Section 44AD: Presumptive Taxation Scheme for Small Businesses

Running a small business in India comes with its unique set of challenges, and navigating the complexities of income tax compliance can often feel like a significant burden. Keeping detailed books of accounts, calculating profits accurately, and understanding various deductions can consume valuable time and resources. Fortunately, the Income Tax Act offers a simplified approach for certain businesses through the concept of presumptive taxation. This post focuses specifically on Section 44AD presumptive taxation, a scheme designed to ease the tax burden for eligible small businesses, offering significant small business tax relief India. If you are a small business owner or planning to start a small enterprise in India, understanding this scheme is crucial. We’ll explore what Section 44AD entails, who is eligible, how income is calculated, its benefits, and essential compliance points.

Understanding Section 44AD Presumptive Taxation

Before diving into the specifics of Section 44AD, let’s understand the broader concept it falls under. This foundational knowledge helps appreciate the value and purpose of this specific tax provision, setting the stage for exploring its application to small businesses.

What is Presumptive Taxation?

Presumptive taxation, at its core, is a method where business income is estimated based on a predetermined percentage of the total turnover or gross receipts, rather than calculating the actual profit or loss from operations. Think of it as a simplified calculation route offered by the tax authorities. The primary purpose of introducing the Indian presumptive taxation scheme was to simplify the tax system for smaller taxpayers, reduce the need for extensive record-keeping, and make tax filing less cumbersome. It acknowledges that maintaining detailed accounts can be challenging for small entities and offers a practical alternative, encouraging voluntary compliance. This approach saves time, reduces potential disputes over expense claims, and streamlines the entire tax assessment process for eligible taxpayers.

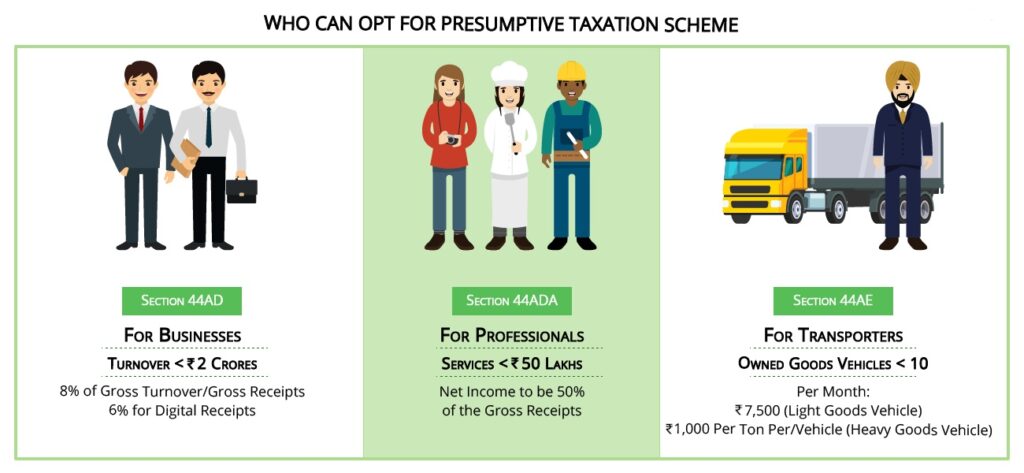

Focus on Section 44AD

While the Income Tax Act includes presumptive schemes for professionals (Section 44ADA) and specific transport businesses (Section 44AE), Section 44AD is specifically tailored for other eligible businesses. It provides a straightforward mechanism for calculating taxable income, primarily aimed at small entrepreneurs, retailers, and traders who meet certain criteria. This section is a cornerstone tax scheme for small businesses in India, offering a significant departure from the traditional method of profit calculation which involves deducting eligible expenses from revenue and maintaining exhaustive documentation. Understanding Section 44AD is therefore essential for any small business looking to simplify its tax obligations and potentially reduce its compliance costs significantly.

Explore how to Set Up An Accounting System for My Small Business to streamline your financial records in line with taxation schemes.

Objective of the Scheme

The government introduced Section 44AD with clear objectives in mind, primarily focused on supporting the small business sector. The main goal was to significantly reduce the compliance burden associated with maintaining detailed books of accounts and undergoing mandatory tax audits for smaller enterprises. By simplifying the calculation of taxable income based on turnover, the scheme promotes ease of filing income tax returns. Furthermore, it aims to encourage more small businesses, including those operating informally, to enter the formal tax system by offering a simpler and more predictable tax regime. This ultimately broadens the tax base while providing much-needed relief and predictability for small entrepreneurs navigating the small business taxation scheme India.

Who Can Opt for the Section 44AD Scheme? Eligibility Criteria

Not every business can automatically avail the benefits of Section 44AD. The Income Tax Act lays down specific criteria regarding the type of taxpayer, the nature of the business, and the turnover limits. Understanding these conditions is the first step in determining if your business qualifies for this simplified presumptive tax scheme eligibility India. Meeting these requirements is crucial for correctly opting into the scheme and avoiding potential issues later.

Eligible Assessees

The Section 44AD presumptive taxation scheme is specifically available to certain types of taxpayers. Primarily, Resident Individuals, Hindu Undivided Families (HUFs), and Partnership Firms can opt for this scheme. However, it’s crucial to note that Limited Liability Partnerships (LLPs) are specifically excluded and cannot use Section 44AD. Similarly, Companies (Private Limited or Public Limited) are also not eligible for this particular presumptive scheme. This focus highlights the scheme’s intention to support smaller, traditionally structured businesses rather than larger corporate entities or LLPs, which typically have more complex operational and accounting structures.

Eligible Business Types

While the scheme is open to various types of businesses, there are specific exclusions based on the nature of the activity. Generally, any business (like trading, manufacturing, retail, etc.) whose turnover meets the limit can opt-in, except for the following:

- Businesses engaged in plying, hiring, or leasing goods carriages (These are covered under a separate presumptive scheme, Section 44AE).

- Businesses operating as an agency.

- Businesses earning income primarily in the nature of commission or brokerage.

Furthermore, individuals carrying on professions that are specifically listed under Section 44AA(1) of the Income Tax Act cannot opt for Section 44AD for their professional income. These professions include legal, medical, engineering, architectural, accountancy, technical consultancy, interior decoration, or any other profession notified by the Board (like authorized representatives, film artists, company secretaries, information technology professionals). Such professionals might be eligible for a different presumptive scheme, Section 44ADA, subject to its own conditions. This distinction ensures Section 44AD remains focused as a tax scheme for small businesses in India rather than specified professions.

If you are unsure how to structure your business for such tax schemes, consider Choosing the Right Legal Structure for Your Business.

Turnover Limit

A key determining factor for eligibility under Section 44AD is the business’s financial scale, measured by its turnover. The primary condition mandates that the total turnover or gross receipts of the eligible business in the relevant previous financial year must not exceed ₹2 crore. However, recognizing the push towards digital transactions, an enhanced threshold is available under specific Section 44AD guidelines India. As per the updates introduced via the Finance Act, this turnover limit is increased to ₹3 crore for a financial year provided that the aggregate of cash receipts during that year does not exceed 5% of the total turnover or gross receipts. This means if 95% or more of your business receipts come through banking channels or prescribed digital modes, you can potentially avail the Section 44AD scheme even with a turnover up to ₹3 crore, offering substantial small business tax relief India for businesses embracing digital payments. You can find more details on eligible digital modes on the Income Tax India Website.

How Section 44AD Works: Calculation and Rules

Once eligibility is confirmed, understanding the mechanics of the Section 44AD presumptive taxation scheme is essential. It involves calculating income based on prescribed rates, knowing which deductions are implicitly allowed, and adhering to specific rules regarding advance tax payments and bookkeeping. This section breaks down these core operational aspects.

Calculating Presumptive Income under Section 44AD presumptive taxation

The calculation of income under this scheme is straightforward and based on a percentage of your total turnover or gross receipts for the financial year:

- Rule 1 (Standard Rate): The presumptive income is deemed to be 8% of the total turnover or gross receipts of the eligible business for the financial year. This applies to turnover received through cash or modes other than prescribed digital ones.

- Rule 2 (Reduced Rate for Digital Transactions): To encourage digital payments, a lower presumptive rate of 6% is applicable. This rate applies only to that portion of the total turnover or gross receipts which is received through an account payee cheque, an account payee bank draft, use of electronic clearing system (ECS) through a bank account, or other prescribed electronic modes (like credit/debit cards, net banking, IMPS, UPI, RTGS, NEFT, BHIM Aadhaar Pay). Importantly, these amounts must be received before the due date for filing the income tax return for that year (under Section 139(1)).

Example: Suppose ‘ABC Enterprises’, an eligible partnership firm, has a total turnover of ₹1.5 Crore in the Financial Year 2023-24.

- ₹1 Crore was received via account payee cheques and UPI before the ITR filing due date.

- ₹50 Lakhs was received in cash.

The presumptive income under Section 44AD would be calculated as follows:

- 6% of ₹1 Crore (digital receipts) = ₹6,00,000

- 8% of ₹50 Lakhs (cash receipts) = ₹4,00,000

- Total Presumptive Income = ₹10,00,000

ABC Enterprises would declare ₹10 Lakhs as their business income under Section 44AD presumptive taxation.

No Further Expense Deductions

A critical aspect of the Section 44AD scheme is that once income is calculated at the presumptive rate (8% or 6%), no further deductions for business expenses are allowed. All expenditures covered under Sections 30 to 38 of the Income Tax Act (including depreciation, rent, salaries, travel, etc.) are deemed to have been already considered and allowed within the presumptive income calculation. This significantly simplifies the process, as you don’t need to track and claim individual expenses against this income. The presumed profit rate is considered net of all such business operating costs.

Payment of Advance Tax

While the presumptive scheme simplifies income calculation, it doesn’t eliminate the need for advance tax payments if your total tax liability exceeds ₹10,000 in a financial year. However, Section 44AD compliance India has a specific rule for advance tax payment under this scheme. Unlike other taxpayers who usually pay advance tax in four quarterly installments, individuals or firms opting for Section 44AD are required to pay the entire amount of their advance tax liability in a single installment on or before the 15th of March of the financial year. Failure to pay by this date can attract interest under Section 234C. This single payment window further simplifies compliance compared to quarterly tracking and payments.

For further understanding of managing advance payments and related obligations, you can visit Understanding and Managing Advance Tax Payments.

Maintenance of Books of Accounts

One of the most significant reliefs offered by the Section 44AD presumptive taxation scheme is regarding bookkeeping. Taxpayers who opt for this scheme AND declare their income at the prescribed rate of 8% or 6% (or higher) are exempted from the mandatory requirement of maintaining detailed books of accounts as stipulated under Section 44AA of the Income Tax Act for that business. This exemption directly addresses the objective of reducing the compliance burden for small businesses. However, there’s a crucial exception: if a taxpayer opts for Section 44AD but declares income lower than the presumptive rates (8%/6%), AND their total taxable income exceeds the basic exemption limit (the threshold below which income tax is not payable), then they lose this exemption. In such cases, they must maintain books of accounts as per Section 44AA and also get those accounts audited under Section 44AB.

Key Benefits of Choosing the Section 44AD Scheme

Opting for the Section 44AD presumptive taxation scheme offers several tangible advantages, making it an attractive option for eligible small businesses in India. These benefits directly contribute to reducing administrative burdens and potentially lowering the overall tax outflow.

Simplified Tax Calculation & Filing

The most immediate benefit is the sheer simplicity it brings to tax calculation. Instead of meticulously tracking every income source and allowable expense, businesses can calculate their taxable income by applying a straightforward percentage (8% or 6%) to their total turnover. This eliminates complex computations and reduces the chances of errors. Consequently, tax filing becomes much easier. Taxpayers opting for Section 44AD typically use the simpler Income Tax Return form, ITR-4 (Sugam), which is specifically designed for presumptive income schemes, making the annual filing process quicker and less daunting. This ease of calculation and filing is a major draw for the presumptive taxation for small businesses India.

Relief from Maintaining Detailed Books

As highlighted earlier, businesses declaring income at or above the presumptive rates under Section 44AD are generally freed from the legal obligation of maintaining elaborate books of accounts as required under Section 44AA. This translates into significant savings in terms of time, effort, and the cost associated with hiring accounting professionals or purchasing sophisticated accounting software. For micro and small enterprises where resources are often stretched thin, this relief from detailed bookkeeping is a substantial advantage, allowing owners to focus more on core business activities rather than extensive compliance paperwork. This is a key element of the small business tax relief India offered by the scheme.

Exemption from Tax Audit

Another significant compliance cost for many businesses is the mandatory tax audit under Section 44AB of the Income Tax Act. Businesses opting for Section 44AD and declaring income at the presumptive rates of 8% or 6% (or higher) are generally exempted from the requirement of getting their accounts audited, even if their turnover exceeds the standard audit threshold (which is currently ₹1 crore, or ₹10 crore if cash transactions are limited). Tax audits involve scrutiny by a Chartered Accountant and associated fees. Avoiding this requirement further reduces compliance costs and administrative hassles, making the Indian presumptive taxation scheme even more appealing for eligible entities.

Potential Tax Savings

While the primary goal is simplification, the Section 44AD presumptive taxation scheme can also lead to tax savings under certain circumstances. If a business’s actual net profit margin (after accounting for all expenses) is higher than the presumptive rate of 8% (or 6% for digital turnover), opting for Section 44AD means paying tax on a potentially lower income base (the presumed income) compared to the actual higher profits. For instance, if a business has a turnover of ₹1 Crore (all digital) and its actual net profit is 12% (₹12 Lakhs), under Section 44AD, it would declare only 6% (₹6 Lakhs) as income, leading to significant tax savings. These potential Section 44AD tax benefits make the scheme financially advantageous for efficient businesses with higher profit margins.

Important Considerations & Section 44AD Compliance India

While Section 44AD offers considerable benefits, taxpayers must be aware of certain conditions, restrictions, and compliance requirements associated with it. Overlooking these aspects can lead to unintended consequences, including disqualification from the scheme or mandatory audit requirements. Ensuring thorough Section 44AD compliance India is key to leveraging its advantages fully.

The 5-Year Restriction

A critical rule governs opting out of the scheme after choosing it. If a taxpayer declares income as per the Section 44AD presumptive taxation scheme in a particular assessment year but then, in any of the next five consecutive assessment years, chooses not to declare income based on the presumptive rates (i.e., declares lower profit or opts for normal provisions), they become ineligible to opt back into the Section 44AD scheme for the following five assessment years. For example, if you use Section 44AD for AY 2024-25 but declare lower profits in AY 2025-26, you cannot use Section 44AD for AY 2026-27 through AY 2030-31. During the period they are ineligible (or have chosen to declare lower profits), if their total income exceeds the basic exemption limit, they must maintain books of accounts (Section 44AA) and get them audited (Section 44AB), irrespective of their turnover. This lock-in period restriction emphasizes the need for careful consideration before opting out.

Option to Declare Higher Income

The presumptive rates of 8% and 6% represent the minimum income that needs to be declared under Section 44AD. Taxpayers always have the option to voluntarily declare an income higher than these presumptive rates if their actual business profit is greater. Declaring a higher income is perfectly permissible and does not attract any adverse consequences under this scheme. It simply reflects a more accurate picture of the business’s earnings for that year. This flexibility ensures that businesses reporting genuine higher profits can do so without being forced into the potentially lower presumptive calculation.

Implications of Declaring Lower Income

As mentioned previously, while taxpayers can choose to declare income lower than the 8%/6% presumptive rates, doing so triggers specific compliance obligations. If a taxpayer eligible for Section 44AD declares profits lower than the deemed rates, and their total income (from all sources, not just business) exceeds the basic income tax exemption limit applicable to them (e.g., ₹2.5 Lakhs, ₹3 Lakhs, or ₹5 Lakhs depending on age), then they forfeit the benefits of simplified compliance for that year. They will be mandatorily required to:

- Maintain proper books of accounts as prescribed under Section 44AA.

- Get these accounts audited by a Chartered Accountant as per Section 44AB.

This underscores the trade-off: enjoying the simplicity of Section 44AD requires adhering to the minimum presumptive profit declaration.

GST Compliance is Separate

It is absolutely crucial for businesses to understand that opting for the Section 44AD presumptive taxation scheme under the Income Tax Act has no bearing on their obligations under the Goods and Services Tax (GST) law. GST compliance is entirely separate. If a business’s turnover exceeds the threshold limit prescribed under the GST Act (currently ₹40 Lakhs for goods suppliers in most states, ₹20 Lakhs for service providers and suppliers in special category states), they must register for GST, collect tax, file regular GST returns (like GSTR-1, GSTR-3B), and comply with all other GST provisions, regardless of whether they use Section 44AD for income tax purposes. Businesses should check their GST applicability and ensure timely compliance via the official GST Portal. Failing to comply with GST can lead to significant penalties, separate from income tax matters. Considering this complexity, seeking advice on both fronts is often beneficial; TaxRobo offers expert TaxRobo GST Service alongside income tax assistance.

To better understand the nuances of GST registration, refer to Ultimate Guide to GST Registration for Small Businesses.

Conclusion

In summary, Section 44AD presumptive taxation stands out as a highly beneficial provision within the Indian tax framework, specifically designed to simplify life for eligible small businesses in India. It significantly reduces the compliance burden by offering a straightforward method of income calculation based on turnover, eliminating the need for extensive bookkeeping and, in most cases, mandatory tax audits. This small business taxation scheme India not only saves time and resources but can also offer potential tax savings for businesses operating at higher profit margins.

The key takeaways for small business owners are:

- Simplicity: Income calculation is simplified (8% or 6% of turnover).

- Reduced Compliance: Relief from maintaining detailed books and mandatory audits (if conditions met).

- Eligibility: Applicable to Resident Individuals, HUFs, and Partnership Firms (excluding LLPs) with turnover up to ₹2 Crore (or ₹3 Crore under specific digital transaction conditions), excluding certain business types.

- Considerations: Be mindful of the 5-year lock-in if you opt-out after choosing the scheme and the requirement for books/audit if declaring lower profits.

- GST Separate: Remember that GST compliance is independent of Section 44AD.

We encourage you to carefully evaluate if this scheme aligns with your business structure and operations based on the Section 44AD guidelines India. Making an informed decision can lead to substantial ease in managing your tax affairs.

If you need assistance determining your eligibility for Section 44AD presumptive taxation, help with filing your ITR-4, ensuring complete Section 44AD compliance India, or require guidance on any other tax, accounting, or legal matters for your small business, TaxRobo is here to help. Our team of experts can provide personalized advice tailored to your needs. Contact us today for an TaxRobo Online CA Consultation Service or explore our comprehensive TaxRobo Income Tax Service.

Frequently Asked Questions (FAQs)

Q1: I run a small consultancy firm. Can I use Section 44AD?

A: No, specified professions like consultancy, legal, medical, engineering, architecture, accountancy, technical consultancy, and interior decoration typically fall under Section 44ADA (Presumptive Taxation for Professionals), not Section 44AD. Section 44AD is meant for eligible businesses. If your consultancy income is from a profession specified under Section 44AA(1), you should check eligibility under Section 44ADA, which has its own criteria (gross receipts limit of ₹75 Lakhs from AY 2024-25, subject to conditions). Consult a tax advisor to determine the correct scheme applicable to you.

Q2: What happens if my business turnover crosses ₹2 crore (or ₹3 crore if eligible) during the financial year?

A: If your total turnover or gross receipts exceed the applicable threshold (₹2 crore, or ₹3 crore if cash receipts are ≤ 5%) during the financial year, you become ineligible to use the Section 44AD presumptive taxation scheme for that year. You will then need to calculate your business profits based on normal accounting principles, maintain regular books of accounts as per Section 44AA, and likely get your accounts audited under Section 44AB, as the audit threshold (usually ₹1 crore) would have been crossed.

Q3: If I opt for Section 44AD, do I still need to pay advance tax?

A: Yes, the requirement to pay advance tax remains if your estimated tax liability for the financial year is ₹10,000 or more. However, the payment schedule under Section 44AD is simplified. Instead of paying in four quarterly installments, taxpayers opting for this scheme need to pay the entire amount of their advance tax liability in a single installment on or before the 15th of March of the relevant financial year.

Q4: Can I claim deductions for my business expenses like salary, rent, or telephone bills under Section 44AD?

A: No. When you opt for Section 44AD presumptive taxation, your income is calculated at a presumed rate (8% or 6% of turnover). This rate is deemed to be inclusive of all business expenses that would normally be deductible under Sections 30 to 38 of the Income Tax Act (including depreciation). Therefore, you cannot claim separate deductions for specific business expenses like salaries, rent, office supplies, travel, or telephone bills against the presumptive income calculated under Section 44AD.

Q5: Is it mandatory to opt for Section 44AD if my business is eligible?

A: No, opting for the presumptive taxation for small businesses India under Section 44AD is entirely optional. Even if your business meets all the eligibility criteria (assessee type, business nature, turnover limit), you can choose not to opt for this scheme. You always have the choice to calculate your taxes under the normal provisions of the Income Tax Act. This involves maintaining detailed books of accounts, calculating actual profits or losses after claiming eligible expenses, and getting your accounts audited if required by Section 44AB. However, carefully weigh the compliance burden associated with normal provisions before deciding against the simplified presumptive scheme.