AIS & SFT Reporting of Loan Repayments – Home Loan & Personal Loans Explained

Are you repaying a home loan or personal loan? Did you know these repayments might be reported to the Income Tax Department? In today’s increasingly transparent financial world, understanding how your financial activities are tracked is crucial for staying compliant. Two key components of this system are the Annual Information Statement (AIS) and the Statement of Financial Transactions (SFT). These are essentially tools used by the tax authorities to get a clearer picture of financial transactions happening across the country. This post focuses specifically on AIS SFT reporting loan repayments, particularly concerning common liabilities like home loans and personal loans within the Indian context. Understanding this process is vital because the information reported by your lender eventually reflects in your AIS, which you should verify before filing your income tax return to ensure accuracy and avoid potential discrepancies flagged by the department. We will cover what AIS and SFT are, how AIS SFT reporting loan repayments work, the potential impact on you as a taxpayer, and how you can check this information yourself.

What are AIS and SFT? A Quick Overview

Understanding the mechanisms behind financial reporting can seem complex, but the core concepts of SFT and AIS are straightforward. They work together to create a more transparent tax environment, impacting how both institutions and individuals interact with the Income Tax Department. Think of SFT as the source of information and AIS as the consolidated report you, the taxpayer, receive.

Statement of Financial Transactions (SFT)

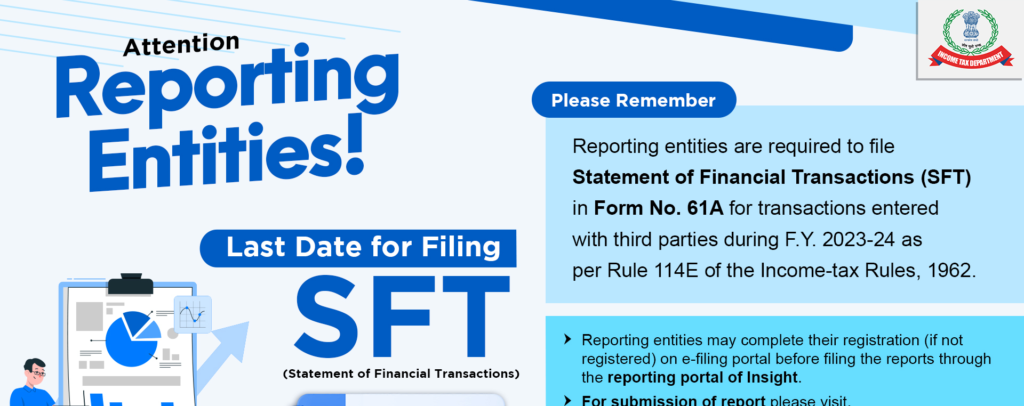

The Statement of Financial Transactions (SFT) is a mandatory report filed by specific entities, such as banks, financial institutions, registrars, and companies. These entities are required by law to report certain high-value financial transactions undertaken by individuals during a financial year directly to the Income Tax Department. The primary purpose of SFT is to help the tax authorities track significant financial activities and gather information that might not be readily available through income tax returns alone. This systematic reporting aids in identifying potential instances of tax evasion and ensures that substantial financial dealings are accounted for. The scope of SFT covers various transactions, including large cash deposits, property purchases, investments, and importantly for this discussion, aspects related to loans. This mechanism forms a crucial part of the loan repayment reporting India framework, ensuring lenders provide relevant data to the authorities.

Annual Information Statement (AIS)

The Annual Information Statement (AIS) is essentially a comprehensive statement provided to each taxpayer. It consolidates various pieces of financial information reported by different entities, including the data submitted through SFT filings. Think of it as your financial activity report card as seen by the Income Tax Department. The AIS provides a taxpayer with a unified view of their financial transactions reported throughout the year, encompassing salary details, interest income, dividend income, securities transactions, TDS/TCS information, and, significantly, data sourced from SFT reports, such as loan-related information. Its main purpose is to promote transparency and assist taxpayers in filing accurate income tax returns by providing pre-filled information and highlighting potentially reportable income or transactions. Critically, the information filed by your bank or NBFC via SFT concerning your loan repayments feeds directly into your individual AIS, making it a central point for verification.

Understanding SFT Reporting for Loan Repayments

Now that we understand SFT is the reporting mechanism used by institutions, let’s delve into how it specifically applies to the loans you might be repaying. Financial institutions don’t report every single transaction, but certain loan-related activities fall under their reporting obligations, ensuring the tax department has visibility into significant financial flows related to borrowing and repayment.

Who Reports Your Loan Repayments via SFT? (AIS SFT compliance for lenders)

The responsibility for reporting loan-related information via SFT falls upon specific types of financial institutions you likely interact with. These reporting entities include:

- Scheduled Commercial Banks: All major public sector and private sector banks.

- Non-Banking Financial Companies (NBFCs): Companies providing various loan products, distinct from banks.

- Housing Finance Companies (HFCs): Institutions specializing in home loans.

- Co-operative Banks: Certain co-operative banks meeting specified criteria.

These institutions have a legal mandate under Section 285BA of the Income Tax Act, 1961, to report specified financial transactions that occur above certain defined thresholds. This ensures that AIS SFT compliance for lenders is maintained, contributing data to the overall tax system regarding significant financial activities, including loan disbursements and repayments handled by them.

What Loan Information is Reported? (home loan reporting requirements, personal loan reporting guidelines)

When it comes to loans, lenders primarily report information related to payments received from borrowers. This generally includes:

- Interest Payments: The amount of interest paid by the borrower during the financial year is a key piece of information, especially relevant for home loans where interest deductions are claimed.

- Principal Repayments: Lenders might also report the total principal amount repaid during the financial year. This is pertinent for claiming deductions under Section 80C for home loans.

- Loan Disbursements: In some cases, information regarding the disbursement of certain types of loans might also be reported.

While both home loan and personal loan repayments can be subject to reporting, the specifics might differ slightly based on regulatory focus and tax implications. For instance, home loan reporting requirements often emphasize the segregation of interest and principal due to their tax deductibility under Sections 24(b) and 80C respectively. For SFT reporting for personal loans, while the reporting might be less granular regarding tax benefits (as there usually aren’t any for the borrower unless for business use), the aggregate payments received might still be reported as part of the lender’s overall SFT obligations, ensuring transparency.

Is There an AIS SFT reporting threshold for Loan Repayments?

SFT reporting is generally triggered when transactions exceed specific financial limits or thresholds set by the Central Board of Direct Taxes (CBDT). However, pinpointing a single, universally applicable AIS SFT reporting threshold specifically for *loan repayments* can be complex. Often, loan-related information might be reported under broader SFT categories like ‘Receipts from any person’ or ‘Payment of Interest’. For example, reporting might be required for interest payments exceeding a certain limit in a financial year, or if aggregate payments cross a threshold. It’s important to note that lenders might report certain loan data based on their internal aggregation rules and interpretation of CBDT guidelines, meaning information could appear in your AIS even if a single EMI payment is small. The rules can evolve, so it’s advisable to refer to the latest official notifications from the CBDT or the Income Tax Department website for the most current SFT thresholds and reporting requirements related to financial transactions, including loans. Don’t assume your loan is too small to be reported; checking your AIS is always prudent.

How Loan Repayments Appear in Your AIS (AIS SFT reporting loan)

The information reported by your lender via SFT ultimately populates your Annual Information Statement (AIS). Understanding how to access and interpret this information is key to leveraging the AIS effectively for tax compliance. This section guides you on finding and reviewing your loan repayment data within the AIS portal.

Accessing Your AIS

Accessing your AIS is a straightforward process through the official Income Tax e-filing portal. Here are the steps:

- Go to the Income Tax e-filing portal: https://www.incometax.gov.in/.

- Log in using your PAN (Permanent Account Number) as the User ID and your password.

- Once logged in, navigate to the ‘Services’ tab on the top menu.

- From the dropdown, select ‘Annual Information Statement (AIS)’.

- You might see a pop-up; click ‘Proceed’. This will redirect you to the separate AIS portal/homepage.

- On the AIS homepage, select the relevant ‘Financial Year’ for which you want to view the statement.

- You can choose to view either the Taxpayer Information Summary (TIS) or the comprehensive Annual Information Statement (AIS). Select ‘AIS’.

- Within AIS, navigate to ‘Part B: SFT Information’ to find details reported by financial institutions.

Locating Loan Repayment Information (AIS reporting for home loan)

Once you are inside the AIS section, specifically under ‘Part B: SFT Information’, you need to look for entries related to your loans. Loan repayment data, stemming from the AIS SFT reporting loan mechanism, might not always be explicitly labelled “Loan Repayment”. It typically appears under categories reported by the lender based on the SFT codes they use. Look for entries under headings such as:

- Interest Payment: This is common, especially for home loans, showing interest reported by the lender.

- Receipts: Lenders might report aggregate payments received under a general ‘Receipts’ category.

- Specific SFT Codes: Sometimes, more specific codes related to loans might be used, though these may vary.

The details usually shown include the Name of the Reporting Entity (your bank/NBFC), the Amount Reported (be mindful if this represents interest, principal, or a combined figure), and the Transaction Date or Period to which it pertains. For AIS reporting for home loan, pay close attention to figures reported as interest, as these directly correlate with potential tax deductions.

What if the Information is Incorrect or Duplicated?

The Income Tax Department acknowledges that discrepancies can occur in the reported data. Therefore, the AIS portal includes a robust feedback mechanism. If you review your AIS and find information related to your loan repayments (or any other transaction) that seems incorrect, duplicated, or doesn’t belong to you, you can submit feedback online directly through the portal. The process generally involves:

- Selecting the specific information row in AIS that you believe is incorrect.

- Choosing the ‘Feedback’ option associated with that row.

- Selecting the nature of the feedback (e.g., ‘Information is not correct’, ‘Information is duplicate’, ‘Information relates to other PAN/Year’, ‘Information is denied’, etc.).

- Providing a brief reason or clarification in the space provided, if required.

- Submitting the feedback.

Providing timely and accurate feedback is crucial. It helps rectify your financial record with the Income Tax Department, potentially prevents incorrect assessments, and ensures that your tax return is based on accurate information. Keep your loan statements and certificates from the lender handy as supporting evidence when reviewing AIS and providing feedback.

Impact on Taxpayers: Home Loans vs. Personal Loans

The reporting of loan repayments in your AIS has different implications depending on the type of loan – primarily whether it’s a home loan or a personal loan. While both contribute to your overall financial picture visible to the tax department, their direct impact on your tax calculations varies significantly.

Home Loan Repayments (reporting of loan repayments)

Home loan repayments offer significant tax benefits, making the accuracy of reporting of loan repayments in AIS particularly important.

- Interest Component (Section 24(b)): The interest paid on a home loan for a self-occupied or let-out property is eligible for deduction under Section 24(b) of the Income Tax Act, up to certain limits (e.g., ₹2 lakh for self-occupied property). The interest amount reported by your lender in the AIS under SFT information should ideally match the interest certificate they provide you. It’s crucial to cross-verify the figure shown in AIS with your official loan statement or interest certificate before claiming the deduction in your Income Tax Return (ITR). Any mismatch should be flagged via AIS feedback.

- Principal Component (Section 80C): The principal portion of the EMI paid towards your home loan is eligible for deduction under Section 80C, within the overall limit of ₹1.5 lakh (which includes other eligible investments like PPF, ELSS, etc.). Similar to the interest component, the principal repayment figure potentially reflected in AIS (or derived from reported figures) should align with the details in your lender’s repayment schedule or certificate. Again, verification against official documents is paramount before claiming this deduction in your ITR to ensure compliance and avoid queries.

For more detailed guidance on how to achieve tax savings through various deductions, you can refer to our Understanding Section 80C: Benefits and Investment Options article.

Personal Loan Repayments (SFT reporting for personal loans)

Unlike home loans, personal loans generally do not offer direct tax benefits on repayments for salaried individuals or for non-business purposes.

- Tax Implications: Typically, neither the principal amount repaid nor the interest paid on a personal loan (used for personal consumption like holidays, weddings, appliances, etc.) can be claimed as a deduction from your taxable income. (An exception exists if the loan is demonstrably used for business purposes or acquiring an asset used for business, but that falls under business income computation, not general tax deductions for individuals).

- Relevance in AIS: Even though there are no direct tax deductions, the

SFT reporting for personal loansand its reflection in your AIS viaAIS SFT reporting loan repaymentsserve the purpose of financial transparency. It allows the Income Tax Department to have a more comprehensive view of your financial activities, including significant outflows towards loan servicing. While it might not directly impact your tax calculation, ensuring this information aligns with your known financial situation helps maintain consistency in your overall financial profile as perceived by the tax authorities, reducing the chances of scrutiny based on perceived inconsistencies between income and expenditure patterns.

Conclusion

Navigating the landscape of tax compliance requires staying informed about mechanisms like the Annual Information Statement (AIS) and the Statement of Financial Transactions (SFT). As we’ve discussed, these tools play a significant role in loan repayment reporting India. Lenders, including banks and NBFCs, are obligated to report certain loan-related payments, which then appear in your AIS. Understanding this AIS SFT reporting loan process is no longer optional; it’s essential for accurate tax filing and financial transparency.

We strongly urge all taxpayers, especially those with ongoing home loans or personal loans, to proactively check their AIS regularly, particularly before filing their Income Tax Return. Take the time to cross-verify the loan repayment details (both principal and interest components, where applicable) shown in your AIS against the official certificates or statements provided by your lenders. Use the feedback mechanism within AIS to report any discrepancies you find. This proactive approach helps ensure your tax return is accurate, minimizes the risk of queries from the Income Tax Department, and contributes to a smoother tax filing experience.

For those who seek further insights into the nuances of online tax return filing, our comprehensive guide on How do I file my income tax return online in India? offers step-by-step assistance.

Need help navigating your AIS, understanding its implications, or ensuring your Income Tax Return is filed accurately considering all reported information? TaxRobo’s experts are here to assist. We specialize in simplifying complex tax matters for small business owners and salaried individuals across India. Let us help you stay compliant and manage your taxes with confidence. Contact TaxRobo’s experts today for online CA consultation.

FAQs

1. Does every single loan EMI payment get reported in SFT/AIS?

Answer: Not necessarily every individual EMI payment. Lenders typically report aggregated figures for the financial year, such as the total interest paid or total principal repaid. This reporting is often based on internal aggregation logic and whether certain overall thresholds set by the CBDT are met during the year. The reporting entity (your lender) determines the exact granularity based on prevailing SFT rules and guidelines.

2. What should I do if my loan repayment shown in AIS is incorrect?

Answer: You should use the online feedback facility available within the AIS section on the Income Tax e-filing portal. Log in, navigate to the specific SFT information related to your loan, select it, choose the ‘Feedback’ option, mark the appropriate reason (e.g., ‘Amount is incorrect’, ‘Information is duplicate’, ‘Information pertains to another PAN/Year’), provide necessary clarification, and submit. It’s advisable to keep your official loan statements or certificates from the lender readily available for reference while providing feedback.

3. Will discrepancies in AIS regarding my loan repayment delay my tax refund?

Answer: Significant mismatches between the deductions you claim in your ITR (like home loan interest under Section 24(b) or principal under Section 80C) and the data reported by your lender in your AIS *could* potentially lead to closer scrutiny by the Income Tax Department, which might result in processing delays or queries, including delays in refunds. It is always best practice to resolve discrepancies using the AIS feedback mechanism or ensure your ITR claims are strongly supported by verifiable documents (like lender certificates), even if the AIS correction process takes some time. Filing an accurate return backed by evidence is key.

4. Is AIS SFT reporting loan only for high-value loans?

Answer: SFT reporting is generally triggered based on specified *transaction* thresholds set by the CBDT, not necessarily the total original loan amount. For instance, the reporting might be based on the aggregate interest paid or principal repaid during the financial year exceeding a certain limit. Therefore, even moderate loan amounts could trigger reporting depending on the annual repayment figures. Given this, it’s always wise to check your AIS regardless of your loan’s principal value. The specific AIS SFT reporting threshold can vary based on the type of transaction category the payment falls under.

5. Does the reporting differ for loans taken from NBFCs vs. Banks?

Answer: Both Scheduled Commercial Banks and specified Non-Banking Financial Companies (NBFCs) are designated as ‘Reporting Entities’ under the SFT regulations (AIS SFT compliance for lenders). While their internal systems or specific interpretations might have minor differences, the fundamental legal obligation to report specified financial transactions (including relevant loan-related payments exceeding thresholds) applies to both types of institutions. Consequently, information from loans taken from either a bank or an NBFC should reflect in your AIS in a broadly similar manner based on the SFT data submitted by them.