What are the benefits of using financial dashboards in wealth management?

Managing personal finances in India often feels like juggling multiple balls at once. You might have savings accounts in different banks, investments scattered across mutual funds, stocks in a demat account, maybe an EPF or PPF account, a home loan, a car loan, and several credit cards. Tracking everything, understanding your net worth, and making informed decisions can be incredibly complex and time-consuming, often involving tedious spreadsheet updates or logging into numerous websites and apps. This is where a financial dashboard steps in as a powerful solution. Simply put, a financial dashboard is a digital tool that gathers all your financial information from various sources and presents it in a single, easy-to-understand visual interface. This post will explore the significant benefits of using financial dashboards for managing your wealth more effectively, especially for busy small business owners and salaried individuals in India. Understanding these advantages can help you take control of your financial journey.

Understanding Financial Dashboards: Beyond Basic Spreadsheets

So, what exactly is a financial dashboard in the context of personal wealth management? Think of it like the dashboard of your car. Your car’s dashboard instantly shows you crucial information – your speed, fuel level, engine temperature, and warning lights – all in one place, allowing you to drive safely and efficiently. Similarly, a financial dashboard provides a centralized, visual snapshot of your financial health. It displays key metrics like your total investments, bank balances, loan outstanding, credit card dues, net worth, and investment performance using charts, graphs, and summaries.

While you might be using spreadsheets to track your finances, dashboards offer significant upgrades:

| Feature | Manual Spreadsheet | Financial Dashboard |

|---|---|---|

| Data Entry | Manual input required | Automatic aggregation via secure links |

| Updates | Requires manual updating | Often real-time or daily updates |

| Visualization | Basic charts, requires setup | Advanced, interactive charts & graphs |

| Integration | Limited, manual | Connects to banks, brokers, etc. |

| Analysis | Requires formulas & effort | Automated performance & trend analysis |

| Time | Time-consuming | Saves significant time |

How do they achieve this? Financial dashboards work by securely connecting to your various financial accounts – bank accounts, credit cards, demat accounts (holding stocks), mutual fund registrars, loan accounts, and sometimes even provident fund portals. They use secure, often read-only, permissions (meaning they can see your data but cannot make transactions) to automatically pull your latest financial information. This data is then processed and presented visually, giving you an up-to-date overview without the hassle of manual compilation. Security is paramount, and reputable dashboards employ bank-grade encryption and robust security protocols to protect your sensitive information.

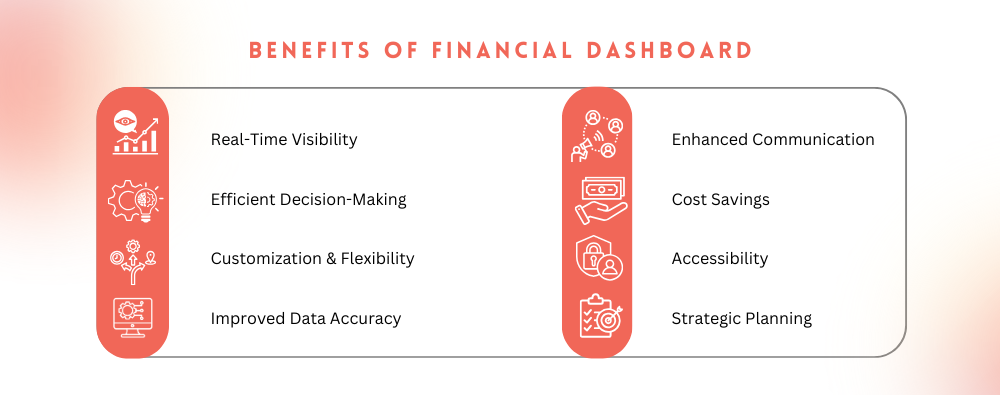

Key Benefits of Using Financial Dashboards for Wealth Management in India

Leveraging wealth management financial dashboards offers substantial advantages beyond simple tracking. The primary benefits of using financial dashboards stem from their ability to consolidate, visualize, and analyze your complete financial picture automatically. For Indians managing diverse assets and liabilities, these tools can be transformative.

Holistic Financial Overview in One Place

One of the most significant pain points in personal finance management is the fragmentation of information. You might need to log into your net banking portal, then a mutual fund app, followed by your stock broker’s platform, and perhaps check your loan statements separately. A financial dashboard eliminates this hassle entirely. It provides a consolidated view of nearly everything you own (assets) and everything you owe (liabilities) on a single screen. You can see your savings account balances, fixed deposits, the current value of your stock portfolio, mutual fund investments, estimates for real estate holdings (often manually updated), and potentially balances in accounts like EPF or PPF (depending on the dashboard’s capabilities). Simultaneously, it displays your outstanding home loan balance, personal loan dues, credit card outstanding, and other debts. This unified view is incredibly powerful. It gives you an accurate, real-time calculation of your net worth (Assets – Liabilities), providing a clear measure of your financial health. Understanding this complete picture is fundamental for effective wealth management, and seeing these financial dashboards benefits India specific context highlights their utility in navigating the diverse financial landscape here.

Simplified Investment Tracking & Performance Analysis

Keeping track of how your investments are performing across different asset classes (equity, debt, gold, real estate, international funds) can be challenging. Are your mutual funds beating their benchmarks? How is your overall stock portfolio doing? What’s your asset allocation mix? Financial dashboards excel at simplifying this. They automatically aggregate data from your linked demat accounts and mutual fund folios (often via consolidated account statements or direct integrations). You can easily visualize your portfolio’s overall growth or decline, see the performance of individual stocks or mutual funds, and understand your exposure to different sectors or asset types. This makes performance analysis straightforward. You can quickly identify which investments are doing well and which are lagging. These insights are crucial for making informed decisions. The advantages of financial dashboards in investment analysis include helping you decide when to rebalance your portfolio to maintain your desired asset allocation, identifying underperforming assets that may need to be reviewed or replaced, and understanding the overall risk profile of your investments more clearly.

Data-Driven Financial Decision Making

Gut feelings and guesswork have no place in serious wealth management. Financial dashboards empower you to move towards data-driven financial decision-making. By presenting complex financial data through intuitive charts and graphs, they help you spot trends and patterns you might otherwise miss. You can visualize your spending habits over months, see how your investment portfolio has grown (or shrunk) over time, track the change in your net worth, and monitor your progress towards debt reduction. Seeing this information clearly laid out helps you make more rational and informed choices. For instance, noticing a consistent spike in discretionary spending might prompt you to adjust your budget. Observing that your portfolio’s risk level has drifted higher than intended could lead to a rebalancing decision. Understanding the trajectory of your net worth growth can motivate you to save and invest more consistently. This highlights the positive impact of financial dashboards on wealth management strategies – they provide the clarity needed to refine your approach based on actual data, not assumptions.

Improved Goal Setting and Progress Monitoring

Financial goals, such as saving for retirement, funding your child’s higher education, buying a house, or creating an emergency fund, are the cornerstones of wealth management. Financial dashboards make goal setting more tangible and tracking progress much easier. Many dashboards allow you to define specific financial goals and allocate existing savings or investments towards them. You can then visualize how close you are to achieving each goal, how much more you need to save, and estimate projected timelines based on your current saving and investment rates. Seeing a visual representation of your progress – like a bar filling up as you get closer to your down payment goal – can be highly motivating. It transforms abstract financial targets into concrete objectives and provides regular feedback on your efforts, helping you stay focused and adjust your saving or investment strategy if you fall behind.

Enhanced Budgeting and Expense Management

Understanding where your money goes is fundamental to financial control. While dedicated budgeting apps exist, many comprehensive financial dashboards incorporate robust budgeting and expense management features. They automatically categorize transactions pulled from your linked bank accounts and credit cards, giving you a clear breakdown of your spending across categories like groceries, utilities, dining out, travel, EMIs, etc. This automated categorization saves significant time compared to manual tracking. You can easily identify areas where you might be overspending, set monthly budgets for different categories, and receive alerts when you approach or exceed your limits. This feature is particularly beneficial for both salaried individuals aiming to optimize their savings and small business owners who need to maintain a clear distinction between personal and business expenses (though dedicated business accounting software is usually recommended for the latter).

For those who want to set a strong financial foundation, Set Up An Accounting System for My Small Business may provide further insights.

Increased Efficiency and Time Savings

Consider the time and effort involved in manually compiling your financial data. You would need to download bank statements, credit card statements, mutual fund Consolidated Account Statements (CAS), log into your brokerage account, update spreadsheets, and perform calculations yourself. This process is not only tedious and time-consuming but also prone to errors. Financial dashboards automate this entire process. Data aggregation happens seamlessly in the background, providing you with up-to-date information with minimal effort. This frees up valuable time that you can spend on analyzing the information, making strategic decisions, or simply focusing on other aspects of your life or business. The efficiency gained is a major practical benefit, making sophisticated wealth management accessible even to those with busy schedules.

If you’re interested in how structured approaches can provide clarity and save time, consider reading about Taxation 101 for Small Business Owners.

Greater Transparency and Control

Ultimately, financial dashboards provide unparalleled transparency into your financial life. Having all your assets, liabilities, income, expenses, investments, and goals consolidated in one place gives you a clear, unambiguous view of your financial situation at any given time. This transparency fosters a sense of control. When you understand your finances thoroughly – your net worth, cash flow, investment performance, and progress towards goals – you are empowered to make confident decisions. You are no longer navigating your financial future in the dark but are equipped with the knowledge and insights needed to steer it effectively towards your objectives. This feeling of control can significantly reduce financial stress and increase confidence in your ability to manage your wealth successfully.

Choosing and Using Financial Dashboards Effectively in India

The market offers several financial dashboard options, each with its own set of features and functionalities. Selecting the right tool that aligns with your needs is crucial to fully leverage the benefits discussed. Once chosen, using it consistently is key to effective wealth management.

Key Features to Look For

When evaluating financial dashboards available in India, consider these essential features:

- Connectivity: This is paramount. Ensure the dashboard can securely connect with the financial institutions you use most frequently. This includes major Indian banks (both public and private sector), popular stock brokers (like Zerodha, Upstox, Groww, Angel One, ICICI Direct, HDFC Securities), and mutual fund registrars (CAMS, KFintech) or platforms. Check if it supports tracking for loans, credit cards, and potentially statutory savings like EPF or NPS (though direct integration for these can be less common).

- Security: Since you’ll be linking sensitive financial accounts, security is non-negotiable. Look for dashboards that employ bank-grade security measures, including strong encryption (like AES-256) for data storage and transmission, multi-factor authentication (MFA) for login, and adherence to strict data privacy policies. Many reputable platforms use secure APIs provided by financial institutions and often operate with read-only access to your accounts. Check if they mention compliance with relevant Indian regulations where applicable.

- Customization & Reporting: A good dashboard should allow some level of customization to tailor the view to your preferences. More importantly, it should offer useful reporting capabilities. Look for features like generating net worth statements over time, detailed investment performance reports (including XIRR calculations), asset allocation summaries, and potentially reports useful for tax purposes like capital gains summaries (though always verify accuracy with official statements).

- User Interface (UI) & Visualization: The primary purpose of a dashboard is clarity. Choose a tool with a clean, intuitive user interface that presents information clearly through well-designed charts and graphs. It should be easy to navigate and understand, even for users who aren’t financial experts.

- Cost: Financial dashboards come in various pricing models. Some offer completely free versions with basic features, often supported by advertisements or cross-selling other financial products. Others operate on a freemium model (basic free tier, paid premium features) or are entirely subscription-based. Evaluate the features offered in each tier against the cost and determine what best suits your needs and budget. Premium features often include advanced analytics, more account connections, goal planning tools, or personalized advisor access.

Getting Started

Once you’ve chosen a financial dashboard tool, getting started is usually a straightforward process:

- Sign Up: Create an account with the chosen dashboard provider.

- Securely Link Accounts: Follow the instructions to connect your bank accounts, credit cards, demat accounts, and other relevant financial accounts. This typically involves logging into your financial institution’s portal through the dashboard’s secure interface to grant authorization (often using OTPs). Remember, prioritize tools with robust security protocols.

- Review and Customize: Once accounts are linked, the dashboard will automatically fetch and organize your data. Review the initial snapshot for accuracy. Customize the dashboard view if options are available, ensuring it highlights the information most important to you. You might need to manually categorize some initial transactions or add assets like real estate or gold holdings that aren’t automatically tracked.

- Set Goals and Monitor Regularly: Define your financial goals within the dashboard if the feature exists. Make it a habit to check your dashboard regularly (e.g., weekly or monthly) to monitor your progress, track spending, review investment performance, and stay informed about your overall financial health. Consistent usage is key for financial dashboards for better wealth management India.

For additional insights into financial organization, refer to the Primary Purpose of Internal Audit in the Modern Organization.

Conclusion: Embrace Clarity with Financial Dashboards

In today’s complex financial world, managing wealth effectively requires clarity, insight, and control. Financial dashboards provide exactly that. As we’ve explored, the core benefits of using financial dashboards range from gaining a holistic, consolidated view of your finances and simplifying investment tracking to enabling data-driven decisions, improving goal monitoring, enhancing budgeting, and saving significant time. These advantages are particularly valuable for Indian small business owners and salaried individuals juggling diverse financial products and aiming for long-term financial security.

By bringing together scattered financial information into a single, intuitive interface, wealth management financial dashboards demystify personal finance. They transform overwhelming data into actionable insights, empowering you to understand your current standing, plan for the future, and make informed choices that align with your goals. The positive impact of financial dashboards on wealth management cannot be overstated – they foster transparency, efficiency, and control. Embracing these tools means embracing financial clarity and taking a proactive step towards building a more secure and prosperous financial future. We encourage you to explore the various financial dashboard options available in India and find one that suits your needs.

For personalized wealth management strategies tailored to your unique situation, consider consulting a qualified financial advisor. TaxRobo offers Online CA Consultation Services to help you navigate your financial journey.

Frequently Asked Questions (FAQs)

Q1. Are financial dashboards secure to use in India?

Answer: Reputable financial dashboards prioritize security. They typically use bank-grade encryption (like AES-256 bit) to protect your data both in transit and at rest. Many use secure Application Programming Interfaces (APIs) provided by banks and financial institutions and often rely on read-only access, meaning the application can view your financial data but cannot initiate transactions. Always look for features like multi-factor authentication (MFA) for login security and review the platform’s privacy policy. It’s crucial to choose well-known, trusted providers and understand their security architecture before linking your accounts.

Q2. How much do financial dashboards cost?

Answer: The cost varies. Some dashboards offer a completely free basic version, which might be sufficient for simple tracking needs but may include ads or limited features. Many operate on a freemium model, providing core functionality for free but charging a subscription fee (monthly or annually) for premium features. These premium features could include linking unlimited accounts, advanced analytics and reports (like detailed capital gains or XIRR), personalized goal planning tools, advisor collaboration features, or an ad-free experience. Evaluate your needs against the features offered in free vs. paid tiers.

Q3. Can these dashboards track all my Indian investments like EPF, PPF, and NPS?

Answer: Connectivity for statutory savings schemes like the Employees’ Provident Fund (EPF), Public Provident Fund (PPF), and National Pension System (NPS) varies significantly between dashboards. Some advanced dashboards might offer direct integration (often requiring login credentials for the respective portals) or allow you to manually add and update the balances for these assets to include them in your overall net worth calculation. Others primarily focus on market-linked investments (stocks, mutual funds) and bank/card accounts. Always check the specific features and supported account types of a dashboard before signing up if tracking these specific investments automatically is important to you.

Q4. What’s the difference between a financial dashboard and a simple budgeting app?

Answer: While there can be overlap, their primary focus differs. A budgeting app typically concentrates on tracking income and expenses, helping you create budgets for various categories, and monitoring your spending patterns. Its main goal is expense management and budget adherence. A financial dashboard, particularly wealth management financial dashboards, offers a much broader perspective. While it usually includes budgeting features, its scope extends to integrating and tracking investments (stocks, MFs), loans, calculating your overall net worth, monitoring investment performance, and often includes tools for long-term financial goal planning (like retirement or education funds). It aims to provide a holistic view of your entire financial health, not just spending.

Q5. How complicated are these dashboards to set up and use?

Answer: Most modern financial dashboards are designed with user-friendliness in mind. The initial setup mainly involves securely linking your various financial accounts. This process usually requires you to authenticate yourself with each financial institution (often via OTPs sent to your registered mobile number), guided by the dashboard’s interface. While linking multiple accounts might take some time initially, it’s generally a one-time effort for each account. Once set up, the dashboard automatically aggregates and updates data. Monitoring your finances then becomes straightforward, relying on visual charts, summaries, and intuitive navigation. Most users find them relatively easy to use daily or weekly.