What are the Key Benefits of Integrated Wealth Management Solutions in India?

Introduction

Are you juggling multiple financial advisors, struggling to see the big picture of your assets, or unsure if your investments align with your tax planning? Many Indian small business owners and salaried professionals face these challenges, leading to confusion and potentially missed opportunities. Imagine trying to build a house with different contractors for the foundation, walls, plumbing, and wiring, none of whom talk to each other – the result could be chaotic and inefficient. Integrated Wealth Management acts as the master architect for your financial life. It’s a comprehensive, coordinated approach that brings together financial planning, investment management, tax optimization, retirement planning, insurance, and estate planning, all managed centrally under one strategic vision. Understanding the key benefits of integrated wealth management solutions is absolutely crucial for anyone serious about building long-term wealth and achieving lasting financial security in the dynamic Indian economy. Whether you are navigating the complexities of growing your own business or steadily climbing the corporate ladder, implementing a holistic financial strategy is no longer a luxury, but an essential element for success, highlighting the growing importance of the benefits of wealth management India.

Understanding Integrated Wealth Management: Beyond Basic Financial Advice

Defining the Holistic Approach

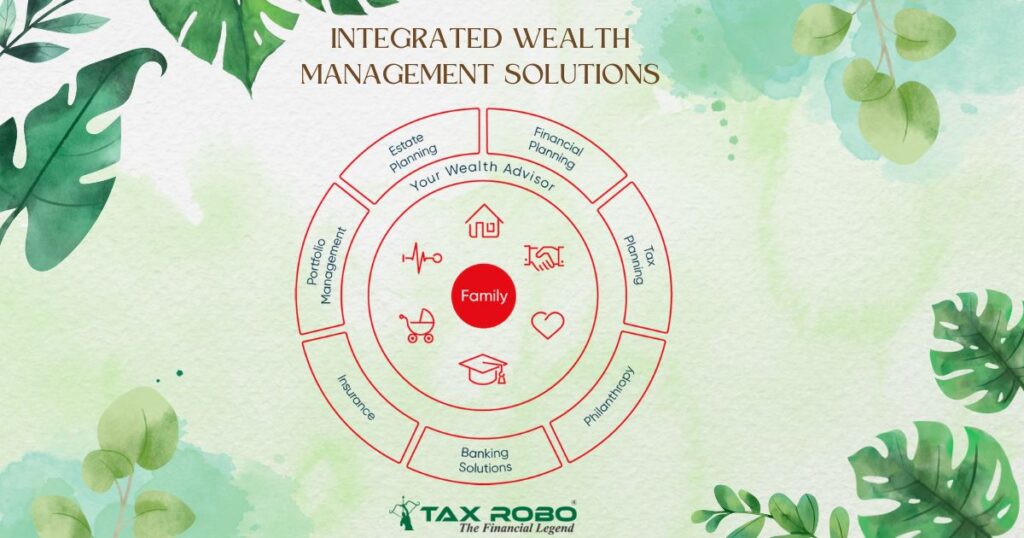

Integrated wealth management fundamentally shifts the perspective from isolated financial products to a complete, interconnected financial ecosystem tailored to your life. It’s far more than just receiving recommendations on which stocks to buy or mutual funds to invest in. This comprehensive approach meticulously weaves together several critical components to create a unified strategy. Central to this is Financial Planning, which involves clearly defining your short-term and long-term goals – be it securing funds for your child’s overseas education, purchasing your dream home, expanding your business, or ensuring a comfortable retirement – coupled with rigorous cash flow analysis to understand your financial capacity. Then comes Investment Management, focusing on constructing a diversified portfolio and allocating assets strategically based on your unique risk tolerance, investment timeline, and specific financial objectives. Crucially, Tax Planning & Optimization is integrated from the outset, aiming to legally minimize your tax liabilities across all sources of income and investments, a vital aspect in India’s tax environment. Retirement Planning involves building an adequate corpus through disciplined savings and investments, potentially utilizing instruments like the National Pension System (NPS). For business owners especially, Estate Planning becomes paramount, addressing wills, trusts, and ensuring smooth succession and wealth transfer (wealth management help in planning). Finally, Risk Management evaluates potential financial threats and incorporates appropriate insurance planning – including life, health, and liability cover – to protect you and your family from unforeseen events. This broad wealth management services overview India showcases the interconnectedness required for true financial well-being.

Why Integration is the Key Differentiator

The true power of integrated wealth management lies in its coordinated nature, standing in stark contrast to the traditional, often siloed, approach to financial advice. Many individuals end up dealing with multiple advisors independently – perhaps an insurance agent selling policies, a mutual fund distributor recommending schemes, a stockbroker handling equity investments, and a chartered accountant managing tax filings. While each professional might offer valuable expertise in their domain, this fragmented approach often leads to suboptimal outcomes, conflicting strategies, or significant missed opportunities. For instance, an investment might be chosen purely for its potential returns without adequate consideration of its tax implications, potentially leading to a higher tax outgo later. Similarly, insurance policies might be purchased without being fully aligned with the overall financial plan or retirement goals. Integrated wealth management breaks down these silos. It ensures that every financial decision – from investment choices and insurance purchases to tax planning and retirement savings – is made cohesively, working in synergy towards achieving your overarching financial objectives. This holistic viewpoint prevents different pieces of advice from working against each other and maximizes the effectiveness of your overall financial plan, making integrated wealth management strategies India particularly potent. The advisor acts as a central coordinator, ensuring all elements of your financial life are aligned and optimized.

Unveiling the Key Benefits of Integrated Wealth Management Solutions

Leveraging a unified financial strategy unlocks numerous advantages. The key benefits of integrated wealth management solutions stem directly from this coordinated and comprehensive methodology, offering clarity, efficiency, and optimization that are hard to achieve with fragmented advice.

Benefit 1: Comprehensive Financial Roadmap & Goal Alignment

One of the most significant advantages is the creation of a clear, detailed, and highly personalized financial roadmap. Instead of vague aspirations, integrated wealth management translates your life goals – such as funding your child’s master’s degree in the US in ten years, retiring comfortably at 60 with a specific monthly income, expanding your business operations into a new city, or buying a vacation home – into actionable financial steps. The process involves quantifying these goals, determining the required corpus, and establishing realistic timelines. Advisors then meticulously align every aspect of your financial plan, including savings rates, investment choices, insurance coverage, and tax strategies, specifically to meet these defined objectives. This ensures that your financial resources are purposefully directed towards what matters most to you, providing a sense of control and direction. This goal-oriented approach makes effective wealth management solutions India truly impactful for individuals and families planning their future. Regular reviews ensure the plan remains relevant as your circumstances or goals evolve.

Benefit 2: Tailored and Optimized Investment Strategy

Integrated wealth management moves beyond generic investment advice to craft a portfolio specifically designed for your unique circumstances. This involves a thorough assessment of your risk appetite (how comfortable you are with potential investment losses), your investment time horizon (how long you plan to stay invested), and your specific financial goals. Based on this profile, a diversified portfolio is constructed, strategically allocating assets across different classes like equity, debt, real estate, and potentially alternative investments, both domestically and internationally, to balance risk and potential returns. This tailored approach often grants access to a wider spectrum of investment products and sophisticated management techniques that might not be available through standard channels. Furthermore, integrated wealth management involves continuous monitoring and periodic rebalancing of the portfolio. This ensures that the asset allocation stays aligned with your target mix and adapts to changing market conditions or shifts in your personal situation, enhancing the advantages of wealth management in India by keeping your investments consistently on track towards your objectives (wealth management strategy components).

Benefit 3: Enhanced Tax Efficiency Across Your Finances

In the Indian context, with its specific tax laws and regulations, tax efficiency is a paramount concern and a major benefit offered by integrated wealth management. Unlike traditional approaches where tax planning might be an afterthought considered only during return filing season, integrated strategies proactively embed tax considerations into every financial decision before it’s made. This means investment choices are evaluated not just for potential returns but also for their tax treatment – favouring instruments like Equity Linked Savings Schemes (ELSS) for Section 80C benefits, Public Provident Fund (PPF) for its EEE (Exempt-Exempt-Exempt) status, or tax-free bonds where appropriate. For business owners, this extends to structuring business income and expenses optimally, choosing the right legal entity for tax advantages, and planning for capital gains tax on asset sales. Salaried individuals benefit from strategies maximizing deductions through house rent allowance (HRA), leave travel allowance (LTA), NPS contributions, and other available exemptions. This proactive and holistic tax planning, often leveraging expert knowledge like that provided by platforms such as TaxRobo Online CA Consultation Service, ensures you legally minimize your tax burden across your entire financial landscape, maximizing your post-tax returns and wealth accumulation. The benefits of wealth management India are significantly amplified through smart tax optimization.

Benefit 4: Streamlined Estate and Succession Planning

Planning for the inevitable transfer of wealth is a critical, yet often overlooked, aspect of financial management. Integrated wealth management brings structure and foresight to estate and succession planning, ensuring your assets are distributed according to your wishes efficiently and effectively, minimizing potential conflicts and tax liabilities for your beneficiaries. For small business owners, this is particularly crucial; integrated planning addresses vital questions around business continuity, identifying and preparing successors, structuring buy-sell agreements if needed, and ensuring the business can thrive beyond the founder’s active involvement. For individuals, it involves drafting clear and legally sound wills, potentially establishing trusts for specific purposes (like managing assets for minors or dependents), appointing nominees correctly across investments and accounts, and structuring asset ownership to simplify transfer. This careful planning helps protect your legacy and provides peace of mind, knowing your loved ones will be taken care of as intended. While often associated with high net worth individuals, proactive estate planning is relevant for anyone building assets and forms a key part of comprehensive wealth management solutions for affluent individuals India, regardless of their current net worth, as it’s about securing the future you’ve worked hard to build.

Benefit 5: Simplified Management and Consolidated View

Dealing with multiple financial advisors, tracking various accounts, and understanding how different investments and policies fit together can be incredibly time-consuming and confusing for busy small business owners and professionals. Integrated wealth management significantly simplifies this complexity by providing a single, trusted point of contact for all your financial matters. This central coordinator understands your complete financial picture and ensures all strategies are aligned. Furthermore, a key benefit is the provision of consolidated reporting. Instead of receiving disparate statements from various institutions, you get comprehensive reports that provide a clear, holistic view of your entire portfolio performance, asset allocation, cash flows, and progress towards your goals. This makes it significantly easier to monitor your financial health, make informed decisions, and understand the overall impact of different strategies. This streamlined approach saves valuable time, reduces administrative burdens, and eliminates the stress associated with managing fragmented financial relationships.

Benefit 6: Proactive Risk Management

A crucial element of securing long-term financial well-being is identifying and mitigating potential risks that could derail your plans. Integrated wealth management adopts a proactive approach to risk management by systematically assessing various threats to your financial stability. These risks can include market volatility impacting investments, inflation eroding the purchasing power of your savings, inadequate insurance coverage leaving you vulnerable to unexpected events (like illness, accidents, or death), and longevity risk (outliving your retirement savings). The integrated advisor doesn’t just focus on investment risk but considers your entire financial exposure. Based on this assessment, tailored strategies are implemented. Diversification across asset classes helps mitigate investment risk. Inflation-adjusted return targets are factored into planning. Most importantly, appropriate insurance planning – covering life, health, critical illness, disability, and even liability for business owners – is woven into the overall financial strategy to create a safety net, ensuring that unforeseen circumstances don’t lead to financial catastrophe. This comprehensive risk mitigation is a cornerstone of a robust financial plan.

Who Benefits Most from Integrated Wealth Management in India?

While the principles of integrated wealth management offer value to many, certain groups find its comprehensive and coordinated approach particularly beneficial due to the complexity of their financial lives.

Small Business Owners

Entrepreneurs and small business owners in India operate in a unique financial environment, constantly balancing the needs of their growing enterprise with their personal financial security. Their specific challenges often include managing irregular or fluctuating cash flows, deciding how much profit to reinvest in the business versus saving personally, planning effectively for business succession or eventual exit, optimizing complex tax structures involving both business and personal income (e.g., choosing between proprietorship, partnership, LLP, or private limited company via services like TaxRobo Company Registration Service), and ensuring personal assets are protected from business liabilities. Integrated wealth management provides an invaluable framework by creating a unified strategy that addresses both business objectives and personal financial goals simultaneously. It helps structure finances tax-efficiently, plan for major capital expenditures, build personal wealth alongside the business, and prepare for a smooth transition in the future, making it highly advantageous for this segment (company registration in India).

Salaried Professionals

As salaried professionals advance in their careers, their income typically rises, but so does the complexity of managing their finances effectively. Their specific needs often revolve around maximizing tax savings within the constraints and opportunities of their salary structure (utilizing components like HRA, LTA, food coupons, maximizing deductions under Section 80C through instruments like ELSS or PPF, contributing to NPS for retirement and additional tax benefits via Section 80CCD), planning for significant life events such as purchasing a home, funding children’s higher education, or managing international assignments, and diligently building a substantial retirement corpus beyond mandatory contributions like the Employee Provident Fund (EPF). Integrated wealth management helps these professionals by creating a disciplined, long-term wealth creation plan that aligns with their career trajectory and evolving life stages. It ensures savings are optimized, investments are goal-oriented and tax-efficient, and adequate provisions are made for future milestones, moving beyond basic salary management to strategic wealth building. Tax efficiency, managed through services like TaxRobo Income Tax Service, becomes a key part of the integrated plan.

HNIs and Affluent Families (Briefly)

While this post focuses on small business owners and salaried individuals, it’s worth noting that High Net Worth Individuals (HNIs) and affluent families face an even greater degree of financial complexity, making integrated wealth management indispensable for them. Their needs often involve managing highly diversified portfolios possibly including international assets, complex succession planning across multiple generations involving trusts and holding structures, sophisticated tax planning strategies, philanthropic goals, and potentially managing family offices. For this segment, the core principles of integration, coordination, and customization are amplified. The ability to manage intricate financial affairs, navigate complex regulations, and preserve wealth across generations underscores the critical wealth management benefits for HNIs. The comprehensive nature of wealth management solutions for affluent individuals India addresses these sophisticated requirements through a dedicated, highly specialized team approach, often incorporating legal and specialized tax experts.

Conclusion

In summary, navigating the financial landscape in India requires more than just isolated advice; it demands a cohesive, strategic approach. The key benefits of integrated wealth management solutions lie precisely in providing this holistic framework. By seamlessly coordinating financial planning, investment management, tax optimization, retirement strategies, risk management, and estate planning, it offers unparalleled clarity, efficiency, and goal alignment. This unified methodology simplifies complex financial lives, optimizes outcomes (particularly regarding tax efficiency – a major concern in India), and ensures all financial decisions work together harmoniously towards your specific aspirations. Whether you are steering a growing business or building a successful career, embracing integrated wealth management provides a powerful and structured pathway to achieving your long-term financial goals and securing your future. Understanding the key benefits of wealth management in India through an integrated lens empowers you to make smarter, more informed financial decisions.

Ready to take control of your financial future with a coordinated strategy? Assess your current financial planning approach. Are different aspects of your finances managed in silos? Could better integration lead to improved outcomes, especially concerning tax efficiency? Contact TaxRobo today to explore how our expertise in TaxRobo Tax Planning Service and TaxRobo Accounts Service can form a crucial part of your integrated financial strategy, ensuring a solid foundation for your wealth-building journey.

Frequently Asked Questions (FAQs)

Q1: What’s the main difference between integrated wealth management and standard financial planning?

A: Standard financial planning often focuses on specific, often isolated, goals like saving for retirement or a child’s education. While valuable, it might not fully coordinate these goals with other financial aspects like tax planning, insurance, or estate needs. Integrated wealth management, on the other hand, takes a much broader, continuous view. It acts as a master plan, actively coordinating all facets of your financial life – investments, tax strategies (using tools like TaxRobo Income Tax Service), insurance policies, retirement savings, and estate arrangements – ensuring they all work together cohesively under one unified, ongoing strategy aligned with your overall life objectives.

Q2: Do I need to be very wealthy to benefit from integrated wealth management in India?

A: Not necessarily. While the benefits certainly scale with wealth and complexity, making it highly valuable for HNIs, the core principles of coordination, optimization, and goal alignment are beneficial long before reaching HNI status. Successful small business owners juggling personal and business finances, or mid-to-senior level salaried professionals managing rising incomes, multiple investments, and planning for significant life goals, often face sufficient complexity to gain significant value from an integrated approach. It’s less about hitting a specific net worth figure and more about the desire to manage financial complexity effectively, optimize outcomes (especially tax), and achieve ambitious long-term goals.

Q3: How exactly does integrated wealth management help reduce my taxes in India?

A: Integrated wealth management embeds proactive tax planning into the very fabric of your financial decision-making, rather than treating it as a separate year-end activity. This means evaluating investment options not just on returns but also on their tax treatment (e.g., favouring ELSS for 80C, PPF for tax-free growth, considering indexation benefits for capital gains). It involves structuring income and assets optimally – particularly relevant for business owners deciding on entity structures. For salaried individuals, it means maximizing deductions and allowances permitted under Indian tax law (Income Tax India Website). It also includes planning for capital gains tax on assets like property or stocks and structuring withdrawals in retirement tax-efficiently. By considering tax implications at every step, the goal is to ensure your overall financial plan is as tax-optimized as legally possible.

Q4: Can TaxRobo help implement integrated wealth management strategies?

A: TaxRobo provides essential pillars that are fundamental to effective integrated wealth management. Our core strengths lie in expert tax planning & compliance through services like TaxRobo Income Tax Service and TaxRobo GST Service for businesses, meticulous accounting via TaxRobo Accounts Service, and foundational business advisory including TaxRobo Company Registration Service. While we may partner with SEBI-registered investment advisors for specialized investment management, our services ensure that your financial plan is built upon a robust, compliant, and critically, a tax-efficient foundation. This expertise is central to executing successful integrated wealth management strategies India, as tax optimization is a key driver of wealth accumulation in the country. We help ensure the tax and compliance aspects of your strategy are flawlessly managed.

Q5: What typical services are included under integrated wealth management solutions benefits?

A: The range of services contributing to integrated wealth management solutions benefits is typically broad and coordinated. Key components usually include:

- Comprehensive Financial Planning: Detailed goal setting, cash flow analysis, net worth tracking.

- Investment Management: Portfolio construction, asset allocation, ongoing monitoring, and rebalancing (can be discretionary or non-discretionary).

- Tax Planning and Optimization: Proactive strategies to minimize tax liability across income, investments, and business structures.

- Retirement Planning: Corpus calculation, pension planning (including NPS), withdrawal strategies.

- Risk Management & Insurance Analysis: Identifying financial risks and recommending appropriate life, health, disability, and liability insurance.

- Estate and Succession Planning: Will drafting assistance, trust advisory, succession planning for businesses, ensuring smooth wealth transfer.

All these services are delivered under a single, coordinated strategic framework tailored to the client’s specific needs and goals.