounts, and calculating tax on the actual lower profit might result in a lower tax liability. It requires careful evaluation based on your specific business’s profitability.

Hey there! Do you know if they make any plugins to protect against hackers? I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?