How to Build a Culture of Compliance in Your Organization Under GST

Are you constantly worried about GST notices, late filing penalties, or incorrect Input Tax Credit (ITC) claims? For many Indian business owners, navigating the complexities of the Goods and Services Tax (GST) can feel like a perpetual challenge. The solution, however, isn’t just about frantically meeting deadlines; it’s about fundamentally shifting your approach from a reactive chore to a proactive business advantage. This is achieved by building a robust culture of compliance within your organization. This proactive mindset transforms GST from a source of anxiety into a pillar of operational efficiency and financial health. This post provides a practical, step-by-step roadmap for small and medium-sized businesses in India to establish and maintain an effective GST compliance culture, ensuring you not only avoid penalties but also unlock your company’s full growth potential. This deep dive into the culture of compliance in organizations India will equip you with the strategies needed to thrive in the current regulatory landscape.

Why a Strong Culture of Compliance is a Business Superpower in India

Many businesses view compliance as a mandatory, yet burdensome, cost center. However, embedding a deep-seated commitment to GST regulations throughout your operations is one of the most powerful strategic decisions you can make. The importance of compliance culture in India cannot be overstated, as it directly influences your bottom line, reputation, and long-term sustainability. It moves your business from a defensive posture, constantly reacting to potential threats, to an offensive one, where solid processes create tangible value. This cultural shift protects your business from financial shocks and positions it as a reliable and trustworthy entity in a competitive market, making it an attractive partner for customers, suppliers, and financial institutions alike.

The Tangible Benefits of a Proactive Compliance Culture

A proactive approach to GST compliance offers significant and measurable rewards that go far beyond simply ticking a box for the government. These benefits directly contribute to your financial stability and operational excellence.

- Avoid Costly Penalties & Interest: The GST framework has stringent penalties for non-compliance. Late filing of GSTR-1 and GSTR-3B returns attracts a daily penalty, and any delay in paying tax liabilities incurs a substantial interest charge of 18% per annum. A strong compliance culture ensures that deadlines are always met and data is accurate, directly saving your business significant amounts of money that would otherwise be lost to penalties. This makes compliance a direct and highly effective cost-saving measure.

- Maximize Input Tax Credit (ITC): Your Input Tax Credit is essentially a refund on the GST you’ve paid on your business purchases, which directly reduces your final tax liability and improves cash flow. A disciplined compliance system ensures every eligible invoice is accounted for, vendor GSTINs are verified, and a meticulous reconciliation is performed between your purchase records and the auto-populated GSTR-2B. This systematic approach guarantees you claim the maximum ITC you are legally entitled to, preventing cash flow leakages.

- Enhance Business Reputation: In today’s business ecosystem, a clean compliance record is a badge of honor. It signals to vendors, customers, banks, and investors that your organization is professionally managed, reliable, and financially sound. When you apply for a business loan or seek a new high-value client, your GST compliance score (tracked by the authorities) can be a critical factor in their decision-making process, opening doors to better credit terms and bigger opportunities.

- Ensure Operational Smoothness: Consistent compliance minimizes the risk of severe administrative actions from tax authorities. These disruptions can include the suspension of your GST registration, freezing of bank accounts, or interruptions in generating e-way bills, all of which can bring your business operations to a grinding halt. A strong compliance culture acts as an insurance policy against such catastrophic interruptions.

The Hidden Costs of a Weak Compliance Culture

Conversely, neglecting compliance creates a cascade of negative consequences that often remain hidden until they cause significant damage. These indirect costs can be even more detrimental than the direct financial penalties.

- Disrupted Supply Chain: Non-compliance, particularly with rules surrounding E-way bills, can lead to your goods being detained in transit. This causes significant delivery delays, spoils customer relationships, and can lead to financial losses, especially with perishable goods. A single disruption can have a ripple effect across your entire supply chain.

- Increased Scrutiny from Authorities: A consistent pattern of late filings, mismatched data, or incorrect ITC claims flags your business’s GSTIN in the government’s system. This makes you a prime candidate for detailed scrutiny, departmental audits, and frequent inspections. Such investigations are time-consuming, stressful, and can unearth further issues, leading to a cycle of regulatory problems. Learning How to Avoid Common Pitfalls Leading to GST Demand Notices is crucial for long-term stability.

- Wasted Time and Resources: Every hour your team or your consultant spends responding to a GST notice, preparing for an audit, or rectifying past errors is an hour not spent on growing the business. This diversion of critical resources—your time, money, and focus—from core activities like sales, marketing, and product development is a massive opportunity cost that hampers growth and innovation.

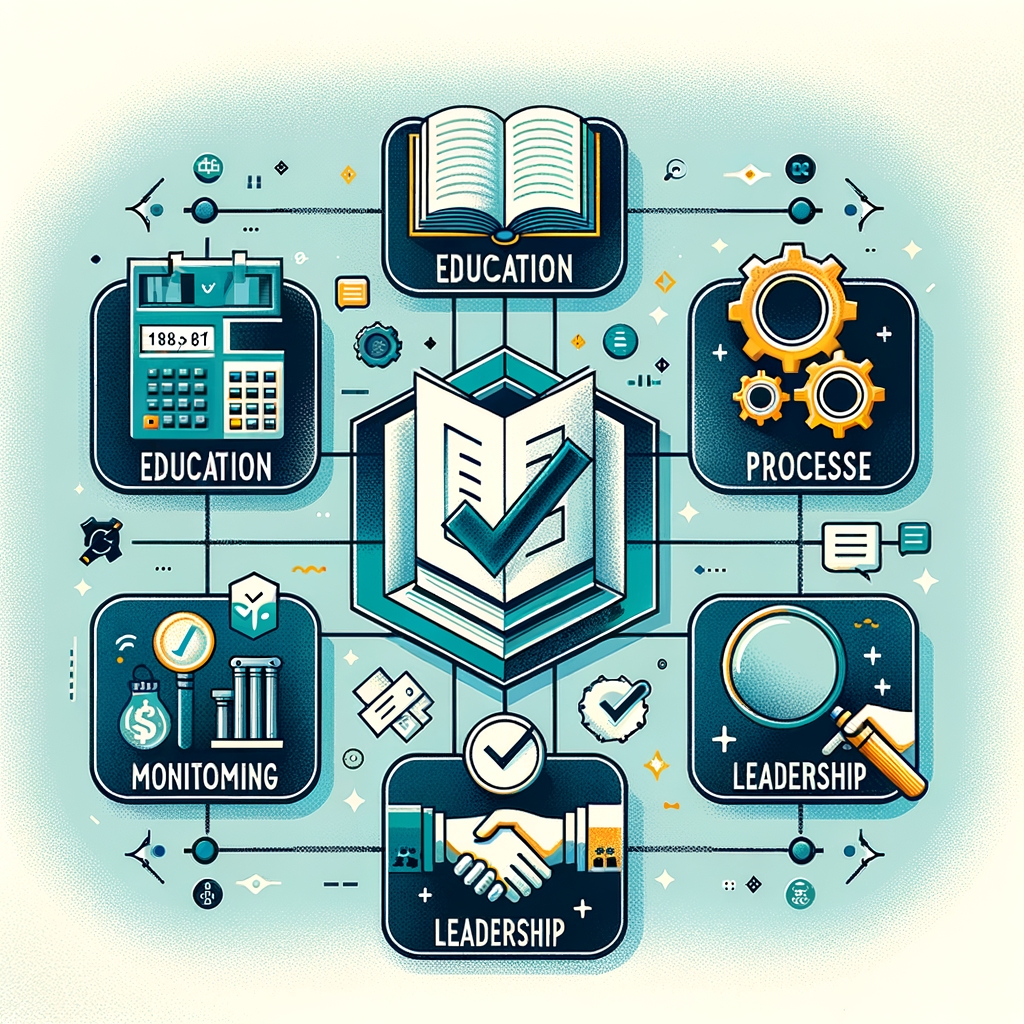

The 4 Pillars for Building a Compliance Culture in Indian Companies

Creating a sustainable compliance culture isn’t about a single action but about building a strong foundation supported by interconnected pillars. These pillars work together to integrate compliance into the very fabric of your daily operations. Successfully implementing these organizational compliance culture strategies is key to long-term success and is the most effective answer to the question of how to ensure compliance in organizations India.

Pillar 1: Leadership Commitment (The “Tone at the Top”)

Compliance culture begins and ends with leadership. If the business owners or senior management treat GST compliance as an afterthought, so will the rest of the team. This “tone at the top” is the single most critical factor in fostering a compliant environment. It involves demonstrating through actions, not just words, that adherence to tax laws is a non-negotiable priority for the organization.

Actionable Advice:

- Champion Compliance Visibly: Business owners and directors must actively participate in and inquire about the company’s GST status. Discussing compliance metrics should be a regular agenda item in management meetings, just like sales figures or marketing performance.

- Allocate a Proper Budget: Demonstrate commitment by investing in the right resources. This could mean allocating a budget for robust accounting software, subscribing to compliance automation tools, or engaging professional experts like TaxRobo’s Managed GST Filing Services.

- Review GST Reports Personally: Before GSTR-3B is filed each month, the leadership should review key figures like total sales, ITC claimed, and tax liability. This simple act of oversight signals the importance of accuracy and accountability to the entire team.

Pillar 2: Clear Policies and Standard Operating Procedures (SOPs)

Vague instructions lead to inconsistent actions and errors. A culture of compliance thrives on clarity and predictability, which can only be achieved through well-documented policies and Standard Operating Procedures (SOPs). These documents don’t need to be complex; simple checklists can be incredibly effective in ensuring that critical steps are never missed, regardless of who is performing the task.

Actionable Advice: Create simple, documented checklists for core GST activities:

- Invoicing Checklist: Define mandatory fields for every invoice, including the customer’s correct GSTIN, precise HSN/SAC codes for goods/services, the correct Place of Supply, and the accurate application of tax rates (CGST/SGST for intrastate, IGST for interstate).

- Vendor Management SOP: Mandate a process to verify the GSTIN of every new vendor on the official portal *before* releasing the first payment. This SOP should also include a clause for holding payments if a vendor’s returns are not filed, as this could impact your ITC.

- Record-Keeping Policy: Specify how and where sales invoices, purchase bills, expense vouchers, and bank statements should be stored. Emphasize that these records must be maintained in a GST-compliant manner for the legally mandated period of six years. Understanding The Importance of Accurate Record-Keeping to Prevent GST Demand Notices can reinforce why this policy is so vital.

- Monthly Return Filing Checklist: Create a step-by-step guide for the monthly filing process. This should include deadlines for data compilation, dates for reconciliation of GSTR-2B with purchase records, the review process, and the final filing of GSTR-1 and GSTR-3B. For a detailed walkthrough, you can reference How to File GST Returns Online: A Step-by-Step Guide of the GST Filing Process & Procedure.

Pillar 3: Employee Training and Role Clarity

Compliance is a team sport. Every employee who touches a financial transaction—from the salesperson creating a quote to the accounts person entering a purchase bill—plays a role in the GST compliance chain. Therefore, it is crucial that each person understands their specific responsibilities and the impact of their actions on the company’s overall compliance.

Actionable Advice:

- Define Roles Clearly: Even in a small team, explicitly assign responsibilities. For instance, designate one person to generate all sales invoices, another to manage purchase entries and vendor communication, and a third to coordinate with the tax consultant. This eliminates confusion and creates clear ownership.

- Conduct Role-Specific Training: You don’t need to teach everyone the entire GST Act. Conduct short, periodic training sessions focused on what’s relevant to their roles. A salesperson needs to know how to determine the correct Place of Supply, while an accounts person needs to understand the importance of matching invoices with GSTR-2B.

- Promote Shared Responsibility: Continuously communicate that compliance is not just the accountant’s job. Emphasize how an error made at the initial stage (e.g., a wrong GSTIN on an invoice) creates significant rework and risk for the entire company down the line.

Pillar 4: Leveraging the Right Technology

In the digital age of GST, attempting to manage compliance manually is inefficient and prone to error. Technology is not a luxury but a necessity for building a scalable and reliable compliance culture. The right tools can automate repetitive tasks, provide crucial data insights, and create a robust framework that minimizes human error.

Actionable Advice:

- Use GST-Compliant Accounting Software: Invest in and properly utilize accounting software like Tally Prime, Zoho Books, or QuickBooks. These platforms are designed to automate the creation of GST-compliant invoices, calculate taxes accurately, and generate the data required for GSTR-1 and GSTR-3B filings with a few clicks.

- Utilize the Official GST Portal: Train your team to use the free resources available on the official government portal. Encourage them to bookmark the Official GST Portal and use its “Search Taxpayer” functionality to verify vendor GSTINs and check their filing status regularly.

- Consider Automation Tools: For businesses with higher transaction volumes, consider tools that offer advanced reconciliation features, vendor compliance tracking, and automated reminders. These tools can drastically reduce the time spent on manual compliance tasks and provide a clear audit trail.

Your Step-by-Step Guide to Compliance Culture Development in India

Building a compliance culture is a journey, not a destination. It requires a structured approach and consistent effort. Here is a practical, step-by-step guide to help you implement the pillars discussed above and kickstart your compliance culture development in India.

Step 1: Conduct a Quick Compliance Audit

Before you can improve, you need to know where you stand. A simple self-assessment can reveal the weak spots in your current process. Ask yourself and your team these critical questions:

- Have all our GSTR-1 and GSTR-3B returns for the last financial year been filed on time?

- Do we have a record of any late fees or interest paid?

- Is there a process to ensure we claim 100% of the eligible ITC reflected in GSTR-2B?

- Are our sales records perfectly reconciled with the turnover declared in our GSTR-3B and GSTR-1?

- Have we ever received a notice from the GST department? If so, what was the root cause?

Step 2: Document Your Core Processes

Based on your audit, start by documenting the most critical processes. You don’t need a 100-page manual. Start simple. Create a one-page flowchart or a simple checklist for your two most important activities: “Sales Invoicing and Data Recording” and “Purchase Entry and Vendor Verification.” This simple act of writing down the process brings immense clarity and ensures consistency.

Step 3: Implement a Monthly Reconciliation Routine

This is arguably the most crucial habit for flawless GST compliance. Make it a non-negotiable monthly routine to reconcile your purchase register with the auto-populated GSTR-2B *before* you file your GSTR-3B. This single step ensures that you only claim ITC on eligible invoices that your suppliers have correctly reported, drastically reducing the risk of future notices and demands for ITC reversal with interest.

Step 4: Stay Informed on GST Amendments

The GST law is not static; it evolves with new rules, notifications, and circulars being issued regularly. Staying ignorant of these changes can lead to unintentional non-compliance.

- Recommended Sources: Make it a habit to follow official sources for updates. The most reliable information comes from the Central Board of Indirect Taxes and Customs (CBIC) website. For simplified summaries and analysis, rely on trusted professional firms and tax portals.

- Call to Action: To make this easier, subscribe to the TaxRobo newsletter for monthly compliance updates and expert insights delivered straight to your inbox.

Conclusion: Making a Culture of Compliance Your Greatest Asset

Building a strong GST compliance framework is far more than a defensive measure to avoid penalties. It is a strategic investment in your business’s future. By focusing on the four key pillars—Leadership Commitment, Clear Policies, Employee Training, and Smart Technology—you can transform compliance from a source of stress into a powerful competitive advantage. A robust culture of compliance leads to significant financial savings through maximized ITC and avoided penalties, enhances your business reputation, and creates a foundation of operational stability that supports sustainable growth. Remember, in the Indian business landscape, a well-managed compliance system is not a cost; it is your greatest asset.

Ready to build an unbreakable culture of compliance in your organization? Don’t let GST complexities slow you down. Contact TaxRobo’s experts today for a free compliance health check and discover how our managed GST services can automate your filings and secure your business.

Frequently Asked Questions (FAQs)

1. As a very small business, how can I build a compliance culture without a big budget?

Answer: A strong compliance culture is about discipline, not expenditure. You can start by leveraging free resources effectively. Use the official Official GST Portal to verify all vendor GSTINs. Create simple process checklists using Microsoft Excel or Google Sheets. Set calendar reminders for all important deadlines (e.g., GSTR-1 and GSTR-3B filing dates). Most importantly, ensure the business owner personally reviews the summary of returns before they are filed. This top-level oversight is the most powerful tool and costs nothing.

2. What is the most common mistake businesses make regarding GST compliance?

Answer: The most frequent and costly mistake is the failure to systematically reconcile purchase records with the auto-generated GSTR-2B report each month. Many businesses either claim ITC based on their book entries alone or fail to follow up with vendors whose invoices are not appearing. This discrepancy is a major red flag for tax authorities and often leads to notices demanding the reversal of incorrectly claimed ITC along with hefty interest and penalties.

3. How can technology improve our organization’s culture of compliance?

Answer: Technology is a cornerstone of a modern culture of compliance. It improves accuracy by automating tax calculations and reducing manual data entry errors. It enhances efficiency by automating repetitive tasks like generating reports and performing reconciliations. It provides a clear and accessible audit trail of all transactions, making it easier to respond to departmental queries. Finally, it ensures timeliness by sending automated reminders for filing deadlines, helping you avoid late fees.

4. How often should we review and update our GST compliance processes?

Answer: A mini-review should be a part of your monthly closing process, especially during the GSTR-3B filing when you reconcile your books. A more comprehensive review of your end-to-end GST process (from invoicing to record-keeping) should be conducted at least once every quarter. Additionally, you must review and update your SOPs immediately whenever there is a significant change in GST law, a major shift in your business operations (like expanding to a new state), or when you adopt new accounting software.