How to Repurpose Content for Maximum Reach in Finance

Introduction: Unlock Wider Audiences for Your Finance Content

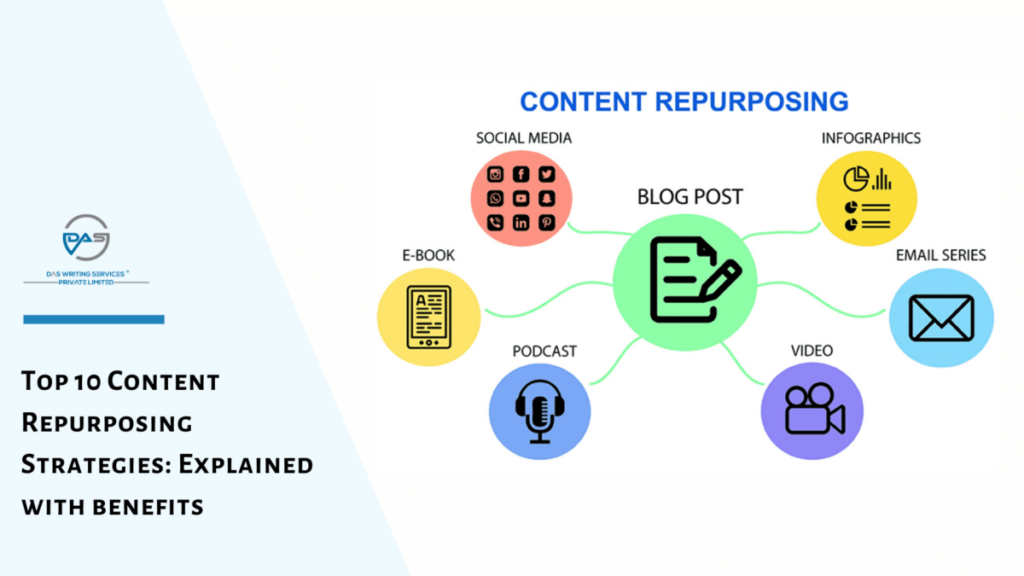

Creating high-quality, relevant finance content consistently is a significant challenge for many Indian businesses and individuals. Whether it’s breaking down complex tax updates, explaining GST implications after council meetings, or providing insights into investment strategies, the process demands considerable time, expertise, and effort. Imagine spending hours crafting the perfect blog post explaining Section 80C deductions, only for it to reach a fraction of your potential audience. This is where a smarter approach comes in: learning how to repurpose content for maximum reach. This strategy isn’t about cutting corners; it’s about intelligently leveraging the valuable assets you’ve already created, transforming them into various formats to connect with more people across different platforms. In the dynamic Indian finance sector, where regulations like GST norms or income tax rules frequently evolve with Budget announcements and notifications, this adaptability is crucial. You need efficient ways to communicate these changes effectively to both small business owners focused on compliance and salaried individuals seeking tax-saving opportunities. This post serves as your practical guide, outlining actionable content repurposing strategies finance India can use to get significantly more mileage from every piece of financial content produced. Implementing effective finance content marketing India techniques like repurposing helps ensure your valuable insights don’t just sit idle but actively work to inform and engage your target audience.

Why Repurposing Content is Essential for Finance Professionals and Businesses in India

Adopting content repurposing isn’t just a “nice-to-have”; it’s a fundamental component of an efficient and effective communication strategy, especially within the complex Indian financial landscape. The benefits are tangible and directly address common challenges faced by businesses and professionals in this field. Let’s explore why integrating repurposing content for finance industry practices is so vital:

- Benefit 1: Save Time and Resources: This is perhaps the most immediate advantage. Developing original content – researching intricate topics like TDS provisions under the Income Tax Act, outlining the steps for company registration, or detailing GST compliance requirements – is resource-intensive. Repurposing allows you to take the core research, insights, and information from one successful piece and adapt it into multiple new formats without starting from scratch each time. This significantly reduces the time and cost associated with content creation, freeing up resources for other critical business activities.

- Benefit 2: Reach New Audience Segments: People consume information differently. A busy small business owner might not have time to read a lengthy blog post on the latest GST updates from the GST Portal but might watch a 2-minute explainer video on YouTube or glance at a key-takeaways infographic on LinkedIn. Similarly, a salaried individual might miss your detailed article on tax-saving investments but engage with a short, informative Reel on Instagram highlighting options under Section 80C. Repurposing helps you meet your audience where they are, in the format they prefer.

- Benefit 3: Reinforce Key Messages & Improve Understanding: Financial concepts can be complex. Understanding the nuances between CGST, SGST, and IGST, remembering various ITR filing deadlines, or grasping the implications of different business structures requires clarity and sometimes, repetition. Presenting the same core information in different ways (e.g., a blog post, a video, a checklist, a Q&A session) helps reinforce key messages and caters to different learning styles, ultimately improving comprehension and retention among your audience.

- Benefit 4: Boost SEO Performance: Repurposing content contributes positively to your Search Engine Optimization efforts. By creating multiple content formats around a central financial theme (e.g., GST filing), you target a broader range of search queries. Someone might search for “how to file GSTR-3B,” another for “GST filing video tutorial,” and a third for “common GST mistakes checklist.” Having diverse content assets increases your chances of ranking for these varied searches, driving more organic traffic to your website and enhancing your overall online visibility.

- Benefit 5: Establish Authority: Consistently providing valuable, accurate, and accessible financial information across multiple platforms solidifies your position as a trusted expert. Whether you’re explaining audit requirements or demystifying accounting principles through blog posts, videos, webinars, or downloadable guides, this multi-channel presence demonstrates deep knowledge and commitment. This consistent value delivery is a cornerstone of a successful content strategy for finance companies India, building credibility and trust with potential clients and stakeholders.

Identifying Your Best Finance Content for Repurposing

Before diving into transforming your content, you need to strategically identify which existing assets offer the most potential for repurposing. Not all content is created equal, and focusing your efforts on proven winners will yield the best results. Start by digging into your performance metrics; data provides invaluable clues about what resonates most with your audience.

- Analyze Performance Metrics:

- Website Analytics: Use tools like Google Analytics to pinpoint your most popular blog posts and pages. Look for content with high traffic, significant time spent on page, and low bounce rates. For instance, a detailed guide on “Understanding Section 80C Deductions for Salaried Employees” or a step-by-step article on “Private Limited Company Registration Process in India” that consistently draws readers is a prime candidate. These are topics your audience actively seeks information on.

- Social Media Engagement: Monitor your social media channels (LinkedIn, Facebook, Instagram, Twitter, YouTube). Identify posts, videos, or infographics that garnered high levels of likes, shares, comments, and saves. A simple graphic explaining different ITR forms that received many shares, or a short video debunking common GST myths that sparked conversation, indicates high interest and shareability potential.

- Email Marketing Data: Review your email campaign reports. Which links within your newsletters consistently get the highest click-through rates? If links pointing to a webinar registration page about “Audit Readiness for Small Businesses” or a blog post explaining recent TDS changes saw significant clicks, it signals strong audience interest in those specific topics.

- Customer Questions: Pay close attention to the questions your clients or audience frequently ask. Track inquiries received via customer support, contact forms, social media messages, or during consultations handled by your team, perhaps through services like TaxRobo Online CA Consultation Service. Recurring questions like “What documents are needed for GST registration?” (See: Launching Your Startup Right – Mastering GST Registration in India) or “How do I calculate HRA exemption?” highlight information gaps and high-demand topics perfect for creating (or repurposing) content around.

- Focus on Evergreen Content (Alongside Timely Updates): Prioritize content that remains relevant over extended periods. Foundational pieces explaining the basics of accounting (Related: Set Up An Accounting System for My Small Business), detailing different types of business structures in India, outlining fundamental tax principles, or explaining core concepts like TDS or TCS are excellent candidates as their value persists. These “evergreen” pieces can be updated and repurposed repeatedly. However, don’t ignore timely content; repurposing a comprehensive analysis of the annual Union Budget or recent GST Council decisions immediately after they occur is crucial for demonstrating relevance and authority.

- Content Audit: Conduct a systematic review of your existing content inventory. Create a simple spreadsheet listing all your significant content assets – blog posts, articles, downloadable guides, ebooks, webinar recordings, presentation decks, case studies, videos, infographics. For each asset, evaluate its past performance (using the metrics above), its relevance (is it still accurate?), and its potential for transformation into other formats. This audit provides a clear overview of your repurposable assets and helps prioritize your efforts.

Actionable Content Repurposing Strategies for Finance India

Once you’ve identified your high-potential finance content, it’s time to implement specific content repurposing strategies finance India can leverage for greater impact. The key is to adapt the core message and information into formats suitable for different platforms and audience preferences. Here are practical ways to transform your existing assets, with examples relevant to Indian finance:

Turning Blog Posts/Articles into Multiple Assets

Your blog often serves as the foundation of your content marketing. Leverage these detailed pieces:

- Blog Post to Infographic: Complex financial processes or data-heavy posts can be distilled into easy-to-understand visuals. Take a blog post detailing “5 Steps to File Your Income Tax Return Online” or summarizing “Key GST Compliance Dates for the Financial Year” and create a compelling infographic. These are highly shareable on platforms like LinkedIn, Pinterest, and Instagram, capturing attention quickly.

- Blog Post to Short Video: Convert the main points of a popular blog post into a concise (1-3 minutes) explainer video. For example, take an article explaining a specific deduction like Section 80D (health insurance) or demystifying a term like ‘Input Tax Credit (ITC)’ under GST, and create an engaging video. Host it on YouTube and share clips on Instagram Reels, YouTube Shorts, and LinkedIn for wider visibility.

- Blog Post Series to Guide/eBook: If you have several blog posts covering different facets of a larger topic (e.g., posts on choosing a business structure, registration process, initial compliance for startups), compile and expand them into a comprehensive downloadable guide, such as “The Complete Guide to Starting Your Business in India.” This serves as an excellent lead magnet to capture email addresses. You can promote services like TaxRobo Company Registration Service within the guide.

- Blog Post to Checklist/Worksheet: Transform actionable blog posts into practical, downloadable resources. An article listing “Documents Required for MSME Loan Application” or a “Year-End Accounting Checklist for Small Businesses” can easily become a printable checklist that users can refer to offline. This adds tangible value and keeps your brand top-of-mind. Find checklist ideas related to TaxRobo Accounts Service.

- Blog Post to Presentation Slides: Adapt the key arguments, data points, and takeaways from a detailed blog post into a set of presentation slides. These can be used for webinars, client workshops, internal training, or shared on platforms like SlideShare and LinkedIn to reach a professional audience looking for summarized information.

Leveraging Webinars and Video Content

Webinars and videos are rich content formats perfect for repurposing:

- Webinar Recording to Blog Posts: Don’t let valuable webinar content disappear after the live session. Transcribe the recording (using AI tools or manual services) and break down key segments into multiple, focused blog posts. A 60-minute webinar on “Decoding the Latest Union Budget for SMEs” could yield separate posts on income tax changes, GST amendments, and new government schemes discussed.

- Webinar/Video to Short Clips: Extract the most impactful moments, tips, or answers from your longer video content or webinar recordings. Create short, shareable clips (15-60 seconds) focusing on a single idea (e.g., “Quick Tip: Avoid this common TDS mistake,” “Understanding a recent GST notification”). These are ideal finance content amplification methods for social media platforms like Instagram, TikTok, LinkedIn, and Facebook.

- Video/Webinar Audio to Podcast Episode: Strip the audio track from your videos or webinars and repurpose it as a podcast episode. This caters to audiences who prefer consuming content while commuting, exercising, or multitasking. Ensure the audio quality is good and add a brief intro/outro specific to the podcast format.

- Key Quotes to Quote Graphics: Identify powerful statements or insightful quotes from experts featured in your videos or webinars. Turn these into visually appealing quote graphics using tools like Canva. Share these on social media platforms like Instagram, Twitter, and LinkedIn to generate engagement and drive traffic back to the full content piece. This acts as a useful part of a content repurposing guide for finance professionals.

Maximizing Guides, Reports, and Case Studies

Your more substantial content assets also hold significant repurposing potential:

- Guide/eBook Chapters to Blog Posts: Break down long-form guides or ebooks into individual chapters or sections and publish them as standalone blog posts over time. This allows you to promote the content repeatedly and reach audiences who might be intimidated by a lengthy download but are interested in specific sub-topics.

- Statistics/Data to Social Media Snippets: If your reports or guides contain compelling statistics or data points (e.g., “X% of Indian SMEs struggle with timely GST filing,” “Average tax savings achieved through Section 80C investments”), extract these nuggets and share them as text updates or small graphics on social media. Data points are highly shareable and can effectively highlight key findings.

- Case Study to Testimonial Video/Quote: Transform written case studies highlighting client success (e.g., how TaxRobo helped a business streamline its GST compliance or navigate an audit) into more dynamic formats. Record short video testimonials with the client (if possible) or pull powerful quotes from the case study to create persuasive testimonial graphics for your website and social media.

Choosing the Right Platforms for Content Distribution in the Finance Sector

Creating repurposed content is only half the battle; ensuring it reaches the right audience on the right platforms is crucial for success. Effective content distribution for finance sector requires understanding where your target audience – Indian small business owners and salaried individuals – spends their time and seeks financial information. Tailoring your content delivery to each platform’s strengths and user expectations is key.

- Understand Your Audience Platforms:

- LinkedIn: This is the prime platform for B2B interactions, professional insights, and establishing thought leadership in finance. Share detailed articles (adapted from blog posts), presentation slides, infographics summarizing compliance updates, insights on corporate law, and links to comprehensive guides or webinar recordings. The tone should be professional and informative.

- YouTube: As the second largest search engine, YouTube is invaluable for visual learners seeking explanations and tutorials. Host longer explainer videos (e.g., detailed ITR filing walkthroughs, breakdowns of complex GST concepts like Reverse Charge Mechanism), webinar recordings, expert interviews, and even short animated videos simplifying financial jargon. Optimize video titles and descriptions with relevant keywords.

- Instagram/Facebook: These platforms excel for visual storytelling and reaching a broader audience, including salaried individuals. Use Instagram Reels and Stories for short video tips (tax savings, budgeting hacks), myth-busting common financial misconceptions, and quick explainers. Share infographics (e.g., upcoming tax deadlines, investment option comparisons) on both platforms. Facebook Groups can also be valuable for targeted discussions.

- WhatsApp: While needing cautious and permission-based use, WhatsApp can be effective for direct communication with existing clients or specific groups. Share quick alerts (e.g., GST payment reminders, ITR deadline extensions), links to newly published blog posts or videos, and concise tips. Avoid spamming and focus on high-value, timely information.

- Company Blog/Website: Your website remains the central hub. Host all your detailed articles, guides, and case studies here. Embed your YouTube videos and infographics within relevant blog posts. Ensure your blog is well-organized, mobile-friendly, and optimized for search engines to capture organic traffic seeking information on topics like income tax or GST.

- Email Newsletters: Leverage your email list to distribute repurposed content directly to engaged subscribers. Send summaries of recent blog posts, links to new videos or downloadable checklists, invitations to webinars, and exclusive content snippets. Segment your list (e.g., by business owners vs. salaried) to tailor content effectively.

- Platform-Specific Formatting: Simply cross-posting the exact same piece of content everywhere is ineffective. You must adapt and tailor your repurposed content for each platform. For example:

- Video: Use vertical format (9:16) for Instagram Reels/Stories and YouTube Shorts, but horizontal (16:9) for standard YouTube videos and LinkedIn.

- Text: Keep captions concise and engaging on visual platforms like Instagram, while LinkedIn allows for longer, more detailed text posts accompanying visuals or links.

- Visuals: Ensure infographics are easily readable on mobile for platforms like Instagram and Facebook. Use professional branding consistent with your website on LinkedIn slides or graphics.

- Tone: Maintain a professional, insightful tone on LinkedIn, while adopting a slightly more conversational and engaging style for Facebook and Instagram might be appropriate.

Measuring the Success of Your Repurposed Content Efforts

To understand the true impact of your content repurposing strategy and continuously improve it, you need to measure its performance effectively. Tracking the right metrics will reveal what’s working, what’s not, and where you can optimize your efforts for better results. Don’t just create and distribute; analyze and refine based on data.

- Define Key Performance Indicators (KPIs): Before launching repurposed content, decide what success looks like. Your KPIs should align with your overall business goals. Common metrics include:

- Reach & Impressions: How many unique users saw your repurposed content? How many times was it displayed? Track views on videos (YouTube, social media), reach figures on social media platforms (LinkedIn Insights, Facebook/Instagram Insights), and impressions. This indicates brand visibility.

- Engagement: How did users interact with the content? Measure likes, shares, comments, saves on social media posts, click-through rates (CTR) on links shared, and comments on blog posts. High engagement suggests the content is resonating and valuable.

- Website Traffic: Did your repurposed assets successfully drive traffic back to your main website or specific landing pages (like TaxRobo services pages)? Use Google Analytics and UTM parameters (unique tracking codes added to URLs) to attribute website visits to specific repurposed content pieces shared on different platforms.

- Lead Generation: Is your repurposed content contributing to business growth? Track conversions such as downloads of guides/checklists, registrations for webinars, contact form submissions, or direct inquiries that originated from a repurposed content piece. This measures the content’s ability to generate potential clients.

- SEO Impact: Monitor your website’s search engine rankings for keywords related to the topics covered by your repurposed content. Are you seeing improved visibility for terms like “GST registration online,” “ITR filing guide,” or “company incorporation steps” after distributing content in various formats targeting these themes?

- Tools for Tracking: Utilize readily available tools to gather data:

- Google Analytics: Essential for tracking website traffic, user behavior, traffic sources, and goal conversions.

- Social Media Platform Analytics: LinkedIn, Facebook, Instagram, YouTube, and Twitter all offer built-in analytics dashboards providing insights into reach, engagement, and audience demographics for your posts and videos.

- Email Marketing Software Reports: Platforms like Mailchimp or Sendinblue provide data on open rates, click-through rates, and subscriber engagement for your newsletters distributing repurposed content.

- URL Shorteners with Tracking (e.g., Bitly): Can help track clicks on links shared across various platforms.

- Analyze and Refine: Regularly review the data collected (monthly or quarterly). Identify patterns: Which formats generate the most engagement? Which platforms drive the most qualified traffic or leads? Which topics consistently perform well across different formats? Use these insights to refine your content repurposing strategies finance India. Double down on what works, experiment with new formats for underperforming topics, and continuously optimize your approach for maximum impact.

Conclusion: Maximize Your Impact with Smart Content Repurposing

In the fast-paced and information-dense world of Indian finance, simply creating good content isn’t enough. To truly connect with your audience, build authority, and drive results, you need to ensure your valuable insights reach as many relevant people as possible, in formats they prefer. Learning how to effectively repurpose content for maximum reach is the key to achieving this. By transforming your existing blog posts, videos, webinars, and guides into diverse assets like infographics, short clips, checklists, and podcast episodes, you save invaluable time and resources. More importantly, you expand your audience reach across different platforms, reinforce complex financial messages for better understanding, boost your SEO visibility, and solidify your position as a trusted resource for topics ranging from GST compliance to income tax planning.

Don’t let your hard work go underutilized. Take the time to audit your existing financial content – those articles explaining company law, the videos detailing tax deductions, the guides on accounting best practices. Identify your top performers and brainstorm how you can give them new life in different formats. Start small, measure your results, and refine your approach based on data. Implementing a smart repurposing strategy is fundamental to successful finance content marketing India.

Need assistance developing a powerful content strategy or creating compelling financial content that’s ripe for repurposing? TaxRobo’s team of experts is here to help. We offer guidance on everything from content ideation and creation to effective distribution and performance analysis. Contact TaxRobo today to explore how we can help you repurpose content for maximum reach and achieve your business goals.

Frequently Asked Questions (FAQ)

Q1. How often should I repurpose my finance content?

A: There isn’t a strict schedule, but a good practice is to regularly review your analytics (perhaps quarterly or bi-annually) to identify top-performing content pieces that are ripe for repurposing. Additionally, timely content, such as analysis of the Union Budget, major GST notifications from the GST Council, or significant changes announced on the Income Tax India Website, should be repurposed almost immediately across relevant channels to maximize relevance. The focus should always be on the quality and strategic value of repurposing, rather than just hitting a certain frequency. Consistent review ensures you leverage your best assets effectively.

Q2. What types of financial content are best suited for repurposing in India?

A: Several types of financial content lend themselves well to repurposing for an Indian audience. Explanatory ‘how-to’ guides (e.g., step-by-step ITR filing, process for GST registration) are prime candidates for video tutorials, checklists, and infographics. Listicles (e.g., top tax-saving investment options, common accounting mistakes for small businesses) are easily adapted into short videos, social media carousels, or infographics. Data-heavy content from reports or surveys can be turned into shareable statistic graphics. Expert interviews or webinar recordings offer abundant material for blog posts, short clips, quote graphics, and podcast episodes. Finally, evergreen foundational guides covering topics like the basics of financial planning, types of business structures (like Private Limited Company), or fundamental tax principles offer long-term repurposing value.

Q3. Can repurposing content negatively impact my SEO?

A: Repurposing content, when done correctly, should enhance your SEO, not harm it. The key distinction is between repurposing and duplication. Repurposing involves adapting the core message into different formats for different platforms or audiences (e.g., a blog post becomes a video summary, an infographic, or presentation slides). This creates unique value for each format and targets different search intents and keywords. It helps you capture a wider range of search queries related to your topic. Conversely, simply copying and pasting large chunks of identical text across multiple pages or platforms without adding unique value can lead to duplicate content issues, which search engines penalize. Focus on transformation and adaptation, not replication.

Q4. Do I need expensive tools to start repurposing content?

A: No, you don’t need a large budget or sophisticated tools to begin repurposing your finance content. Many free or affordable tools can get you started effectively. Canva is excellent for creating infographics, social media graphics, and presentation slides with professional-looking templates. Simple video editing software available on smartphones (like CapCut or InShot) or desktops (like OpenShot – free) is sufficient for creating short explainer videos or clips. Presentation software like Google Slides (free) or Microsoft PowerPoint can be used to create slide decks. For transcriptions, some services offer limited free tiers (like Otter.ai), or you can transcribe short segments manually. Start with accessible tools and invest more as your strategy scales.

Q5. How can repurposing help my small business specifically with compliance topics like GST or TDS?

A: Repurposing content is incredibly beneficial for communicating complex compliance topics like GST, TDS, PF/ESI, or ROC filings to small business owners or their teams. These regulations can be dense and confusing. Repurposing allows you to break down intricate information into multiple, more digestible formats. For example, a detailed blog post explaining different GST return types (GSTR-1, GSTR-3B) can be repurposed into:

- A simple checklist of information needed for each return.

- A short video explaining common errors to avoid during filing.

- An infographic visualizing filing deadlines for the upcoming quarter.

- A FAQ section on your website addressing common GST queries.

- Short social media tips highlighting specific compliance points.

This multi-format approach increases understanding, reinforces key dates and requirements (like those found on the official GST Portal), helps prevent costly errors and penalties, and makes compliance seem less daunting for your clients or your own business operations. It helps ensure crucial information from resources like TaxRobo GST Service or TaxRobo Accounts Service reaches and is understood by the target audience.