What are the Risks and Rewards of Scaling a Franchise Business in India?

The Indian market is buzzing with entrepreneurial energy, and franchise business growth in India is a significant part of this story. For many successful small business owners, the idea of multiplying their success through franchising is incredibly appealing. Similarly, individuals looking for investment opportunities often consider acquiring multiple units of an established franchise. Scaling a franchise business, which essentially means expanding from one or a few units to many, can unlock tremendous potential. However, this journey is far from simple. It’s a path filled with both exciting opportunities and considerable challenges. Understanding the risks and rewards of scaling a franchise business is absolutely crucial before you decide to expand your footprint in the dynamic Indian market. This knowledge is vital whether you’re a potential franchisor aiming to grow your brand or an aspiring multi-unit franchisee. This post will explore the significant benefits, the inherent dangers, and effective strategies for successfully navigating franchise expansion in India.

The Exciting Rewards: Why Scale Your Franchise Business in the Indian Market?

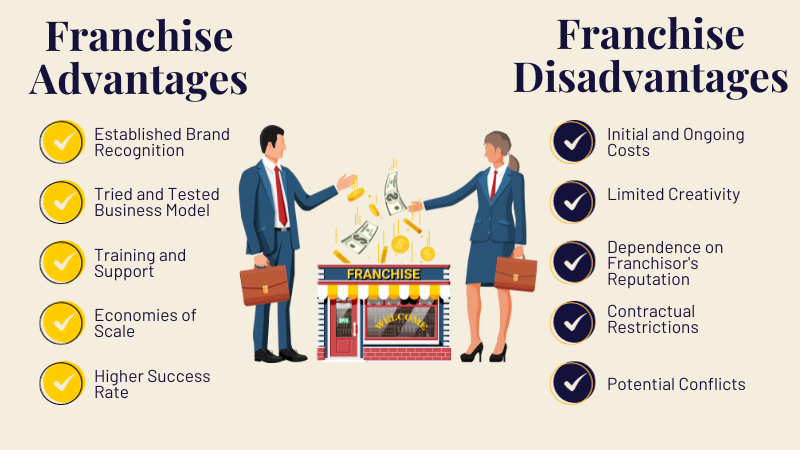

Expanding your franchise presence across India offers numerous compelling advantages. These potential upsides are often the primary drivers behind the decision to scale, promising significant growth and market influence. The rewards of scaling a franchise business Indian market are substantial, making it an attractive proposition for ambitious entrepreneurs. Let’s delve into the key scaling a franchise business benefits:

Exponential Revenue Growth and Profitability

Perhaps the most obvious benefit of scaling is the potential for dramatically increased revenue. Each new franchise unit represents an additional stream of income. As a franchisor, you typically earn initial franchise fees from new partners and ongoing royalty fees, usually calculated as a percentage of their revenue. This creates a more diversified and potentially stable income base compared to relying on a single outlet. Furthermore, scaling allows you to leverage economies of scale. Bulk purchasing of raw materials, inventory, or equipment across multiple units can lead to significant cost savings per unit. Similarly, marketing campaigns can be spread across a larger network, reducing the advertising cost attributable to each location and increasing overall efficiency. This combination of increased revenue streams and reduced operational costs per unit can lead to exponential growth in overall profitability, making the venture financially rewarding.

Enhanced Brand Recognition and Market Dominance

Operating multiple franchise locations significantly boosts your brand’s visibility and presence. As your outlets spread across different neighbourhoods, cities, or even states within India, more potential customers become aware of your brand. This increased recognition builds credibility and trust. Consumers often perceive larger, multi-location brands as more stable and reliable. Consistent branding and service across all locations reinforce this positive image. This heightened visibility not only attracts more customers but also helps establish a stronger competitive position within the Indian market. A wider presence can deter potential competitors and solidify your brand as a leader in its niche, contributing to long-term market dominance and customer loyalty. The more visible your brand, the more it becomes a part of the local landscape and consumer consciousness.

Increased Bargaining Power

As your franchise network grows, so does your collective purchasing power and market influence. This translates into increased bargaining power with various stakeholders. You can negotiate better rates and terms with suppliers due to larger order volumes. Landlords may offer more favourable lease agreements for desirable locations, seeing the stability and draw of a recognized brand. Advertising agencies and media outlets might provide better deals for larger campaigns covering multiple territories. Even financial institutions may offer more favourable credit terms and loan conditions, recognizing the reduced risk associated with a larger, diversified business operation. This improved negotiation leverage can significantly impact your bottom line and operational efficiency across the entire network.

Attracting Top Talent and Franchisees

Success breeds success. A growing, thriving franchise network naturally becomes more attractive to high-calibre professionals seeking management roles and talented individuals looking for employment opportunities. The perception of stability, growth potential, and a strong brand makes it easier to recruit and retain skilled staff, which is crucial for maintaining quality across units. Moreover, a successful, expanding network significantly enhances the appeal of the franchise opportunity itself. Potential franchisees are more likely to invest in a brand with a proven track record of growth and profitability. This allows you to be more selective in choosing franchise partners, ensuring you onboard individuals who are financially capable, operationally skilled, and aligned with your brand’s values. Highlighting successful franchise business opportunities in India within your network becomes a powerful recruitment tool.

Building a Valuable, Sellable Asset

A well-scaled, profitable franchise network is often significantly more valuable than a single independent business or a small number of outlets. The established systems, recurring royalty streams, brand recognition, and market footprint create a substantial asset. This increased valuation provides the franchisor with greater wealth-building potential. Whether the long-term goal is to pass the business on to the next generation, sell it to a larger corporation or private equity firm, or even take it public, a scaled franchise network represents a much more attractive and lucrative exit strategy. Scaling effectively transforms a successful business into a potentially high-value, transferable asset.

Understanding the Inherent Risks of Scaling a Franchise Business in India

While the rewards are enticing, ignoring the potential pitfalls would be reckless. Scaling introduces a new layer of complexities and challenges that can derail even a successful core business if not managed properly. Understanding the risks of scaling a franchise business India is paramount for sustainable growth. These risks involved in franchise expansion India require careful consideration and proactive mitigation strategies.

Dilution of Brand Standards and Quality Control

One of the biggest challenges in scaling a franchise is maintaining consistency across all locations. What makes your original unit successful – the unique product quality, specific service standards, brand ambience, and customer experience – must be replicated faithfully by every franchisee. As the network grows, ensuring this consistency becomes exponentially harder. Franchisees might cut corners to save costs, fail to train staff adequately, or deviate from established operating procedures. Even minor inconsistencies can dilute the brand’s image over time. A single poorly managed outlet or a “rogue” franchisee providing subpar service can generate negative reviews and damage the reputation painstakingly built by the entire network. Protecting the brand promise across geographically dispersed units operating under different managers requires robust monitoring and enforcement mechanisms.

Increased Operational Complexity

Managing a single business is demanding; managing a network of ten, fifty, or a hundred units across different parts of India is vastly more complex. Logistics and supply chain management become critical – ensuring timely delivery of goods or raw materials to all locations, potentially dealing with varying state-level regulations or taxes, can be a nightmare without efficient systems. Communication across the network needs to be streamlined and effective. You need robust IT infrastructure for point-of-sale (POS) systems, inventory management, reporting, and communication platforms. Developing and delivering consistent training programs for franchisees and their staff across diverse locations requires significant resources. Furthermore, the sheer diversity of the Indian market – with its regional variations in consumer preferences, local regulations, and business environments – adds another layer of operational complexity that must be navigated carefully.

Significant Financial Strain and Investment

Scaling requires substantial capital investment, often far exceeding the initial startup costs of the original business. Funds are needed for identifying and securing new locations (often involving high real estate costs in prime areas), outlet setup and furnishing, initial marketing campaigns for new launches, developing comprehensive training programs, investing in technology infrastructure, and building a corporate support team to manage the network. There’s often a significant lag before new units become profitable, which can put considerable strain on the franchisor’s cash flow. Underestimating the capital required or failing to secure adequate funding can quickly lead to financial distress. Specific risks involved in franchise expansion India include navigating complex property acquisition processes and managing the working capital needed to support multiple fledgling units simultaneously. Therefore, understanding how much capital is required to start a Private Limited Company could provide valuable insights into managing financial resources for franchise expansion.

Finding and Managing Qualified Franchisees

The success of your franchise network heavily depends on the quality of your franchisees. Finding the right partners – individuals who are not only financially capable but also possess the necessary business acumen, share your brand’s vision and values, and are committed to following operational standards – is a significant challenge. The selection process needs to be rigorous and thorough. Once franchisees are onboard, managing these relationships effectively is crucial. Disputes can arise over territorial rights, marketing contributions, operational standards, or perceived lack of support. Dealing with underperforming franchisees requires careful handling, balancing the need to uphold standards with contractual obligations and potential legal ramifications. Poor franchisee selection or ineffective relationship management can severely hamper growth and damage the brand. For detailed guidelines to streamline these processes, refer to what legal requirements must be met to start a franchise business in India.

Legal and Regulatory Hurdles

Franchising involves complex legal frameworks. Drafting comprehensive, fair, and legally sound franchise agreements is essential to protect both the franchisor and the franchisee. While India does not have a single, dedicated franchise law like some countries (which mandates a specific Franchise Disclosure Document or FDD), adherence to contract law, intellectual property law, competition law, and various other regulations is critical. Ensuring compliance across the network with diverse central and state-level laws (such as the Shops and Establishments Act, labour laws, food safety regulations like FSSAI if applicable, and varying Goods and Services Tax – GST – requirements) can be a significant burden. Navigating potential legal disputes with franchisees over agreement terms, termination clauses, or other issues is another inherent risk. Failure to establish a solid legal foundation and maintain ongoing compliance can lead to costly litigation and regulatory penalties. Understanding these complexities often requires expert legal and financial guidance, implicitly highlighting the value of services like those offered by TaxRobo Online CA Consultation Service.

- (For general business regulations, business owners can refer to resources from the Ministry of Corporate Affairs (MCA) and relevant industry associations.)

Strategic Approaches: How to Scale a Franchise Business Successfully in India

Successfully navigating the expansion journey requires more than just a great concept; it demands meticulous planning, robust systems, and strategic execution. Implementing successful franchise scaling strategies India involves a proactive approach to managing growth and mitigating risks. Here’s how to scale a franchise business in India effectively, balancing the potential rewards with the inherent challenges while evaluating franchise risks and rewards at each step.

Start with a Proven and Profitable Prototype

Before even thinking about franchising, ensure your core business model is not just successful but also thoroughly proven and consistently profitable. It must be replicable. This means the success shouldn’t rely solely on your personal skills or unique local advantages that cannot be duplicated elsewhere. Document everything meticulously. Create detailed operations manuals covering every aspect of the business – from product preparation (recipes, techniques) and service protocols to customer interaction guidelines, opening/closing procedures, and financial reporting. This documented system becomes the blueprint for your franchisees, ensuring consistency and providing a solid foundation for replication across the Indian market. Without a strong, replicable prototype, scaling attempts are likely to falter.

Develop Robust Systems and Processes

Scaling magnifies the need for efficiency and consistency. Implement strong Standard Operating Procedures (SOPs) derived from your documented prototype. Invest wisely in technology. A reliable Point-of-Sale (POS) system that integrates inventory management and sales reporting is crucial. Customer Relationship Management (CRM) software can help manage customer data across the network. A central communication platform (intranet or dedicated software) facilitates smooth information flow between the franchisor and franchisees. Most importantly, establish comprehensive and ongoing training programs. These should cover initial training for new franchisees and their key staff on all operational aspects, brand standards, and use of technology, as well as continuous learning modules to keep skills updated and introduce new initiatives. Strong systems are the backbone of successful franchise scaling strategies India.

Rigorous Franchisee Selection Process

Choosing the right partners is arguably one of the most critical factors in successful scaling. Don’t rush this process. Define clear, objective criteria for your ideal franchisee. This should include minimum financial capacity (liquid capital, net worth), relevant business or management experience, a strong understanding of the local market they intend to operate in, and crucially, a cultural fit with your brand’s values and vision. Your selection process should be multi-staged, involving application reviews, financial verification, multiple interviews (including behavioural interviews), background checks, and potentially discovery days where candidates experience the business firsthand. Being highly selective upfront significantly reduces future management headaches and increases the likelihood of maintaining brand standards and achieving collective success.

Strategic Financial Planning and Funding

Expansion requires significant capital, so meticulous financial planning is non-negotiable. Create detailed financial projections for the expansion phase, including realistic estimates for setup costs per unit, ongoing support costs, marketing funds, and working capital requirements. Clearly map out your funding strategy – will you rely on internal accruals, seek bank loans (exploring schemes like Mudra or Stand-Up India where applicable, check MSME portals), attract private investors, or use a combination? Secure adequate funding before you commit to expansion targets. Implement strong financial controls and reporting mechanisms across the network, allowing you to monitor the financial health of individual units and the overall system. Proactive financial management helps anticipate cash flow challenges and ensures the scaling process is financially sustainable. Expert financial advice, potentially through services like TaxRobo Accounts Service, can be invaluable here.

Solid Legal Foundation and Compliance

A robust legal framework is essential to protect your brand and manage relationships effectively. Work with experienced legal counsel specializing in franchise and business law in India to draft clear, comprehensive, and fair franchise agreements. These agreements should meticulously detail the rights and obligations of both parties, including territory rights, fee structures, operational standards, training requirements, marketing contributions, term and renewal conditions, and termination clauses. Ensure ongoing compliance with all applicable central, state, and local laws and regulations. This includes business registrations (TaxRobo Company Registration Service), licenses, labour laws, intellectual property protection (TaxRobo Intellectual Property Service), and particularly tax regulations. Understanding the complexities of GST (CGST, SGST, IGST) for multi-state operations is vital. Regularly consult the official GST Portal for updates and ensure your systems are compliant. Proactive legal and compliance management, possibly supported by TaxRobo GST Service or TaxRobo Audit Service, minimizes legal risks involved in franchise expansion India.

Effective Communication and Support Structure

Maintaining strong, positive relationships with your franchisees is crucial for long-term success. Establish clear and regular channels for communication – this could include newsletters, regular regional or national meetings (virtual or in-person), a dedicated support hotline, and field visits from support staff. Provide robust ongoing support covering operations, local marketing assistance, technical troubleshooting, and business coaching. Create mechanisms for franchisees to provide feedback, raise concerns, and resolve conflicts constructively. A supportive and communicative environment fosters trust, encourages adherence to standards, and helps franchisees feel like valued partners in the brand’s growth journey. This strong support system is a key element in how to scale a franchise business in India successfully.

Evaluating Franchise Risks and Rewards: Making the Right Decision

The decision to scale a franchise is a significant strategic move with long-term implications. It requires a clear-headed assessment, moving beyond the initial excitement to objectively weigh the potential benefits against the very real challenges. Evaluating franchise risks and rewards specific to your business and the targeted expansion within the Indian market is a critical step that should not be rushed.

First, take a hard, honest look inward. Assess your company’s readiness for scaling. Do you have the necessary financial resources secured or a clear path to obtaining them? Is your operational model truly standardized, documented, and replicable? Does your current management team have the capacity and expertise to oversee a larger, more complex network, or will you need to hire experienced franchise professionals? Acknowledging any weaknesses allows you to address them proactively before launching into expansion.

Next, thorough market research is essential. Don’t assume success in one city or region guarantees success elsewhere in India. Analyze potential expansion markets carefully. Consider demographic trends, local competition, real estate availability and costs, supply chain feasibility, and any specific state or local regulations that might impact operations. Understand the nuances of consumer behaviour in different regions.

Engage in scenario planning. Map out different potential outcomes based on varying levels of success and potential setbacks. What does the best-case scenario look like financially and operationally? What are the potential downsides in a worst-case scenario (e.g., slow uptake, high franchisee failure rate), and do you have contingency plans and the financial resilience to withstand them? What is the most likely scenario, and are the projected rewards under this scenario worth the associated risks and required investment?

Finally, and crucially, seek expert advice. Don’t try to navigate the complexities of franchise scaling alone. Consult with experienced franchise consultants who understand the intricacies of the Indian market. Engage legal experts specializing in franchise law to ensure your agreements and compliance strategies are sound. Work closely with financial advisors or chartered accountants, like the experts at TaxRobo, to refine your financial projections, develop funding strategies, and establish robust financial controls (TaxRobo Online CA Consultation Service). Their expertise can help you make informed decisions and avoid costly mistakes while evaluating franchise risks and rewards.

Conclusion

Scaling a franchise business presents a powerful pathway to accelerated growth, enhanced brand recognition, and significant wealth creation. The potential rewards of scaling a franchise business Indian market are undeniable, offering opportunities for exponential revenue increase and market leadership. However, this journey is equally fraught with challenges. Diluted brand standards, operational nightmares, severe financial strain, difficulties in franchisee management, and complex legal hurdles are significant risks involved in franchise expansion India.

Success hinges on a strategic, well-planned approach. It requires a proven business model, robust systems, careful franchisee selection, solid financial backing, a strong legal foundation, and continuous support and communication. Ultimately, the decision to scale requires a thorough and honest evaluation of the risks and rewards of scaling a franchise business. Carefully weighing these factors, understanding the specific demands of the diverse Indian market, and preparing meticulously is the foundation for sustainable and profitable growth. Approaching expansion strategically, with eyes wide open to both the opportunities and the challenges, and leveraging expert guidance to navigate the financial and legal complexities, will significantly increase your chances of achieving long-term success.

Frequently Asked Questions (FAQs)

What are the first steps in how to scale a franchise business in India?

The very first steps involve perfecting your existing business unit. Ensure it’s consistently profitable and operates efficiently. Then, meticulously document all your operational procedures, recipes, service standards, and branding guidelines into comprehensive manuals. Critically assess if your success is replicable without your direct daily involvement. Finally, conduct initial consultations with legal and financial experts to understand the requirements and feasibility of franchising your specific business model in India.

How much capital is typically needed for franchise expansion in India?

There’s no single answer, as capital requirements vary hugely depending on the industry (e.g., quick-service restaurant vs. education centre vs. retail store), the scale of expansion planned, location choices (Tier 1 city vs. Tier 3 town), and the level of support infrastructure you intend to build. However, it always requires significant investment covering potential real estate acquisition or leasing deposits, outlet setup costs, initial inventory, local marketing launch expenses, legal fees for agreement drafting, technology investments (POS, software), building a franchisor support team, and sufficient working capital to sustain operations during the initial growth phase before royalty streams become substantial. Plan for substantial capital needs.

What are the main legal risks involved in franchise expansion India?

The main legal risks include:

- Contract Disputes: Ambiguities or perceived unfairness in the franchise agreement leading to disagreements over fees, territories, termination, or obligations.

- Non-Compliance: Failing to adhere to various central, state, and local regulations (e.g., Shops & Establishments Act, labour laws, FSSAI, GST rules which vary by state) can lead to penalties or forced closures.

- Intellectual Property (IP) Infringement: Franchisees misusing the brand’s trademarks or confidential information, or third parties infringing on the brand’s IP.

- Inconsistent Law Application: Navigating the varying interpretations or applications of laws across different Indian states.

- Termination Issues: Legal challenges arising from terminating underperforming or non-compliant franchisees.

How can I maintain brand consistency while scaling?

Maintaining brand consistency requires a multi-pronged approach:

- Detailed SOPs: Clear, comprehensive operations manuals that leave no room for ambiguity.

- Rigorous Training: Thorough initial and ongoing training programs for franchisees and their staff.

- Regular Audits: Scheduled and unscheduled visits by field support staff to check compliance with operational and brand standards.

- Mystery Shopping: Using third-party services to evaluate the customer experience anonymously.

- Robust Communication: Clear channels for disseminating updates, guidelines, and best practices.

- Shared Marketing Guidelines: Providing templates and standards for local marketing activities.

- Technology: Using integrated systems for monitoring key performance indicators (KPIs) and standards.

Are there government schemes supporting franchise business growth in India?

While there aren’t many government schemes specifically labelled for “franchise” expansion, franchisors and franchisees can often leverage general schemes aimed at supporting Micro, Small, and Medium Enterprises (MSMEs). Schemes like the Pradhan Mantri MUDRA Yojana (PMMY) for micro-unit loans, Stand-Up India for promoting entrepreneurship among women and SC/ST communities, and various credit guarantee schemes offered by SIDBI might be applicable depending on the scale and nature of the business and the profile of the borrower (franchisor or franchisee). It’s advisable to check the official portals of the Ministry of MSME and related financial institutions for the latest applicable schemes and eligibility criteria. The focus is generally on broader business support rather than franchise-specific incentives.