Implications of Notification No. 22/2024 – Central Tax on Rectification of Demand Orders

Staying Updated: Why Understanding Tax Notifications Matters

India’s tax landscape is constantly evolving. New rules, clarifications, and notifications are regularly issued by authorities like the Central Board of Indirect Taxes and Customs (CBIC). For small business owners and even salaried individuals interacting with the Goods and Services Tax (GST) system, staying informed isn’t just good practice – it’s essential for compliance and financial health. Missing a key update can lead to confusion, penalties, or missed opportunities. Recently, Notification No. 22/2024 – Central Tax, dated 15th May 2024, was issued. While this specific notification primarily addresses the time limits for issuing certain types of demand orders, its issuance highlights the ongoing activity in tax administration and underscores the importance of understanding related processes, such as the rectification of demand orders India. This blog post aims to break down the key Notification No. 22/2024 implications and provide clarity on the crucial process of handling and potentially rectifying demand orders under Central Tax laws, a topic highly relevant for businesses navigating GST compliance.

Understanding Demand Orders under Central Tax

What is a Demand Order in the Context of GST/Central Tax?

A demand order under the Central Goods and Services Tax (CGST) Act, 2017, is essentially an official communication from the tax department requiring a taxpayer to pay tax that has not been paid, short paid, or erroneously refunded, along with applicable interest and penalties. Think of it as a formal notice stating that the department believes you owe more tax than what you’ve declared or paid. These orders are typically issued after a process involving scrutiny of returns, audits, or investigations, often preceded by a Show Cause Notice (SCN) asking the taxpayer to explain discrepancies. The primary legal basis for these orders often falls under Understanding Section 73 of the CGST Act: Handling GST Demand Notices Without Fraud (for cases not involving fraud, willful misstatement, or suppression of facts) or Section 74 of the CGST Act: Dealing with GST Demand Notices Involving Fraud (for cases where fraud, willful misstatement, or suppression of facts is alleged). For a small business owner, receiving a demand order can be concerning. Common scenarios include discrepancies found between sales reported in GSTR-1 and tax paid in GSTR-3B, claiming Input Tax Credit (ITC) that the department deems ineligible, calculation errors in tax liability, or failure to pay tax on certain supplies. Understanding the nature of the demand is the first step towards addressing it correctly.

Common Reasons for Receiving a Demand Order

Several situations can trigger the issuance of a demand order by the GST authorities. Being aware of these can help businesses maintain better compliance and potentially avoid receiving such notices. Some common triggers include:

- Calculation Errors: Simple arithmetic mistakes in calculating tax liability or ITC.

- Mismatch between Returns: Differences in data reported between GSTR-1 (outward supplies) and GSTR-3B (summary return and tax payment), or between GSTR-3B and GSTR-2A/2B (auto-populated inward supplies/ITC).

- Non-payment or Short Payment of Tax: Failing to pay the full tax liability due for a tax period.

- Incorrect Refund Claims: Claiming a refund of tax or accumulated ITC based on incorrect information or ineligible grounds.

- Input Tax Credit (ITC) Issues: Availing ITC which is ineligible according to GST law (e.g., blocked credits under Section 17(5), ITC claimed without satisfying conditions under Section 16, or credit claimed on invoices not reflected in GSTR-2B).

- Classification Errors: Applying the wrong HSN code or tax rate to goods or services supplied.

- Valuation Errors: Undervaluing supplies, thereby paying less tax than required.

Failing to address a demand order correctly and promptly can lead to significant demand orders tax implications India, including recovery proceedings, bank account attachment, and accrual of further interest and penalties. Therefore, understanding why an order might be issued is crucial for proactive compliance and risk management.

Decoding Notification No. 22/2024 – Central Tax

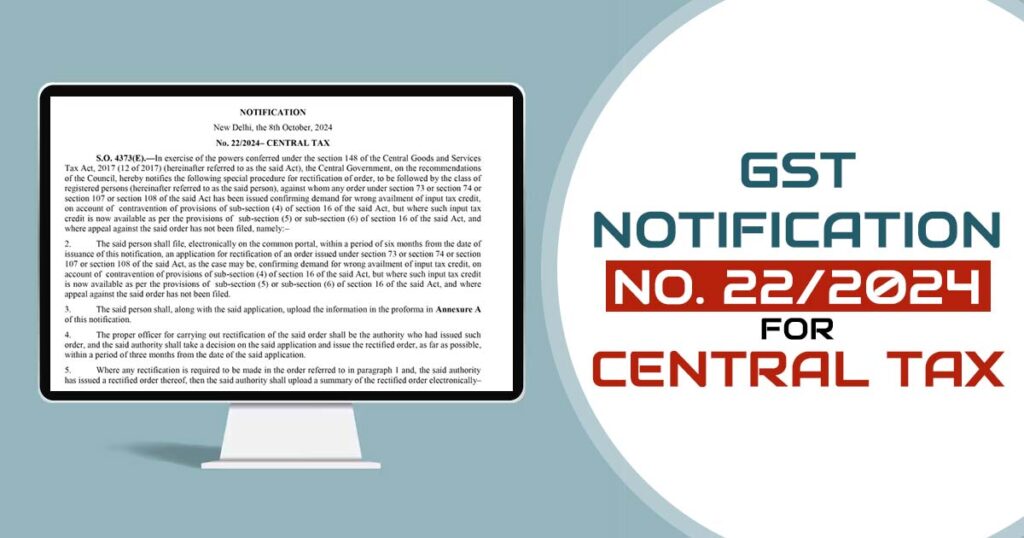

Overview of Notification No. 22/2024

Notification No. 22/2024 – Central Tax, issued by the CBIC on 15th May 2024, serves a specific purpose: it amends a previous notification (No. 14/2022-Central Tax) to further extend the time limits for tax officers to issue certain types of demand orders. Specifically, this notification extends the deadline for issuing orders under Section 73(10) of the CGST Act, which deals with demands for non-fraud cases (tax not paid, short paid, erroneously refunded, or ITC wrongly availed/utilized). The extension provided by Notification 22/2024 applies to the financial years 2018-19 and 2019-20. This Notification No. 22/2024 notification analysis reveals that its primary impact is on the timeline available to the tax department for concluding proceedings and issuing demand orders for these specific years, not directly on the procedure for rectifying existing orders.

You can access official notifications on the CBIC website: CBIC GST Notifications (Note: Search for Notification No. 22/2024-Central Tax dated 15/05/2024 specifically).

Key Provision Introduced: Extension of Time Limits for Issuance

The core change brought about by Notification No. 22/2024 is the modification of deadlines for issuing demand orders under Section 73 for specific financial years. Here’s a breakdown:

| Financial Year | Original Time Limit (under Sec 73(10)) | Extended Time Limit (Post Notfn 14/2022 & earlier extensions) | New Extended Time Limit (via Notfn 22/2024) |

|---|---|---|---|

| FY 2018-19 | 3 years from due date of Annual Return | 30th April 2024 | 31st August 2024 |

| FY 2019-20 | 3 years from due date of Annual Return | 31st August 2024 | 31st December 2024 |

Essentially, this notification grants the tax authorities additional time to complete their assessments and issue demand orders related to potential tax discrepancies for FY 2018-19 and FY 2019-20 in non-fraud cases. While it doesn’t alter the process of Central Tax notification rectification itself, it increases the window during which taxpayers might receive such orders for these older financial years. Understanding this extension is important for businesses as it means scrutiny for these periods remains open longer than initially anticipated.

Core Notification No. 22/2024 Implications for Rectification (and the Rectification Process Itself)

Understanding the Process for Rectifying Demand Orders (Crucial Given Extended Timelines)

While Notification 22/2024 primarily deals with the issuance timelines for demand orders under Section 73 for FY 2018-19 and FY 2019-20, its key implication is that more businesses might receive such orders within these extended deadlines. This makes understanding the existing process for rectification of demand orders India even more critical. Rectification is governed by Section 161 of the CGST Act, which allows the tax authority that issued an order (including a demand order) to correct any “error apparent on the face of the record”. This isn’t a mechanism for re-evaluating the entire case or considering new evidence; it’s strictly for correcting obvious mistakes. If a taxpayer identifies such an error in a demand order received, they can file an application (typically Form GST DRC-08, although procedures can vary) requesting rectification. Alternatively, the officer can initiate rectification suo motu (on their own). The implications for tax rectification India remain governed by Section 161, but the extended issuance timelines mean taxpayers need to be vigilant about reviewing any orders received for these older periods for potential rectifiable errors. The demand orders rectification 2024 procedures essentially follow the framework laid out in Section 161 and associated rules, unless specific procedural changes are notified separately.

Time Limits for Rectification: Any Changes?

Notification No. 22/2024 does not change the time limits associated with the rectification process itself under Section 161. The standard time limit for applying for rectification or for the officer to rectify an order suo motu generally remains three months from the date of the original order. However, the law allows for this period to be extended by the officer for a further period considered fit. It’s crucial for taxpayers who receive a demand order to note the date of the order and act quickly if they spot an error apparent on the face of the record. Missing the three-month window could mean losing the opportunity for a relatively simpler correction via rectification, potentially requiring a more complex appeal process instead. Given that Notification 22/2024 extends the issuance deadline for orders related to FY 18-19 and 19-20, taxpayers receiving such orders (potentially well into 2024) must be mindful of the separate, shorter timeline applicable for seeking rectification of any errors within those orders.

Scope of Rectification: What Errors Can Be Addressed?

The scope of rectification under Section 161 is specific: it only covers “errors apparent on the face of the record”. This term isn’t explicitly defined in the CGST Act but is generally understood through legal precedent to mean an error that is obvious and self-evident, not requiring detailed investigation, elaborate arguments, or interpretation of law. It should be a mistake that can be identified simply by looking at the record. Examples relevant to demand orders received by small businesses could include:

- Arithmetic errors: Mistakes in addition, subtraction, multiplication, or division used to calculate the tax, interest, or penalty demanded.

- Clerical errors: Typing mistakes, incorrect dates, or wrong references to sections or notifications (if the error is obvious from the context).

- Ignoring mandatory provisions: Overlooking a clear legal provision that directly impacts the calculation (though debatable points of law are typically outside rectification scope).

- Applying the wrong tax rate: If the correct rate is undisputed and clearly applicable based on the facts on record.

Notification No. 22/2024 does not alter this scope. Rectification cannot be used to debate interpretations of law, contest the applicability of a section based on new evidence, or challenge the officer’s judgment where multiple views are possible. It’s a tool for correcting clear, undeniable mistakes within the existing order and record. Understanding this limited scope is vital when considering whether rectification is the appropriate remedy for an issue identified in a demand order.

What Notification No. 22/2024 Means for You

Implications for Small Business Owners

For small business owners, the primary Notification No. 22/2024 implications stem from the extended deadlines for receiving Section 73 demand orders for FY 2018-19 and FY 2019-20. This means:

- Prolonged Scrutiny: The window for potential GST audits and investigations related to these financial years remains open longer (until Aug 31, 2024, for FY 18-19 and Dec 31, 2024, for FY 19-20).

- Record Keeping is Key: Maintaining meticulous records (invoices, returns, reconciliations) for these older periods is more crucial than ever, as they might be needed to respond to queries or orders.

- Increased Vigilance: Businesses should be prepared for potential notices or orders relating to these years and review them carefully upon receipt.

- Understanding Rectification: Knowing the process for rectification of demand orders India is vital. If an order received contains an obvious error, acting promptly within the 3-month rectification window (from the order date) can save time and potential litigation costs.

- Strategic Planning: Businesses should factor in the possibility of demands arising from these older periods into their financial planning and contingency measures.

These notification implications India highlight the need for continued diligence in GST compliance, even for past financial years. Businesses should ensure their internal processes are robust and seek professional advice if they receive any departmental communication.

Relevance for Salaried Individuals

For most salaried individuals who do not have a registered business or significant other income sources falling under GST, Notification No. 22/2024 typically has minimal direct impact. GST demand orders are primarily issued to registered taxpayers concerning their business activities. However, awareness can still be beneficial for a few reasons:

- General Financial Literacy: Understanding how tax administration works, including timelines and compliance processes, contributes to overall financial awareness.

- Potential Side Income: If a salaried individual has a side business (even unregistered, exceeding threshold limits) or significant rental income, they might theoretically fall under GST scrutiny, making such notifications potentially relevant.

- Future Applicability: Understanding concepts like demand orders and rectification might be useful if their financial situation changes in the future (e.g., starting a business).

Essentially, while the direct demand orders tax implications India from this notification are low for typical salaried employees, staying generally informed about significant Central Tax reforms India is always advisable.

Actionable Steps Upon Receiving a Demand Order (Post-Notification)

Receiving a demand order can be stressful. Regardless of whether it pertains to the extended timelines under Notification 22/2024 or other periods/sections, here’s a clear checklist of initial steps:

- Review Carefully: Read the entire demand order thoroughly. Understand the basis of the demand, the financial year(s) involved, the specific discrepancies alleged, and the amount of tax, interest, and penalty being demanded.

- Note Key Dates: Immediately note the Date of Issue of the order. This date is crucial for calculating deadlines for response, payment, appeal, or rectification.

- Identify Potential Errors: Scrutinize the order for any “errors apparent on the face of the record” (calculation mistakes, obvious clerical errors).

- Check Records: Compare the department’s claims against your own filed returns, books of accounts, invoices, and reconciliations for the relevant period.

- Understand Timelines & Procedures: Be aware of the deadlines. Typically, payment might be due within three months, the window for rectification application is usually three months, and the deadline for filing an appeal is also generally three months from the date of communication of the order. Confirm the exact procedures under the updated rules.

- Consult a Tax Professional: Do not ignore the order. If you are unsure about the validity of the demand, identify errors, or need help formulating a response or considering rectification/appeal, consult with a qualified tax professional immediately. Experts like TaxRobo can provide crucial guidance.

- Act Timely: Delaying action can lead to recovery proceedings and potentially higher

demand orders tax implications India. Ensure responses, applications, or appeals are filed well within the stipulated deadlines.

Key Takeaways on Notification No. 22/2024 Implications

To summarize the discussion on Notification No. 22/2024 implications:

- Primary Purpose: The notification primarily extends the time limit for tax officers to issue demand orders under Section 73 (non-fraud cases) for FY 2018-19 (up to Aug 31, 2024) and FY 2019-20 (up to Dec 31, 2024).

- No Change to Rectification Procedure: It does not directly alter the existing procedure for

rectification of demand orders India, which is governed by Section 161 (for errors apparent on the face of the record) and typically has a 3-month time limit from the order date. - Increased Relevance of Rectification: Due to the extended issuance timelines, businesses might receive orders for these older periods later than expected. This makes understanding and utilizing the rectification process for any obvious errors within these orders even more important.

- Need for Vigilance: Businesses must maintain good records for these periods and carefully review any demand orders received, acting promptly if errors are found or professional advice is needed.

- Ongoing Compliance: This development underscores the dynamic nature of

Central Tax reforms Indiaand the importance of staying updated and compliant.

Call to Action (CTA)

Navigating GST demand orders, understanding intricate notifications, and ensuring compliance can be challenging. If you have received a demand order, are unsure about the notification implications India for your business, or need assistance with the rectification of demand orders India process, don’t navigate it alone.

Seek expert help. The team at TaxRobo specializes in GST matters and can provide clarity, help you assess the validity of orders, identify potential errors, and assist with filing necessary responses, rectification applications, or appeals.

Contact TaxRobo today for professional guidance tailored to your situation. Visit our Online CA Consultation page or explore our GST Services to learn more.

Frequently Asked Questions (FAQs)

Q1: What is meant by “rectification of an error apparent on the face of the record” in a demand order?

An “error apparent on the face of the record” is a mistake that is obvious, clear, and self-evident from the case records, requiring no detailed investigation or interpretation of complex legal points. Examples include mathematical miscalculations (e.g., 2+2=5 in the order), clear clerical errors (e.g., demanding tax for the wrong financial year clearly mentioned elsewhere in the order), or overlooking a mandatory legal provision whose applicability is undisputed based on the record. It doesn’t cover debatable issues or errors discovered through elaborate reasoning.

Q2: Does Notification No. 22/2024 apply retrospectively to older demand orders?

Notification No. 22/2024 doesn’t apply to existing demand orders already issued. Its purpose is prospective – it extends the deadline for the tax department to issue new demand orders under Section 73 for the specific financial years 2018-19 and 2019-20. It gives officers more time to finalize proceedings and issue orders for these periods, up to the new deadlines (Aug 31, 2024, and Dec 31, 2024, respectively).

Q3: Where can I find the official Notification No. 22/2024 – Central Tax?

You can find official Central Tax notifications, including Notification No. 22/2024 dated May 15, 2024, on the website of the Central Board of Indirect Taxes and Customs (CBIC). A general link for notifications is: CBIC GST Notifications. You may need to search or navigate by date and notification number.

Q4: What should I do first if I receive a GST demand order?

The first steps are crucial:

- Read it carefully: Understand the reason, amount, and period.

- Note the date: Mark the date of issue to track deadlines.

- Review your records: Check your filings and accounts for the period.

- Don’t ignore it: Acknowledge receipt if required and plan your response.

- Seek professional advice: If you’re unsure or find discrepancies, consult a tax expert like TaxRobo immediately.

Q5: How can TaxRobo assist with issues related to demand orders and this new notification?

TaxRobo can provide comprehensive support:

- Analysis: We can help you understand the demand order and its legal basis, including any relevance of Notification 22/2024.

- Verification: We assist in verifying the calculations and claims made in the order against your records.

- Rectification Advice: We can advise if any errors qualify for rectification under Section 161 and assist in filing the application (Form GST DRC-08).

- Response/Appeal: We help draft and file appropriate replies to the notice or assist in filing an appeal if rectification is not applicable or sufficient.

- Compliance Guidance: We offer ongoing GST Services to help minimize the risk of future discrepancies and demands. Contact us via Online CA Consultation.