How do I structure equity distribution when taking on investors?

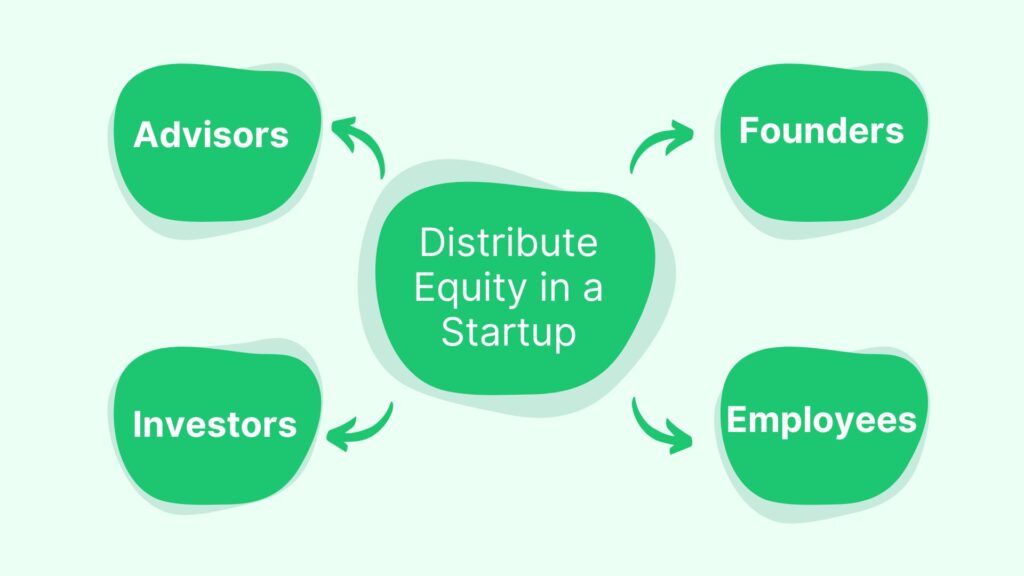

Introduction: Navigating Equity Distribution for Investors in Your Indian Startup

So, you’ve captured the interest of investors for your Indian startup – a huge milestone! Congratulations! But securing interest is just the beginning. Now comes one of the most critical steps in your entrepreneurial journey: deciding how to share ownership, or structure the equity distribution for investors. This isn’t just about giving away a piece of your company; it’s about setting the foundation for future growth, maintaining appropriate founder control, and ensuring you can attract further investment down the line. Getting this structure right from the outset is vital, as missteps in equity distribution for investors in India can be incredibly costly, hard to fix later, and potentially sour relationships.

This guide is designed specifically for Indian entrepreneurs, small business owners, and even salaried individuals considering founding a startup or making early-stage investments. We’ll walk you through the essentials of equity distribution for investors, covering the basic concepts like equity and valuation, exploring common methods used in the Indian market, discussing key strategies for negotiation, and outlining the crucial legal considerations. Understanding these elements will empower you to make informed decisions when bringing investors on board.

Understanding the Fundamentals: Equity, Valuation, and Dilution in India

Before diving into specific methods, it’s essential to grasp the core concepts that underpin any discussion about sharing ownership. These fundamentals dictate how much of your company investors receive for their capital and how your own stake changes over time. Without a clear understanding of equity, valuation, and dilution, navigating investor negotiations becomes significantly more challenging. This foundational knowledge is key to effectively structuring equity distribution models India relies upon.

What Exactly is Equity? Why Do Investors Seek It?

At its heart, equity represents ownership in a company. When you give equity to investors, you are essentially selling them a percentage stake in your business. For investors, acquiring equity isn’t just about owning a piece of paper; it’s their primary mechanism for achieving a return on investment (ROI). They contribute capital hoping the company’s value will significantly increase over time, allowing them to sell their stake for a substantial profit during an “exit” event (like an acquisition or IPO). Beyond financial returns, equity can sometimes grant investors influence over company decisions, depending on the type and amount of equity they hold. Startups typically issue two main types of shares: equity shares (also known as common shares), which founders usually hold, and preference shares, often preferred by investors due to specific rights attached, which we’ll explore later.

The Crucial Role of Valuation in Equity Distribution for Investors

Valuation is arguably the most critical factor in determining equity distribution for investors. It’s the process of determining the economic worth of your company. In the context of fundraising, two terms are crucial: Pre-Money Valuation and Post-Money Valuation. The Pre-Money Valuation is what your company is deemed to be worth before the investment comes in. The Post-Money Valuation is the Pre-Money Valuation plus the amount of investment raised. This Post-Money figure is then used to calculate the percentage of equity the new investors will receive.

- Example:

- Your startup is valued at ₹4 Crore (Pre-Money Valuation).

- An investor agrees to invest ₹1 Crore.

- The Post-Money Valuation is ₹4 Crore + ₹1 Crore = ₹5 Crore.

- The investor’s equity stake = (Investment Amount / Post-Money Valuation) * 100

- Investor’s equity = (₹1 Crore / ₹5 Crore) * 100 = 20%.

Clearly, a higher valuation means you give away less equity for the same amount of investment, while a lower valuation means you give away more. Negotiating valuation is therefore central to the entire process of structuring equity distribution models India uses for startups.

Understanding Dilution: What Happens to Your Stake?

Dilution is a natural consequence of issuing new equity. When your company issues new shares to investors (or employees via ESOPs), the total number of shares increases. While the value of your existing shares might not decrease (and hopefully increases due to the new investment and growth), your percentage of ownership in the company inevitably goes down. For instance, if you owned 100% of 10,000 shares, and you issue 2,500 new shares to an investor (based on the valuation example above, giving them 20%), you still own 10,000 shares, but now there are 12,500 total shares. Your ownership percentage drops from 100% to (10,000 / 12,500) * 100 = 80%. Founders must anticipate dilution across multiple funding rounds and plan strategically to retain sufficient ownership and control over the long term. Managing dilution effectively is a key aspect of sustainable growth. Learn more about Managing Cash Flow Effectively During Tax Season, crucial for startups planning for sustainable growth.

Common Equity Distribution Methods for Investors in India

Once you understand the basics, the next step is choosing the right method for bringing investors into your company’s capital structure. Several equity distribution methods for investors in India are commonly used, each with its own set of advantages, disadvantages, and typical use cases. The choice often depends on the stage of your startup, the amount of funding being raised, and the complexity of agreeing on a valuation at that specific point in time. Understanding these options helps in figuring out how to structure equity for investors India based startups.

Direct Equity Issuance (Equity Shares)

The most straightforward method is issuing equity shares (often referred to as common shares in global contexts, but typically just ‘equity shares’ under the Indian Companies Act) directly to investors in exchange for their capital. This happens after agreeing on a pre-money valuation. The number of shares issued is calculated based on the agreed valuation and investment amount, leading to immediate dilution for existing shareholders.

- Pros: Relatively simple structure; ownership percentages are clear from day one. Aligns investor and founder interests directly through shared ownership.

- Cons: Requires agreeing on a potentially difficult valuation early on. Results in immediate dilution of the founders’ stake. May involve more complex negotiations around investor rights attached to these shares initially.

- Relevance: Common in Series A and later funding rounds where the company has more traction and establishing a valuation is more feasible. It can also be used in seed rounds if valuation is agreed upon.

Convertible Instruments: Deferring Valuation Decisions

Early-stage startups often face challenges in agreeing on a concrete valuation. Convertible instruments provide a solution by allowing investment now while deferring the valuation discussion until a later, typically larger, funding round (often called a “priced round” or “qualified financing round”). Two popular types in India are:

- Convertible Notes (or Convertible Debentures): This is essentially short-term debt that automatically converts into equity at a future qualified financing round. Key terms include:

- Interest Rate: The note accrues interest, which may also convert into equity.

- Valuation Cap: A maximum valuation at which the note converts, protecting the early investor if the next round valuation is very high.

- Discount Rate: A percentage discount on the valuation of the next round, rewarding the early investor for taking risk sooner. The investor gets equity as if they invested at a lower valuation.

- SAFE Notes (Simple Agreement for Future Equity): Popularized by Y Combinator, SAFEs are not debt instruments (they don’t typically accrue interest or have a maturity date). They are agreements that promise the investor equity in the future upon certain trigger events (like a priced round), often with a valuation cap and/or discount, similar to convertible notes.

- Pros: Faster execution compared to priced rounds; postpones difficult valuation talks; offers investors downside protection (cap) and upside reward (discount).

- Cons: Can create complexity in the cap table later; terms like caps and discounts still require negotiation; investors technically don’t have equity rights until conversion. Learning how to structure equity for investors India using these instruments requires careful legal drafting. Consider consulting the Legal and Compliance Checklist for NRIs Registering a Business in India for more insights.

- Relevance: Very common in seed, pre-seed, and bridge funding rounds where valuation is uncertain or speed is critical.

Preference Shares vs. Equity Shares: Understanding the Rights

When investors, particularly Venture Capital funds, invest directly for equity (or when convertible instruments convert), they often receive Preference Shares rather than standard Equity Shares held by founders. Preference shares come with specific rights designed to protect the investor’s capital and ensure certain returns, aligning with common Indian investors equity distribution guidelines seen in term sheets. Understanding these differences is crucial:

| Feature | Equity Shares (Common Shares) | Preference Shares |

|---|---|---|

| Liquidation Pref. | Paid after all liabilities and preference shareholders. | Paid before equity shareholders in an exit (sale/winding up), often getting back 1x (or more) their investment. |

| Dividend Pref. | Receive dividends only if declared, after preference holders. | May carry a right to a fixed cumulative or non-cumulative dividend, paid before equity shareholders. |

| Participation Rights | Participate in remaining proceeds after preference payout. | Participating: Get preference payout + share in remaining proceeds. Non-participating: Get only preference payout. |

| Voting Rights | Typically carry standard voting rights on all matters. | Usually have limited voting rights, often only on matters affecting their specific rights or as defined in the SHA. |

| Conversion Rights | N/A | Often convertible into equity shares, sometimes automatically upon IPO or optionally by the holder. |

Negotiating the terms of preference shares (especially liquidation preference and participation rights) is a significant part of the equity distribution for investors process in priced rounds.

Key Equity Distribution Strategies for Indian Startups

Structuring equity isn’t just about the method but also about the strategy. How much equity should you give away? How do you protect the company and motivate key people? These strategic decisions are core to successful fundraising and building a sustainable business. Applying thoughtful equity distribution strategies for Indian startups can significantly impact your long-term success and control.

How Much Equity Should You Give Away?

This is often the first question founders ask, but there’s no magic number. The percentage of equity given to investors depends heavily on several factors:

- Funding Stage: Early rounds (Seed) typically see higher percentages given away (e.g., 15-25%) compared to later rounds (Series B, C) where valuations are higher and percentages might be lower (e.g., 10-20%), though the absolute investment is larger.

- Amount Raised: Raising a larger amount will generally require giving up more equity, assuming valuation remains constant.

- Business Traction & Valuation: A startup with strong revenue, user growth, and a solid team can command a higher valuation, thus giving away less equity for the same investment amount.

- Market Standards: While varying, there are general benchmarks in the Indian startup ecosystem for different stages, which experienced investors and advisors are aware of.

- Future Funding Needs: Founders need to consider how much equity they might need to give away in subsequent rounds to avoid excessive dilution over time.

It’s crucial to research comparable deals, understand your leverage in negotiations, and focus on securing a fair valuation that reflects your company’s potential while leaving enough equity for founders and future needs. Preparation for this stage can be aided by reviewing the Essential Steps to Start a Business Startup in India.

Implementing Vesting Schedules for Founders and Early Team Members

Investors need assurance that the founding team is committed for the long haul. Vesting is the mechanism that ensures this. Instead of owning their shares outright from day one, founders and key employees “earn” their equity over a set period. A typical vesting schedule in India (and globally) is:

- 4-year vesting period: Shares are earned gradually over four years.

- 1-year cliff: No shares vest for the first year. If the founder leaves before the cliff, they get nothing. On the first anniversary, 25% of their shares vest at once.

- Monthly or Quarterly Vesting: After the cliff, the remaining shares vest in equal installments each month or quarter for the next three years.

Vesting protects the company and investors. If a founder leaves early, the unvested shares return to the company treasury (or ESOP pool), preventing significant equity from walking out the door and ensuring it can be used to incentivize replacements or reward remaining team members. It’s a standard requirement in almost all venture-backed deals.

Carving Out an Employee Stock Option Pool (ESOP)

Attracting and retaining top talent is critical for startup success, but early-stage companies often can’t compete with large corporations on salary alone. An Employee Stock Option Pool (ESOP) helps bridge this gap. An ESOP is a certain percentage of the company’s equity set aside for granting stock options to employees, advisors, and future hires.

- Creation: The ESOP pool is typically created before the new investment round closes, meaning its dilutive effect is shared by both existing shareholders (founders) and the new investors. This is often a point of negotiation (pre-money vs. post-money ESOP creation).

- Size: ESOP pool sizes commonly range from 10% to 20% of the company’s total equity, depending on the stage and hiring plans.

- Importance: Investors see a well-structured ESOP as essential for building a strong team and aligning employee incentives with company growth.

Properly planning the ESOP size is a crucial part of the overall equity distribution strategies for Indian startups.

Negotiating Investor Rights and Control

Beyond the equity percentage, investors (especially VC funds investing via preference shares) will negotiate for specific rights and controls to protect their investment. Common rights include:

- Board Seats/Observer Rights: The right to appoint a director to the company’s board or have a non-voting observer attend board meetings.

- Protective Provisions: Veto rights on major company decisions, such as selling the company, issuing new shares senior to theirs, taking on significant debt, changing the business scope, or amending governing documents.

- Information Rights: The right to receive regular financial statements, budgets, and other key company information.

- Pro-Rata Rights: The right (but not obligation) to maintain their percentage ownership by investing in future funding rounds.

- Anti-Dilution Protection: Adjustments to their share price if the company issues shares at a lower valuation in the future (more on this later).

Founders need to carefully negotiate these rights, balancing the investors’ legitimate need for protection with the founders’ need for operational flexibility and control over day-to-day decisions.

Legal Framework and Documentation: Getting it Right in India

Structuring equity distribution for investors in India isn’t just about negotiation; it involves formal legal documentation and compliance with Indian laws, primarily the Companies Act, 2013. Getting this wrong can lead to disputes, regulatory penalties, and difficulties in future fundraising. Ensuring all agreements are legally sound and properly filed is paramount.

The Term Sheet: Outlining the Deal

The Term Sheet is typically the first document exchanged after initial agreement. It’s a non-binding summary outlining the key terms and conditions of the proposed investment. While mostly non-binding (except for clauses like confidentiality and exclusivity), it forms the basis for the definitive legal agreements. Key elements related to equity distribution covered in a term sheet include:

- Investment Amount

- Pre-Money Valuation

- Type of Shares (Equity or Preference)

- Key Preference Share Rights (Liquidation Preference, Dividends, etc.)

- Vesting Schedules for Founders

- ESOP Pool Size and Creation Timing

- Investor Rights (Board Seats, Protective Provisions, etc.)

- Conditions Precedent to Closing

A clear and comprehensive term sheet minimizes misunderstandings later in the process.

The Shareholders’ Agreement (SHA): The Binding Contract

The Shareholders’ Agreement (SHA) is the definitive, legally binding contract that governs the relationship between the shareholders (founders, investors, and potentially others) and the company. It details the rights, responsibilities, and obligations of each party and is a critical document for executing equity distribution methods for investors in India. Key clauses impacting equity include:

- Share Issuance: Formalizes the issuance of shares to the new investor.

- Transfer Restrictions: Rules on how and when shareholders can sell their shares, often including:

- Right of First Refusal (ROFR): Existing shareholders get the first option to buy shares before they are offered to outsiders.

- Right of First Offer (ROFO): A shareholder must offer shares to existing shareholders before seeking external buyers.

- Tag-Along Rights: Protects minority shareholders; if a majority shareholder sells their stake, minority holders have the right to join the sale on the same terms.

- Drag-Along Rights: Protects majority shareholders/investors; if a certain majority agrees to sell the company, they can force the remaining minority shareholders to sell their shares on the same terms.

- Anti-Dilution Protection: Protects investors if the company later issues shares at a lower price (“down round”). Common types include:

- Full Ratchet: Investor’s conversion price is repriced to the new, lower price (very founder-unfriendly).

- Weighted Average: Adjusts the conversion price based on a formula considering the number and price of new shares issued (more common and fairer).

Drafting and negotiating the SHA requires careful legal expertise.

Compliance under the Companies Act, 2013

Issuing shares to investors in India must comply with the Companies Act, 2013, and associated rules. Key compliance aspects include:

- Private Placement (Section 42): If issuing shares to a select group of persons (up to 200 in a financial year), specific procedures must be followed, including issuing a private placement offer letter, using separate bank accounts, and filing relevant forms (like PAS-3 for allotment of shares) with the Registrar of Companies (RoC).

- Valuation Report: Often, a valuation report from a registered valuer is required, especially for certain types of share issuance or conversions.

- Board and Shareholder Resolutions: Proper board meetings and shareholder meetings must be held, and resolutions passed to approve the share issuance, amend the Articles of Association (if needed), and adopt the SHA.

- Filings with RoC: Various forms need to be filed with the RoC through the Ministry of Corporate Affairs (MCA) portal within stipulated timelines.

Failure to comply can render the share issuance invalid and attract penalties. Given the complexities, seeking professional guidance is highly recommended. TaxRobo offers expert assistance with TaxRobo Company Registration and Legal Services ensuring full compliance.

Considerations for Foreign Investment (FDI)

If your investors are based outside India, you must also comply with the Foreign Exchange Management Act (FEMA) regulations regarding Foreign Direct Investment (FDI). Key considerations include:

- Sectoral Caps and Routes: Ensure your business sector allows FDI and whether it falls under the automatic route or requires government approval.

- Pricing Guidelines: FEMA stipulates minimum pricing for issuing shares to non-residents, often linked to fair valuation certified by authorized professionals.

- Reporting Requirements: Specific forms (like Form FC-GPR) must be filed with the Reserve Bank of India (RBI) through authorized dealer banks within set timelines after receiving funds and issuing shares. You can find more information on the Reserve Bank of India – FEMA section of the RBI website.

FDI compliance adds another layer of complexity. Engaging experts familiar with FEMA, like those at TaxRobo’s Startup Advisory Service, is crucial to avoid violations.

Conclusion: Strategically Planning Your Equity Distribution for Investors

Structuring equity distribution for investors is far more than just a financial transaction; it’s a strategic process that shapes your company’s future. From understanding the fundamental interplay of valuation and dilution, choosing the appropriate equity instruments like direct equity or convertibles, implementing vesting schedules and ESOPs to attract and retain talent, to meticulously navigating the legal landscape through term sheets, SHAs, and regulatory compliance – every element is interconnected. Successfully managing this process requires careful thought, foresight, and often, expert guidance.

The key takeaway is that thoughtful planning, a clear understanding of Indian investors equity distribution guidelines, and strict adherence to legal requirements under the Companies Act and FEMA (if applicable) are absolutely non-negotiable. This diligence forms the bedrock of a healthy founder-investor relationship, protects your interests, and positions your startup for sustainable growth and future funding success. Making informed decisions today about equity distribution for investors will pay dividends for years to come.

Don’t navigate the complexities of valuation, legal documentation like SHAs and Term Sheets, RoC filings, and strategic equity planning alone. TaxRobo’s team of experts specializes in supporting Indian startups. We can provide tailored advice and hands-on assistance to ensure your fundraising process is smooth, compliant, and strategically sound. Contact us today through TaxRobo’s Startup Advisory Service or explore our comprehensive TaxRobo Company Registration and Legal Services.

Disclaimer: This blog post is intended for informational purposes only and does not constitute legal, financial, or professional advice. Equity structuring involves complex legal and financial considerations specific to each situation. You should consult with qualified legal and financial professionals before making any decisions regarding equity distribution or fundraising.

Frequently Asked Questions (FAQs)

Q1: How much equity should a founder give away in the first funding round in India?

Answer: There’s no fixed percentage, as it varies significantly based on factors like the startup’s stage (pre-seed, seed), the amount of capital being raised, the agreed-upon valuation, the strength of the team and traction, and prevailing market conditions. Typically, for a seed round in India, founders might give away anywhere from 10% to 25% equity. However, this is just a general range. The final percentage is a result of negotiation. It’s crucial to focus on achieving a fair valuation and securing enough capital for your milestones while retaining sufficient ownership for future rounds and motivation. Getting expert advice during negotiation is highly recommended.

Q2: What is the difference between pre-money and post-money valuation?

Answer: Pre-money valuation is the value of your company before any new investment is added. Post-money valuation is the value of your company immediately after the investment is made. The formula is simple: Post-Money Valuation = Pre-Money Valuation + Investment Amount. The post-money valuation is critical because it’s used to calculate the percentage stake the new investor receives. For example, if a company has a pre-money valuation of ₹8 Crore and raises ₹2 Crore, its post-money valuation is ₹10 Crore. The investor who put in ₹2 Crore would receive (₹2 Crore / ₹10 Crore) * 100 = 20% equity.

Q3: Do I absolutely need a lawyer for equity distribution for investors?

Answer: While technically not mandated by law for every single step, it is highly recommended to engage experienced legal counsel when dealing with equity distribution for investors. Agreements like the Term Sheet (even if largely non-binding) and especially the Shareholders’ Agreement (SHA) are complex legal documents with long-term consequences. Lawyers ensure these documents accurately reflect the agreed terms, protect your interests, comply with the Companies Act, 2013, and other relevant regulations (like FEMA for foreign investment), and minimize the risk of future disputes. Mistakes in legal documentation can be incredibly costly and detrimental to your company.

Q4: How can founders minimize dilution over time?

Answer: Dilution across multiple funding rounds is almost inevitable for high-growth startups. However, founders can employ strategies to manage and minimize it:

- Increase Valuation Between Rounds: Focus on achieving significant milestones (revenue growth, user acquisition, product development) to justify higher valuations in subsequent funding rounds.

- Negotiate Terms Carefully: Besides valuation, negotiate other terms like the size of the ESOP pool (and whether it’s created pre or post-money) and anti-dilution clauses (aim for weighted average over full ratchet).

- Raise Appropriate Capital: Avoid raising more money than needed at lower valuations. Sometimes, achieving profitability or exploring non-dilutive funding options (like venture debt or grants) can delay or reduce the need for equity financing.

- Efficient ESOP Management: Grant options strategically and ensure vesting schedules are in place to recycle unvested equity if employees leave.

Q5: Are SAFE notes legally recognized and commonly used in India?

Answer: Yes, SAFE notes (Simple Agreement for Future Equity), along with Convertible Notes (or Convertible Debentures), are increasingly common instruments used for early-stage fundraising in India, particularly for seed and bridge rounds. They offer speed and defer valuation discussions. While the concept of SAFEs originated in the US, they are being adapted and used in India. However, it’s crucial that these agreements are drafted carefully by lawyers familiar with Indian contract law and the Companies Act, 2013 to ensure their terms (like conversion triggers, valuation caps, discounts) are clearly defined and legally enforceable within the Indian legal framework. Their exact structure might sometimes resemble convertible preference shares or debentures under Indian law to ensure compliance.