Benefits of Outsourcing Bookkeeping and Auditing Services in India

Running a business in India, whether it’s a small enterprise or managing significant personal investments, comes with its own set of financial complexities. Juggling daily operations, growth strategies, and the intricate demands of financial record-keeping and regulatory compliance can feel overwhelming. Many business owners find themselves bogged down by tasks like tracking transactions, calculating taxes, and ensuring every financial detail is accurate and compliant. This is where outsourcing bookkeeping and auditing emerges as a powerful strategic solution. Simply put, bookkeeping involves the systematic recording of your day-to-day financial transactions, while auditing is the independent examination of these financial records to verify their accuracy and ensure they comply with relevant laws and standards. Accurate bookkeeping forms the bedrock of sound financial health, enabling informed decision-making, while independent auditing provides crucial assurance to stakeholders and regulators under frameworks like the Goods and Services Tax (GST), Income Tax Act, and Companies Act. This post will delve into the key benefits businesses and individuals in India can unlock by outsourcing these vital financial functions.

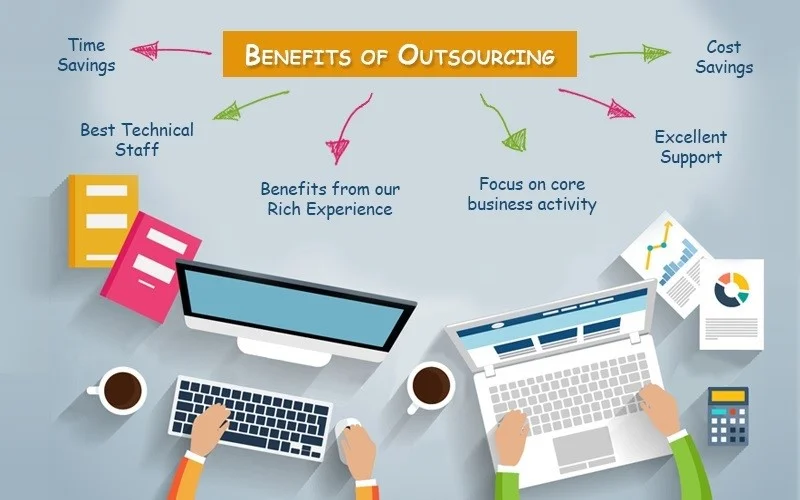

Why Consider Outsourcing Bookkeeping and Auditing?

Managing bookkeeping and auditing in-house presents several hurdles, particularly for small to medium-sized businesses in India. A primary challenge is the lack of dedicated financial expertise or simply the insufficient time available to manage these tasks effectively amidst other business priorities. Hiring qualified full-time accountants or internal auditors involves significant costs, including salaries, benefits, training, and providing necessary infrastructure like office space and software. Furthermore, the Indian financial landscape is dynamic, with frequent updates to tax laws (like GST and Income Tax provisions) and accounting standards requiring continuous learning and adaptation. This constant change increases the risk of errors in financial reporting or delays in compliance, potentially leading to hefty penalties and legal complications. Handling sensitive financial data internally also requires robust security measures, which can be costly to implement and maintain. Bookkeeping and auditing outsourcing for Indian companies directly addresses these pain points by providing access to specialized skills, advanced technology, and scalable resources without the overheads and risks associated with maintaining a large in-house finance team.

For more insight into how to manage these tasks internally, you might consider our post on Set Up An Accounting System for My Small Business.

Key Benefits of Outsourcing Bookkeeping Services

Focusing specifically on the bookkeeping function, outsourcing offers a compelling range of advantages that significantly impact a business’s efficiency and bottom line. Many Indian businesses wonder why outsource bookkeeping services India, and the reasons often centre around cost, expertise, and focus. Understanding the tangible benefits of outsourcing bookkeeping in India can help businesses make informed decisions about managing their financial operations.

3.1. Significant Cost Savings

One of the most immediate and compelling advantages is the potential for significant cost reduction. Maintaining an in-house bookkeeping team requires substantial investment. This includes not just the salaries of qualified accountants and bookkeepers but also associated costs like employee benefits (PF, ESI, insurance), recruitment expenses, ongoing training to keep up with regulatory changes, office space allocation, and IT infrastructure. Additionally, professional accounting software licenses (like Tally ERP, Zoho Books, or QuickBooks) and their regular upgrades represent another considerable expense. When you outsource, you typically pay a fixed fee or a rate based on the volume of work, converting fixed overheads into predictable variable costs. This model eliminates the hidden costs associated with employees, such as paid leave, and reduces administrative burdens. Highlighting the cost-saving benefits of bookkeeping outsourcing, businesses can often achieve savings of 30-50% compared to maintaining an equivalent in-house function. We recommend businesses perform a simple calculation: sum up all current internal costs related to bookkeeping (salaries, benefits, software, space, training) and compare it against quotes from reputable outsourcing providers like TaxRobo.

3.2. Access to Expertise and Advanced Technology

Outsourcing opens the door to a pool of highly qualified and experienced professionals who specialize in bookkeeping and accounting. These experts possess up-to-date knowledge of Indian Generally Accepted Accounting Principles (GAAP), complex Goods and Services Tax (GST) regulations, Tax Deducted at Source (TDS) rules, Provident Fund (PF), Employee State Insurance (ESI), and other statutory requirements. They are adept at managing diverse accounting tasks accurately and efficiently. Furthermore, outsourcing firms invest heavily in cutting-edge accounting software and technology. This means your books are managed using professional tools that ensure precision, security, and provide insightful financial reports, often beyond the capabilities of software affordable for a small business. This access ensures compliance with crucial portals like the official GST Portal and the Income Tax Department Portal. The combined benefit of skilled professionals and advanced technology represents one of the key advantages of outsourcing bookkeeping services.

3.3. Focus on Core Business Activities

For any business owner or key management personnel, time is the most valuable asset. Getting entangled in the minutiae of bookkeeping – data entry, reconciliations, report generation – diverts precious time and energy away from strategic activities that drive growth. Sales, marketing, product development, customer relationship management, and long-term planning are areas where leadership focus yields the highest returns. By outsourcing the time-consuming bookkeeping tasks to a reliable partner, entrepreneurs and their teams can reclaim their focus and dedicate their efforts towards innovation, expanding market reach, enhancing operational efficiency, and ultimately, growing the business. This strategic reallocation of internal resources is a fundamental benefit that fuels business development and competitiveness.

For businesses looking to ensure all yearly financial deadlines are met, see our Tax Filing Deadlines in India: A 2025 Calendar Overview.

3.4. Improved Accuracy and Compliance

Manual bookkeeping, especially when handled by non-experts or rushed staff, is prone to errors – incorrect data entry, calculation mistakes, or missed transactions. These inaccuracies can lead to flawed financial reports, poor business decisions, and serious compliance issues. Professional bookkeeping service providers utilize standardized processes, double-checks, and advanced software features to minimize human error and ensure high levels of accuracy. More importantly, they understand the critical importance of regulatory compliance in India. Outsourcing ensures that your financial statements are prepared accurately and that all statutory deadlines for filing returns (such as monthly/quarterly GST returns, annual income tax returns, TDS returns, PF/ESI filings) are met consistently. This proactive approach significantly reduces the risk of incurring penalties, interest charges, or facing scrutiny from tax authorities, safeguarding the financial health and reputation of your business.

Advantages of Outsourcing Auditing Services

While bookkeeping focuses on recording, auditing provides verification and assurance. Outsourcing the audit function offers its own unique set of benefits, primarily centred around independence, specialized knowledge, and credibility. Understanding the outsourcing auditing services benefits is crucial for businesses aiming for transparency and robust governance.

4.1. Enhanced Objectivity and Independence

The cornerstone of a credible audit is independence. An auditor must provide an unbiased and objective opinion on the fairness and accuracy of a company’s financial statements. When auditing is performed internally, there’s an inherent risk of bias, whether conscious or unconscious, as internal staff may face pressure or have conflicting loyalties. Outsourced auditors, by contrast, are external parties with no operational involvement in the company. This detachment ensures a truly independent perspective, free from internal influences. This objectivity is vital for building trust with external stakeholders such as banks (for loans), investors (for funding), shareholders, and regulatory bodies. An audit report from a reputable, independent firm carries significantly more weight and credibility than an internal review.

For more detailed information about the role of internal audit in organizations, learn more at Primary Purpose of Internal Audit in the Modern Organization.

4.2. Specialized Audit Expertise

The field of auditing encompasses various specializations, including statutory audits (mandated by law, e.g., under the Companies Act, 2013), internal audits (focused on operational efficiency and risk management), tax audits (required under the Income Tax Act, 1961 based on turnover or receipts), forensic audits, and industry-specific audits. Reputable auditing firms employ experienced Chartered Accountants (CAs) and audit professionals who possess deep expertise across these different domains and specific industry nuances. Indian firms outsourcing auditing services gain access to this specialized knowledge base, ensuring their audits are conducted thoroughly and in accordance with the latest standards and regulations. Whether your business needs compliance checks under the Companies Act or specific scrutiny related to Income Tax provisions, an outsourced expert brings the necessary skills tailored to your requirements, which might be difficult or expensive to find and retain in-house.

4.3. Ensuring Regulatory Compliance and Credibility

Navigating the complex web of Indian regulations is a significant challenge. Outsourced auditors are well-versed in the Indian Auditing Standards (SAS) issued by the Institute of Chartered Accountants of India (ICAI), as well as the specific requirements laid out in the Companies Act, 2013, Income Tax Act, 1961, GST laws, and other applicable legislation. They ensure that the audit process itself is compliant and that the financial statements accurately reflect the company’s adherence to these legal and accounting frameworks. Engaging an independent auditor demonstrates a commitment to transparency and good corporate governance. The resulting independent audit report enhances the credibility of the financial statements, providing assurance to stakeholders that the company’s financial position and performance are fairly presented. This credibility is invaluable when seeking finance, attracting investment, or dealing with regulatory authorities.

4.4. Scalability and Efficiency

A company’s auditing needs can fluctuate. There might be peak periods requiring intensive audit work (like year-end statutory audits) or specific situations demanding specialized audits (like due diligence for an acquisition). Maintaining a full-time internal audit team capable of handling these peaks and diverse requirements can be inefficient and costly during leaner periods. Outsourcing provides scalability; you can engage audit services precisely when needed and scale the scope up or down based on your business cycle or specific projects. Furthermore, established auditing firms have refined methodologies, dedicated teams, and technology-driven processes that ensure efficiency in outsourcing auditing services India. They can often conduct audits more quickly and systematically than an overburdened internal team, minimizing disruption to your daily operations while delivering high-quality results.

The Synergy: Benefits of Integrated Outsourcing Bookkeeping and Auditing

While often considered separate functions, there’s significant synergistic value in outsourcing bookkeeping and auditing, potentially through coordinated service providers. When the bookkeeping function is outsourced to a professional firm that maintains meticulous, accurate, and up-to-date records according to established standards, the subsequent auditing process becomes considerably smoother, faster, and potentially less expensive. Auditors rely heavily on the quality of the underlying financial records; clean books mean less time spent on verification and correction during the audit.

Furthermore, having coordinated providers (or a single provider offering distinct services where permitted) can lead to more consistent data handling, reporting formats, and a better overall understanding of the company’s financial narrative. However, it is critically important to understand the regulations regarding auditor independence in India, particularly under the Companies Act, 2013. For many companies (especially larger ones), the firm providing bookkeeping services cannot also act as the statutory auditor due to conflict of interest rules. Reputable providers like TaxRobo understand these regulations deeply. We can offer comprehensive bookkeeping services through our TaxRobo Accounts Service and independent auditing services via our dedicated TaxRobo Audit Service, ensuring full compliance with independence requirements while still offering the benefits of coordinated understanding and efficiency where regulations allow.

Choosing the Right Outsourcing Partner in India

Selecting the right partner for your bookkeeping and auditing needs is crucial for realizing the benefits discussed. Not all outsourcing providers are created equal. When evaluating potential partners in India, consider the following key factors:

- Experience and Expertise: Look for firms with a proven track record and deep expertise specifically in Indian accounting standards, GST, Income Tax, Companies Act, and other relevant regulations. Industry-specific experience can also be a plus.

- Credentials and Qualifications: Ensure the firm employs qualified professionals, such as Chartered Accountants (CAs), Cost Accountants (CMAs), and experienced bookkeepers. Verify their credentials.

- Technology Used: Inquire about the accounting software and technology platforms they use. Ensure they employ modern, secure, and efficient tools.

- Data Security and Confidentiality: Financial data is highly sensitive. Verify the provider’s data security protocols, confidentiality agreements (NDAs), infrastructure security, and compliance with data protection norms.

- Client Testimonials and Reputation: Check for client reviews, testimonials, or case studies. A good reputation and positive client feedback are strong indicators of reliability and service quality.

- Communication and Reporting: Ensure clear communication channels, regular reporting schedules, and a dedicated point of contact. The provider should be responsive and transparent.

- Understanding Your Needs: The provider should take the time to understand your specific business requirements, transaction volume, industry nuances, and reporting needs to offer a tailored solution.

Taking the time to vet potential partners thoroughly will ensure you find a reliable firm that acts as a true extension of your business.

Conclusion

In today’s competitive business environment, managing finances effectively and ensuring compliance are non-negotiable. For many Indian small businesses and individuals managing substantial financial activities, the complexities and costs of handling these functions internally can be prohibitive. Outsourcing bookkeeping and auditing offers a strategic and efficient alternative. The key benefits – significant cost savings, access to specialized expertise and technology, the ability to focus on core business growth, improved accuracy, robust regulatory compliance, enhanced objectivity in audits, and scalable efficiency – collectively empower businesses. By entrusting these critical functions to experts, Indian businesses can achieve greater financial health, mitigate risks, enhance credibility, and pave the way for sustainable growth.

Ready to streamline your finances and ensure compliance with confidence? Let TaxRobo take the burden off your shoulders. Contact TaxRobo today for a consultation on our expert bookkeeping (TaxRobo Accounts Service) and auditing (TaxRobo Audit Service) outsourcing services tailored specifically for Indian businesses and individuals.

Frequently Asked Questions (FAQ)

Q1: What is the main difference between bookkeeping and auditing?

A: Bookkeeping is the process of recording, classifying, and summarizing financial transactions on a day-to-day basis (e.g., recording sales, purchases, payments). Auditing is the independent examination and verification of these financial records and statements to ensure they are accurate, complete, and fairly presented according to accounting standards and legal regulations. Bookkeeping creates the records; auditing verifies them.

Q2: Is outsourcing bookkeeping and auditing secure for my confidential business data?

A: Yes, provided you choose a reputable outsourcing partner. Established firms like TaxRobo prioritize data security. We utilize robust security protocols, including data encryption, secure servers, access controls, and strict confidentiality agreements (Non-Disclosure Agreements – NDAs) to protect your sensitive financial information. Always inquire about a provider’s security measures before engaging their services.

Q3: How much does outsourcing bookkeeping and auditing typically cost in India?

A: The cost varies significantly based on several factors: the volume of transactions, the complexity of your business operations, the specific scope of services required (e.g., basic bookkeeping vs. comprehensive accounting and MIS reporting, type of audit needed), and the chosen service provider’s pricing structure. However, outsourcing is generally more cost-effective than hiring equivalent full-time in-house staff due to savings on salaries, benefits, infrastructure, and software. For a precise estimate tailored to your needs, it’s best to request a custom quote.

Q4: At what stage should my small business consider outsourcing these services?

A: There’s no single answer, but common triggers include: when financial tasks start consuming too much of the owner’s or key employees’ time; when you feel unsure about compliance with changing tax laws (GST, TDS, Income Tax); when you need more accurate and timely financial reports for decision-making; when the cost of hiring qualified in-house staff seems prohibitive; or simply when you want to ensure greater accuracy, efficiency, and peace of mind regarding your finances. Even early-stage startups can benefit from setting up good financial practices through outsourcing.

Q5: Can TaxRobo handle both my bookkeeping and auditing needs?

A: Yes, TaxRobo offers both comprehensive bookkeeping and accounting services (TaxRobo Accounts Service) as well as independent auditing services (TaxRobo Audit Service). We understand and strictly adhere to Indian regulations concerning auditor independence (as mandated by the Companies Act, 2013 and ICAI guidelines), ensuring that where required, these services are provided with the necessary separation to maintain integrity and compliance. We can structure our engagement to meet your specific requirements while respecting all legal frameworks. Please reach out for an TaxRobo Online CA Consultation Service to discuss how we can best assist your business.