ITC on Services: Eligibility and Documentation Requirements Under GST

Input Tax Credit (ITC) is a cornerstone of the Goods and Services Tax (GST) regime in India, significantly reducing the tax burden for businesses. It essentially allows you to deduct the tax you’ve already paid on your business purchases (inputs) from the tax you need to pay on your sales (outputs), preventing the cascading effect of taxes. This post focuses specifically on ITC on Services, a critical area for many small businesses and professionals registered under GST. We will delve into the crucial aspects of ITC eligibility for services in India and the necessary documentation requirements for ITC claims. Understanding these rules is vital; it not only improves your business’s cash flow by reducing tax outgo but also ensures you remain compliant with GST laws, avoiding potential penalties. Whether you’re a small business owner or a salaried individual with GST-registered side-income, mastering ITC on Services is key to financial efficiency. For a comprehensive analysis of the broader implications of GST on small and medium enterprises, see The Impact of GST on Small and Medium Enterprises.

Understanding ITC on Services Under GST

To effectively claim and utilize Input Tax Credit on services, it’s essential to grasp the fundamental concepts within the GST framework. This section provides a foundational understanding ITC on services. Grasping how ITC works, especially concerning the different components of GST, is the first step towards optimising your tax liability correctly and legally. Without this basic knowledge, navigating the claims process and ensuring compliance can become unnecessarily complex and prone to errors. If you are considering new business structures in light of GST, Choosing the Right Legal Structure for Your Business may be beneficial.

What is Input Tax Credit (ITC)?

Input Tax Credit, or ITC, refers to the credit of GST paid by a registered taxpayer on the inward supply of goods or services, or both, which are used or intended to be used in the course or furtherance of their business. In simpler terms, when you purchase services for your business (like consultancy, rent, software subscriptions, etc.) and pay GST on them, that GST amount becomes available to you as ITC. This credit can then be used to pay off the GST liability arising from your own sales or provision of services. The core mechanism of ITC is designed to avoid the “tax on tax” effect, also known as cascading taxes, which was prevalent in the previous indirect tax system. By allowing credit for taxes paid at each stage of the supply chain, GST ensures that tax is levied only on the value added at each step, making the final product or service potentially cheaper for the end consumer and reducing the overall cost burden for businesses.

How GST Components (CGST, SGST/UTGST, IGST) Impact ITC on Services

GST in India has three main components: Central GST (CGST), State GST (SGST) or Union Territory GST (UTGST), and Integrated GST (IGST). CGST is levied by the Central Government, SGST/UTGST by the State/Union Territory Government on intra-state supplies (within the same state/UT), and IGST is levied by the Central Government on inter-state supplies (between different states/UTs) and imports. Understanding how ITC of one component can be used against the liability of another is crucial when claiming ITC on Services. The general rule for setting off ITC is that IGST credit must be utilized first, fully exhausting it before moving to other credits. It can be used against IGST, CGST, and SGST/UTGST liabilities, in that order. After IGST credit is exhausted, CGST credit can be used against IGST and CGST liabilities, but not against SGST/UTGST liability. Similarly, SGST/UTGST credit can be used against IGST (after utilizing IGST and CGST credits) and SGST/UTGST liabilities, but not against CGST liability. Therefore, when you procure services, the type of GST charged (IGST for inter-state services, CGST+SGST/UTGST for intra-state services) determines the type of credit you receive and how you can utilize it against your output tax obligations.

Determining ITC Eligibility for Services in India

Claiming ITC isn’t automatic; specific conditions must be met to ensure eligibility. This section details these prerequisites, focusing on ITC eligibility for services in India under the current GST regime. While the concept of credit for taxes paid on inputs existed partially under the previous regime (often referred to concerning service tax ITC eligibility criteria in India), the GST framework has its own comprehensive set of rules outlined primarily in Section 16 and Section 17 of the CGST Act, 2017. Meeting these conditions is non-negotiable for lawfully claiming ITC on Services.

Core Conditions for Claiming Any ITC (Section 16 of CGST Act)

To claim ITC on any inward supply, including services, a registered person must satisfy the following fundamental conditions laid out in Section 16 of the CGST Act:

- GST Registration: You must be registered under GST. ITC is not available to unregistered persons or those registered under the Composition Scheme. For guidance on initial steps such as registration, see Launching Your Startup Right – Mastering GST Registration in India.

- Possession of Tax Invoice/Debit Note: You must possess a valid tax invoice, debit note, or other prescribed tax-paying document issued by the supplier charging the tax. This document is the primary evidence for your claim.

- Receipt of Services: You must have actually received the services. Unlike goods, which have physical delivery proof, service receipt might require agreements, completion certificates, or usage logs as evidence if questioned.

- Tax Paid to Government: The tax charged by the supplier on the services you received must have been actually paid to the government by the supplier. This is typically verified through the supplier’s return filing.

- Return Filing: You (the recipient) must have filed your own GST return, specifically Form GSTR-3B, where the ITC is claimed.

- Supplier’s Compliance: A crucial condition added via amendments and enforced through rules is that the ITC claimed by the recipient should match the details uploaded by the supplier in their outward supply return (GSTR-1), which reflects in the recipient’s auto-drafted statements, GSTR-2A and GSTR-2B. ITC is generally restricted to what appears in GSTR-2B.

Specific Considerations for ITC on Services

Beyond the core conditions applicable to all ITC claims, there are considerations particularly relevant when dealing with ITC on Services:

- Business Purpose: This is a cardinal rule. Section 16(1) mandates that the services must be used or intended to be used “in the course or furtherance of business.” This means the service must have a direct or indirect link to your business operations or activities aimed at expanding or managing the business. Personal expenses are strictly disallowed. Examples relevant for small businesses include:

- Accounting and legal consultation fees.

- Marketing and advertising services.

- Rent paid for office premises or business facilities.

- Internet and telephone bills used for business communication.

- Software subscriptions (e.g., CRM, accounting software) used for business processes.

- Repair and maintenance services for office equipment (other than disallowed works contracts).

- Place of Supply: While delving deep into Place of Supply (POS) rules is beyond this post’s scope, it’s important to know they determine whether a service supply is considered inter-state (attracting IGST) or intra-state (attracting CGST + SGST/UTGST). The type of tax charged dictates the type of ITC you receive. For instance, if you are in Maharashtra and receive consulting services from a provider also in Maharashtra, it’s intra-state, and you get CGST + SGST credit. If the consultant were in Karnataka, it would be inter-state, and you’d receive IGST credit. Correct POS determination by the supplier is vital for your ITC eligibility.

Services with Restricted or Blocked ITC (Section 17(5) of CGST Act)

Even if a service is used for business purposes and meets all Section 16 conditions, GST law explicitly blocks ITC on certain specified services under Section 17(5) of the CGST Act. It’s critical to be aware of these restrictions to avoid incorrect claims and potential penalties. Common examples of services where ITC is generally blocked include:

- Food and beverages, outdoor catering: ITC is usually blocked unless it’s used for making an outward taxable supply of the same category or as an element of a taxable composite or mixed supply.

- Health services, cosmetic and plastic surgery: Blocked, except when used for making an outward taxable supply of the same category of services or as part of a composite/mixed supply.

- Services used for personal consumption: Any service availed for personal use, even if invoiced to the business, is ineligible for ITC.

- Rent-a-cab, life insurance, and health insurance: ITC is blocked unless (a) the government makes it obligatory for an employer to provide these to employees under any law, or (b) they are used for making an outward taxable supply of the same category of services or as part of a taxable composite/mixed supply.

- Works contract services: When supplied for the construction of an immovable property (other than plant and machinery), ITC is blocked. An exception exists if these services are an input service for the further supply of works contract service (e.g., a main contractor hiring a sub-contractor). ‘Construction’ includes re-construction, renovation, additions, alterations, or repairs to the extent of capitalization to the said immovable property.

- Membership of a club, health, and fitness centre.

Actionable Tip: Always meticulously check the nature of the service against the list in Section 17(5) before claiming ITC. If in doubt, consult a GST expert. For the most current and detailed list of blocked credits, refer to the official GST law.

External Link: You can explore the detailed provisions under Section 17 of the CGST Act on the official CBIC website: CBIC GST Acts Information (Navigate to CGST Act -> Chapter V -> Section 17).

Essential Documentation Requirements for ITC Claims on Services

Having established eligibility, the next crucial step is ensuring you possess the correct and complete documentation to substantiate your ITC claims. Robust documentation is the backbone of a compliant ITC process. This section outlines the key documentation requirements for ITC claims and highlights the specific documentation for claiming ITC on services. Without proper documents, even genuinely eligible ITC can be denied during assessments or audits.

The Crucial Role of the Tax Invoice

The single most important document for claiming ITC is the tax invoice issued by your service provider. Rule 36 of the CGST Rules specifies that ITC can be availed based on specific documents, with the tax invoice being primary. According to Rule 46 of the CGST Rules, a valid GST tax invoice for services must mandatorily contain the following details:

- Supplier’s name, address, and Goods and Services Tax Identification Number (GSTIN).

- A consecutive serial number (unique for the financial year).

- Date of issue.

- Recipient’s name, address, and GSTIN (if registered).

- Service Accounting Code (SAC) for services.

- Description of services provided.

- Total value of supply of services.

- Taxable value of supply, considering any discount.

- Rate of tax (CGST, SGST/UTGST, IGST).

- Amount of tax charged in respect of taxable services (CGST, SGST/UTGST, IGST separately).

- Place of supply along with the name of the State (in case of inter-state supply).

- Address of delivery (if different from the place of supply).

- Whether tax is payable on a reverse charge basis.

- Signature or digital signature of the supplier or their authorized representative.

Actionable Tip: Develop a habit of scrutinizing every supplier invoice upon receipt. Check for all mandatory details, especially your GSTIN and the correct tax calculation. Any discrepancy should be immediately communicated to the supplier for correction via a revised invoice or debit/credit note. Missing or incorrect details can jeopardize your ITC claim.

Other Supporting Documents

While the tax invoice is paramount, other documents play a vital role in supporting your ITC on Services claim and ensuring compliance:

- Debit Notes: If the supplier issues a debit note to increase the taxable value or GST charged in the original invoice (e.g., due to a price revision), this debit note also becomes a valid document for claiming the corresponding additional ITC, provided it contains the prescribed details.

- Proof of Payment (Rule 37 Compliance): Section 16(2) has a proviso linked to Rule 37, which mandates that the recipient must pay the supplier the value of the services plus the tax amount within 180 days from the date of invoice issuance. If payment is not made within this period, the ITC claimed earlier must be reversed (added back to output tax liability) along with applicable interest. However, the recipient can reclaim the ITC once the payment is eventually made to the supplier. Maintaining proof of payment (bank statements, payment vouchers) is crucial evidence for compliance with this rule.

- Contracts/Agreements: For significant or recurring services (like annual maintenance contracts, retainership agreements for legal/accounting services, rental agreements), having a formal contract or agreement is highly recommended. While not a primary document for claiming ITC like an invoice, it serves as strong supporting evidence regarding the nature of the service, scope, duration, value, and confirms the “receipt of services” aspect, especially if questioned by tax authorities.

Importance of GSTR-2A/2B Reconciliation

In the current GST system, the concept of matching ITC claimed by the recipient with the details reported by the supplier is critical. This is facilitated through two auto-drafted statements available on the GST portal:

- GSTR-2A: This is a dynamic statement that gets updated in near real-time as suppliers file their GSTR-1 returns. It provides a view of invoices uploaded by your suppliers.

- GSTR-2B: This is a static, auto-drafted ITC statement generated monthly for every registered person (based on GSTR-1 filed by suppliers by the cut-off date). It indicates the ITC available and unavailable for a particular tax period.

Crucially, Rule 36(4) (as amended) generally restricts the ITC claim in GSTR-3B to the amount reflected in the taxpayer’s GSTR-2B for that period. Therefore, reconciling your purchase records (including service invoices) with your GSTR-2B is no longer just good practice; it’s essential for determining the eligible ITC you can claim in your GSTR-3B return.

Actionable Tip: Make it a mandatory monthly process to download your GSTR-2B from the GST Portal and reconcile it line-by-line with your purchase register before filing your GSTR-3B. If legitimate invoices for services received are missing in GSTR-2B, immediately follow up with the respective suppliers and urge them to file their GSTR-1 correctly and promptly. Claiming ITC for invoices not appearing in GSTR-2B can lead to notices and demand for reversal with interest.

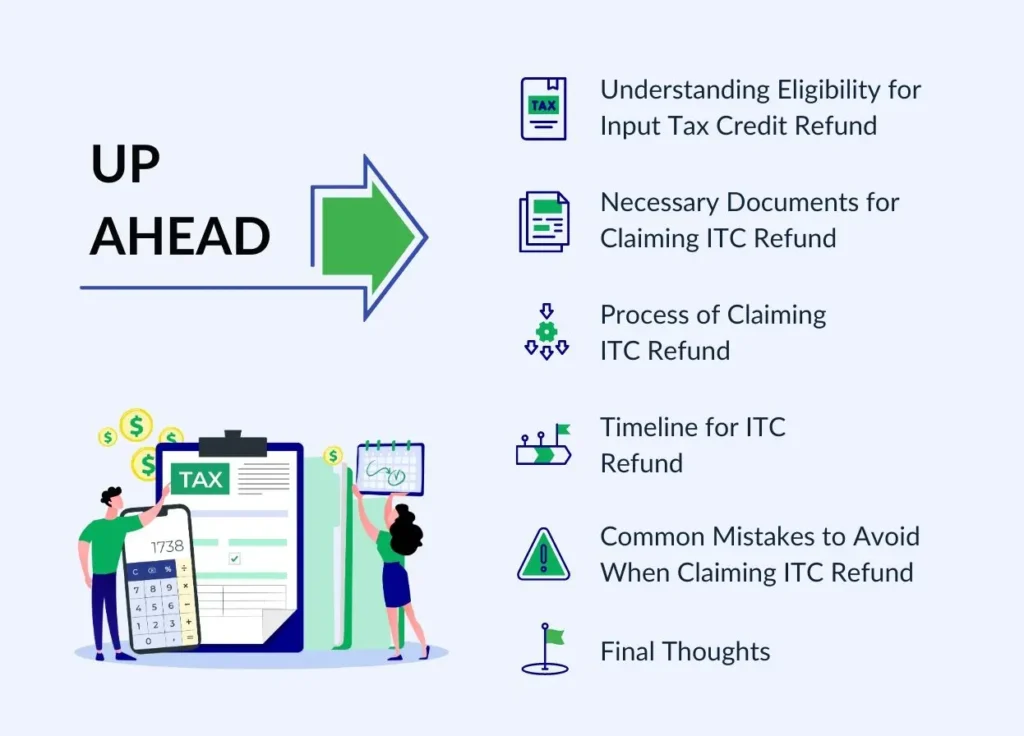

The ITC Claims Process for Services in India

Understanding eligibility and documentation sets the stage, but knowing how and when to actually claim the credit is equally important. This section briefly outlines the ITC claims process for services in India, highlighting the key steps and deadlines involved in availing your eligible ITC on Services. Following the correct procedure ensures timely credit utilization and avoids compliance issues.

How to Claim ITC in GSTR-3B

The primary mechanism for claiming your eligible Input Tax Credit, including ITC on Services, is through your GST return, Form GSTR-3B. This return summarises your outward supplies (sales), inward supplies (purchases) liable to reverse charge, and the eligible ITC for the tax period (monthly or quarterly, depending on your filing frequency). Specifically, Table 4 of the GSTR-3B form is dedicated to reporting eligible ITC. You need to consolidate all the eligible ITC based on your purchase records (invoices, debit notes) which have been reconciled and validated against your GSTR-2B for the period. The ITC amounts are auto-populated in GSTR-3B from GSTR-2B, but you must verify these figures against your books and make necessary adjustments (like reversals required under Rule 37 or for blocked credits mistakenly appearing in GSTR-2B) before submitting the return. The net ITC claimed in GSTR-3B gets credited to your Electronic Credit Ledger on the GST Portal and can then be used to offset your output tax liability.

Timelines and Deadlines for Claiming ITC

GST law prescribes a specific time limit for claiming ITC on invoices or debit notes pertaining to a financial year. According to Section 16(4) of the CGST Act, the deadline to claim ITC for a financial year is the earlier of the following two dates:

- The due date for furnishing the GSTR-3B return for the month of September following the end of the financial year to which such invoice or debit note pertains.

- The date of furnishing the relevant Annual Return (Form GSTR-9) for that financial year.

For example, for an invoice related to services received in the financial year 2023-24 (April 2023 to March 2024), the ITC must be claimed in a GSTR-3B filed on or before the due date of the GSTR-3B for September 2024 (typically October 20th, 2024) or the date you actually file the Annual Return for FY 2023-24, whichever date comes first.

Actionable Tip: This deadline is strict. Missing it means forfeiting the ITC permanently. Ensure timely accounting of all service invoices, regular reconciliation with GSTR-2B, and prompt follow-up with suppliers for missing invoices well before the September deadline each year. Don’t postpone claiming eligible credits.

Common Mistakes to Avoid When Claiming ITC on Services

Navigating the rules for ITC on Services can be tricky, and several common mistakes can lead to incorrect claims, subsequent notices, and potential penalties. Being aware of these pitfalls can help ensure compliance:

- Claiming ITC on Blocked Services: Incorrectly claiming credit for services listed under Section 17(5) (like catering, health insurance unless mandatory, works contracts for immovable property) is a frequent error. Always verify against the blocked credit list.

- Claiming Based on Invalid/Missing Invoices: Attempting to claim ITC without possessing a valid tax invoice containing all mandatory details, or based on a proforma invoice or challan, is not permissible.

- Not Reconciling with GSTR-2B / Ignoring Supplier Non-Compliance: Claiming ITC solely based on your purchase records without ensuring the corresponding details are reflected in your GSTR-2B (due to supplier non-filing or errors) is risky and often leads to disallowance.

- Failing to Reverse ITC for Non-Payment: Forgetting or neglecting to reverse the ITC claimed if the payment to the supplier (including tax) is not made within 180 days from the invoice date (as per Rule 37) can result in demands for reversal along with interest.

- Errors in GSTR-3B Filing: Making data entry errors while filling Table 4 of GSTR-3B, such as incorrectly classifying ITC under IGST, CGST, SGST/UTGST, or making calculation mistakes, can lead to incorrect credit utilization or reporting mismatches.

Conclusion

Successfully navigating the complexities of ITC on Services under GST is crucial for the financial health and compliance of small businesses and GST-registered professionals in India. Understanding the core principles, diligently adhering to the ITC eligibility for services in India, and meticulously maintaining the required documentation for claiming ITC on services are non-negotiable. Key takeaways include ensuring services are used for business purposes, possessing valid tax invoices, reconciling purchases with GSTR-2B, being aware of blocked credits under Section 17(5), and adhering to claim deadlines and payment timelines. Getting ITC right translates directly into optimized cash flow, reduced tax liability, and avoidance of interest and penalties associated with non-compliance.

Navigating ITC on Services requires careful attention to detail. If you find GST compliance, ITC reconciliation, or return filing challenging, don’t risk costly errors. Contact TaxRobo’s experts today for reliable, professional support tailored to your business needs. Let us help you maximize your eligible credits while staying fully compliant. Connect with TaxRobo GST Experts.

Frequently Asked Questions (FAQs) about ITC on Services

1. Can I claim ITC on all services used in my business?

Answer: Generally yes, if the services are directly used or intended to be used in the course or furtherance of your business, and you satisfy all the conditions under Section 16 (like having a valid GST invoice, being registered, supplier paying tax, etc.). However, it’s crucial to remember Section 17(5) of the CGST Act lists certain services as ‘blocked credits’. This means even if used for business, ITC cannot be claimed on them. Common examples include certain food/beverage supplies, health/cosmetic services (unless used for onward supply), rent-a-cab services (with exceptions), life/health insurance (unless obligatory), and works contract services for constructing immovable property. Always cross-check the specific service against this list before claiming ITC on Services. For a deeper look at blocked credits, refer to Blocked Credits Under Section 17(5): What ITC Cannot Be Claimed?.

2. What happens if my service provider hasn’t uploaded the invoice, and it’s not showing in my GSTR-2B?

Answer: Under the current GST framework, ITC claims in your GSTR-3B are primarily linked to the details appearing in your auto-generated GSTR-2B statement. If a valid invoice for services you’ve received is missing from your GSTR-2B, it usually means the supplier has either not filed their GSTR-1 return for that period or has made an error in reporting the transaction. In this scenario, you should not claim the ITC for that invoice in your GSTR-3B for the current period. Your immediate action should be to contact the supplier, highlight the discrepancy, and request them to upload the invoice details correctly in their subsequent GSTR-1. Once the supplier files/corrects it and the details reflect in a future GSTR-2B, you can claim the pending ITC on Services in the corresponding future GSTR-3B, provided you do so within the overall time limit specified under Section 16(4).

3. Is there a deadline for claiming ITC on Services related to a particular invoice?

Answer: Yes, absolutely. Section 16(4) of the CGST Act sets a strict deadline. For any invoice or debit note pertaining to a financial year (e.g., April 2023 to March 2024), the Input Tax Credit must be claimed in a GSTR-3B return filed by the earlier of these two dates: (a) the due date for filing the GSTR-3B for the month of September of the following financial year (i.e., September 2024, with a due date usually around October 20th, 2024), OR (b) the actual date when you file the Annual Return (GSTR-9) for the financial year 2023-24. If you miss this deadline, the ITC for that invoice is lost permanently. This makes timely accounting and reconciliation critical.

4. What are the absolute minimum documentation requirements for ITC claims on services?

Answer: To successfully claim and sustain an ITC on Services claim, the absolute minimum documentation and conditions you must meet are:

- Valid Tax Invoice/Debit Note: You must possess the original tax invoice or debit note issued by the service provider, containing all the mandatory details prescribed under GST rules (Rule 46), including both supplier and recipient GSTINs, SAC code, value, tax breakdown, etc.

- Proof of Receipt: You must have actually received the service. While harder to document physically than goods, agreements or usage logs can help.

- GSTR-2B Reflection: The invoice details must be reflected in your GSTR-2B statement, indicating the supplier has filed their GSTR-1 and declared the liability.

- Proof of Payment (within 180 days): You need evidence that you have paid the supplier the invoice amount (including tax) within 180 days from the invoice date to avoid reversal of claimed ITC (Rule 37). Bank statements are common proof.

Meeting these core requirements is essential for compliant documentation for claiming ITC on services.

5. I am a salaried individual but run a small online consultancy on the side and I’m registered for GST. Can I claim ITC on Services like internet bills or software subscriptions?

Answer: Yes, absolutely. If you are registered under GST specifically for your consultancy business (even if it’s a side activity alongside your salaried job), you are generally eligible to claim ITC on Services that are used “in the course or furtherance” of that registered business. Services like internet charges, telephone bills, specific software subscriptions (e.g., video conferencing tools, project management software), professional domain/hosting fees, etc., can qualify if they are genuinely used for your consultancy work. The key conditions are:

- You must have a valid GST invoice for the service, correctly addressed to your registered business name and including your GSTIN.

- The service must be predominantly used for your consultancy business, not primarily for personal purposes. If a service like internet is used for both personal and business use, GST rules require you to apportion the ITC; you can only claim the portion attributable to your business use. Keep records to justify the apportionment basis if needed.

- All other general conditions (like the invoice appearing in GSTR-2B, payment within 180 days) must be met.

Claiming such valid ITC on Services can significantly reduce the net GST payable from your consultancy income.