What role does private banking play in comprehensive wealth management?

Introduction: Understanding Your Financial Future in India

India’s vibrant economy is creating unprecedented opportunities for growth, both for small business owners scaling their ventures and salaried professionals climbing the corporate ladder. As your income and assets grow, managing your finances effectively becomes crucial for achieving long-term goals like securing your family’s future, planning for retirement, or leaving a legacy. This often involves moving beyond simple saving and investing towards comprehensive wealth management practices. But where does specialized banking fit in? Many hear the term ‘private banking’ associated with High Net Worth Individuals (HNWIs). This post aims to clarify exactly what role does private banking play in comprehensive wealth management, particularly within the Indian context, helping you understand how these exclusive services integrate into a holistic strategy for building and preserving wealth. We’ll explore what private banking offers, how it differs from traditional banking, and its relevance as you navigate your financial journey.

Defining the Key Terms: Private Banking and Wealth Management

Before diving into the integration, let’s clearly define the two core concepts: private banking and comprehensive wealth management. Understanding these terms individually is essential to grasp how they work together effectively. Many sophisticated financial strategies rely on a clear understanding of the services available and the overarching plan they support.

What Exactly is Private banking?

Private banking refers to a suite of exclusive, personalized financial and banking services offered by banks specifically to High Net Worth Individuals (HNWIs) and their families. It goes far beyond the standard services offered at a typical bank branch. Key characteristics include a dedicated Relationship Manager (RM) who acts as a single point of contact, offering bespoke solutions tailored to the client’s unique financial situation and goals. Clients gain access to specialized investment products often unavailable to retail customers, enjoy enhanced confidentiality, and frequently receive preferential pricing on standard banking products like loans and foreign exchange. While the exact threshold varies, eligibility for private banking services India typically requires significant investable assets, often starting from ₹1 Crore to ₹5 Crore or more, signifying a focus on individuals with complex financial needs requiring specialized attention.

What Constitutes Comprehensive Wealth Management?

Comprehensive wealth management practices represent a holistic advisory approach that integrates various aspects of an individual’s or family’s financial life to manage, grow, and protect their wealth over the long term. It’s not just about picking stocks; it’s about creating a cohesive financial strategy. Core components typically include:

- Investment Management: Building and managing diversified investment portfolios aligned with risk tolerance and goals, including asset allocation strategies.

- Financial Planning: Setting clear financial goals (retirement, education funding, property purchase), managing cash flow, and creating a roadmap to achieve objectives.

- Tax Planning: Developing legal strategies to optimize and minimize tax liabilities, which is particularly crucial for business owners and high-income earners in India. (TaxRobo offers expert Tax Planning Services).

- Estate Planning: Ensuring smooth transfer of assets to the next generation through wills, trusts, and succession planning – vital for family businesses.

- Risk Management & Insurance: Identifying financial risks and using insurance products (life, health, property) to protect assets and income streams.

- Philanthropic Planning (Optional): Assisting clients in structuring their charitable giving effectively.

Essentially, wealth management strategies India aim to provide a 360-degree view and coordinated management of a client’s entire financial world.

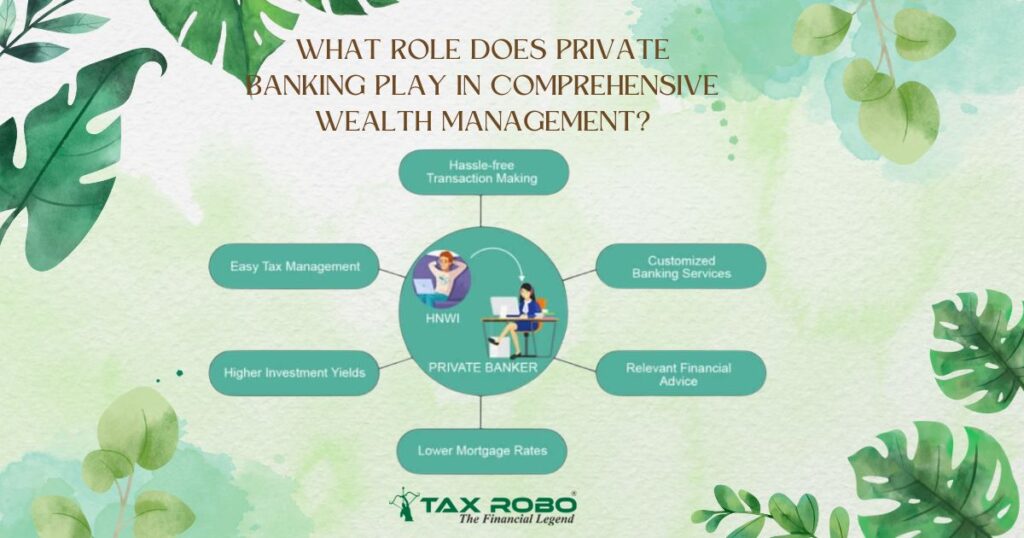

The Core Integration: The Specific Role of Private Banking in Wealth Management

Now, let’s address the central question: What specific role does private banking play in comprehensive wealth management? Private banking isn’t wealth management itself, but rather a powerful enabler and integrator of various wealth management components. It acts as the sophisticated banking and execution layer that supports and enhances the overall strategy. Think of it as the high-performance engine and chassis that allows the wealth management strategy (the driver’s plan) to be implemented effectively and efficiently. The private banking in wealth management connection is symbiotic, where the personalized banking platform facilitates the achievement of broader financial objectives.

Personalized Strategy & Advisory Hub

One of the primary roles of private banking is acting as a central coordination hub through the dedicated Relationship Manager (RM). The RM develops a deep understanding of the client’s complete financial picture – assets held both within and outside the bank, liabilities, income streams, business interests, family structure, risk appetite, and long-term aspirations. Leveraging this holistic view, the RM collaborates with specialists within the bank (investment advisors, tax experts, estate planners) to develop and refine tailored wealth management strategies India. They ensure that day-to-day banking requirements, credit needs, and investment decisions are all aligned with the overarching financial plan, providing a single, knowledgeable point of contact who understands the full context, rather than dealing with separate departments for each need. This personalized advisory function is central to the role of private banking in wealth management.

Access to Specialized Investment Opportunities

Private banking platforms often provide access to a wider and more sophisticated range of investment products than those available through retail banking channels. This exclusive access is a key component of its role in enhancing comprehensive wealth management practices. These opportunities might include:

- Alternative Investments: Private equity funds, venture capital, hedge funds, distressed assets.

- Structured Products: Customized investment vehicles designed to meet specific risk-return profiles or market views.

- Exclusive Real Estate Deals: Access to curated commercial or high-value residential property investment opportunities.

- Pre-IPO Placements: Opportunities to invest in companies before they list publicly.

- Global Investment Access: Seamless execution for investing in international markets and different currencies.

These specialized wealth management options India allow for greater portfolio diversification and the potential for higher returns (often accompanied by higher risk), enabling the implementation of more complex investment strategies tailored to HNWI goals, which might not be achievable through standard mutual funds or stocks alone.

Seamless Execution of Complex Needs

Executing large or complex financial transactions can be cumbersome through traditional channels. Private banking excels in providing seamless execution, which is vital for HNWIs and business owners. This includes facilitating large domestic and international fund transfers efficiently, handling complex foreign currency requirements for travel, education, or investment, and providing specialized lending solutions (like loans against securities, property, or art). For business owners, private banks often offer sophisticated treasury management services, cash flow solutions, and can connect clients with M&A advisory or business succession planning experts within the bank or its network. Furthermore, they coordinate effectively with legal and tax advisors (sometimes internal specialists, sometimes external partners like TaxRobo’s Online CA Consultation Service) to implement sophisticated tax optimization and estate planning structures, ensuring the practical execution aligns perfectly with the strategic advice. This smooth operational capability underscores the practical role of private banking in wealth management.

Consolidated Reporting and Monitoring

A significant advantage offered by private banking is consolidated reporting. Instead of receiving separate statements for banking accounts, loans, investments, and potentially other services, clients often receive integrated reports. These provide a comprehensive overview of their entire relationship with the bank, including assets, liabilities, portfolio performance, and transaction summaries. This holistic view makes it much easier to monitor progress towards comprehensive wealth management practices goals, assess overall portfolio performance, and make informed decisions. The RM typically reviews these reports with the client regularly, providing context and recommendations, ensuring the client remains informed and engaged with their wealth strategy. This simplifies financial administration and enhances oversight, a crucial element in managing substantial wealth effectively.

Private Banking vs. Traditional Banking in India: Key Differences

Understanding the distinction between private banking and the traditional banking services most people use is key to appreciating its specific value proposition. While both operate under a banking license, their approach, offerings, and target audience differ significantly. Here’s a comparison highlighting the core differences relevant in the private banking vs traditional banking India context:

| Feature | Private Banking | Traditional / Retail Banking |

|---|---|---|

| Target Client | High Net Worth Individuals (HNWIs) | Mass market, general public, small businesses |

| Service Model | Dedicated Relationship Manager (RM), proactive, personalized | Branch network, call centers, reactive, standardized |

| Relationship | Deep, holistic understanding of client’s finances | Transactional, product-focused |

| Product Suite | Bespoke solutions, exclusive investments, integrated services | Standardized products (savings, loans, cards), often siloed |

| Focus | Wealth growth, preservation, legacy planning | Day-to-day banking needs, basic lending & deposits |

| Advisory | Integrated financial planning, investment advisory | Limited or product-specific advice |

| Eligibility | High AUM/Relationship Value (e.g., ₹1 Cr – ₹5 Cr+) | Low/no minimum balance (for basic accounts) |

| Cost Structure | Often fee-based (AUM fees), relationship pricing | Transaction fees, interest margins, lower charges |

| Key Offering | Coordinated private banking services India, wealth management | Basic banking infrastructure |

This table clearly illustrates the fundamental differences in philosophy and service delivery in the private banking vs traditional banking India landscape. Private banking is designed as a high-touch, comprehensive solution for complex financial needs, whereas traditional banking serves the everyday requirements of a broader population.

Service Model & Relationship

The most striking difference lies in the service model. Private banking revolves around a dedicated Relationship Manager (RM). This individual is the client’s primary contact, expected to build a deep, long-term relationship based on trust and a thorough understanding of the client’s entire financial situation, goals, and even family dynamics. The service is proactive – the RM anticipates needs, suggests strategies, and coordinates specialists. In contrast, traditional banking typically involves interacting with various staff at a branch or through call centers for specific transactions. The relationship is often transactional, and the service is reactive, responding to requests rather than proactively advising on a holistic financial picture.

Product & Service Suite

The range and nature of products and services also diverge significantly. Private banking services India offer access to a suite of bespoke and often exclusive investment products (alternatives, structured notes, global markets) designed for sophisticated investors. More importantly, these products are presented as part of an integrated wealth solution, connecting banking, credit, investment, and planning. Traditional banking focuses on mass-market products: standard savings and current accounts, fixed deposits, personal loans, home loans, credit cards, and basic mutual fund distribution. These products often operate in silos, with little integration or overarching strategic advice connecting them.

Eligibility & Cost

Eligibility is a major differentiator. Private banking is exclusive, requiring clients to meet substantial thresholds for Assets Under Management (AUM) or the total relationship value they maintain with the bank. These thresholds ensure the bank can provide the high level of personalized service required. Traditional banking is accessible to almost everyone, with basic accounts often having very low or no minimum balance requirements. Consequently, the cost structures differ. Private banking often involves explicit fees, such as an annual percentage of AUM, advisory fees, or higher pricing reflecting the value-added services. Traditional banking primarily relies on transaction-based fees, interest spreads on loans and deposits, and relatively lower charges for standard services, reflecting its mass-market, lower-touch model in the private banking vs traditional banking India comparison.

Benefits and Considerations for Indians

As wealth creation accelerates in India, understanding the landscape of wealth management options India becomes increasingly important for aspiring individuals, small business owners, and established professionals. Private banking offers distinct advantages but also requires careful consideration.

Key Benefits Summarized

The primary benefits of private banking for Indians with substantial assets align with the core functions discussed earlier:

- Personalization: A dedicated RM providing bespoke advice and solutions tailored to individual circumstances and goals.

- Expertise: Access to specialized teams for investments, tax planning, estate planning, and credit structuring.

- Exclusive Access: Opportunities to participate in sophisticated investment products and deals not available to the general public.

- Convenience: A single point of contact managing complex financial affairs, simplifying administration.

- Integration: A holistic approach where banking services seamlessly support broader wealth management strategies.

These benefits combine to offer a powerful platform for effectively managing, growing, and protecting significant wealth over the long term.

Emerging Private Banking Trends in India

The private banking landscape in India is evolving dynamically. Key private banking trends in India include:

- HNWI Segment Growth: India is one of the fastest-growing HNWI markets globally, driving demand for sophisticated wealth management and private banking services.

- Digital Integration: While the RM relationship remains central, banks are heavily investing in digital platforms to offer clients enhanced reporting, transaction capabilities, and access to information anytime, anywhere. This creates a hybrid ‘phy-gital’ model.

- Demand for Specialized Advisory: There’s growing demand for specialized advice, particularly in areas like business succession planning, managing global assets, inter-generational wealth transfer, and philanthropic advisory.

- Rise of Alternatives: Boutique wealth management firms, multi-family offices, and independent financial advisors are emerging as strong competitors, offering specialized or conflict-free advice, pushing traditional private banks to enhance their offerings.

- Focus on Tier 2 & 3 Cities: Wealth creation is no longer confined to metros; private banks are expanding their reach and adapting offerings for emerging HNWIs in smaller cities.

These trends highlight a maturing market where client expectations are rising, demanding more sophisticated and tailored wealth management options India.

Is it Relevant for You Now? (Small Business Owners / Salaried Professionals)

You might be reading this as a successful small business owner or a rising salaried professional, thinking, “Private banking sounds great, but I’m not quite there yet.” That’s a common situation. While direct eligibility for top-tier private banking might be an aspirational goal requiring significant assets, understanding comprehensive wealth management practices is relevant right now.

The principles underpinning private banking – holistic planning, disciplined investing, tax optimization, and strategic use of banking – are universally applicable. You can start implementing these concepts today:

- Build a Strong Foundation: Ensure clear separation between personal and business finances. Maintain meticulous records (explore TaxRobo’s Accounting Services).

- Prioritize Financial Planning: Define your short-term and long-term goals. Create a budget and savings plan.

- Focus on Tax Efficiency: Proactively plan your taxes to minimize liability legally. Business owners and high earners, in particular, benefit significantly (consider TaxRobo’s Tax Planning Services).

- Invest Systematically: Start investing early and regularly, perhaps through Systematic Investment Plans (SIPs) in mutual funds, aligned with your risk profile and goals.

- Explore Available Options: Many banks have ‘Priority’ or ‘Premium’ banking segments below private banking that offer enhanced services. Independent Financial Advisors (IFAs) or smaller wealth management firms can provide personalized advice without the high AUM requirements of private banks. These are viable wealth management options India as stepping stones.

Understanding the role of private banking helps you visualize the level of integration and service to aspire to as your wealth grows.

Conclusion: Integrating Banking for Holistic Wealth Growth

In summary, private banking in wealth management plays a crucial, multifaceted role. It acts as a highly personalized, integrated service layer that significantly enhances comprehensive wealth management practices for individuals and families with substantial assets. Its primary role of private banking in wealth management lies in providing:

- Personalized Coordination: A dedicated RM who understands the client’s total financial picture and orchestrates expert advice.

- Exclusive Access: Entry into sophisticated investment opportunities and specialized financial products.

- Seamless Execution: Efficient handling of complex banking, credit, and transactional needs.

- Integrated Oversight: Consolidated reporting for a clear view of the overall financial position and progress.

While distinct from traditional banking in its exclusivity, service model, and focus, the principles of integrating banking tightly with financial planning and investment strategy are valuable for everyone. As you build your business or career in India, proactively managing your finances and exploring the available wealth management options India is key. Even if private banking isn’t accessible today, adopting a holistic approach to your financial life, focusing on planning, tax efficiency (with support from experts like TaxRobo), and disciplined investing, lays the foundation for long-term financial success and potentially unlocks access to more sophisticated services like private banking in the future.

Frequently Asked Questions (FAQs)

Q1. What is the typical minimum asset requirement for private banking in India?

The minimum requirement, usually measured in Assets Under Management (AUM) or total relationship value, varies significantly between banks in India. Major players like HDFC Bank (Imperia), ICICI Bank (Private Banking), Kotak Mahindra Bank (Private Banking), Axis Bank (Burgundy Private), as well as foreign banks like Citi, HSBC, and Standard Chartered, all have their own criteria. Generally, thresholds start around ₹1 Crore to ₹5 Crore (approximately $120,000 – $600,000 USD) in investable assets, but premier tiers can require significantly more (₹25 Crore+). It’s always best to check directly with the specific bank for their current eligibility criteria for private banking services India.

Q2. Are private banking services only for ‘old money’ or inherited wealth?

No, this is a common misconception. While private banks certainly serve families with inherited wealth, a large and growing segment of their clientele in India consists of first-generation entrepreneurs, successful professionals (like senior executives, doctors, lawyers), and salaried individuals who have accumulated significant wealth through their own efforts, savings, and successful investments. The primary criterion is the level of assets and the complexity of financial needs, not the source of the wealth.

Q3. As a small business owner not yet eligible for private banking, what wealth management steps should I take?

Focus on building strong financial fundamentals, which are essential regardless of net worth:

- Separate Finances: Strictly distinguish between personal and business accounts and transactions.

- Robust Accounting: Implement sound bookkeeping and accounting practices. (TaxRobo offers Accounting Services tailored for businesses).

- Proactive Tax Planning: Work with professionals to optimize your tax position legally, both for your business and personally. (See TaxRobo’s Tax Services).

- Create a Financial Plan: Define personal financial goals (retirement, children’s education, etc.) and create a savings and investment strategy.

- Disciplined Investing: Start investing regularly through accessible options like mutual fund SIPs, diversifying appropriately.

- Seek Advice: Consider consulting an independent financial advisor or exploring the premium banking options offered by your current bank as potential wealth management strategies India.

Q4. What’s the difference between a Wealth Manager and a Private Banker?

The roles can overlap, but there are typical distinctions. A Private Banker usually works within a bank and offers a broader suite of services that integrates banking (deposits, loans, transactions) with wealth management coordination. They act as the primary relationship manager for all the client’s needs with the bank. A Wealth Manager (who could be independent, part of an advisory firm, or within a bank’s wealth division) often focuses more specifically on investment management, financial planning, and advisory services. They might coordinate with a client’s banker but may not provide banking services directly. Private Banking often aims to bring both banking execution and wealth advisory under one integrated umbrella relationship.

Q5. How are private banking and wealth management services regulated in India?

These services operate under a multi-regulator framework in India:

- Banking Activities: Core banking products (deposits, lending, remittances) offered by private banks fall under the purview of the Reserve Bank of India (RBI), the central banking authority. You can find more information on the RBI website.

- Investment Advisory & Portfolio Management: The investment advice, portfolio management services, and distribution of investment products (like mutual funds, PMS) are regulated by the Securities and Exchange Board of India (SEBI). SEBI sets regulations for investment advisors (RIAs) and portfolio managers to ensure investor protection. Details are available on the SEBI website.

It’s crucial to ensure any entity or individual providing these services is registered with the appropriate regulatory body.