Section 101. Notice of meeting under the companies act 2013

Holding regular and properly conducted meetings is the cornerstone of effective corporate governance and decision-making for any company registered in India. Whether it’s an Annual General Meeting (AGM) under the companies act 2013 or an Extraordinary General Meeting (EGM), the process ensures transparency and allows shareholders to exercise their rights. Central to this process is the mechanism of informing stakeholders about an upcoming meeting, which is governed by Section 101 of the Companies Act, 2013. Understanding the intricacies of issuing a valid notice of meeting under companies act 2013 is not just a procedural formality; it’s a critical legal requirement. The importance of notice under companies act cannot be overstated, as failure to comply can render meetings and the resolutions passed therein invalid, potentially leading to disputes and legal challenges. This guide is specifically designed for directors, company secretaries, and importantly, shareholders (including small business owners and individuals holding shares) to navigate the companies act 2013 notice requirements. Our goal is to break down the rules, procedures, and best practices outlined in Section 101, ensuring your company meetings stand on solid legal ground.

Understanding Section 101: The Core of Meeting Notices

What is Section 101 of the Companies Act, 2013?

Section 101 of the Companies Act, 2013, lays down the fundamental framework for issuing a notice to call a general meeting of a company. Its primary objective is to ensure that all individuals entitled to attend the meeting are adequately informed well in advance, allowing them sufficient time to prepare and participate effectively. This section primarily governs the notices for General Meetings, which include Annual General Meetings (AGMs) and Extraordinary General Meetings (EGMs). While Board Meetings are governed by Section 173, which has its own notice requirements (typically 7 days), the underlying principle of proper intimation remains consistent across corporate governance practices. The basic mandate of Section 101 is clear: a general meeting can only be called by giving proper, legally compliant notice to every entitled person. This notice acts as the official communication channel, detailing when, where, and why the meeting is being convened, forming the very foundation upon which a valid meeting rests.

Why is a Proper Notice of Meeting under Companies Act 2013 Crucial?

Adhering strictly to the requirements for a notice of meeting under companies act 2013 is not merely about ticking a compliance box; it has profound implications for the company’s functioning and legal standing. Firstly, a correctly issued notice ensures the legal validity of the meeting itself and any resolutions passed during it. If the notice is defective (e.g., insufficient notice period, missing information, not sent to all entitled persons), the entire meeting can be challenged and potentially declared void. Secondly, it upholds the democratic rights of members and shareholders to be informed and participate in the company’s key decisions. Proper notice allows them time to understand the agenda, decide their stance, arrange representation (like appointing a proxy), and attend if they choose. Thirdly, it significantly prevents potential disputes and costly legal challenges from shareholders who might feel disenfranchised due to inadequate notice. Lastly, meticulous adherence to notice requirements reinforces good corporate governance, signalling transparency, accountability, and respect for shareholder rights. The importance of notice under companies act thus extends beyond mere procedure to the very legitimacy of corporate actions.

Who Must Receive the Meeting Notice?

The Companies Act, 2013 is specific about who is entitled to receive the notice for a general meeting. Ensuring the notice reaches all these individuals is a critical aspect of compliance. Failure to notify even one entitled person (unless it’s an accidental omission, discussed later) could potentially jeopardize the meeting’s validity. According to Section 101, the notice must be sent to:

- Every Member of the company: This primarily refers to the shareholders whose names appear in the Register of Members.

- Legal representative of any deceased member: If a member has passed away, their legal heir or representative is entitled to receive the notice.

- Assignee of an insolvent member: If a member has been declared insolvent, the official assignee or receiver appointed is entitled to the notice.

- The Auditor(s) of the company: The statutory auditors have the right to receive notice and attend general meetings.

- Every Director of the company: All directors, including independent and non-executive directors, must receive the notice.

Sending the notice to this complete list ensures that all key stakeholders are informed and have the opportunity to participate or be represented.

Essential Companies Act 2013 Notice Requirements

Notice Period: The 21 Clear Days Rule

One of the most fundamental companies act 2013 notice requirements pertains to the timing. Section 101(1) mandates that a general meeting may be called by giving not less than twenty-one clear days’ notice. The term “clear days” is crucial here. It means that the day on which the notice is sent and the day of the meeting itself are excluded from this calculation. For example, if a notice is dispatched on the 1st of a month, the earliest day the meeting can be held is the 23rd of that month (giving 21 full days between the 1st and the 23rd). This period is designed to provide members sufficient time to review the agenda, make necessary arrangements, and decide on their participation or proxy appointment.

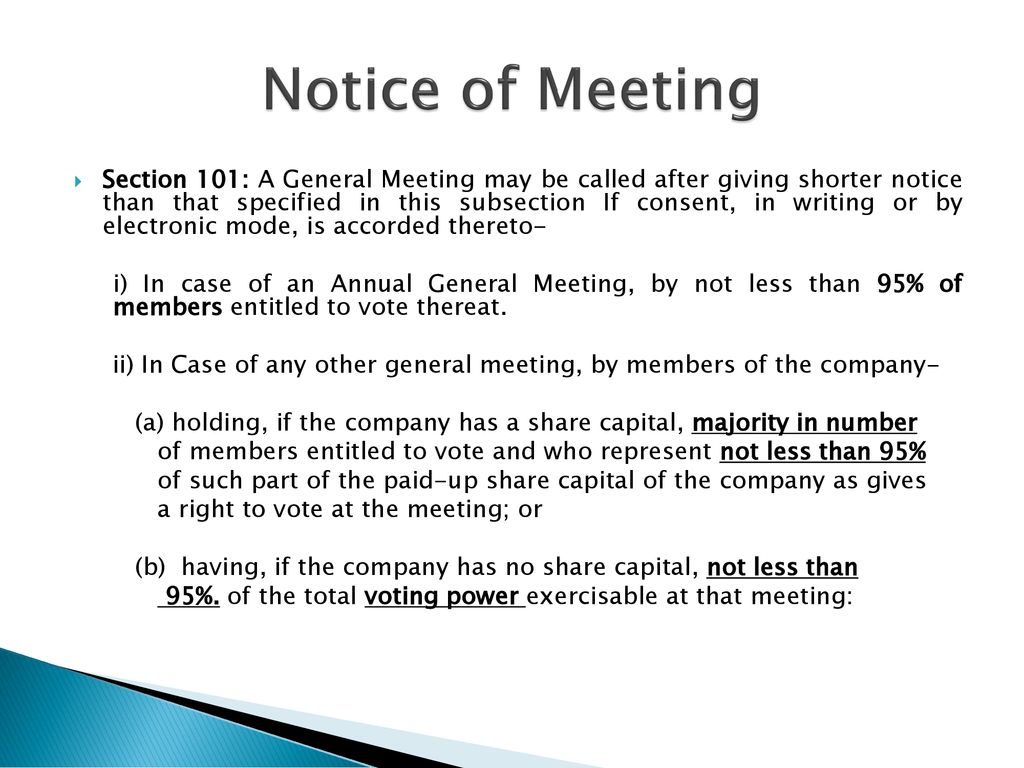

However, the Act does provide an exception for calling a meeting at shorter notice. A general meeting can be convened with less than 21 clear days’ notice if consent is obtained beforehand. For an Annual General Meeting (AGM), consent must be given by not less than 95% of the members entitled to vote at the meeting. For any other general meeting (like an EGM), consent is required from members holding a majority in number and representing at least 95% of the paid-up share capital carrying voting rights (or 95% of total voting power if the company has no share capital). Obtaining this consent must be properly documented.

Mode of Sending: Permitted Methods for Notice of Meeting India

The Companies Act, 2013, along with the Companies (Management and Administration) Rules, 2014, specifies the permissible methods for dispatching the notice of meeting India. These companies act meeting notice guidelines aim to ensure reliable delivery while embracing modern communication. The allowed modes include:

- By Post: Sending the notice through regular postal services (Ordinary Post) or via Registered Post or Speed Post to the registered address of the member/director/auditor as recorded with the company or its depository participant. Proof of posting is crucial here.

- Through Electronic Means: This is a widely used and encouraged method. Notice can be sent via email to the email address registered by the member/director/auditor with the company or depository. Key conditions under Rule 18 of the Companies (Management and Administration) Rules, 2014 include:

- The company must provide an opportunity for members to register their email addresses.

- The notice must be sent from the company’s official email address.

- The subject line should clearly state the company’s name, meeting type (AGM/EGM), and date.

- The company must maintain proof of sending emails (e.g., system logs) and ensure non-delivery reports are handled appropriately.

- Members should have the option to request a physical copy.

- Other Methods (Potentially): While post and email are standard, the Act allows for delivery by “any other mode as may be prescribed.” Sometimes, Articles of Association (AoA) might permit hand-delivery or courier, but compliance with the Act and Rules is paramount. Relying solely on post and electronic means is generally the safest approach.

Choosing the appropriate mode depends on the company’s infrastructure, member preferences (especially regarding electronic communication consent), and the need for verifiable proof of dispatch.

Mandatory Contents: Notice Preparation Under Companies Act 2013

Effective notice preparation under companies act 2013 requires including specific, essential information to ensure clarity and legal compliance. A vague or incomplete notice can be deemed invalid. Every notice calling a general meeting must clearly state:

- The Day, Date, and Time of the Meeting: This must be precise (e.g., “Thursday, 15th August 2024 at 11:00 AM IST”).

- The Full Address of the Venue: The complete postal address of the place where the meeting will be held needs to be mentioned. Ambiguity must be avoided. For virtual or hybrid meetings, clear instructions for joining electronically must be provided.

- Agenda: Statement of the Business to be Transacted: This is the core purpose of the notice. It must list all items of business that will be discussed and voted upon at the meeting. This allows members to understand what decisions will be made.

Beyond these absolute essentials, practical considerations often lead to including additional information like notes regarding proxy appointments, requirements for admission to the meeting hall (attendance slip), route maps (for physical meetings), information on e-voting procedures, and relevant contact details for queries.

Differentiating Business: Ordinary vs. Special

The Companies Act categorizes the business transacted at general meetings into two types: Ordinary Business and Special Business. Understanding this distinction is vital because it impacts the level of detail required in the notice.

- Ordinary Business: This typically relates to routine matters usually dealt with at an Annual General Meeting (AGM). As defined in Section 102(2)(a), Ordinary Business comprises:

- Consideration of financial statements, board reports, and auditor reports.

- Declaration of any dividend.

- Appointment of directors in place of those retiring.

- Appointment of, and fixing the remuneration of, the auditors.

- Special Business: Any business transacted at an Extraordinary General Meeting (EGM) is considered Special Business. Additionally, any business transacted at an AGM, other than the four items classified as Ordinary Business, is also deemed Special Business (Section 102(2)(b)). Examples include altering the Memorandum or Articles of Association, approving related party transactions, issuing shares via private placement, appointing a managing director, etc.

The crucial difference lies in the disclosure requirement. For all items of Special Business, Section 102(1) mandates that an Explanatory Statement must be annexed to the notice. This statement must set out all material facts concerning each item of special business, including the nature of concern or interest (financial or otherwise), if any, of every director, manager, key managerial personnel, and their relatives. This ensures members have sufficient information to make an informed decision on non-routine matters. The legal notice meeting companies act requirements are particularly stringent for special business due to its potential impact on the company and its shareholders.

Practical Steps & Compliance with Companies Act 2013

Drafting the Notice: Key Considerations

Crafting a legally sound and clear meeting notice is essential for ensuring compliance with companies act 2013. Sloppy drafting can lead to confusion or even legal challenges. Here are key best practices and considerations during notice preparation under companies act 2013:

- Clarity and Unambiguous Language: Use simple, precise language. Avoid jargon where possible or explain technical terms clearly. Ensure dates, times, and venue details are unmistakable.

- Inclusion of All Mandatory Details: Double-check that the day, date, time, full venue address, and a clear statement of the business (agenda) are included, as required by Section 101.

- Agenda Specificity: List each item of business distinctly. For Special Business, ensure a comprehensive Explanatory Statement as per Section 102 is attached, detailing material facts and interests.

- Proper Authorization: The notice should be issued under the authority of the Board of Directors. Usually, a Board resolution authorizes the company secretary or another designated officer to issue the notice. The notice should state it is being issued “By Order of the Board.”

- Inclusion of Standard Notes: Incorporate necessary statutory and practical notes, such as:

- A statement that a member entitled to attend and vote is entitled to appoint a proxy.

- Details on proxy form submission deadlines and procedures.

- Information regarding electronic voting, if applicable.

- Instructions for members holding shares in electronic form.

- An attendance slip and potentially a route map for physical meetings.

- The cut-off date for determining member eligibility for voting.

- Review and Verification: Before dispatch, have the notice reviewed for accuracy, completeness, and compliance by a qualified person (e.g., Company Secretary, legal counsel).

Dispatch and Proof of Sending

Timeliness and documentation are critical after drafting the notice. The notice must be dispatched sufficiently in advance to meet the 21 clear days requirement (or the shorter period if consented). Calculate the dispatch deadline carefully, considering weekends and postal delivery times if using physical mail.

Equally important is maintaining irrefutable proof of sending. This documentation is vital evidence for compliance with companies act 2013 should any disputes arise regarding the notice’s dispatch. Recommended practices include:

- For Postal Mail: Keep copies of the notice sent, maintain a list of recipients with addresses, and retain postal receipts (Registered Post/Speed Post tracking slips, proof of bulk posting for ordinary mail).

- For Electronic Mail: Retain system logs showing successful transmission to registered email addresses. Store copies of the emails sent and manage any bounce-back or delivery failure reports diligently. Consider using email platforms that provide delivery reports.

- Master Record: Maintain a consolidated record documenting the date of dispatch, mode of dispatch for each recipient, and the corresponding proof.

This meticulous record-keeping safeguards the company by demonstrating adherence to the procedural requirements of Section 101.

Accidental Omission & Non-Receipt

What happens if, despite best efforts, a notice isn’t sent to or received by a member? Section 101(4) provides some relief. It states that any accidental omission to give notice to, or the non-receipt of such notice by, any member or other person entitled to such notice shall not invalidate the proceedings of the meeting.

The key word here is “accidental.” If the omission was unintentional, perhaps due to a clerical error or an unforeseen issue with the postal or email system, the validity of the meeting generally remains intact. However, if the omission was deliberate or if the failure to send notices was widespread and systemic, it could certainly be grounds for challenging the meeting’s validity. Similarly, non-receipt by a member (e.g., due to postal delay or email filtering) typically doesn’t invalidate the meeting, provided the company can prove it dispatched the notice correctly according to the prescribed mode and timeline. Companies should, however, investigate non-delivery reports (especially for emails) and take corrective action where possible.

Common Pitfalls and Consequences

What Happens If the Notice is Defective?

Failing to comply with the requirements of Section 101 regarding the notice of meeting can lead to serious repercussions for the company and its management. A defective notice (e.g., shorter notice period without proper consent, missing mandatory information, failure to attach the explanatory statement for special business, not sent to all entitled persons) can result in:

- Meeting Declared Invalid: Aggrieved members or even regulatory authorities can challenge the validity of the meeting itself. If a court or tribunal finds the notice materially defective, the entire meeting could be declared null and void.

- Resolutions Rendered Void: Consequently, any resolutions passed at such an invalid meeting would also be void and unenforceable. This can halt critical business decisions, financing arrangements, or structural changes.

- Potential Penalties: Section 101 doesn’t specify a direct penalty for defective notice itself, but non-compliance with provisions related to meetings can attract penalties under other sections of the Act (e.g., Section 117 for failure to file certain resolutions, or general penalty under Section 450) for the company and “officers in default” (which can include directors and key managerial personnel).

- Legal Challenges and Costs: Shareholders might initiate legal proceedings, leading to significant legal expenses, management time diversion, and reputational damage for the company.

Ensuring the notice is meticulously prepared and dispatched is therefore not just about procedure, but about mitigating substantial legal and financial risks.

Importance of Consistency Across Meeting Types

While Section 101 specifically details the requirements for notices of General Meetings (AGM/EGM), the underlying principle of providing adequate, clear, and timely notice is a fundamental tenet of good corporate governance applicable to all formal company meetings. Section 173 governs the notice requirements for Board Meetings (generally requiring 7 days’ notice), and specific rules might apply to committee meetings. Maintaining consistency in adhering to notice requirements – ensuring clarity, completeness, proper authorization, and timely dispatch – across all types of meetings demonstrates a commitment to procedural fairness and transparency. This consistency helps build trust among stakeholders, including directors, shareholders, and auditors, and strengthens the overall governance framework of the company. It ensures that all participants are well-informed and can contribute effectively, regardless of the meeting type.

Leveraging Technology: Electronic Notices

Rules and Benefits of E-Notices

The Companies Act, 2013, and associated rules actively encourage the use of electronic means for communication, including sending meeting notices. As mentioned earlier, Rule 18 of the Companies (Management and Administration) Rules, 2014, facilitates sending notice of meeting India via email. Key rules include obtaining member consent (implied if they’ve registered an email ID for receiving such communications), using the company’s official email, providing clear subject lines, and maintaining proof of delivery.

Leveraging electronic notices offers significant advantages, especially for modern businesses:

- Cost-Effectiveness: Reduces expenses associated with printing, paper, postage, and handling physical mail.

- Speed and Efficiency: Email delivery is instantaneous, ensuring quicker dissemination compared to postal mail, which is particularly useful when timelines are tight.

- Environmental Friendliness: Contributes to sustainability goals by reducing paper consumption.

- Ease of Record-Keeping: Digital records of sent emails and delivery reports are often easier to store, manage, and retrieve compared to physical proofs of posting.

- Wider Reach: Can potentially reach members faster, irrespective of their geographical location, provided they have access to email.

Companies should establish robust systems for managing member email databases, handling consent, ensuring secure transmission, and tracking delivery to fully realize the benefits of e-notices while ensuring full compliance.

Conclusion

Navigating the requirements of Section 101 of the Companies Act, 2013 is essential for the lawful operation of any company in India. Issuing a proper notice of meeting under companies act 2013 is not a mere formality but a critical legal obligation that safeguards the validity of meetings and the decisions made therein. As we’ve discussed, this involves adhering strictly to the companies act 2013 notice requirements, including the 21 clear days’ rule (or obtaining consent for shorter notice), using permitted modes of sending like post or email, and ensuring the notice contains all mandatory information (day, date, time, venue, agenda) along with explanatory statements for special business. Meticulous notice preparation under companies act 2013 and maintaining proof of dispatch are vital components of good corporate governance and risk mitigation.

Failure to ensure compliance with companies act 2013 regarding meeting notices can lead to invalid meetings, void resolutions, potential penalties, and costly legal disputes. For small business owners, directors, and shareholders, understanding and implementing these rules is non-negotiable. The process, while detailed, is manageable with careful planning and execution.

Managing Companies Act compliance, including meeting procedures, can seem complex. If you need expert assistance with notice preparation under companies act 2013, ensuring overall compliance with companies act 2013, or require support with any other company secretarial services, TaxRobo is here to help. Contact TaxRobo today for reliable, professional, and tailored support to keep your business compliant and running smoothly. Let us handle the complexities so you can focus on growing your business.

FAQ Section

Frequently Asked Questions (FAQs)

- Q1: What is the minimum notice period for calling a General Meeting under Section 101?

Answer: Generally, a notice of not less than 21 clear days must be given before the date of the General Meeting. “Clear days” exclude the date the notice is sent and the date of the meeting. However, a meeting can be called with shorter notice if consent is obtained from members representing at least 95% of the voting power (for AGM) or a majority in number holding 95% of voting power (for EGM), as specified in the Act. - Q2: Can a meeting notice under companies act be sent only by email?

Answer: Yes, electronic means, primarily email, is a permitted mode for sending meeting notices under the Companies Act, 2013, and the Companies (Management and Administration) Rules, 2014. However, the company must comply with specific conditions, such as having the member’s registered email address (often implying consent), sending from an official ID, ensuring proper formatting, and maintaining proof of delivery. Physical modes like post remain valid alternatives. Companies should ideally offer members a choice or use methods ensuring receipt. - Q3: What are the consequences if a company fails to send a notice of meeting under companies act 2013 to a member?

Answer: Section 101(4) states that an accidental omission to give notice or non-receipt by a member does not invalidate the meeting proceedings. However, if the failure is deliberate, systemic, or affects a significant number of members, it could be grounds for declaring the meeting and its resolutions invalid. Consistent non-compliance can also attract penalties for the company and its officers under various provisions of the Act. - Q4: What essential details must be included in the notice?

Answer: Every notice for a general meeting must mandatorily specify:- The day of the week (e.g., Monday).

- The date (e.g., 25th September 2024).

- The time (e.g., 10:00 AM IST).

- The full address of the venue where the meeting will be held.

- A statement of the business (agenda) to be transacted at the meeting.

Furthermore, for any item of ‘Special Business’, an Explanatory Statement outlining material facts must be attached as per Section 102.

- Q5: Is compliance with companies act 2013 regarding meeting notices difficult for small businesses?

Answer: While the rules under Section 101 and related provisions are specific and require careful attention to detail, they are certainly manageable for small businesses. Key challenges might include maintaining updated member records (addresses, emails) and ensuring timely dispatch. However, using standardized templates, creating checklists for mandatory contents, maintaining meticulous records of dispatch, and leveraging electronic communication can simplify the process. Seeking professional guidance from experts like TaxRobo’s Company Secretarial Services can significantly ease the compliance burden and ensure accuracy.