What impact does inflation have on wealth management strategies?

Introduction: Why Inflation Matters for Your Wealth in India

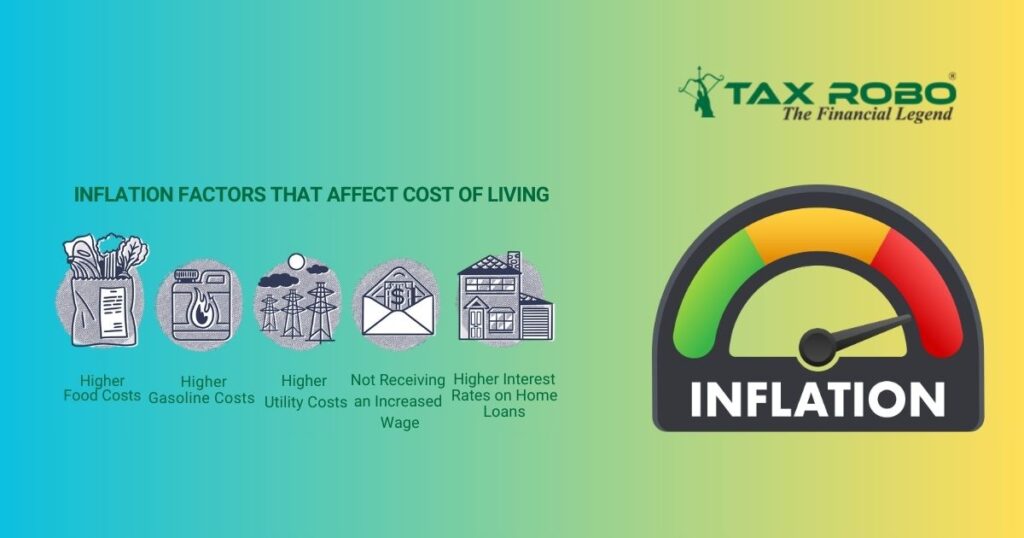

Have you noticed how the price of petrol keeps climbing, or how your usual grocery bill seems to buy less each month? This feeling of your hard-earned money not stretching as far is a direct result of inflation, a significant economic factor impacting everyone in India. Simply put, inflation is the general increase in prices of goods and services over time, which means the purchasing power of the Rupee decreases. In India, this is often measured using the Consumer Price Index (CPI), which tracks the cost of a typical basket of consumer goods. You can often find current data on the Reserve Bank of India’s website (Optional Link: RBI Publications – Check for Inflation Reports). Now, think about wealth management. Its primary goal is to grow and protect your wealth over the long term, helping you achieve financial goals like a comfortable retirement, funding your children’s education, or buying a home. Understanding the impact of inflation on wealth management is absolutely critical because inflation directly works against these goals by silently eating away at the value of your money. For small business owners managing costs and revenues, and salaried individuals planning for the future, grasping this concept is the first step towards securing your financial well-being in India. This post will delve into how inflation affects your wealth and provide practical strategies for adjusting your investments, savings, and overall financial planning during these inflationary times.

Understanding How Inflation Erodes Your Wealth

Inflation is often called a ‘silent thief’ because its effects aren’t always immediately obvious, but over time, it can significantly diminish your accumulated wealth. It works quietly in the background, making your money worth less each year. This erosion affects not just your daily spending but also your long-term savings and investments, making it crucial to understand its mechanisms. Without a clear picture of how inflation operates, your financial planning might fall short of achieving your objectives, leaving you financially vulnerable in the future. Let’s break down the specific ways inflation chips away at your financial foundation.

The Shrinking Rupee: Loss of Purchasing Power

The most direct impact of inflation is the reduction in your money’s purchasing power. Imagine you had ₹100 ten years ago. Think about how many cups of chai, movie tickets, or basic groceries like dal and rice you could buy then compared to now. Today, that same ₹100 note buys significantly less. This is inflation in action – the nominal value (₹100) stays the same, but its real value (what it can actually buy) decreases. This seemingly small daily erosion has a massive cumulative effect on long-term financial goals. If you’re saving ₹10 lakhs for your child’s higher education in 15 years, inflation means that ₹10 lakhs will likely cover much less of the actual cost by the time you need it. Similarly, the retirement corpus you calculate today needs to account for the rising cost of living years down the line. This constant decline in real value underscores how inflation affects wealth management India; your saved money simply doesn’t hold its worth unless it grows faster than the rate of inflation. Ignoring this means your future financial security could be seriously compromised.

Impact on Savings and Fixed Income Investments

A key concept to grasp here is ‘real return’. This is the return your investment earns after accounting for inflation. The formula is simple: Real Return ≈ Nominal Return – Inflation Rate. Now consider traditional safe havens like savings accounts or Fixed Deposits (FDs). Banks offer an interest rate (nominal return) on these deposits. However, if the inflation rate in India is higher than the interest rate offered by your bank (Optional Link: Check current rates on a major bank site like HDFC Bank FD Rates) then your money is actually losing purchasing power, even though it’s earning interest. For example, if your FD gives you a 6% annual return, but inflation is running at 7%, your real return is negative (-1%). You have more rupees, but they buy less than before. This scenario is particularly harsh for retirees or conservative investors heavily reliant on fixed-income instruments. Furthermore, existing bondholders face challenges too. If you hold a bond paying a fixed 5% interest rate and new bonds are being issued at 7% due to rising inflation and interest rates, your existing bond becomes less attractive and its market value might fall if you need to sell it before maturity.

How Different Asset Classes React to Inflation

Inflation doesn’t affect all investments equally. Understanding how different asset classes typically behave during inflationary periods is crucial for adjusting your portfolio.

- Equities (Stocks): Stocks of companies can potentially act as an inflation hedge, but it’s not guaranteed. Companies with strong ‘pricing power’ – the ability to pass increased input costs (raw materials, labour) onto customers without significantly hurting demand – tend to perform better. Think about companies selling essential goods or services with strong brand loyalty. However, high inflation often leads to increased market volatility and uncertainty, which can negatively impact stock prices in the short term. Sectors like consumer staples, energy, and materials sometimes benefit, but careful stock selection or investing through diversified mutual funds is key.

- Real Estate: Historically, real estate in India has often been considered a good hedge against inflation. As prices rise, property values tend to increase, and landlords can often raise rents, potentially keeping pace with inflation. However, real estate is not a perfect solution. It’s highly illiquid (takes time to sell), requires significant capital investment, involves transaction costs (stamp duty, registration), and its performance is heavily dependent on location and local market dynamics. Rental yields might not always outpace high inflation either. Consider consulting an Expert Commercial Real Estate Consultant: Maximize Your Investment & Minimize Risks to navigate these challenges.

- Gold: Gold holds a traditional status as a safe-haven asset and an inflation hedge in India, deeply ingrained in our culture. When the value of currency decreases due to inflation, gold prices often tend to rise. Investors can gain exposure through physical gold, Gold ETFs (Exchange Traded Funds) which trade like stocks, or Sovereign Gold Bonds (SGBs) issued by the RBI, which offer interest income in addition to capital appreciation potential and tax benefits.

- Debt/Loans: Inflation can have opposing effects here. If you are a borrower with a fixed-interest rate loan (like an older home loan), high inflation can actually benefit you. You are repaying the loan over time with rupees that are worth less than when you borrowed the money. Conversely, lenders are harmed in this scenario, as the real value of the repayments they receive is lower. However, if you have variable-rate debt, rising inflation often prompts central banks (like the RBI) to increase interest rates, which would increase your loan repayment burden.

Adapting Your Wealth Management Strategies During Inflation in India

Understanding how inflation erodes wealth is only half the battle; the other half is taking proactive steps to protect and grow your money despite rising prices. A passive approach simply won’t work when inflation is high. You need to actively adjust your financial plan and investment choices. Mitigating the impact of inflation on wealth management requires a conscious effort to review and adapt your strategies. This means looking critically at your current investments, how you manage debt, and even your savings habits to ensure they align with the goal of preserving and increasing your purchasing power over the long term.

Re-evaluating Your Investment Portfolio

Your investment portfolio is the engine for wealth growth, and it needs tuning during inflationary periods. The primary goal shifts towards achieving positive real returns. Start by reviewing your diversification. Are your investments spread across different asset classes like equity, debt, gold, and perhaps real estate? These asset classes react differently to inflation, so diversification can help cushion the impact and reduce overall portfolio volatility. Don’t put all your eggs in one basket, especially not just in fixed-income instruments that might lag behind inflation. Instead, focus on real returns. Prioritize investments that have the historical potential to outpace inflation over the long run. This often means increasing allocation towards equities, despite their short-term volatility. For individual investors, understanding how to file taxes efficiently can also influence investment decisions—learn more in How do I file my income tax return online in India?.

Within your equity strategy, consider focusing on companies with strong fundamentals, sustainable earnings growth, and significant pricing power. Investing through mutual funds, particularly diversified equity funds or tax-saving ELSS schemes via Systematic Investment Plans (SIPs), remains a prudent approach for most investors. SIPs allow you to average out your purchase cost over time, which can be beneficial during volatile markets often associated with inflation. Furthermore, strategically incorporate inflation hedges. Consider allocating a portion of your portfolio to assets like Sovereign Gold Bonds (SGBs) or Gold ETFs. Real Estate Investment Trusts (REITs), which invest in income-generating properties, could offer another avenue, providing exposure to real estate with smaller ticket sizes and better liquidity than direct property ownership. In some market conditions, inflation-indexed bonds (if available and suitable for your profile) could also be considered, as their principal or interest payments are linked to inflation measures. Adopting these specific wealth management strategies during inflation India is crucial for navigating the challenging economic climate. The inflation effect on investment strategies for Indians necessitates a move towards assets with growth potential beyond fixed-interest returns.

Managing Your Debt Strategically

Inflation changes the equation for debt management. High-interest debt, especially on credit cards or personal loans, becomes even more detrimental. The interest rates on these are typically much higher than inflation, meaning they rapidly erode your wealth. Prioritizing the repayment of high-cost debt should be a top financial goal during inflationary times. Aggressively paying down these balances frees up cash flow and reduces the drag on your finances.

Conversely, the strategy for low-interest, fixed-rate debt might change. If you have an older home loan with a low, fixed interest rate, the urgency to prepay it might decrease during periods of high inflation. As mentioned earlier, you are effectively repaying this loan with ‘cheaper’ money over time. The funds you might have used for prepayment could potentially earn higher real returns if invested wisely in assets that beat inflation. However, this depends heavily on your risk tolerance and investment opportunities. It’s crucial to be cautious about taking on new debt, especially if it comes with a variable interest rate. If the RBI raises interest rates to combat inflation, your repayment burden on variable-rate loans could increase significantly, straining your budget. Always evaluate the necessity and terms of any new loan carefully in an inflationary environment. If you’re considering starting or scaling a business amid inflation, read about the Company Registration in India for strategic insights.

Revisiting Savings and Emergency Funds

While inflation erodes the purchasing power of cash savings, the importance of maintaining an adequate emergency fund cannot be overstated. This fund, typically covering 3-6 months of essential living expenses, provides a crucial safety net for unexpected events like job loss or medical emergencies, preventing you from having to sell long-term investments at potentially inopportune times. Don’t sacrifice your emergency fund in the pursuit of higher returns.

However, holding the entire emergency fund in a standard savings account, which often yields returns far below the inflation rate, might not be optimal. Consider strategies to protect its value slightly better while maintaining reasonable liquidity and safety. You could explore keeping a portion in higher-yielding options like liquid mutual funds, which invest in short-term debt instruments and aim to provide better returns than savings accounts, though they carry slightly higher risk and returns are not guaranteed. Another option could be sweep-in Fixed Deposits, where amounts above a certain threshold in your savings account are automatically moved into FDs, potentially earning higher interest, while still offering relatively easy access. Carefully understand the features, risks, and withdrawal conditions associated with these options before committing your emergency savings. The key is balancing safety, liquidity, and mitigating inflation’s impact as much as possible for these essential funds.

Tailored Advice: Inflation Planning for Different Indians

Inflation impacts everyone, but the specific challenges and the most effective strategies can differ based on your primary source of income and financial situation. Small business owners face distinct pressures related to costs and pricing, while salaried individuals need to focus on protecting their income and optimising investments. Let’s explore some tailored advice.

Wealth Management Planning in an Inflationary Economy India: Tips for Small Business Owners

For small business owners, inflation directly squeezes profit margins through rising input costs – raw materials, utilities, wages, and transportation all become more expensive. Effective wealth management planning in an inflationary economy India must integrate business strategy with personal financial health. Firstly, critically review your pricing power. Can you increase the prices of your products or services to reflect higher costs without losing significant customer volume? This requires understanding your market position and competitors. Secondly, focus intensely on cost management. Scrutinise every expense line item. Can you negotiate better terms with suppliers, find operational efficiencies, or reduce wastage? Prudent cost control is vital.

Thirdly, maintain healthy cash flow. Inflation can strain working capital. Manage your inventory levels carefully to avoid tying up too much cash in stock that might become expensive to hold. Implement efficient systems for invoicing and collecting payments (receivables) to ensure money comes in promptly. Fourth, evaluate business investments carefully. Reinvesting profits back into the business is often necessary, but weigh the expected Return on Investment (ROI) against the option of diversifying into personal assets (like equities or gold) that might offer a better hedge against inflation during uncertain times. Finally, don’t neglect tax planning. Inflation can artificially inflate nominal profits, potentially leading to higher tax liabilities even if real profitability hasn’t increased. Proactive tax planning can help manage this. Consider leveraging expert advice for complex scenarios. Need help with business accounting or tax strategies? Explore TaxRobo Accounts Service or connect with our experts.

Inflation-Proofing Your Finances: Strategies for Salaried Individuals

Salaried individuals often feel inflation’s pinch directly through reduced purchasing power from their fixed income. The key is to protect and grow that income and make savings work harder. When possible, factor inflation into salary negotiations or annual appraisals. While not always feasible, highlighting the rising cost of living can strengthen your case for a raise that maintains your real income level. Exploring side hustles or freelance opportunities can provide additional income streams, offering a buffer against rising expenses and boosting your investment capacity.

Rigorous budgeting becomes essential. Track your expenses meticulously using apps or spreadsheets to understand exactly where your money is going and identify areas where costs are escalating rapidly. This allows you to make informed decisions about adjusting spending patterns. Continue disciplined contributions to tax-saving investments under Section 80C, such as the Public Provident Fund (PPF), Employee Provident Fund (EPF), National Pension System (NPS), and Equity Linked Savings Schemes (ELSS). While PPF and EPF offer stability, remember the long-term, inflation-beating potential often lies with equity-linked options like ELSS and NPS (especially if you choose a higher equity allocation). Ensure you’re maximizing your tax savings. Check out TaxRobo Income Tax Service for filing and planning assistance. Finally, maintain your Systematic Investment Plans (SIPs) in equity mutual funds. Don’t panic sell during market volatility. SIPs allow you to benefit from rupee cost averaging. If your budget allows, consider implementing a ‘step-up SIP’ strategy – gradually increasing your SIP amount annually (e.g., by 5-10%) to counteract inflation’s effect on your investment value over the long term. This tailored approach addresses the specific impact of inflation on wealth management in India for employees.

Conclusion: Taking Control of Your Wealth Amidst Rising Prices

Inflation presents a undeniable challenge to building and preserving wealth in India. It silently erodes the purchasing power of your hard-earned money, impacting everything from daily expenses to long-term goals like retirement and education funding. It affects savings, fixed-income investments, and even the real returns from potentially higher-growth assets if not managed correctly. However, understanding these effects is the first step towards taking control.

The key takeaway is that proactive planning and strategic adjustments are essential to navigate the impact of inflation on wealth management. You cannot afford to be passive. By embracing core strategies such as diversification across asset classes (equity, debt, gold, real estate), focusing on investments that offer the potential for positive real returns over the long term, managing debt wisely (prioritizing high-cost debt and being cautious with new variable loans), and conducting regular reviews of your financial plan and portfolio, you can significantly mitigate inflation’s negative effects. Whether you are a small business owner managing rising costs or a salaried individual protecting your income, informed action is your best defence.

Feeling overwhelmed by wealth management planning in an inflationary economy India? It’s complex, and personalized guidance can make a significant difference. TaxRobo’s financial and tax experts understand the unique challenges faced by Indians. We can help you assess your situation, review your investments, and create a tailored strategy to protect and grow your wealth, even amidst rising prices. Contact TaxRobo today for a consultation!

Frequently Asked Questions (FAQs)

Q1. What is the best ‘inflation-proof’ investment in India?

Answer: There’s no single ‘perfect’ or completely ‘inflation-proof’ investment. The best strategy involves diversification across asset classes that tend to perform differently during inflation. Equities, particularly stocks of companies with pricing power, offer long-term growth potential that can outpace inflation, but come with market risk. Real estate can act as a hedge through potential appreciation and rental income, but it’s illiquid and requires large capital. Gold (physical, SGBs, ETFs) is a traditional hedge but doesn’t generate regular income (except SGBs). Inflation-indexed bonds, when available, are directly linked to inflation but might offer lower returns than equities. The ideal mix depends on your individual risk tolerance, investment horizon, and financial goals. A well-diversified portfolio is generally the most resilient approach.

Q2. Should I stop my mutual fund SIPs when inflation is high?

Answer: Generally, no, stopping your SIPs during periods of high inflation and market volatility is often counterproductive for long-term investors. High inflation can sometimes lead to market corrections, meaning equity prices might fall. Continuing your SIPs allows you to take advantage of rupee cost averaging – you automatically buy more mutual fund units when prices are low and fewer units when prices are high. Stopping your SIPs means you miss out on the potential benefit of buying low and could hinder your long-term wealth creation when the market eventually recovers. Disciplined, regular investing through SIPs is a cornerstone of long-term financial planning, especially useful for navigating market cycles.

Q3. How does inflation affect my home loan EMIs?

Answer: The impact depends on whether your home loan has a fixed or floating interest rate. If you have a fixed-rate home loan, your EMI (Equated Monthly Instalment) remains unchanged throughout the loan tenure, regardless of inflation or changes in market interest rates. In a high inflation scenario, this benefits you as a borrower because you are repaying the loan with money that is losing purchasing power. If you have a floating-rate home loan, your interest rate is linked to a benchmark rate (like the RBI’s repo rate). To control high inflation, the RBI often increases the repo rate. When this happens, your bank will likely increase your floating home loan rate, leading to a higher EMI or a longer loan tenure. Always check your loan agreement to understand the terms.

Q4. Is keeping cash at home a good idea during inflation?

Answer: No, keeping large amounts of physical cash at home (or even in a standard savings account) is generally a poor strategy during periods of significant inflation. Cash loses purchasing power every day that inflation persists. While you need some easily accessible money for immediate needs and emergencies (your emergency fund), holding excess cash means its real value is steadily decreasing. It’s far better to keep only necessary liquidity accessible and invest the rest in assets that have the potential to grow faster than the inflation rate, such as equities, mutual funds, or other appropriate investments based on your risk profile.

Q5. How often should I review my financial plan due to inflation?

Answer: During periods of stable, low inflation, an annual review of your financial plan might suffice. However, when inflation is high or volatile, more frequent reviews are advisable – perhaps semi-annually or even quarterly. This allows you to assess the impact of rising prices on your budget, the real returns on your investments, and the progress towards your financial goals. You should re-evaluate if your asset allocation is still appropriate, whether your savings rate needs adjustment, and if your debt management strategy remains sound. Regularly reviewing and adjusting your wealth management strategies during inflation India ensures your plan stays relevant and effective in a changing economic landscape.