Maintenance of Books of Accounts: Section 128 Explained

Running a successful business in India involves more than just a great idea and hard work; meticulous financial record-keeping is absolutely essential. It not only paints a clear picture of your company’s financial health but is also a strict legal requirement. For companies registered under the Companies Act, 2013, maintaining proper financial records isn’t optional – it’s mandated by law. This post serves as your clear guide to Section 128 of the Companies Act, 2013, focusing specifically on the crucial requirements for Books of Accounts maintenance. Understanding these rules is vital for ensuring accounting compliance India and steering clear of significant penalties. Let’s dive into what your company needs to know.

What Constitutes ‘Books of Accounts’?

When the law talks about “Books of Accounts,” it refers to a comprehensive set of financial records that accurately reflect a company’s transactions and financial position. As defined under Section 2(13) of the Companies Act, 2013, “books of account” includes records maintained in respect of:

- All sums of money received and expended by a company and the matters in relation to which the receipts and expenditure take place. This essentially covers all cash inflows and outflows and why they occurred.

- All sales and purchases of goods and services by the company. This includes detailed records of everything the company buys and sells.

- The assets and liabilities of the company. This means keeping track of everything the company owns (assets) and owes (liabilities).

- The items of cost as may be prescribed under section 148 of the Act in the case of a company which belongs to any class of companies specified under that section. This applies to companies required to maintain cost records.

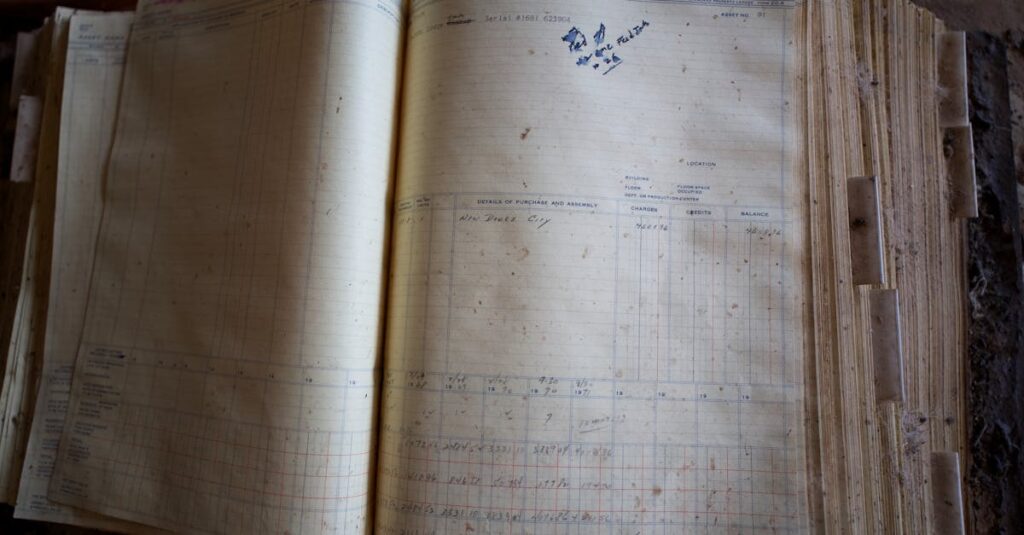

Common examples of these records include your General Ledger, Cash Book, Journal Vouchers, Purchase Registers, Sales Registers, along with supporting documents like bills, invoices, bank statements, and ultimately, the Financial Statements derived from these books (like the Balance Sheet and Profit & Loss Account). These records form the backbone of your company’s financial reporting.

Why is Proper Books of Accounts Maintenance Crucial for Your Business?

Maintaining accurate and up-to-date books of accounts goes far beyond just ticking a legal box. It’s a cornerstone of good corporate governance and sound business management. Here’s why Books of Accounts maintenance is so critical:

- Legal Compliance: First and foremost, it ensures you meet the statutory requirements laid out in the Companies Act, 2013, specifically Section 128. Adherence helps avoid hefty fines and potential legal action, ensuring regulatory compliance books of accounts India.

- Financial Health Monitoring: Accurate books provide a real-time view of your company’s financial performance. You can track revenue, expenses, profitability, and cash flow, allowing you to identify trends and potential issues early on.

- Informed Decision Making: Reliable financial data is the foundation for smart business decisions. Whether you’re considering expansion, launching a new product, seeking funding, or managing day-to-day operations, accurate financial insights guide your strategic planning and budgeting.

- Tax Compliance: Properly maintained books are indispensable for calculating and filing various taxes accurately and on time. This includes Goods and Services Tax (GST) and Income Tax. Having organized records simplifies the process and minimizes the risk of errors or disputes with tax authorities. (Need help with tax filings? Check out TaxRobo’s GST Service and Income Tax Service).

- Investor/Lender Confidence: If you plan to seek investment or loans, potential investors and financial institutions will scrutinize your financial records. Well-maintained, transparent books build trust and significantly improve your chances of securing funding.

In essence, neglecting your books means navigating your business blindfolded, risking both financial instability and legal trouble.

Section 128 Explained: Key Provisions for Indian Companies

Section 128 of the Companies Act, 2013 is the primary legislation governing the maintenance of books of accounts for companies in India. It lays down specific rules that every registered company must follow, forming a critical part of Indian accounts maintenance law. Understanding this section is non-negotiable for compliant business operations.

Who Must Comply? This section applies universally to every company registered under the Companies Act, 2013, or any previous company law, regardless of its size or nature of business. Whether you are a private limited company, a public limited company, or a one-person company, Section 128 applies to you. This comprehensive Section 128 explained guide breaks down the key requirements you need to know.

Core Requirement: True and Fair View

The fundamental principle underlying Section 128 is that the books of accounts must give a “true and fair view” of the state of the affairs of the company. This means the records should accurately and comprehensively reflect the company’s financial position and performance, without concealing any material information. To achieve this, the Act specifies two key accounting methodologies:

- Accrual Basis: Generally, accounts must be maintained on an accrual basis. This means revenues and expenses are recognized when they are earned or incurred, respectively, regardless of when the cash is actually received or paid.

- Double-Entry System: Companies must follow the double-entry system of accounting. In this system, every financial transaction has two effects, recorded as a debit in one account and a credit in another, ensuring the accounting equation (Assets = Liabilities + Equity) always balances.

Adhering to these principles constitutes key Section 128 accounting requirements India.

Place of Keeping Books of Accounts

Section 128 mandates where a company’s books of accounts must be kept:

- Registered Office: The default location for maintaining the books of accounts is the company’s registered office. All necessary books and papers should be accessible here.

- Other Place in India: The Board of Directors holds the authority to decide if the books should be kept at another location within India. If they choose to do so, two conditions must be met:

- A board resolution must be passed approving the alternative location.

- The company must file Form AOC-5 with the Registrar of Companies (RoC) within seven days of passing the board resolution, informing the RoC about the full address of the other place.

This flexibility allows companies with operations spread across different locations to manage their records efficiently while complying with the requirements for maintaining company books as per Section 128.

Maintaining Books in Electronic Form

Recognizing the shift towards digitalization, Section 128 explicitly permits companies to maintain their books of accounts in electronic mode. However, this comes with specific conditions outlined in the Companies (Accounts) Rules, 2014, ensuring the integrity and accessibility of digital records. These rules are a key part of Section 128 accounts regulations:

- Accessibility: The electronic records must be accessible in India at all times, ensuring they can be readily produced for inspection when required.

- Original Format: The books must be maintained in the format in which they were originally generated, sent, or received, or in a format that presents the information accurately as generated, sent, or received. The information must remain complete and unaltered.

- Legibility: Information in the electronic records must be legible and capable of being displayed in a readable format.

- Branch Records: Any electronic records related to entries in branch offices must also be accessible at the registered office.

- Backup Requirement: A proper system for backup of the electronic records must be in place. Crucially, these backups must be maintained on servers physically located in India.

- RoC Intimation (Cloud Storage): If the company uses a service provider for maintaining electronic books (e.g., cloud storage), and the service provider’s servers are located outside India, the company must intimate the RoC on an annual basis at the time of filing its financial statements. This intimation should include details like the name, IP address, and location of the service provider.

Period of Preservation

How long must you keep these records? Section 128 is very clear on the preservation period:

- Minimum Duration: Companies are required to preserve their books of accounts, along with relevant vouchers and supporting documents, for a minimum period of eight financial years immediately preceding the current financial year.

- Shorter Existence: If a company has been in existence for less than eight years, it must maintain the books and records for the entire duration of its existence.

- Investigations: In cases where an investigation into the company’s affairs has been ordered under the Act, the Central Government may direct that the books be preserved for a longer period as it deems necessary.

Proper archiving, whether physical or digital, is essential to meet this requirement.

Inspection Rights

Transparency is key, and Section 128 grants inspection rights to certain stakeholders:

- Directors: Any director of the company has the right to inspect the books of accounts and other related books and papers during business hours. This includes directors residing outside India, who can inspect through their authorized representatives (like a Power of Attorney holder). Inspection of subsidiary company books is also permitted.

- Regulatory Authorities: Statutory bodies like the Registrar of Companies (RoC), the Securities and Exchange Board of India (SEBI), the Income Tax Department, and other relevant authorities have the power to inspect the company’s books of accounts as per the provisions of the Companies Act or other applicable laws during investigations, inquiries, or routine checks.

How to Maintain Books of Accounts as per Section 128: Practical Steps

Complying with Section 128 involves establishing systematic processes for recording and managing financial data. Here’s how to maintain books of accounts as per Section 128 effectively:

- Choose the Right System: Select an accounting system appropriate for your business size and complexity. Modern cloud-based accounting software (like Zoho Books, Tally Prime on Cloud, QuickBooks) is highly recommended for accuracy, accessibility, and backup features. While manual bookkeeping is possible, it’s prone to errors and less efficient for growing companies. Check our Set Up An Accounting System for My Small Business.

- Implement Consistent Processes: Establish a routine for recording all financial transactions promptly. Daily or weekly updates are ideal to keep records current. Ensure all entries are supported by valid documentation.

- Maintain Supporting Documents: Diligently file and preserve all original source documents that substantiate your accounting entries. This includes invoices (sales and purchase), expense receipts, bank statements, contracts, debit notes, credit notes, and journal vouchers. Organize them logically (chronologically, by vendor/customer) either physically or digitally using scanning and secure storage.

- Follow Accounting Standards: Ensure your accounting practices adhere to the Accounting Standards (AS) or Indian Accounting Standards (Ind AS), as applicable, notified by the Central Government in consultation with the National Financial Reporting Authority (NFRA).

- Regular Reconciliation: Perform reconciliations regularly, at least monthly. This involves comparing your internal records with external statements, such as reconciling your cash book with bank statements, and verifying accounts receivable and payable balances.

- Segregation of Duties & Internal Controls: Implement basic internal controls to minimize errors and prevent fraud. This might involve segregating duties (e.g., different people responsible for recording transactions, handling cash, and approving payments) where feasible.

- Seek Professional Help: Maintaining accurate books and ensuring compliance can be complex and time-consuming. Consider outsourcing your accounting function or consulting with professionals. TaxRobo offers expert Accounting & Bookkeeping Services and Auditing Services to help businesses stay compliant and focus on growth.

Consequences of Non-Compliance with Section 128

Failure to comply with the provisions of Section 128 regarding the maintenance of books of accounts can lead to serious repercussions for the company and its key personnel. The Companies Act, 2013 imposes strict penalties for non-compliance, emphasizing the importance of regulatory compliance books of accounts India.

- Penalties: If a company contravenes the provisions of Section 128, the following persons are punishable:

- The Managing Director (MD)

- The Whole-Time Director (WTD) in charge of finance

- The Chief Financial Officer (CFO)

- Any other person charged by the Board of Directors with the duty of complying with this section.

- Nature of Penalty: These individuals shall be punishable with:

- Fine: A fine which shall not be less than fifty thousand rupees (₹50,000) but which may extend to five lakh rupees (₹5,00,000). (Note: Penalty amounts are subject to change via amendments; always refer to the latest version of the Act or consult a professional.)

- Imprisonment: The Act also previously included provisions for imprisonment up to one year for certain defaults under this section, though recent amendments often focus on monetary penalties. However, severe or wilful non-compliance could potentially attract stricter actions under related provisions.

- Other Impacts: Beyond statutory penalties, non-compliance can severely damage a company’s reputation and credibility. It can make it difficult to secure loans or attract investors, lead to complications during statutory audits, trigger investigations by regulatory bodies, and potentially result in disqualification of directors.

Conclusion

Maintaining proper Books of Accounts maintenance is not merely an administrative task; it’s a legal mandate under Section 128 of the Companies Act, 2013, and a fundamental aspect of good corporate governance in India. Adhering to the requirements regarding the true and fair view, place of keeping books, electronic maintenance standards, preservation period, and inspection rights is crucial. The consequences of non-compliance, including substantial fines and loss of credibility, underscore the importance of diligence in this area. For more information, see Taxation Services in India.

Proper accounting forms the bedrock of your company’s financial health, facilitates informed decision-making, and ensures legal adherence. If you find managing accounting compliance India challenging or need assistance ensuring your Books of Accounts maintenance practices meet the requirements of Section 128, don’t hesitate to seek expert guidance.

Contact TaxRobo today for comprehensive Accounting & Bookkeeping Services tailored to your business needs. Let our experts help you stay compliant and focus on what you do best – growing your business.

Frequently Asked Questions (FAQs)

Q1. For how long must a company preserve its books of accounts in India under Section 128?

A: Companies registered under the Companies Act, 2013 must preserve their books of accounts, along with relevant vouchers, for a minimum period of eight financial years immediately preceding the current financial year. If the company has been in existence for less than eight years, it must keep the records for its entire period of existence. In case of an investigation, a longer period might be mandated.

Q2. Can company accounts be maintained fully digitally as per Section 128?

A: Yes, Section 128 permits companies to maintain their books of accounts entirely in electronic mode. However, they must comply with specific conditions laid down in the Companies (Accounts) Rules, 2014. These include ensuring the records are accessible in India at all times, maintained in a proper, unaltered format, legible, and securely backed up on servers physically located in India.

Q3. What are the penalties for not maintaining books of accounts according to Section 128?

A: Failure to comply with Section 128 can result in significant penalties. The company’s key officers, such as the Managing Director, Whole-Time Director in charge of finance, CFO, or any other person designated by the Board, can face a fine ranging from ₹50,000 to ₹5,00,000. It’s crucial to adhere to the regulations to avoid these financial penalties and other negative consequences like loss of credibility.

Q4. Does Section 128 apply to LLPs or Partnership Firms?

A: No, Section 128 of the Companies Act, 2013, specifically applies only to companies registered under this Act or previous company laws. Limited Liability Partnerships (LLPs) have their own bookkeeping requirements stipulated under the Limited Liability Partnership Act, 2008, and associated rules. Partnership Firms are governed by the Indian Partnership Act, 1932, and typically follow bookkeeping practices as required under the Income Tax Act, 1961.

Q5. Who can inspect the books of accounts of a company?

A: The directors of the company have the statutory right to inspect the books of accounts and related records during business hours. Additionally, various statutory and regulatory authorities, such as the Registrar of Companies (RoC), SEBI, Income Tax Department, GST Department, and others, can inspect the company’s books as part of their regulatory oversight, investigations, or inquiries, as permitted under the relevant laws.