Applying the 50/30/20 Budgeting Rule to Accelerate Debt Repayment

Feeling overwhelmed by EMIs, credit card bills, and personal loans? You’re not alone. Managing debt is a major financial challenge for many salaried professionals and small business owners across India. The constant pressure of repayment can feel like a maze with no exit. However, there is a simple yet powerful framework that can help you regain control, and it’s called the 50/30/20 budgeting rule. This article will not only break down this popular rule in an Indian context but also show you a modified approach specifically designed to accelerate your journey to debt freedom. Mastering this strategy is one of the most effective personal finance tips India has to offer for building a secure financial future.

What is the 50/30/20 Budgeting Rule? A Simple Breakdown

Before we can adapt this rule to aggressively tackle debt, it’s crucial to understand its core components. The 50/30/20 principle is one of the most popular and effective budgeting techniques India has adopted because of its simplicity and flexibility. It provides a straightforward guideline for allocating your after-tax income (your take-home pay) into three main categories, ensuring you cover your essentials, enjoy your life, and build for the future simultaneously. The beauty of the 50/30/20 budgeting rule India is that it doesn’t require meticulous tracking of every single rupee; instead, it offers a broad framework that you can tailor to your specific financial situation and goals, whether you live in a bustling metro or a quieter town.

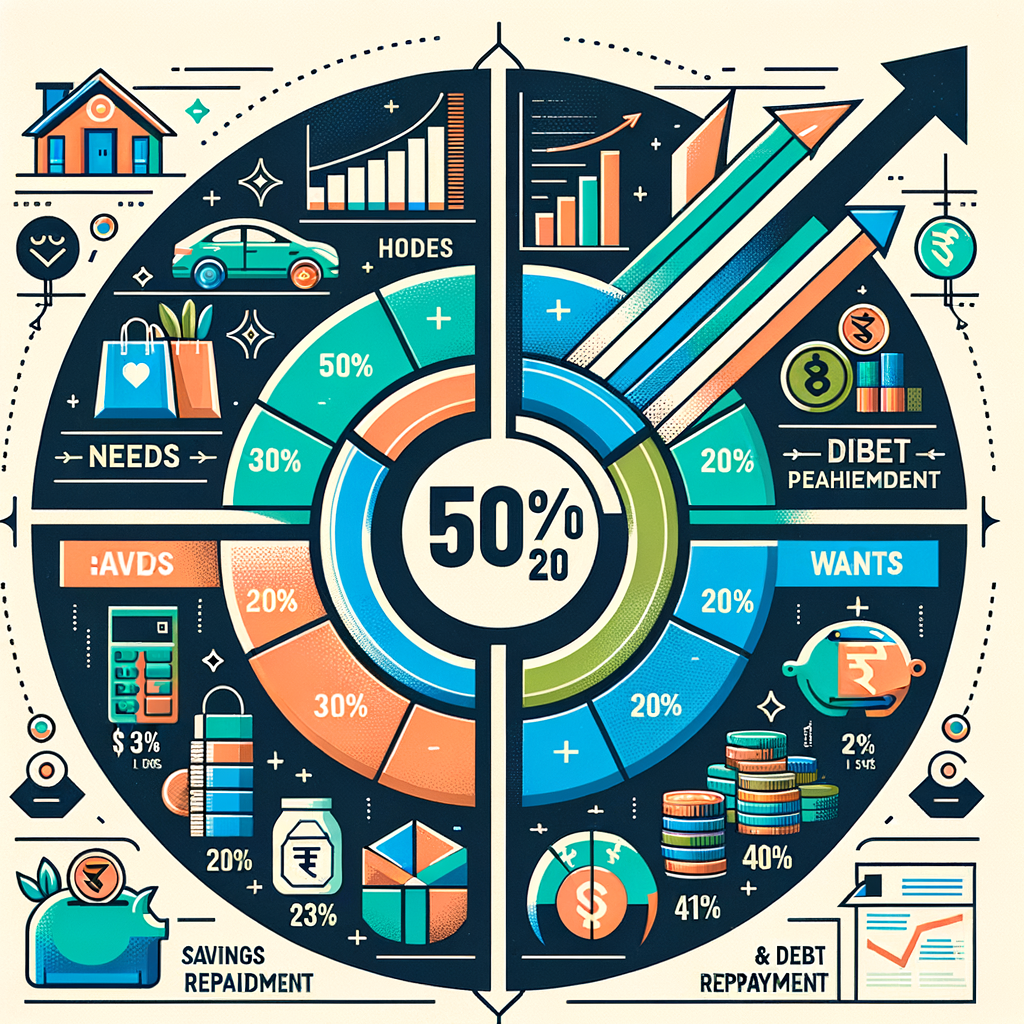

The Three Pillars: 50% Needs, 30% Wants, 20% Savings & Debt

The rule divides your take-home salary into three distinct buckets:

- 50% for Needs: This category covers all your essential expenses—the bills you absolutely must pay to live and work. Think of these as your survival costs. In the Indian context, this includes items like your monthly rent or home loan EMI, groceries and rations for your family, utility bills such as electricity, water, cooking gas, and your broadband connection. It also includes essential transportation costs to get to work, whether it’s fuel for your vehicle or a public transport pass. Crucially, your insurance premiums (both health and term life) and the minimum required payments on all your existing debts (like your credit card minimum due or personal loan EMI) fall into this non-negotiable category.

- 30% for Wants: This portion of your income is allocated to your lifestyle and discretionary spending. These are the expenses that improve your quality of life but are not strictly necessary for survival. This is where you have the most flexibility to cut back when needed. Common examples for many Indians include ordering food through Zomato or Swiggy, subscriptions to entertainment services like Netflix, Hotstar, and Amazon Prime Video, going to the movies, shopping for non-essential clothes or the latest gadgets, and spending on hobbies or vacations. While these expenses bring joy, they are the first place to look for extra cash to redirect towards more pressing financial goals.

- 20% for Financial Goals (Savings & Debt Repayment): This final 20% is your powerhouse category, dedicated to securing your financial future and clearing the debts of your past. This is where you actively work to get ahead. This bucket includes any extra payments you make on your loans over and above the minimum EMI, which is key to reducing your principal and saving on interest. It also encompasses building a critical emergency fund (typically 3-6 months of living expenses), making investments through Systematic Investment Plans (SIPs) in mutual funds, and contributions to long-term savings instruments like the Public Provident Fund (PPF).

The Modified 50/30/20 Rule: Your Blueprint for Debt Freedom

The standard 50/30/20 budgeting rule is an excellent starting point, but when you’re burdened with high-interest debt, a standard approach isn’t enough—you need an aggressive strategy. This is where a modified version of the rule becomes your blueprint for financial freedom. By making a conscious and strategic shift in your allocations, you can supercharge your repayment efforts and significantly shorten the time it takes to become debt-free. This modified framework is central to any effective strategy for budgeting for debt repayment India, as it transforms a simple budget into a powerful debt-elimination tool.

Step 1: Calculate Your Net Monthly Income (Take-Home Salary)

Before you can allocate your money, you need to know exactly how much you have to work with. Your net monthly income is the foundation of your budget.

- For Salaried Individuals: This is straightforward. Look at your monthly payslip and find the “Net Pay” or “Take-Home Salary” figure. This is your Gross Salary minus all deductions like Provident Fund (PF), Professional Tax (PT), and Tax Deducted at Source (TDS). This is the amount that is credited to your bank account each month.

- For Small Business Owners: Your income might fluctuate. To create a stable budget, calculate your average monthly profit over the last 6 to 12 months. Do this by taking your total revenue and subtracting all business expenses, taxes, and other operational costs. Using an average provides a realistic baseline to build your budget upon. For more specific strategies, refer to our A Guide to Budgeting and Financial Planning for Startups.

Step 2: Track Your Spending and Categorize Ruthlessly

To understand where your money is going, you must track it. For one full month, monitor every single expense. Go through your bank and credit card statements, and use a budgeting app or a simple notebook to log all your spending. Once the month is over, categorize each expense as a “Need” or a “Want.” This exercise is often an eye-opener and reveals exactly where you can make cuts.

Use a simple table to organize your findings:

| Expense | Amount (₹) | Category (Need/Want) |

|---|---|---|

| Rent | 20,000 | Need |

| Groceries | 12,000 | Need |

| Electricity Bill | 2,500 | Need |

| Credit Card Min. Due | 5,000 | Need |

| Total Needs | 39,500 | |

| Swiggy/Zomato | 4,000 | Want |

| Netflix & Hotstar | 998 | Want |

| Weekend Movie | 1,500 | Want |

| Shopping | 3,500 | Want |

| Total Wants | 9,998 |

Step 3: Flip the Rule – Prioritize Debt Repayment

Here is the strategic shift. Instead of the standard 50/30/20, you adopt a modified rule focused on aggressive debt repayment: 50% Needs / 15% Wants / 35% Savings & Aggressive Debt Repayment.

The logic is simple: the ‘Wants’ category is the most elastic part of your budget. By slashing it in half (or even more), you free up a significant chunk of cash that can be weaponized against your debt. This proactive approach is the essence of applying 50/30/20 rule in India for a specific, urgent goal like debt freedom.

Let’s look at a worked example:

- Your Take-Home Income: ₹70,000 per month.

- Old ‘Wants’ Budget (30%): ₹21,000.

- New ‘Wants’ Budget (15%): ₹10,500.

- Extra Cash Freed Up: ₹10,500.

This extra ₹10,500 is now added to your original 20% (₹14,000), giving you a massive ₹24,500 (35%) every month to throw at your highest-interest debt. This targeted approach can save you thousands in interest and cut years off your loan tenure.

Smart Debt Repayment Strategies to Use with Your Budget

Creating a budget and freeing up cash is the first half of the battle. The second half is using that money in the most efficient way possible. Combining your modified budget with proven debt repayment strategies for salaried individuals will create a powerful synergy, helping you reach your goal much faster. There are several budgeting methods India has embraced, but coupling them with a clear repayment plan is what truly makes the difference.

Choose Your Weapon: Debt Snowball vs. Debt Avalanche

Once you have your monthly debt repayment fund (the 35% from our modified rule), you need to decide how to allocate it. Two primary methods are popular for their effectiveness, and you can explore which is better in our detailed comparison: Debt Snowball vs. Debt Avalanche: Which Strategy Is Best for You?.

- Debt Snowball: With this method, you list all your debts from the smallest balance to the largest, regardless of the interest rate. You make minimum payments on all debts, but you throw every extra rupee at the smallest debt until it’s paid off. Once it’s gone, you roll the payment you were making on that debt into the payment for the next smallest debt.

- Benefit: This method is about psychological momentum. Clearing a debt quickly provides a powerful motivational boost and makes you feel like you’re making progress, which helps you stay committed.

- Best For: Individuals who need quick wins to stay motivated on a long journey.

- Debt Avalanche: Here, you list your debts from the highest interest rate to the lowest, regardless of the balance. You make minimum payments on all debts but focus all extra funds on tackling the one with the highest interest rate first. This is often credit card debt or personal loans, which can have exorbitant rates in India.

- Benefit: Mathematically, this is the most efficient method. By eliminating high-interest debt first, you save the most money on interest payments over the long term.

- Best For: Individuals who are disciplined, numbers-driven, and motivated by financial efficiency.

Practical Tips to Increase Your Debt Repayment Fund

To maximize your 35% allocation, or even push it higher, consider these practical tips:

- Reduce Wants:

- Go through your subscriptions and cancel any you don’t use regularly.

- Challenge yourself to a “no-spend” weekend or limit eating out to once a month.

- Explore free entertainment options like parks, community events, or library resources.

- Optimize Needs:

- Plan your meals for the week before going grocery shopping to avoid impulse buys and reduce food waste.

- Negotiate with your internet or mobile provider for a better plan.

- Practice energy conservation at home to lower your electricity bill. Every rupee saved is a rupee that can fight your debt.

- Increase Income:

- Consider taking up freelance work in your area of expertise on platforms like Upwork or Fiverr.

- Turn a hobby into a side hustle, such as baking, writing, or graphic design.

- Build a strong case and negotiate for a raise at your current job. Any extra income should go directly towards debt repayment, not lifestyle inflation.

Conclusion

Regaining control of your finances begins with a clear plan, and the 50/30/20 budgeting rule provides a brilliant and simple foundation. By understanding its principles and, more importantly, by modifying it to aggressively target your liabilities, you can transform it from a simple budgeting tool into a powerful debt-destroying machine. Slashing your ‘Wants’ to supercharge your repayment fund is a short-term sacrifice for the long-term prize of financial peace. Achieving a debt-free status is not just about numbers; it’s about freeing up your mind and your money to focus on building wealth and achieving your dreams. This is ultimately How Debt Management Leads to Financial Freedom. This approach to debt management budgeting India can truly set you on the path to financial independence.

Managing your finances can be complex. If you need help with tax planning, GST filing, or creating a robust financial strategy for your business, TaxRobo’s experts are here to help. Contact Us Today for a Free Consultation!

Frequently Asked Questions (FAQs)

1. Is the 50/30/20 rule practical for someone living in an expensive Indian metro city?

Yes, the rule is a guideline, not a rigid law. It is absolutely practical, but it requires flexibility. In a city like Mumbai or Bengaluru, high rent and transportation costs can easily push your ‘Needs’ category to 60% or even higher. The key is to acknowledge this reality and adjust the other categories accordingly. If your Needs are at 60%, you must consciously reduce your ‘Wants’ to 10% or 15%. This ensures you can still dedicate a healthy 20-25% to your financial goals, including critical savings and debt repayment.

2. What should I do if my mandatory debt EMIs are already more than 20% of my income?

This is a sign of a high debt-to-income ratio and requires immediate and decisive action. In this scenario, your financial priority must shift entirely to debt repayment. You should aim to drastically cut your ‘Wants’ category, potentially to 5% or even zero for a temporary period. Every rupee saved from eating out, shopping, or entertainment should be redirected to debt. Furthermore, scrutinize your ‘Needs’ for any possible reductions. The goal is to free up as much cash flow as possible to tackle the debt principal. You might also want to explore debt consolidation loans to get a lower interest rate or seek professional financial advice to restructure your loans.

3. Can I use the 50/30/20 rule for investing after I become debt-free?

Absolutely! That is the ideal progression and the ultimate goal of becoming debt-free. Once your high-interest consumer debts are cleared, the entire 20% (or the modified 35%) that you were funneling towards EMIs is now free. You can redirect this powerful stream of cash towards wealth-building investments. This could include increasing your mutual fund SIPs, investing in stocks, contributing more to your PPF, or exploring other avenues that align with your risk appetite and financial goals. For more on this, you can explore our guide on investment options for beginners.

4. How can a small business owner with a fluctuating income use this rule?

For entrepreneurs and small business owners, income isn’t always predictable. The key is to budget based on a conservative average. Calculate your average monthly profit after all business expenses and taxes over the past 6-12 months. Use this average figure as your baseline “salary” for applying the 50/30/20 rule. In months where your income exceeds this average, a disciplined approach is crucial: allocate the entire surplus directly to your emergency fund or your debt repayment. In leaner months where you earn less, your well-funded emergency fund can help you stay on budget without taking on new debt. This is one of the most practical budgeting methods India offers for managing variable incomes.