What contingency planning measures should businesses include in their financial strategy?

Running a business in India is an exciting journey, but it’s rarely a straight road. Economic shifts, sudden regulatory updates like changes in GST rules, unexpected supply chain hiccups, or even major unforeseen events like a pandemic – these uncertainties are part of the landscape. This is precisely why a robust contingency planning financial strategy is not just advisable, but absolutely essential. Simply put, it’s about having a solid financial backup plan to navigate rough waters when unexpected negative events strike. The critical importance of contingency planning in financial strategy cannot be overstated; it’s the bedrock of business survival, building resilience, and ensuring long-term growth, particularly for Small and Medium Enterprises (SMEs) operating in India’s dynamic market. Effective contingency planning is a core element of financial risk management in Indian businesses. This post will detail actionable financial strategy contingency measures for businesses in India, providing a practical guide to safeguarding your financial future. Developing a sound contingency planning financial strategy is key to weathering storms and emerging stronger.

Why is a Robust Contingency Plan Essential for Your Financial Strategy in India?

Operating without a financial safety net is like sailing in unpredictable seas without a life raft. For businesses in India, especially SMEs with potentially tighter margins, the lack of a contingency planning financial strategy India can expose them to significant vulnerabilities. Unexpected events, big or small, can quickly escalate into financial crises if there’s no pre-defined plan to manage the fallout. From meeting immediate obligations to funding recovery efforts, a contingency plan provides the necessary financial cushion and direction. It allows businesses to react thoughtfully and strategically during a crisis, rather than making panicked decisions under pressure. Ultimately, it’s about ensuring the financial health and continuity of the business even when faced with adversity, transforming potential disasters into manageable challenges.

Identifying Key Financial Risks for Indian Businesses

Effective financial risk management in Indian businesses starts with understanding the specific threats you might face. Anticipating these risks allows you to build targeted contingency measures. Some common financial risks for businesses operating in India include:

- Economic Downturns: Periods of recession or slowed economic growth can lead to significantly reduced consumer spending, lower demand for products and services, and difficulties in securing payments from customers, directly impacting revenue and cash flow.

- Market Volatility: Fluctuations in currency exchange rates, commodity prices, or interest rates can unexpectedly increase operating costs or affect the value of investments and assets, creating financial instability.

- Regulatory Changes: The Indian regulatory environment can evolve rapidly. Sudden changes in tax laws (like updates to the Goods and Services Tax – GST or Income Tax regulations), compliance requirements, or industry-specific rules can impose unexpected costs, necessitate system changes, or even disrupt business models. Staying updated via official sources like the GST Portal and the Income Tax India Website is crucial but requires readiness for potential financial impacts. Understanding how to stay informed is crucial; learn more about Staying Updated with the Latest Tax and GST Changes.

- Supply Chain Disruptions: Over-reliance on a single supplier, geopolitical events, transportation strikes, or logistical bottlenecks can interrupt the flow of essential goods or raw materials, halting production or service delivery and leading to lost revenue and increased costs.

- Operational Issues: Internal problems such as critical equipment failure requiring expensive repairs or replacement, damaging cybersecurity breaches leading to financial loss or recovery costs, or the sudden loss of key personnel can severely strain financial resources.

- Natural Disasters/Pandemics: Events like floods, earthquakes, or health crises can cause physical damage to property, disrupt operations for extended periods, impact employee availability, and lead to sharp declines in customer demand, requiring significant unplanned expenditure for recovery.

The High Cost of Inadequate Planning

Failing to implement adequate financial strategy contingency measures for businesses in India can have severe and potentially irreversible consequences. It’s not merely an inconvenience; it can threaten the very existence of the business. The potential fallout includes:

- Severe Cash Flow Shortages: An unexpected drop in revenue or a sudden large expense can deplete available cash, making it impossible to cover day-to-day operating costs.

- Inability to Meet Obligations: This includes struggling to make payroll for employees, failing to pay suppliers on time (damaging relationships and potentially halting supplies), or missing loan repayment installments.

- Defaulting on Statutory Dues: Failure to pay mandatory obligations like GST, TDS (Tax Deducted at Source), or PF (Provident Fund) on time can lead to hefty penalties, interest charges, and legal complications.

- Forced Asset Liquidation: In desperate situations, businesses might be forced to sell essential assets (like machinery or property) quickly and often at unfavorable prices to generate cash, hindering future operations and growth.

- Operational Paralysis or Business Closure: A severe financial crisis without a contingency plan can bring operations to a standstill, and in the worst-case scenario, lead to bankruptcy and the complete shutdown of the business.

- Damage to Reputation and Creditworthiness: Financial instability, defaulting on payments, and operational disruptions can severely damage the business’s reputation among customers, suppliers, lenders, and employees, making future financing and partnerships difficult to secure.

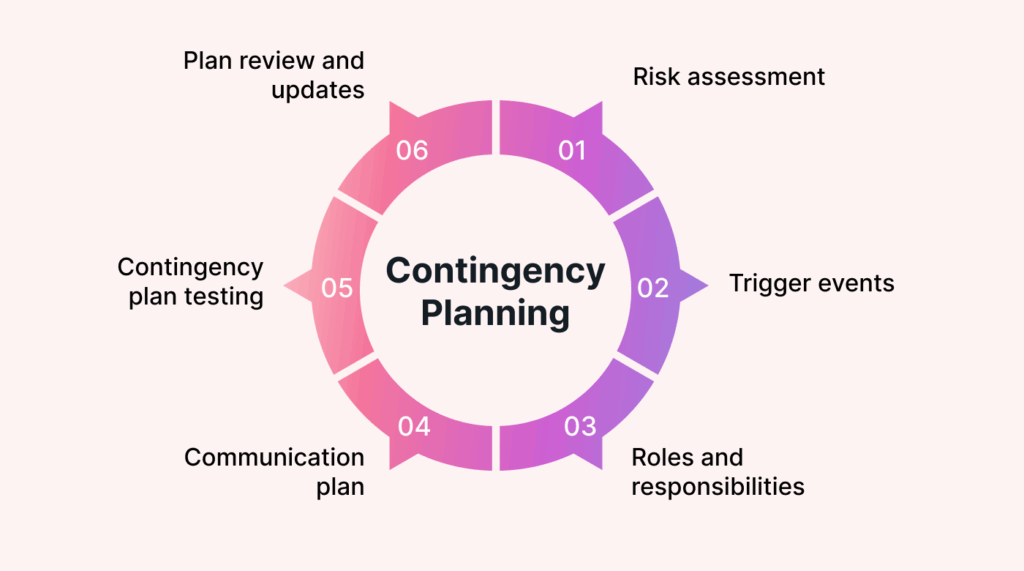

Core Contingency Measures for Your Business’s Financial Strategy

Now that we understand the risks and the potential costs of inaction, let’s focus on the practical steps. Implementing robust financial strategy contingency measures for businesses in India is crucial for building resilience. This section serves as a practical ‘how-to’ guide for safeguarding your business financially. These measures form the core of a proactive approach to managing uncertainty and ensuring your business can withstand financial shocks. Think of these not as optional extras, but as fundamental components of a sound financial framework designed for the realities of the Indian market.

1. Building and Maintaining an Emergency Fund

The cornerstone of any financial contingency plan is an emergency fund – a dedicated cash reserve specifically set aside to cover essential expenses during a crisis, which is closely linked to Managing Cash Flow Effectively During Tax Season. This isn’t just your regular working capital; it’s a separate, readily accessible pool of money untouched during normal operations. The common guideline suggests holding 3 to 6 months’ worth of essential operating expenses. However, the ideal amount for your Indian business depends on factors like your industry’s volatility (seasonal businesses might need more), your typical customer payment cycles, the proportion of fixed versus variable costs, and your overall risk tolerance. To build this fund, consistently allocate a percentage of profits, even if small, into a separate, highly liquid bank account (like a savings or money market account) that isn’t used for regular transactions. This discipline ensures the funds are available when truly needed.

2. Securing Access to Credit Lines

While an emergency fund is the first line of defence, having pre-approved access to credit provides a crucial second layer of financial flexibility. This involves establishing facilities like bank overdrafts, business lines of credit, or even business credit cards before you actually need them. The primary advantage is speed; during a cash crunch, you can draw upon these funds almost immediately, bypassing the lengthy application and approval processes typically required for new loans, which can be impossible to navigate quickly during a crisis. To secure these, proactively build strong relationships with your bankers and Non-Banking Financial Companies (NBFCs). Maintain a good credit history and understand the interest rates, repayment terms, fees, and any collateral requirements associated with these credit lines well in advance. Being aware of relevant RBI guidelines or government-backed SME loan schemes can also provide additional options.

3. Diversifying Income Streams

Relying heavily on a single product, a major client, a specific service, or one market segment makes your business financially vulnerable. If that single source experiences a downturn, your entire revenue stream could be jeopardized. Diversifying income streams is a strategic approach to spread this risk. When one revenue source falters due to market shifts, regulatory changes, or other disruptions, other sources might remain stable or even grow, compensating for the loss and stabilizing overall cash flow. Actively brainstorm and explore new, complementary revenue avenues relevant to the Indian market. This could involve adding related services, developing new products for your existing customer base, targeting new customer segments, or even considering careful geographical expansion, perhaps starting locally or regionally. The goal is to create multiple pillars supporting your business’s financial structure.

4. Implementing Strict Expense Management Protocols

Knowing where your money goes is critical, but even more so is having a plan to quickly reduce outflows when revenues decline. This requires implementing strict expense management protocols. Start by clearly categorizing all business expenses into essential (absolutely necessary for core operations, like rent, salaries, core utilities, loan repayments) and non-essential/discretionary (nice-to-have but not critical for immediate survival, like marketing campaigns, travel, office upgrades, some subscriptions). This categorization allows for quick, targeted cost-cutting during a financial squeeze without impairing core functions. Regularly review all expenses line by line, actively negotiate better payment terms or prices with suppliers, and develop a tiered plan for expense reduction – outlining which discretionary costs get cut first, second, and third, based on the severity and expected duration of the financial challenge.

5. Reviewing and Optimizing Insurance Coverage

Insurance acts as a financial safety net for specific types of catastrophic events, transferring potentially crippling financial risk to an insurer. It’s a vital component of contingency planning, but only if the coverage is adequate and appropriate. Ensure you have robust insurance coverage against various operational and financial risks relevant to your business in India. Key types to consider include:

- Business Interruption Insurance: Covers lost income and operating expenses if your business has to shut down temporarily due to a covered event (like fire or flood).

- Property Insurance: Protects your physical assets like buildings, equipment, and inventory against damage or loss.

- Liability Insurance: Covers legal costs and damages if your business is sued for injury or property damage.

- Key Person Insurance: Provides funds to help the business cope with the financial impact of losing an owner or essential employee due to death or disability.

- Health Insurance for Employees: Increasingly important for attracting and retaining talent, and crucial during health crises.

Conduct an annual review of all your insurance policies with a qualified insurance advisor. Ensure the coverage limits, deductibles, and scope of protection accurately reflect your current business scale, operations, asset values, and the evolving risk landscape.

6. Strengthening Financial Monitoring and Reporting

You cannot manage what you do not measure. Strengthening financial monitoring and reporting means maintaining accurate, timely, and insightful financial records. This isn’t just about year-end accounting; it’s about having a real-time pulse on your business’s financial health. Robust monitoring allows for the early detection of warning signs, such as declining profit margins, slow-moving receivables (customers taking longer to pay), inventory build-up, or emerging cash flow gaps. Detecting these issues early gives you more time and options to react before they become critical problems. Furthermore, accurate reporting is essential for quick, informed decision-making during a crisis and crucial for meeting statutory compliance obligations like timely TaxRobo GST Service filings and TaxRobo Income Tax Service payments. Use reliable accounting software (consider TaxRobo Accounts Service), prepare regular financial statements (Profit & Loss, Balance Sheet, Cash Flow Statement), and actively track key performance indicators (KPIs) relevant to your business’s financial stability. Learn how to Set Up An Accounting System for My Small Business to achieve this.

Integrating Contingency Planning into Your Overall Business Strategy

A financial contingency plan shouldn’t be a document created once and then forgotten in a drawer. To be effective, it must be a living part of your overall business strategy. Integrating contingency planning financial strategy into your regular operations ensures it remains relevant, effective, and ready to be deployed when needed. It’s a crucial element of broader business continuity planning strategies India, ensuring not just financial survival but the continuation of core business operations during disruptions. This integration requires ongoing commitment and proactive management, transforming contingency planning from a reactive measure into a strategic advantage.

Schedule Regular Reviews and Updates

The business environment, especially in India, is constantly changing. Risks evolve, your business grows or pivots, and financial circumstances shift. Therefore, your contingency plan must adapt accordingly. Make reviewing and updating the financial contingency plan a standard agenda item in your regular financial reviews, ideally quarterly, but at least annually. During these reviews, assess the adequacy of your emergency fund based on current expenses, check the status and terms of your credit lines, evaluate the performance of diversified income streams, re-examine expense categories, review insurance coverage adequacy, and analyze your latest financial monitoring data. Adjust the plan based on your business’s performance, changes in the market, new regulations, emerging risks, or significant operational changes.

Communicate the Plan Internally

A plan is useless if the people who need to implement it don’t understand it. Communicate the key elements of the financial contingency plan to relevant team members. Ensure they understand the potential triggers that might activate certain contingency measures (e.g., revenue dropping below a certain threshold for two consecutive months might trigger specific expense cuts). Clearly define roles and responsibilities – who is authorized to access the emergency fund? Who communicates with the bank regarding credit lines? Who implements expense reduction protocols? Fostering a culture of preparedness, where key staff understand the importance of the plan and their part in it, ensures a smoother, more coordinated response during an actual crisis.

Test Your Assumptions (Scenario Planning)

Assumptions underpin every plan. Regularly test the assumptions built into your financial contingency plan through simple scenario planning exercises. Ask ‘what-if’ questions relevant to your identified risks: “What if our largest client delays payment by 60 days?”, “What if our main supply route is disrupted for a month?”, “What if our sales drop by 30% for the next quarter due to an economic slowdown?”. Run the numbers based on these scenarios to see how your cash flow would be impacted and whether your emergency fund and credit lines would be sufficient. These ‘stress tests’ help identify potential gaps or weaknesses in your plan, allowing you to refine your contingency measures (e.g., increasing the emergency fund target, securing a larger credit line, accelerating diversification efforts) before a real crisis hits.

Conclusion

In the unpredictable landscape of Indian business, incorporating contingency planning into your core financial strategy is not optional; it’s an absolute necessity for survival and sustainable growth. Ignoring the potential for financial shocks leaves your business vulnerable to disruptions that can derail even the most promising ventures. By proactively implementing key measures such as building an emergency fund, securing access to credit, diversifying income, managing expenses diligently, ensuring adequate insurance, and maintaining robust financial monitoring, you build crucial resilience. These aren’t just defensive tactics; they are strategic investments in your business’s longevity.

Remember the key takeaways:

- Emergency Fund: Your first line of defence.

- Credit Access: A vital backup for liquidity.

- Diversification: Spreading risk across multiple revenue sources.

- Expense Control: Knowing where to cut quickly and effectively.

- Insurance: Transferring catastrophic risk.

- Monitoring: Early detection of warning signs.

Proactive contingency planning financial strategy doesn’t just help you weather storms; it builds a more robust, agile, and ultimately more competitive business. It provides peace of mind and a solid foundation from which to navigate challenges and seize opportunities.

Don’t wait for a crisis to test your financial preparedness. Assess your current financial strategy today and start implementing these essential contingency measures. Need help developing a robust contingency planning financial strategy tailored to your Indian business? TaxRobo’s financial experts can assist with risk assessment, financial planning, cash flow management, and ensuring compliance. Contact us today for expert guidance.

Frequently Asked Questions (FAQs)

Q1: How much emergency fund is enough for a small business in India?

A: While the general benchmark of 3-6 months of essential operating expenses is a good starting point, the ideal amount truly depends on your specific circumstances. Factors like your industry’s cyclical nature (highly seasonal businesses may need more), typical customer payment terms (longer cycles increase risk), the proportion of fixed costs (higher fixed costs require a larger buffer), and your overall financial risk management appetite play a significant role. It’s wise to calculate your bare minimum monthly operating expenses and start by targeting a 3-month fund, progressively building towards 6 months or even more if your business faces higher volatility.

Q2: Is contingency planning the same as business continuity planning (BCP)?

A: They are closely related but distinct concepts. Financial contingency planning, as discussed here, focuses specifically on the financial resources, strategies, and measures needed to manage and survive unexpected events that impact finances. Business Continuity Planning (BCP) is a broader, more holistic strategy that encompasses all aspects of keeping the business operational during and after a disruption – including IT systems, operations, supply chain management, human resources, communications, and stakeholder management. Financial contingency planning is a critical component of comprehensive business continuity planning strategies India, ensuring the financial means exist to support the broader BCP efforts.

Q3: What’s the very first step in creating a financial contingency plan?

A: The foundational first step is Risk Assessment. You need to identify the most significant potential financial risks specific to your business operating within the Indian context. Consider the threats outlined earlier (economic, regulatory, operational, etc.) and assess which ones pose the biggest danger to your financial stability. Immediately following risk identification, the next practical step is to accurately calculate your essential monthly operating expenses. This figure is crucial for determining a realistic and meaningful target for your emergency fund, which is often the first contingency measure businesses focus on building.

Q4: How often should we review our financial strategy contingency measures for businesses in India?

A: You should review your plan at least annually. However, given the dynamic nature of business and the economy, a quarterly review is highly recommended, especially during periods of high volatility, rapid growth, or significant changes within your industry or the regulatory environment. Treat it as a living document. You should also trigger an immediate review and potential update whenever major internal factors (like acquiring a large new contract or making a significant investment) or external factors (like major regulatory changes or economic shifts) occur.

Q5: Can TaxRobo help with setting up our contingency planning financial strategy?

A: Absolutely. TaxRobo offers expert financial advisory services designed specifically for Indian businesses. Our services include comprehensive risk assessment, cash flow forecasting and management, budgeting, strategic financial planning, and compliance management (TaxRobo GST Service, TaxRobo Income Tax Service). These are all integral components of building effective financial strategy contingency measures for businesses in India. We can work with you to understand your unique situation, identify risks, and help you create and implement a tailored contingency planning financial strategy to safeguard your business’s future. Reach out for an online CA consultation to learn more.