GST On Affordable Housing and Non Affordable Housing

Buying a home is a significant milestone for most people in India, often representing the largest financial investment they will make. Understanding the various costs involved, especially taxes, is crucial for making informed decisions and avoiding unexpected financial burdens. One major component of the cost structure for new homes is the Goods and Services Tax (GST). However, the application of GST isn’t uniform across all residential properties. The government has introduced specific provisions that differentiate the tax treatment based on whether a property qualifies as ‘affordable housing’. This distinction is vital because it can lead to a substantial difference in the final price paid by the homebuyer. This post aims to clearly explain the concept of GST on affordable housing in India, defining what constitutes affordable housing, detailing the applicable GST rates for both affordable and non-affordable categories, and discussing the overall impact of GST on affordable housing India compared to other residential properties. Understanding these nuances will empower potential buyers to navigate the property market more effectively.

What Qualifies as Affordable Housing Under GST?

To understand the differential GST rates, it’s essential first to grasp what the government defines as “affordable housing” specifically under the GST law. This definition isn’t just a general term; it’s based on precise criteria related to the property’s size and value. Meeting these criteria is the sole determinant for eligibility for the concessional GST rate. Understanding the specifics of GST on affordable housing India begins with this classification. The criteria were established to ensure that the tax benefits are targeted towards housing units genuinely intended for the lower and middle-income segments of the population, aligning with the government’s objective of ‘Housing for All’. This clear definition prevents ambiguity and helps both developers and buyers determine the applicable tax rate from the outset, contributing to transparency in real estate transactions involving under-construction properties.

Key Criteria for Classification

For a residential property to be classified as ‘affordable housing’ under the GST regime, it must simultaneously satisfy both conditions related to its carpet area and its value. These conditions vary slightly depending on the property’s location:

- Carpet Area Limits: The internal usable area of the apartment is a key factor.

- Metropolitan Cities: The carpet area must not exceed 60 square meters. Metropolitan cities for this purpose include Bengaluru, Chennai, Delhi National Capital Region (limited to Delhi, Noida, Greater Noida, Ghaziabad, Gurgaon, Faridabad), Hyderabad, Kolkata, and Mumbai (Mumbai Metropolitan Region).

- Non-Metropolitan Cities/Towns: For properties located in cities or towns other than the metropolitan areas listed above, the carpet area limit is higher, capped at 90 square meters.

- Value Cap: The gross amount charged by the builder for the apartment must not exceed INR 45 lakhs. This value includes the consideration for the apartment itself, any charges for preferential location, development charges, parking charges, etc., but excludes charges like stamp duty, registration fees, and maintenance charges paid separately. This value cap of ₹45 lakhs applies uniformly across both metropolitan and non-metropolitan areas.

- Combined Condition: It is absolutely critical to remember that both the relevant carpet area limit (60 sq. mtrs or 90 sq. mtrs depending on location) and the value cap (₹45 lakhs) must be met. If even one condition is breached, the property does not qualify as affordable housing for GST purposes, even if it meets the other criterion. For instance, a 55 sq. meter apartment in Mumbai costing ₹50 lakhs would not be ‘affordable’ under GST, nor would a 70 sq. meter apartment in a non-metro city costing ₹40 lakhs.

Why This Definition Matters

This precise definition is not merely an academic exercise; it has direct and significant financial implications. The classification of a property as ‘affordable housing’ based on these stringent criteria directly determines whether the buyer benefits from a much lower, concessional GST rate or pays the standard, higher rate applicable to other residential properties. Knowing these thresholds allows buyers to assess upfront whether a property they are considering falls into the affordable category and what the corresponding tax liability will be. Builders also rely on this definition to structure their projects and pricing if they aim to target the affordable segment and pass on the GST benefits. For official clarifications and detailed notifications regarding the definition, buyers and developers can refer to resources provided by the Central Board of Indirect Taxes and Customs (CBIC). You can find general information and circulars on the official CBIC GST portal.

GST Rates for Affordable Housing

Once a property successfully meets the dual criteria of carpet area and value cap, it qualifies for a significantly reduced GST rate. This concessional rate is a key component of the government’s strategy to make housing more accessible. Understanding the specific GST rates for affordable housing India is crucial for buyers calculating the final cost of their prospective home. The lower tax burden directly translates into savings, making homes that fit the ‘affordable’ definition more attractive, especially for first-time homebuyers and those in lower to middle-income brackets. This special rate structure reflects a targeted fiscal incentive aimed squarely at boosting the affordable housing sector.

The Concessional Rate Explained

For residential properties classified as affordable housing, the effective Goods and Services Tax (GST) rate applicable is 1% on the total value of the property, payable by the buyer. This rate is applied without the benefit of Input Tax Credit (ITC) for the developer or builder. This 1% is typically split between Central GST (CGST) and State GST (SGST) if the transaction is within the same state (0.5% CGST + 0.5% SGST), or it’s levied as Integrated GST (IGST) at 1% if it’s an inter-state supply, although the latter is less common for immovable property transactions involving individual buyers. The key takeaway for the buyer is the final effective rate of 1%, which represents a substantial reduction compared to the rate applicable to non-affordable housing projects.

Key Conditions for the 1% Rate

While the 1% rate is highly beneficial, it comes with specific conditions that buyers should be aware of:

- No Input Tax Credit (ITC): This is a crucial condition tied to the 1% rate. The builder or developer constructing the affordable housing unit cannot claim Input Tax Credit on the goods (like cement, steel) and services (like architectural fees, labor charges) used in the construction process. This means the taxes paid by the builder on their procurements become part of their construction cost. While this might slightly increase the base cost passed on to the buyer, the significantly lower final GST rate of 1% generally results in a lower overall price compared to a system where ITC was allowed but the final GST rate was higher. The government opted for this simpler, low-rate structure without ITC for affordable housing to ensure the benefit clearly reaches the end consumer.

- Under-Construction Status: GST, whether at the 1% concessional rate or the standard 5% rate, is generally applicable only when purchasing an under-construction property. This means the transaction involves a construction service being provided by the developer to the buyer. If the property is already completed and has received its Completion Certificate (CC) or Occupancy Certificate (OC) before the sale agreement is executed, GST is typically not levied on the transaction.

Non-Affordable Housing GST Implications India

Properties that do not meet the specific criteria for affordable housing – either because their carpet area exceeds the limits (60/90 sq. mtrs) or their value surpasses the ₹45 lakh threshold, or both – are classified as non-affordable residential properties for GST purposes. These properties are subject to a different, higher GST rate compared to their affordable counterparts. Understanding the non-affordable housing GST implications India is essential for buyers considering properties in the mid-range or luxury segments, as the tax component will constitute a larger portion of the overall purchase cost. This standard rate applies to a vast majority of new residential projects in major urban centers that cater to higher income groups or offer larger living spaces.

Standard GST Rate for Residential Housing

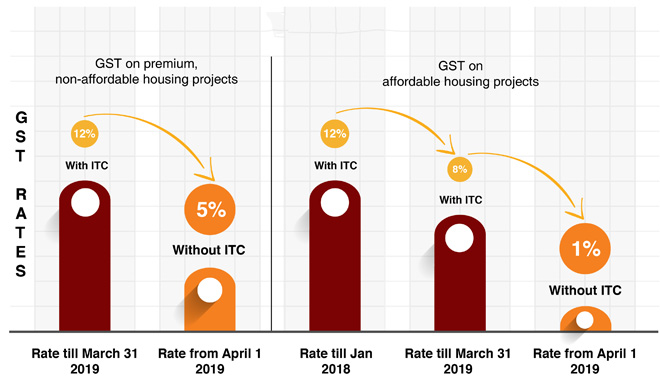

For under-construction residential properties that fall outside the definition of affordable housing, the applicable effective GST rate is 5% on the total value of the property. Similar to the affordable housing scheme, this 5% rate is also levied without the benefit of Input Tax Credit (ITC) for the developer. This rate structure was introduced effective April 1, 2019, replacing older, more complex rate structures that involved ITC. The 5% rate is typically divided into 2.5% CGST and 2.5% SGST for intra-state supplies, or levied as 5% IGST for inter-state supplies. This standard rate aims to provide a relatively simple tax framework for the majority of the housing market while still distinguishing it from the concessional rate offered for the affordable segment.

Comparison: Affordable vs. Non-Affordable

The key difference in GST treatment boils down entirely to whether the property meets the defined criteria for affordable housing. Here’s a direct comparison:

| Feature | Affordable Housing | Non-Affordable Housing |

|---|---|---|

| Definition | Meets Area (≤60/90m²) & Value (≤₹45L) | Exceeds Area or Value limits |

| GST Rate | 1% (Effective) | 5% (Effective) |

| Input Tax Credit (ITC) for Builder | Not Allowed | Not Allowed |

| Applicability | Under-Construction Property | Under-Construction Property |

As the table highlights, both categories operate under a ‘without ITC’ model for the builder since April 2019. The primary differentiator impacting the buyer’s cost is the final effective GST rate: 1% for qualifying affordable homes versus 5% for all other under-construction residential properties. This four-percentage-point difference can translate into significant cost variations, emphasizing why verifying a property’s classification under GST is crucial for potential buyers.

Impact and Benefits for Home Buyers

The distinct GST rates for affordable and non-affordable housing have a direct and tangible impact of GST on affordable housing India and the choices available to homebuyers. The structure is designed to provide specific advantages to those purchasing homes within the defined affordable limits, aligning with broader socio-economic goals. Understanding these impacts and the associated GST benefits for affordable housing buyers India helps individuals assess the true cost of ownership and potentially stretches their budget further within the affordable segment.

Cost Advantage of Affordable Housing

The most significant benefit for buyers purchasing a property classified as affordable housing is the substantial cost saving due to the lower GST rate. The difference between paying 1% GST versus 5% GST is considerable, especially on a high-value purchase like a home.

- Simple Calculation Example:

- Consider an affordable house meeting the criteria, valued at ₹40 lakhs. The GST payable at 1% would be ₹40,000.

- Now, consider a non-affordable house (perhaps slightly larger or in a prime location), valued at ₹60 lakhs. The GST payable at 5% would be ₹3,00,000.

- Even if we considered a non-affordable house valued at the same ₹40 lakhs (assuming it didn’t meet the area criteria, for instance), the GST at 5% would be ₹2,00,000 – five times higher than the affordable unit.

This example clearly illustrates how the lower GST on affordable housing directly reduces the financial burden on the buyer, making homeownership more attainable for many.

Considerations for All Buyers

While the GST rate is a critical factor, potential homebuyers should evaluate properties holistically. The tax advantage of affordable housing is appealing, but it shouldn’t be the sole deciding factor. Buyers must also carefully consider:

- Location: Proximity to workplaces, schools, healthcare, and transportation links.

- Amenities: Facilities offered within the housing complex (e.g., park, gym, security).

- Builder Reputation: Track record for quality construction and timely delivery.

- RERA Compliance: Ensure the project is registered under the Real Estate (Regulation and Development) Act, 2016, which provides buyer protection.

Furthermore, observing affordable housing market trends India can be insightful. Government initiatives like ‘Pradhan Mantri Awas Yojana’ (PMAY) coupled with the concessional GST rate have encouraged developers to launch more projects in this segment, potentially increasing supply and options for buyers in certain markets. However, availability might vary significantly based on location and prevailing real estate dynamics.

Important Clarification: Ready-to-Move-In Property

It is absolutely essential to reiterate a crucial point: GST is generally NOT applicable on the sale of ready-to-move-in properties or resale properties where the Completion Certificate (CC) or Occupation Certificate (OC) has been issued by the competent authority *before* the sale agreement is signed. GST applies to the service of construction provided by the developer. Once the construction is complete and certified, the transaction is treated as a sale of immovable property, which falls outside the scope of GST (though other charges like stamp duty and registration fees still apply). This means if you buy a brand new, completed flat directly from a builder *after* the OC/CC has been obtained, or if you buy a flat from a previous owner (resale), you typically do not have to pay GST. The 1% or 5% GST discussion is relevant only for under-construction units.

Navigating the complexities of property purchase in India requires careful attention to tax implications. The distinction between affordable and non-affordable housing under the GST regime is a prime example. To summarize the key takeaways: the GST on affordable housing is levied at a concessional rate of 1% (without ITC for the builder) for under-construction properties that meet specific criteria – a carpet area of up to 60 sq. meters in metros or 90 sq. meters elsewhere, and a value not exceeding ₹45 lakhs. In contrast, under-construction residential properties that do not meet these criteria attract a higher GST rate of 5% (also without ITC). This differential tax treatment significantly impacts the final cost for homebuyers, making properties classified as ‘affordable’ substantially cheaper from a tax perspective