Recent High Court Rulings Impacting ITC Claims and Compliance

Navigating the complexities of Goods and Services Tax (GST) compliance is a critical task for every Indian business, big or small. Among the most vital aspects of GST is the Input Tax Credit (ITC), a mechanism that directly impacts your business’s cash flow and overall profitability by allowing you to reduce your tax liability. However, the interpretation of GST law is not static; it continuously evolves through departmental clarifications, amendments, and significantly, through judicial pronouncements. Understanding recent High Court rulings on ITC claims is therefore crucial for staying compliant and safeguarding your business interests.

These court decisions shed light on how the law is being interpreted in real-world disputes, often clarifying ambiguities or setting precedents for contentious issues. For small business owners and salaried individuals earning business income, keeping abreast of these developments is not just about ticking compliance boxes. It’s about understanding the potential legal impact of ITC claims in India, avoiding hefty penalties and interest, ensuring you claim the correct amount of ITC, and effectively navigating common ITC compliance issues India faces today. This post will guide you through the basics of ITC, delve into key recent High Court rulings affecting ITC claims, and provide actionable steps to enhance your compliance strategy.

Understanding Input Tax Credit (ITC) Basics under GST

Before we dive into the specifics of recent court decisions, let’s refresh our understanding of the fundamentals of Input Tax Credit under the GST regime. Having a clear grasp of these basics is essential to appreciate the significance of the High Court rulings we’ll discuss later.

What is Input Tax Credit (ITC)?

In simple terms, Input Tax Credit (ITC) means that when you pay GST on your business purchases (inputs like raw materials, capital goods, or input services), you can claim a credit for this tax amount. This credit can then be used to reduce the GST liability you have on your sales (outputs). Essentially, it prevents the cascading effect of taxes – meaning you don’t pay tax on tax. The GST framework includes Central GST (CGST), State GST (SGST), and Integrated GST (IGST). Typically, the credit of CGST paid on purchases can be used to offset CGST liability on sales, and similarly for SGST. IGST credit can usually be used against IGST, CGST, and SGST liabilities in that order. This mechanism is fundamental to the GST structure, ensuring tax is levied only on the value addition at each stage of the supply chain.

Why is Accurate ITC Claiming Crucial?

Claiming the correct amount of ITC, and doing so in compliance with the law, is paramount for several reasons. Firstly, it directly impacts your business finances. Correct ITC claims reduce your net tax payable, thereby improving your working capital and cash flow. Over-claiming can lead to demands for reversal along with significant interest and penalties, while under-claiming means you pay more tax than necessary, hurting your profitability and potentially making your pricing less competitive. Secondly, accurate ITC claiming is a legal mandate. Non-compliance can attract scrutiny from tax authorities, leading to audits, investigations, and potential litigation. Understanding the nuances, especially in light of ITC compliance rulings in India, helps businesses avoid these pitfalls and maintain a clean compliance record, which is increasingly important in today’s transparent tax environment.

Taxation 101 for Small Business Owners

Core Conditions for Claiming ITC (Brief Overview – Section 16(2) of CGST Act)

The eligibility to claim ITC is not automatic. Section 16(2) of the Central Goods and Services Tax (CGST) Act, 2017, lays down specific conditions that must be fulfilled:

- Possession of Tax Invoice/Debit Note: You must possess a valid tax invoice, debit note, or other prescribed tax-paying document issued by a registered supplier.

- Receipt of Goods or Services: You must have actually received the goods or services (or both) for which you are claiming ITC. There are specific provisions for ‘bill-to-ship-to’ models and delivery in installments.

- Tax Actually Paid by Supplier: The tax charged on your purchase invoice must have been actually paid to the government by the supplier, either in cash or through utilization of their own ITC. This condition is often a major point of contention.

- Filing of Return: You (the recipient) must have filed your GST return (typically Form GSTR-3B) for the relevant tax period.

Many disputes leading to litigation and subsequent High Court rulings on ITC claims revolve around the interpretation and fulfillment of these conditions, particularly the requirement concerning supplier tax payment and invoice matching. For more detailed official rules, you can refer to the GST Portal.

Key Recent High Court Rulings on ITC Claims and Their Implications

The interpretation of GST laws, especially concerning ITC, is constantly being shaped by judicial review. Several High Courts across India have delivered significant judgments addressing common pain points faced by taxpayers. Understanding the principles laid down in these High Court rulings on ITC claims is vital for robust compliance. Here, we explore some key themes emerging from these rulings.

Ruling Focus 1: ITC Denial Due to Supplier Default (Non-payment/Non-filing)

One of the most persistent ITC compliance issues India faces is the denial of ITC to a recipient because their supplier failed to deposit the collected tax with the government or did not file their returns (like GSTR-1, affecting GSTR-2B visibility). The recipient, despite having a valid invoice, proof of receiving goods/services, and proof of payment to the supplier (including the tax amount), finds their legitimate ITC claim challenged. This issue stems primarily from Section 16(2)(c) which requires the tax to be paid by the supplier.

Handling ITC in Case of Supplier Default: Legal Remedies and Precautions

Different High Court rulings on ITC claims India have addressed this complex situation, often highlighting the difficulty for a bona fide recipient to ensure their supplier’s compliance. While the ultimate responsibility for tax payment lies with the supplier, some rulings have explored the extent of the recipient’s burden. Key principles emerging include:

- Bona Fide Transactions: Courts have often considered whether the transaction itself was genuine. If the recipient can demonstrate with credible evidence (invoice, e-way bill, proof of payment, proof of goods receipt) that the purchase was legitimate and they acted in good faith, denying ITC solely for the supplier’s default is often viewed critically.

- Departmental Action: Some judgments suggest that the tax authorities should first attempt to recover the unpaid tax from the defaulting supplier before moving against the recipient who has fulfilled their obligations (payment to supplier, possessing valid documents).

- Recipient’s Due Diligence: The concept of recipient due diligence is gaining importance. While a recipient cannot force a supplier to pay tax, demonstrating reasonable steps taken (e.g., checking supplier’s GST registration status, maybe their filing history before large transactions) could potentially strengthen their case, although the extent of this expectation is still evolving.

Implication for Businesses: The impact of High Court on ITC claims in this area underscores the need for enhanced supplier risk management. It’s no longer enough to just receive an invoice. Businesses must:

- Implement stricter supplier onboarding checks (verifying GSTIN, basic compliance history).

- Maintain impeccable documentation proving the legitimacy of the transaction beyond doubt (contracts, delivery confirmation, payment proof linked to the invoice).

- Be prepared to demonstrate their bona fides if challenged. Relying solely on the supplier’s compliance is risky.

Ruling Focus 2: Mismatches Between GSTR-2A/2B and GSTR-3B

Another frequent point of friction is the mismatch between the ITC auto-populated in Form GSTR-2A (historical) or Form GSTR-2B (current standard) and the ITC claimed by the taxpayer in their Form GSTR-3B return. GSTR-2B is generated based on the details uploaded by suppliers in their GSTR-1 returns. Tax authorities often issue notices proposing ITC denial simply because an invoice appearing in the taxpayer’s purchase records and GSTR-3B is not reflected in their GSTR-2B.

High Court decisions affecting ITC compliance have examined whether ITC can be disallowed solely on the basis of this mismatch, particularly when the taxpayer possesses all the documents required under Section 16(2). Key takeaways from rulings include:

- GSTR-2B as a Facilitator: Courts have often observed that GSTR-2A/2B are facilitation measures, not the primary basis for ITC eligibility prescribed in the law (Section 16). The core conditions remain possession of invoice, receipt of goods/services, supplier tax payment (subject to Ruling Focus 1 nuances), and return filing by the recipient.

- Primacy of Section 16(2): If a taxpayer can substantiate their ITC claim with valid documents fulfilling Section 16(2) conditions, denying the credit merely due to non-reflection in GSTR-2B (often caused by supplier error or delay in filing GSTR-1) has been questioned in several judgments. The recipient shouldn’t necessarily be penalized for the supplier’s procedural lapse if the substantive conditions are met.

- Need for Proper Adjudication: Rulings emphasize that tax authorities cannot reject ITC claims mechanically based on automated mismatches. They need to conduct a proper inquiry, examine the evidence provided by the taxpayer, and pass a reasoned order.

Implication for Businesses: These recent High Court rulings India highlight the critical importance of:

- Meticulous Reconciliation: Regularly comparing purchase records, GSTR-3B claims, and GSTR-2B data is essential. Identify discrepancies promptly.

- Robust Documentation: Maintain not just tax invoices, but also supporting documents like contracts, purchase orders, e-way bills, delivery challans, quality reports, and proof of payment (bank statements clearly linking payments to specific invoices). This evidence becomes crucial if you need to contest a mismatch notice.

- Proactive Communication: If a discrepancy is due to a supplier’s error, communicate with the supplier to get it rectified in their subsequent GSTR-1 filings. Document these communications.

Impact of GSTR-2A and GSTR-3B Mismatches on ITC Claims

Ruling Focus 3: Interpretation of Time Limits for Claiming ITC (Section 16(4))

Section 16(4) of the CGST Act imposes a time limit for claiming ITC in respect of any invoice or debit note for the supply of goods or services. The deadline is typically the 30th of November following the end of the financial year to which such invoice or debit note pertains, or the date of filing the relevant annual return, whichever is earlier. Failure to claim ITC within this timeframe leads to its lapse.

High Court rulings on ITC claims related to Section 16(4) have generally examined the mandatory nature of this provision. Key aspects considered include:

- Strict Interpretation: Most rulings tend to uphold the strict application of the time limits prescribed under Section 16(4), viewing it as a condition for availing the concession of ITC. The argument is that ITC is not a vested right but a benefit granted under the statute, subject to specific conditions, including time limits.

- Limited Exceptions: While the general stance is strict, some courts might consider relief in extremely exceptional circumstances, possibly involving acknowledged technical glitches on the GST portal that prevented timely filing, or situations covered by specific government notifications extending deadlines (like during the initial phases of GST or COVID-19). However, routine delays or taxpayer oversight are generally not excused.

- Distinction from Rectification: Some cases distinguish between claiming ITC for the first time (subject to Section 16(4)) and rectifying errors in previously filed returns, where different time limits might apply (e.g., related to GSTR-9 annual return).

Implication for Businesses: These rulings reinforce the absolute necessity of timely compliance. Businesses must ensure:

- All eligible ITC for a financial year is identified and claimed in their GSTR-3B returns well before the Section 16(4) deadline.

- Robust internal processes exist to track invoices and ensure they are accounted for within the stipulated timeframe.

- While rulings provide some context, relying on potential judicial leniency regarding deadlines is highly risky. Proactive and timely claiming is the best approach to avoid losing valuable ITC and navigate ongoing ITC compliance issues India.

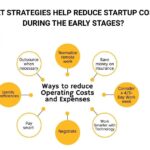

Actionable Steps for Businesses Post These Rulings

The evolving landscape shaped by High Court rulings on ITC claims necessitates a proactive and diligent approach to GST compliance. Simply filing returns is not enough; businesses need robust internal processes to safeguard their ITC claims and minimize disputes. Here are some actionable steps to consider:

Enhance Supplier Due Diligence

Given the rulings concerning ITC denial due to supplier default, verifying your suppliers’ compliance is crucial.

- Regular Checks: Periodically check the GST compliance status of your key suppliers using the GST portal. Look at their registration status (active/inactive) and, where available, their return filing frequency. While you cannot directly check their tax payment status, consistent filing is a positive indicator.

- Onboarding Process: Implement a supplier onboarding process that includes verification of GSTIN and perhaps contractual clauses regarding timely tax payment and return filing, especially for high-value transactions.

- Documentation: Maintain comprehensive records of your supplier interactions and transaction legitimacy, including contracts, purchase orders, email communication, and any compliance checks performed.

Implement Rigorous Reconciliation Processes

Mismatches between your records and GST portal data (GSTR-2B) are a major trigger for scrutiny.

- Frequent Reconciliation: Don’t wait until year-end. Reconcile your purchase register with GSTR-2B on a monthly or at least quarterly basis. Identify discrepancies immediately.

- Investigate Differences: When mismatches occur, investigate the reasons. Is it a supplier error (invoice not uploaded, incorrect details)? Is it a timing difference? Is it an error in your own records?

- Document Findings: Keep a clear record of the reconciliation process, the discrepancies found, the reasons identified, and the steps taken to resolve them (e.g., communication with the supplier). This documentation is vital if you receive a notice.

Maintain Meticulous Documentation

Court rulings consistently emphasize the importance of documentary evidence to substantiate ITC claims, especially when facing challenges related to supplier defaults or mismatches. The legal impact of ITC claims in India makes robust documentation non-negotiable.

- Beyond Invoices: While a valid tax invoice is primary, don’t stop there. Preserve supporting documents such as:

- Contracts and Purchase Orders

- E-way Bills (where applicable)

- Delivery Challans / Proof of Receipt of Goods (signed by storekeeper/recipient)

- Proof of Receipt of Services (service completion certificates, reports)

- Bank Statements clearly showing payments made against specific invoices

- Relevant correspondence with the supplier.

- Organized Storage: Keep these documents organized and easily accessible, preferably digitally, for the mandatory retention period under GST law (currently six years from the due date of filing the annual return for the relevant year).

Stay Updated and Seek Expert Advice

GST law and its interpretation are dynamic. What was compliant yesterday might need adjustment based on new circulars, notifications, or judicial pronouncements.

- Follow Reliable Sources: Keep track of updates from the official GST Portal, CBIC website, and reputable tax news portals or professional bodies.

- Consult Experts: Understanding the nuances of ITC compliance rulings in India and their specific application to your business can be complex. Don’t hesitate to consult with qualified GST professionals. Tax experts, like the team at TaxRobo, can help you interpret these rulings, review your current processes, implement best practices, and ensure your compliance strategies are up-to-date. For personalized guidance, consider reaching out for TaxRobo Online CA Consultation Service or exploring our specialized TaxRobo GST Service.

Conclusion

Staying informed about High Court rulings on ITC claims is no longer optional for businesses serious about GST compliance in India. These judicial interpretations provide critical insights into how tax laws are applied in practice and directly impact your rights and responsibilities regarding Input Tax Credit. As we’ve seen, issues surrounding supplier defaults, GSTR-2B mismatches, and time limits for claims are frequently litigated, and the resulting rulings shape the compliance landscape.

The key takeaway is that GST compliance, particularly ITC management, is not a static, one-time activity. It requires continuous diligence, adaptation to evolving legal interpretations highlighted by recent High Court rulings India, and proactive measures to mitigate risks. By enhancing supplier due diligence, implementing rigorous reconciliation processes, maintaining meticulous documentation, and seeking expert advice when needed, businesses can better safeguard their ITC, avoid costly disputes, and navigate potential ITC compliance issues India with greater confidence. Review your current ITC processes today in light of these developments, and if you need assistance ensuring your business is fully compliant and optimized, contact TaxRobo for expert support.

Frequently Asked Questions (FAQs)

Q1: My supplier hasn’t filed their GSTR-1/paid tax. Can the GST department deny my ITC based solely on recent High Court rulings on ITC claims?

While Section 16(2)(c) requires the supplier to pay the tax, recent High Court rulings on ITC claims suggest that denying ITC to a bona fide recipient solely based on supplier default might be challengeable. The department may be expected to first pursue the defaulting supplier. However, the onus is increasingly on the recipient to prove the genuineness of the transaction (valid invoice, proof of goods receipt, proof of payment to supplier). If you can demonstrate you acted in good faith and fulfilled all your obligations, you may have grounds to contest the denial, but strong documentation is crucial.

Q2: What should I do if my ITC claim in GSTR-3B differs from GSTR-2B?

First, meticulously reconcile your purchase records with GSTR-2B to identify the specific invoices causing the difference. Investigate the reason – it could be a supplier error, timing difference, or your own recording error. If the invoice is valid, you received the goods/services, and paid the supplier, you are generally eligible for ITC under Section 16(2). Maintain all supporting documents. If the department issues a notice based solely on the mismatch, you should reply with justification and proof of eligibility based on your documents, referencing principles from court rulings that GSTR-2B is a facilitator, not the sole determinant of ITC eligibility. Corrective action from the supplier (amending their GSTR-1) is also advisable.

Q3: Are these High Court rulings applicable nationwide in India?

A ruling delivered by a specific High Court is binding only within its own territorial jurisdiction. However, rulings from High Courts have significant persuasive value before tax authorities and appellate tribunals (like GSTAT) across India, and even in other High Courts. If a High Court has interpreted a GST provision in a particular way, taxpayers in other states can cite that ruling as a precedent to support their case, although the authorities or courts in their jurisdiction are not strictly bound to follow it unless their own High Court or the Supreme Court has ruled similarly.

Q4: How can TaxRobo help my business manage ITC compliance effectively, considering these legal updates?

TaxRobo offers comprehensive GST services designed to help businesses navigate complexities like ITC compliance. We can assist with:

- Accurate and timely GST return filing (GSTR-1, GSTR-3B, GSTR-9).

- Detailed ITC reconciliation between your purchase records, GSTR-3B, and GSTR-2B.

- Reviewing your existing documentation practices and advising on improvements.

- Providing expert advisory on specific ITC compliance rulings in India and their impact on your business.

- Assisting in responding to departmental notices related to ITC mismatches or denials.

- Offering regular compliance health checks. Contact us via our TaxRobo Online CA Consultation Service for tailored advice.

Q5: Where can I find authentic information about High Court rulings on ITC claims India?

Authentic sources for High Court judgments include:

- Official websites of the respective High Courts (most now publish judgments online).

- Reputable legal databases and news portals specializing in Indian law and taxation (e.g., Livelaw, Bar and Bench, TaxGuru, Taxmann).

- Judgments databases provided by legal research platforms (often subscription-based).

- While the CBIC website (Central Board of Indirect Taxes and Customs) provides circulars and notifications, it doesn’t typically consolidate High Court rulings. Always verify information from multiple reliable sources or consult a legal/tax professional.